I& #39;ve always wondered if investors need small-cap funds in their portfolios. Moreso given the fact that they have become incredibly popular among new investors, particularly the millennials. This is just a thread with a surface level look at small-cap funds.

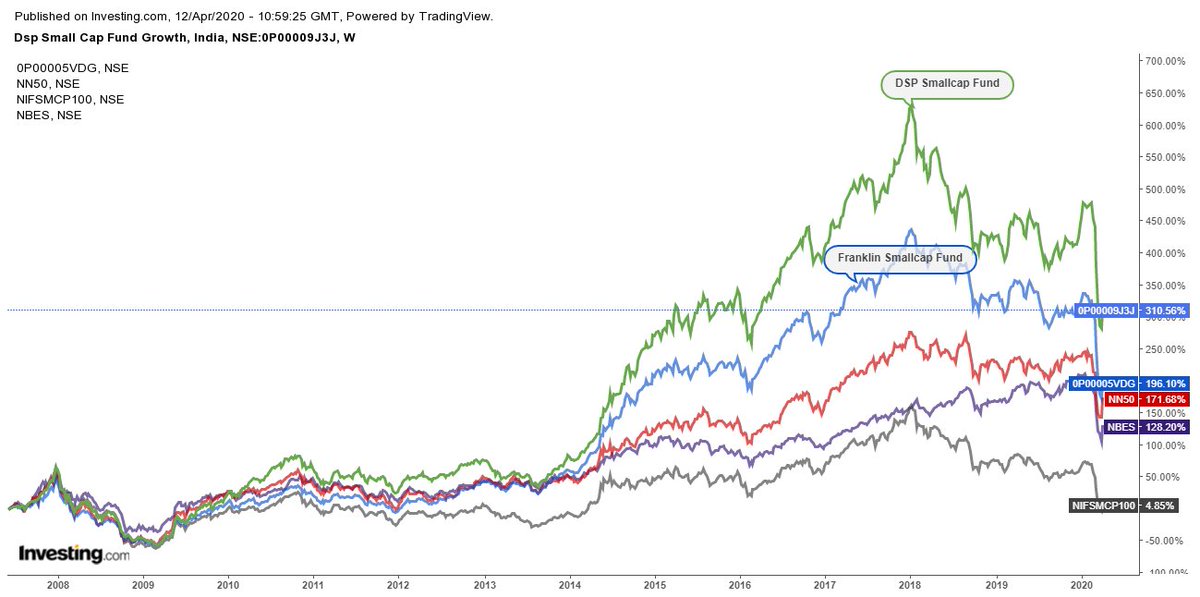

Don& #39;t get me wrong. The returns of some of the small-cap funds have been phenomenal. Here& #39;s how DSP small-cap and Franklin small-cap, the 2 oldest small-cap funds to cover a cycle have performed since the 2007.

Since inception, the SIP returns of the DSP small-cap fund are 12% annualized as against a 7% on the Nifty index, lesser if you accounted for expenses.

But the questions remains, how many people would& #39;ve have remained invested since the inception. A while ago, DSP had tweeted that only 41 investors remained invested in their DSP Equity Fund since the inception in 1997. How many would& #39;ve remained in the small-cap fund sine 1997?

100, 1000? According to AMFI only about 35% of the assets remain invested for more than 2 years, so take your guess. But coming back to the question of small-caps are they worth investing in? They fall as fast as they go up and remain there for years.

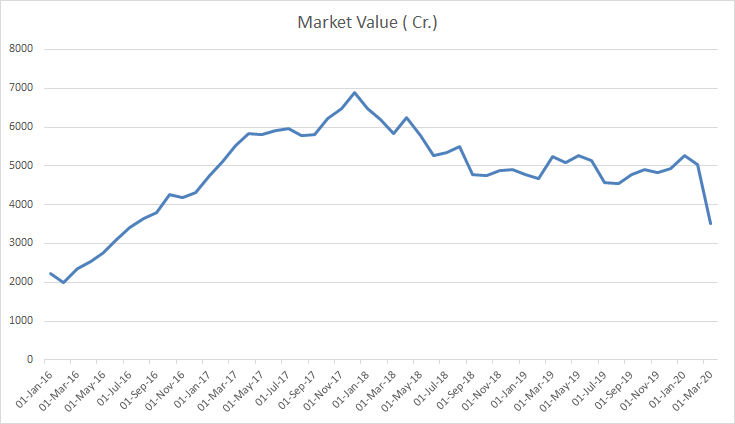

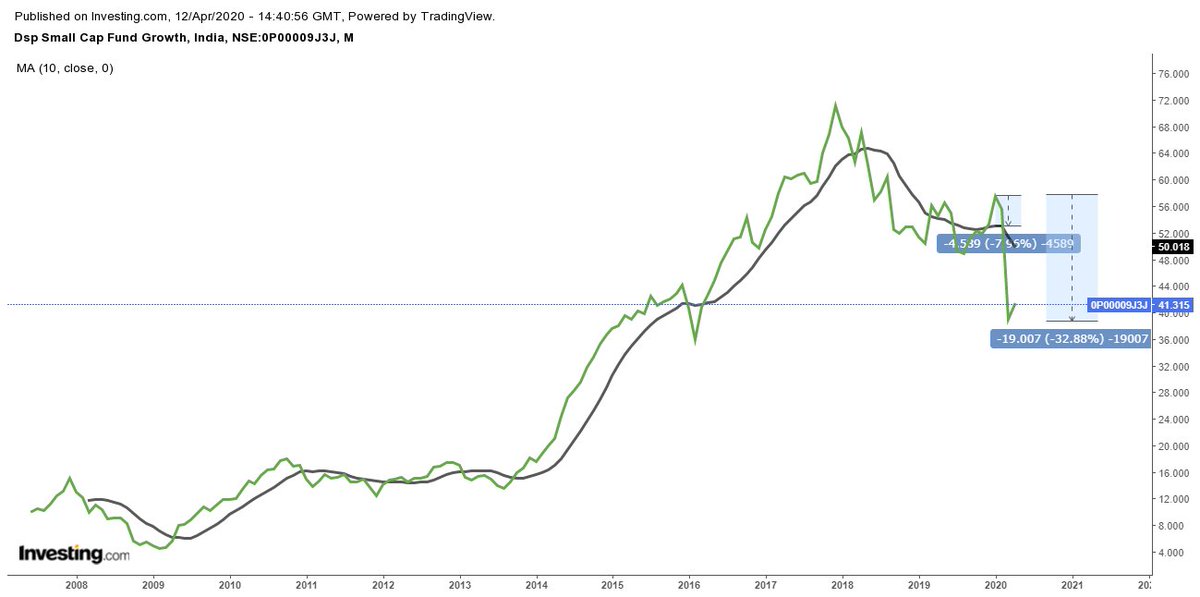

The volatility in these funds is gutwrenching. Look at the sharp peaks and the deep troughs. They had a crazy rally since 2014. As is the proud tradition of retail investors, they started performance chasing. Look at the jump in the AUM of the DSP small-cap fund.

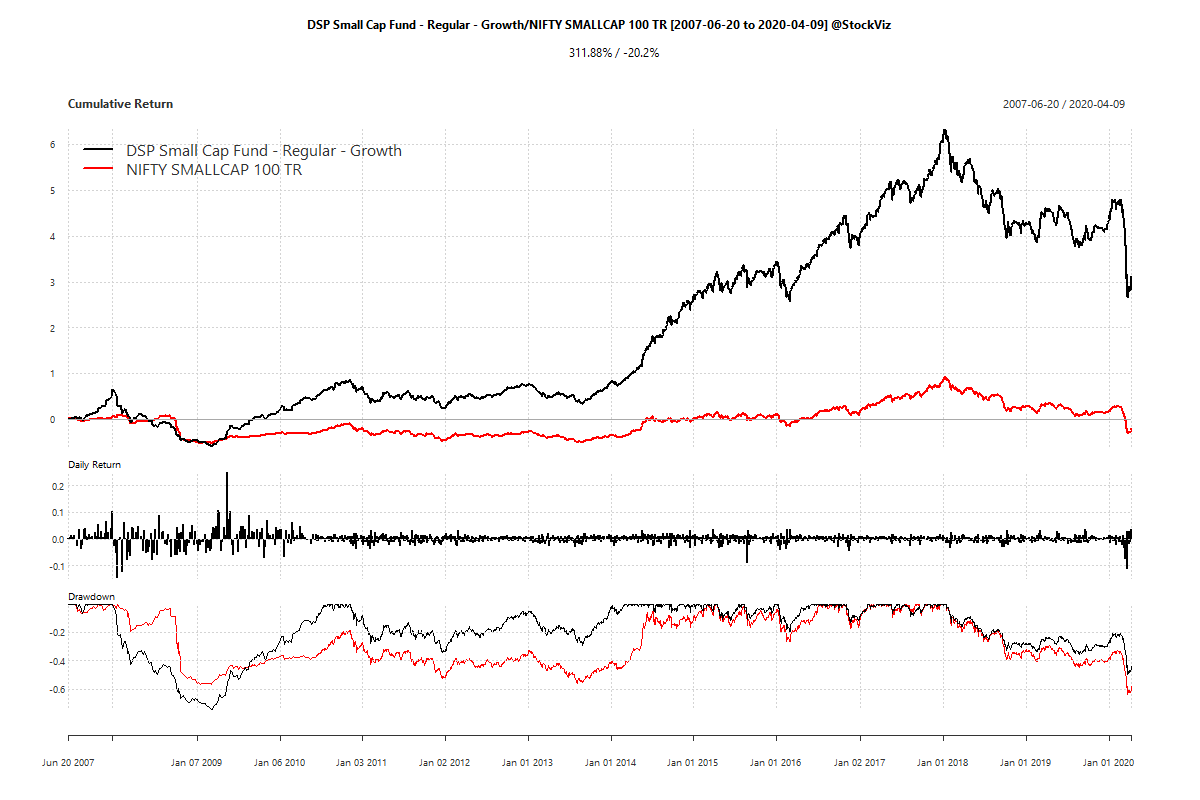

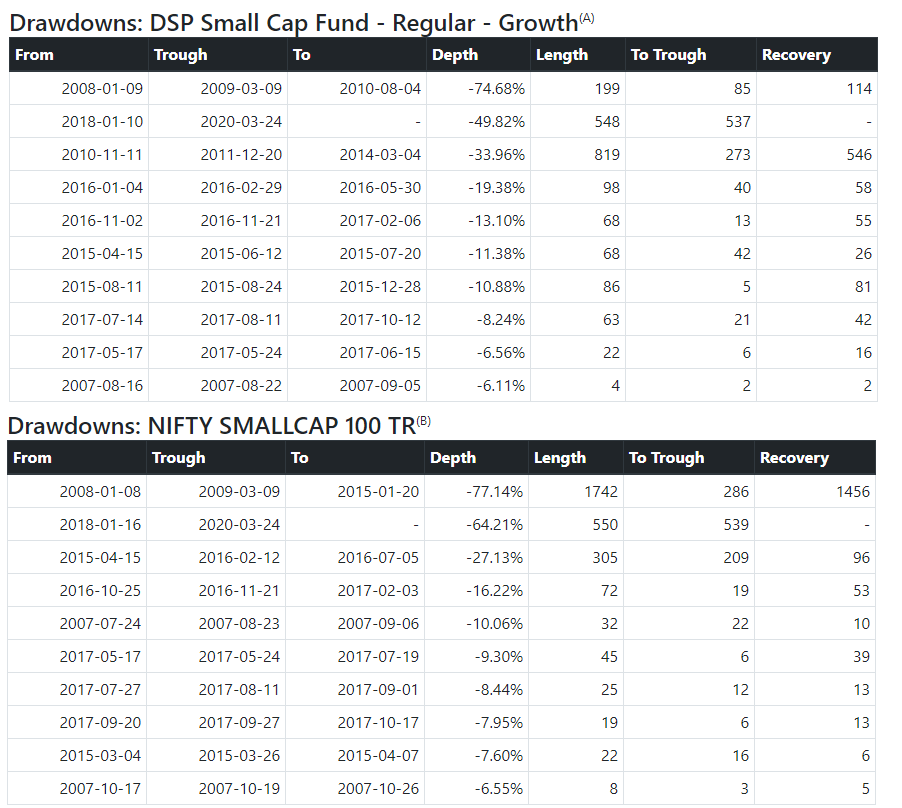

And then since 2018, the small-cap index is down by around 50%. In the funds, all the gains in the past 5 years have been wiped out. Will investors stick around? To be fair them not sticking around is a problem in all equity funds. But here the volatility is a lot higher than LCs

To get the 12% SIP returns in DSP small-cap, investors had to sit through a 75% fall in the fund, and this would& #39;ve been within 1 year of the launch.

I also think small-cap funds amplify loss aversion - a behavioral bias we all suffer from.

loss aversion refers to people& #39;s preferences to avoid losing compared to gaining the equivalent amount. “losses loom larger than gains” https://www.economicshelp.org/blog/glossary/loss-aversion/">https://www.economicshelp.org/blog/glos...

loss aversion refers to people& #39;s preferences to avoid losing compared to gaining the equivalent amount. “losses loom larger than gains” https://www.economicshelp.org/blog/glossary/loss-aversion/">https://www.economicshelp.org/blog/glos...

We were recently having a discussion on small-caps and @anishteli said people should only invest in them if they time them right and I agree with him. small-caps should be traded. Oh, before you jump on me with "nobody should time the markets" shtick, bugger off. We& #39;re all

Market timers in one way or the other. If you recently bought the dip or did a rebalance, congrats, you& #39;re a market timer too!!

For example, @anishteli recommended a 10-month average, which would& #39;ve protected investors from those sharp falls.

For example, @anishteli recommended a 10-month average, which would& #39;ve protected investors from those sharp falls.

of course, like any system, there& #39;s nothing 100% foolproof. investors assuming they followed this would& #39;ve entered right before the recent fall but they still would& #39;ve only seen a 10% fall as opposed to the current 20%+

Even Prof. Pattu @FreeFinCal published a similar view recently. The post has some more material on how to time small-caps. You can check it out. https://freefincal.com/why-a-sip-in-small-cap-mutual-funds-is-a-waste-of-money-and-time/">https://freefincal.com/why-a-sip...

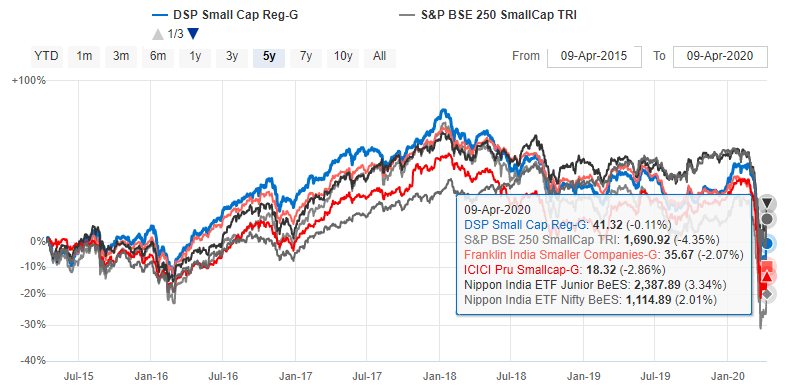

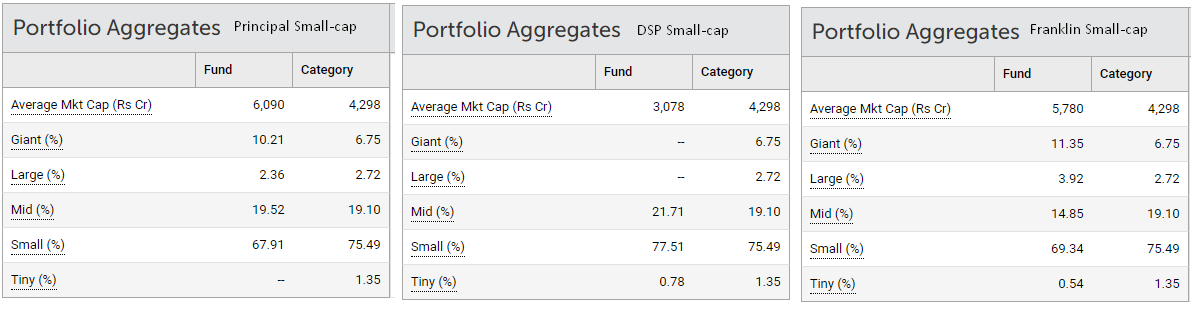

And small-caps are pretty new in India. Most of the so-called small-cap funds were largely mid-cap funds earlier. DSP smallcap and Franklin Smallcap are the granddaddies of the small-cap funds. As to the performance of small-cap funds vs benchmarks, remember, small-cap funds

needn& #39;t hold 100% of small-caps. According to SEBI& #39;s categorization norms, they need to hold at least 65% in small-caps and the rest can be held in mid and large-caps. Except for DSP - the granddaddy, most funds have higher proportions of mid and large-caps.

Here are the portfolios of DSP, Franklin, and the newer Principal small-cap fund. DSP has the highest small-cap exposure which also explains its volatility. The mid-cap and large-cap exposures also explain why the active funds have performed well against the benchmark

because the MC and LC exposure tends to buffer the downside and buttress the upside. And the reason for SEBI& #39;s 65% norm as posed to 80% minimum for large-cap funds is that small caps are notoriously illiquid in India, even more so during bear markets. If funds held 100%

in small-caps and if there were severe redemptions, they& #39;d be unable to liquidate the holdings. The large and mid-cap helps in this aspect is my reading. But beware, all small-caps aren& #39;t pure small-caps.

Anyway, this whole thread came about because I was listening to this podcast of Cliff Asness, co-founder of AQR and one of the original quants. He finished his PhD under the tutelage of Euge Fama, the Nobel Prize winner who also came up with the 3-factor https://www.youtube.com/watch?v=1v_NOLc02Hk">https://www.youtube.com/watch...

model. For you uninitiated, a factor is a unique attribute that drives the returns in an asset class. Size - the tendency of small stocks to outperform the large ones was one of the original factor in the 3-factor model, now a 5-factor model. You& #39;d have probably heard of another

term used to describe factors - smart beta, which is a bullshit, horrible and meaningless retarded term. This might seem confusing to you but we got you covered. @anishteli went on a rampage to demystify factor investor form simpletons like you and I https://indexheads.substack.com/p/is-my-beta-smarter-than-yours">https://indexheads.substack.com/p/is-my-b...

Anyway, Cliff in the conversation says that the evidence for the size factor is much weaker than originally thought off. The original results showing the Size Premium were probably a result of poor stock return databases. Which is also relevant to India.

Is the story that small-cap stocks hold companies that can become future giants, and hence they carry higher risk giving you equal reward all gas? What if you are just assuming a higher risk without getting an equivalent reward? I think that& #39;s the case here.

I highly recommend reading this paper.

https://www.aqr.com/-/media/AQR/Documents/Whitepapers/Fact-Fiction-and-the-Size-Effect.pdf">https://www.aqr.com/-/media/A...

https://www.aqr.com/-/media/AQR/Documents/Whitepapers/Fact-Fiction-and-the-Size-Effect.pdf">https://www.aqr.com/-/media/A...

Professor Jayanth Varma is the authority on factors in Indian markets and his research also pretty much found the same result, i.e. no size effect in India.

https://qedcap.com/blog/dalal-street-rules-years-2015-and-2016/">https://qedcap.com/blog/dala...

https://qedcap.com/blog/dalal-street-rules-years-2015-and-2016/">https://qedcap.com/blog/dala...

parting thought. This is just my perspective, that investors don& #39;t really need small caps. But if you do decide to invest in small-caps, I think buy and hold is a bad idea. Using a long-term trend filter to get in and get out seems like a way better strategy then

sitting through the pain. Finally, this is just my perspective and I might be totally wrong. Please do you own research and don& #39;t consider this as a recommendation of anything. Whatever I have said is also not a comment on the quality of the funds.

The DSP Small-cap fund seems like a well-managed fund. But my comments were more on the absence of small-cap premium and a way to probably invest in small-caps without getting caught in the brutal drawdowns.

And like I said this is just a simple look at the category. Didn& #39;t have time to do in depth analysis, so did your own dirt  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙂" title="Slightly smiling face" aria-label="Emoji: Slightly smiling face">

Read on Twitter

Read on Twitter