1/n Banking is risky, as they are the leveraged 10:1 or worse but that& #39;s not bad in the good times.

Taking the context of how JP Morgan Chase, the largest bank in the United States dealt with the 2008 Great Financial Crisis: Thread.

Taking the context of how JP Morgan Chase, the largest bank in the United States dealt with the 2008 Great Financial Crisis: Thread.

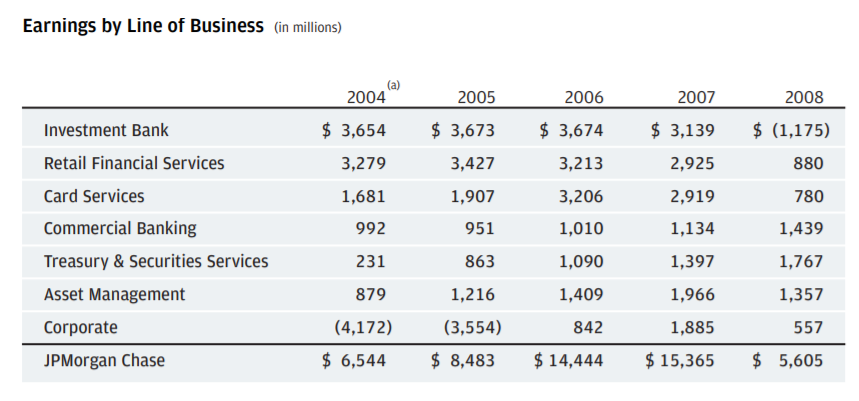

2/n Their profits did decline by 60%. (PROFITABLE.)

Total assets went up 38%

Advances up by 43%

Deposits up by 36%

& Liquidity increased up a bit during the worst crisis since 1929 THE GREAT DEPRESSION.

Bought Bear Sterns & Washington Mutual on pennies. (more on that later)

Total assets went up 38%

Advances up by 43%

Deposits up by 36%

& Liquidity increased up a bit during the worst crisis since 1929 THE GREAT DEPRESSION.

Bought Bear Sterns & Washington Mutual on pennies. (more on that later)

3/n They were one of the first to talk about the upcoming storm & prepared for the upcoming economic downturn.

Accepted the uncertainty & prepared for the worst conditions.

Accepted the uncertainty & prepared for the worst conditions.

4/n They messed up with their mortgage broking business. Accepted it & made the changes.

Obviously, people do mistakes in business but that doesn& #39;t mean you close that shop as wall street asks you to do so. You get better & address the opportunity with a little bit of optimism.

Obviously, people do mistakes in business but that doesn& #39;t mean you close that shop as wall street asks you to do so. You get better & address the opportunity with a little bit of optimism.

5/n Credit cards businesses had a nosedive. This is what they did:

- Intensified collection efforts+ restructuring of stressed accounts

- Closed Inactive accounts & stringent standards for fresh lending.

projected for a no-profit year (had a 2.2B$ loss next year)

- Intensified collection efforts+ restructuring of stressed accounts

- Closed Inactive accounts & stringent standards for fresh lending.

projected for a no-profit year (had a 2.2B$ loss next year)

6/n MINDSET: the best of entrepreneurs always go for solving the customer& #39;s problem: the cost of banking. The PULL business: they will come as you have the best product.

Other things, in a big organisation, kill it slowly as explained below.

Other things, in a big organisation, kill it slowly as explained below.

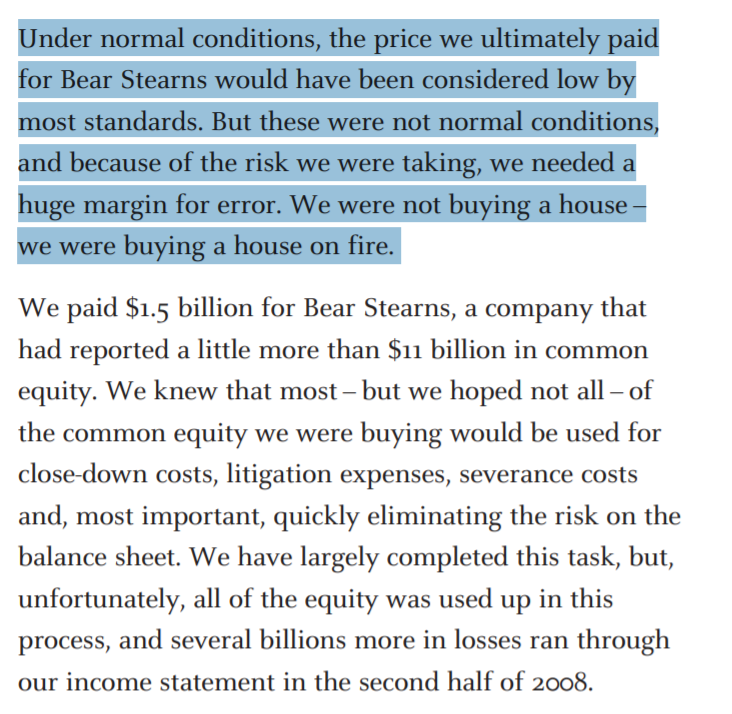

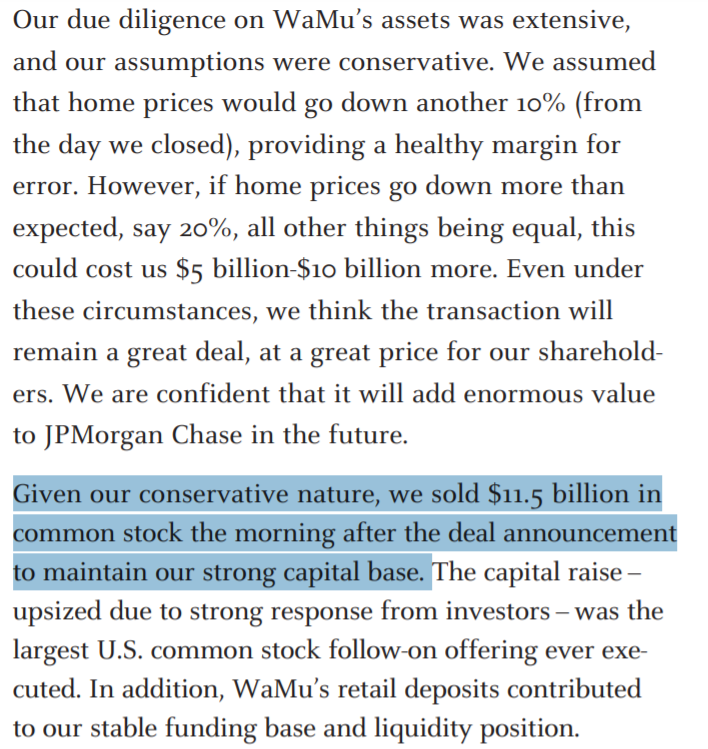

7/n On their 2 acquisitions:

- Bought them with a high margin of safety & conservative assumptions.

"We were not buying a house- We were buying a house on fire."

- Raised 11.5b$ to maintain a strong capital base.

- Gained a better franchise+ huge Deposits (Investing).

- Bought them with a high margin of safety & conservative assumptions.

"We were not buying a house- We were buying a house on fire."

- Raised 11.5b$ to maintain a strong capital base.

- Gained a better franchise+ huge Deposits (Investing).

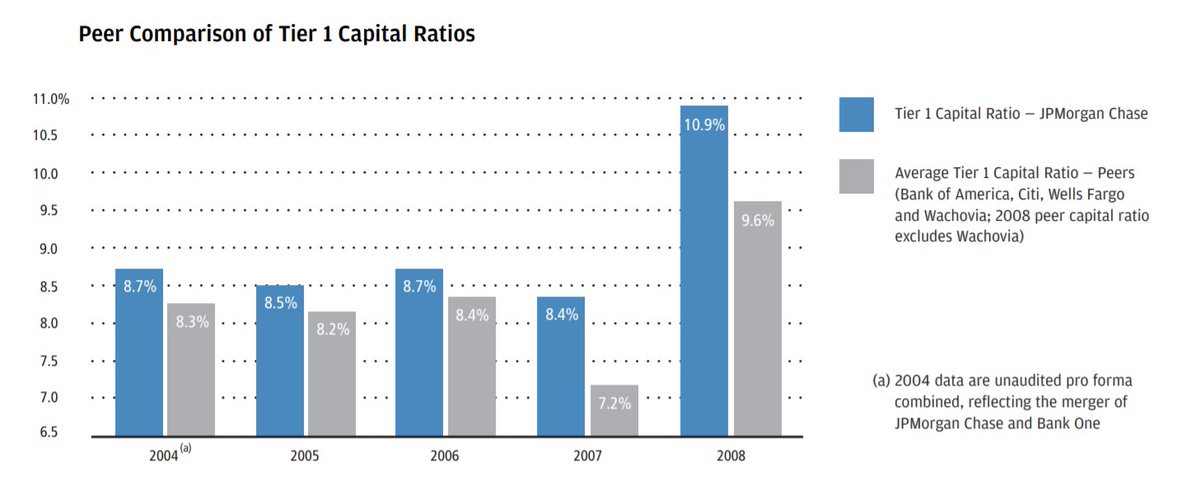

8/n How they avoided blowing up:

- Reduced subprime mortgage exposures in 2006+ Never went into the CDO or the CDO squared businesses.

- No ALM mismatch.

- Best capital ratios in the Industry.

- Reduced subprime mortgage exposures in 2006+ Never went into the CDO or the CDO squared businesses.

- No ALM mismatch.

- Best capital ratios in the Industry.

9/n It is in Human Nature to pinpoint rather than show gratitude, especially the market commentators who are more than focused on their TRPs than the results.

Appreciation for how the Govt. & the FED acted.

Appreciation for how the Govt. & the FED acted.

10/n Heard Regulators were the main culprit, was it really?

"In each and every circumstance, the responsibility for a company’s actions rests with us, the CEO and

the company’s management."

Basel 2 & 2.5 failed, these are the shortcomings of Basel 3: https://marketrealist.com/2014/09/shortcomings-basel-3-accord/">https://marketrealist.com/2014/09/s...

"In each and every circumstance, the responsibility for a company’s actions rests with us, the CEO and

the company’s management."

Basel 2 & 2.5 failed, these are the shortcomings of Basel 3: https://marketrealist.com/2014/09/shortcomings-basel-3-accord/">https://marketrealist.com/2014/09/s...

Read on Twitter

Read on Twitter