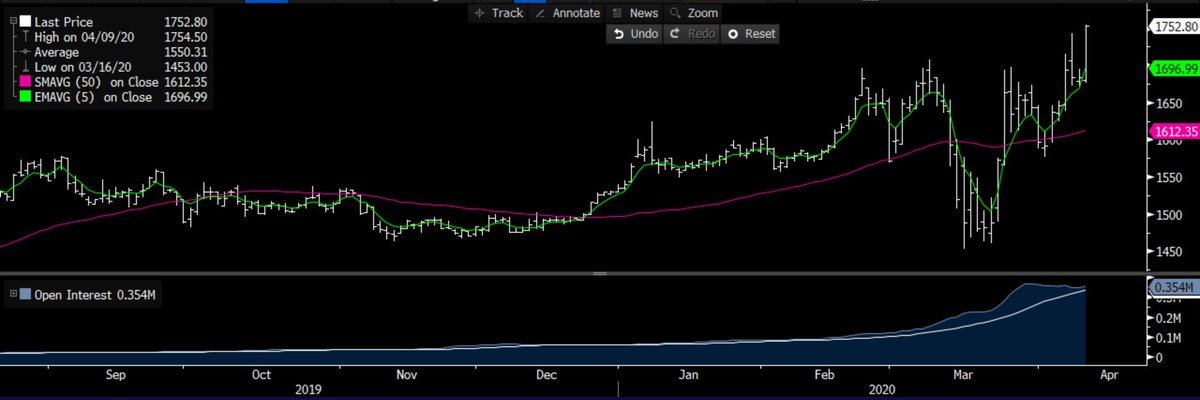

A few considerations for #gold traders for the week ahead = Spot gold still needing to print a new high, but futures getting it done (dont hola at me about the paper market) - GDX looking pretty tasty too

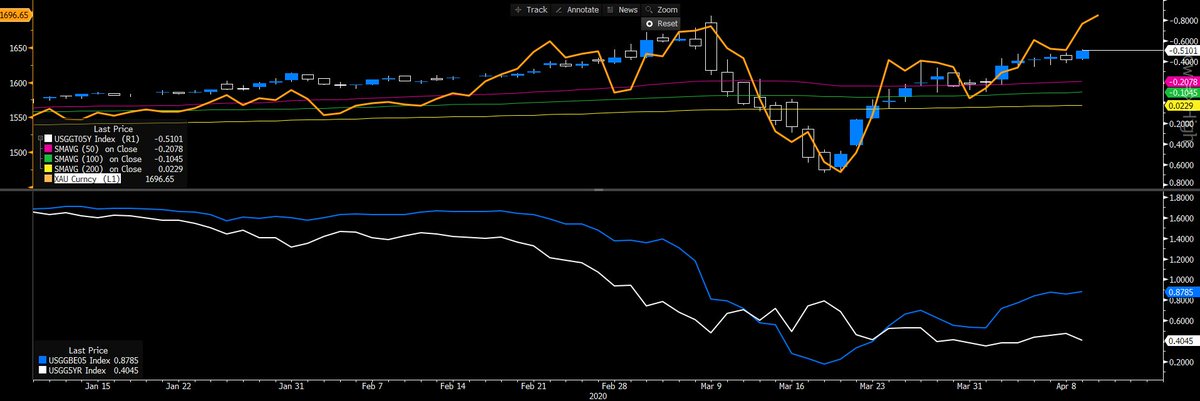

Top pane - 25D 1m risk reversals (with 1,2,3 std dev) - we see call vol trading at a 2.66 vol premium to puts. No real concerns here on that, where > 4.5 vols we tend to see gold facing ST headwinds

Lower pane - 1-week minus 1-year implied vol...market not getting carried away

Lower pane - 1-week minus 1-year implied vol...market not getting carried away

Read on Twitter

Read on Twitter