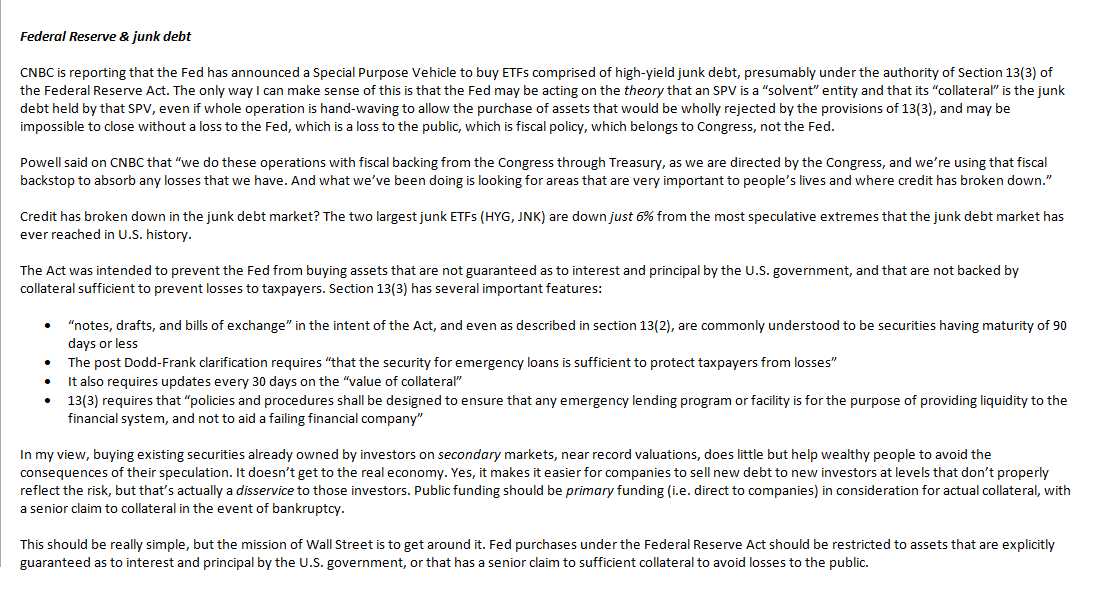

Understand this NOW. The Fed is buying OUTSTANDING corporate bonds - you know, the ones that financed buybacks to offset stock-based compensation for a decade. It needs a shell (SPV here, Maiden Lane in 08) so it can treat unsecured debt as if it’s legal 13(3) collateral. https://twitter.com/DiMartinoBooth/status/1249126753643225090">https://twitter.com/DiMartino...

Buying outstanding corporate bonds on the secondary market with public money does NOTHING to put money in the hands of employees or even those companies. These are not primary transactions. They’re intended to support Wall Street, not Main Street, using public funds to do it.

Look. It& #39;s FINE for Fed to buy loans ORIGINATED by banks to businesses under CARES, in the amount LIMITED by Congress, on terms of forgiveness or repayment specified by CARES. That& #39;s the ONLY qualifying private debt under 13(3) & 14 of FRA.

Buying ETFs is illegal f---ing MADNESS

Buying ETFs is illegal f---ing MADNESS

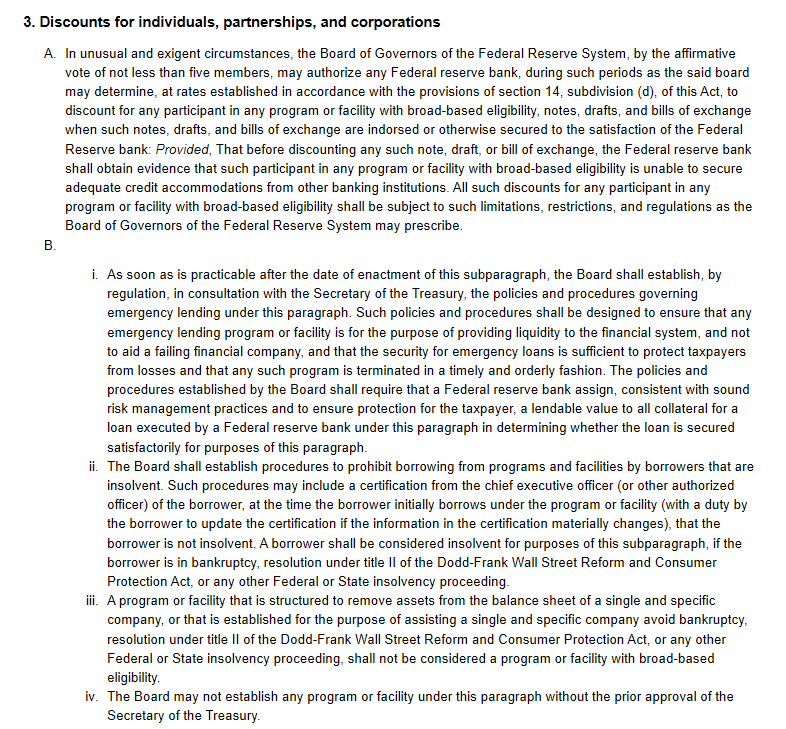

Section 13(3) was clarified like a children’s book by Congress after the GFC. The illegal end-run is to act as if the shell SPV is the “company” getting a loan secured by “collateral.”

UNSECURED SECONDARY MARKET DEBT OF CORPORATIONS IS BEING TREATED AS ITS OWN COLLATERAL.

UNSECURED SECONDARY MARKET DEBT OF CORPORATIONS IS BEING TREATED AS ITS OWN COLLATERAL.

The ONLY securities the Fed can legally purchase are those guaranteed as to interest and principal by the government. Emergency loans under 13(3) always require that “the security for emergency loans is sufficient to protect the public from losses.” Buying ETFs involves neither.

Now, if Congress chooses to support distressed companies, or their restructuring, while suspending dividends and repurchases, excluding excess and stock-based comp, and requiring repayment of public money by companies that still show a profit - HAVE AT IT!

Part of my 4/9 memo.

Part of my 4/9 memo.

One thing for sure: A wedge between unemployment & payroll protection puts the employees completely at the mercy of the plan. This is wrong. We really need a level playing field here. Josh Hawley (R, MO) makes sense.

@SenHawleyPress @ChrisVanHollen https://www.nytimes.com/2020/04/10/opinion/coronavirus-unemployment-small-business.html">https://www.nytimes.com/2020/04/1...

@SenHawleyPress @ChrisVanHollen https://www.nytimes.com/2020/04/10/opinion/coronavirus-unemployment-small-business.html">https://www.nytimes.com/2020/04/1...

Read on Twitter

Read on Twitter