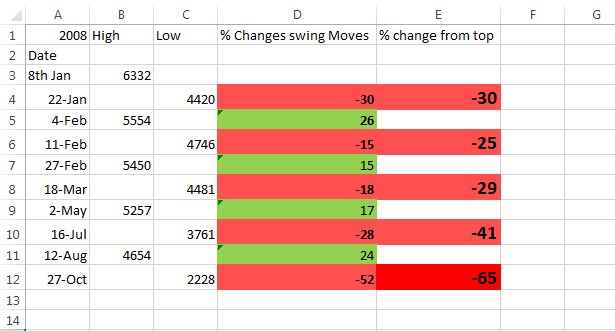

People think 2008 was such a bear market that one had to just sell and sit tight and one would have made money. Nothing could be further from the truth.

See the pic, despite being 65% down from the top in 10 months, we had 4 ferocious rallies.

See the pic, despite being 65% down from the top in 10 months, we had 4 ferocious rallies.

The fear of recession was there from Jan& #39;08. After each new low and the subsequent rally, the common consensus #always was that "the markets have discounted all bad news and bottom has been made".

Each bear market though structurally same will have different trajectories. So don& #39;t try to interpolate the percentages now. Just understand that these fast ferocious rallies are a part of the whole structure. So choose your places to go long and go short wisely and carefully

Same scenario is 2000, a grinding bear market from 1800 to 850 Nifty levels. But see the rallies in between.

Still followed the lower high lower low structure, but the rallies were breath taking https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">

Still followed the lower high lower low structure, but the rallies were breath taking

Read on Twitter

Read on Twitter

" title="Same scenario is 2000, a grinding bear market from 1800 to 850 Nifty levels. But see the rallies in between.Still followed the lower high lower low structure, but the rallies were breath taking https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">" class="img-responsive" style="max-width:100%;"/>

" title="Same scenario is 2000, a grinding bear market from 1800 to 850 Nifty levels. But see the rallies in between.Still followed the lower high lower low structure, but the rallies were breath taking https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">" class="img-responsive" style="max-width:100%;"/>