(Thread: 1/n) I dont want to comment on proposed institutional structure since there is a lot of missing info which is imp towards forming any opinion on proposed changes. But i do want to comment on @StateBank_Pak proposal to adopt "Inflation Targeting" https://tribune.com.pk/story/2195341/2-sbp-proposes-changes-law-restrict-role/">https://tribune.com.pk/story/219...

(2/n) First, inflation targeting (IT) requires an explicit infl target which the central bank (CB) is required to achieve. For example, Bank of England (BoE) is required to keep infl close to 2%. Also, adopting IT does NOT mean that CBs do not care about output.

(3/n) In practice, CBs almost always care about keeping growth stable under IT. Some govts& #39; explicitly require their CBs to also care about employment stability as part of their mandate. Not to forget tht a growth rate of 7% may be & #39;stable& #39; for one country & unstable for another.

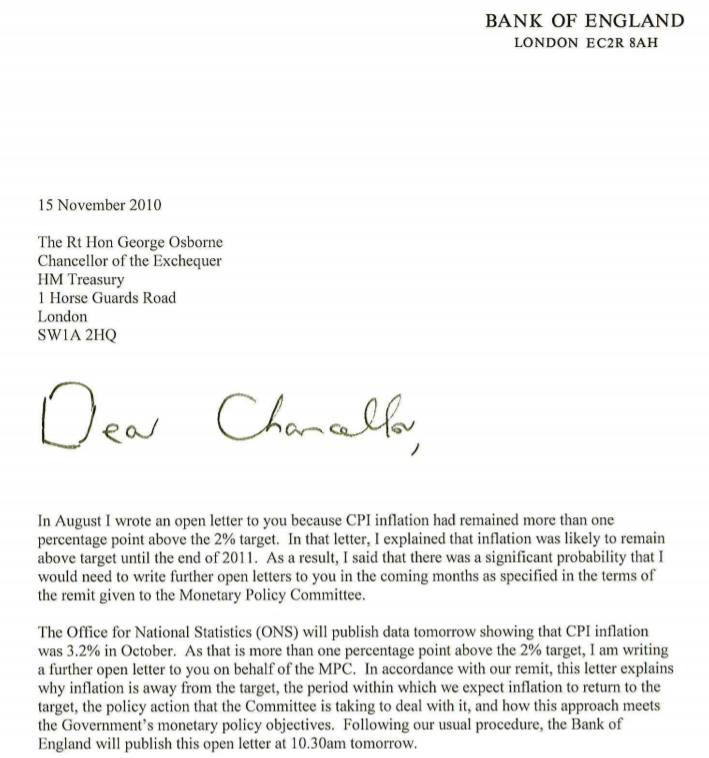

(4/n) Second, IT brings significant transparency to the process. For example, every time infl deviates from target infl by 1% point, BoE governor has to write a letter to Chancellor (i.e. Finance Minister) explaining y this happened. See image of one such letter written in 2010:

(5/n) Third, IT does not just work in advanced economies. Instead, many developing countries have also adopted & #39;inflation targeting& #39; as the monetary policy regime. These include Turkey, India, Brazil, Indonesia among many others.

(6/n) Fourth, studies after studies have shown that IT has been successful in developing countries across many dimensions. Goncalves and Salles (2008) show that developing countries which adopted IT experienced a bigger drop in inflation compared to those which did not.

(7/n) Not only that, they also show that output growth becomes more stable in IT countries. Batini & Laxton (2007) find similar results. Importantly, there is no evidence that adopting IT comes at the cost of lower avg average growth rate https://si2.bcentral.cl/public/pdf/documentos-trabajo/pdf/dtbc406.pdf">https://si2.bcentral.cl/public/pd...

(8/n) This is not it. Batini & Laxton further show that adopting IT also makes exchange rate less volatility and decreases the probability of a currency crisis. See this thread to understand y targeting inflation may also stabilise exchange rate https://twitter.com/ajpirzada/status/1243159758753931264?s=20">https://twitter.com/ajpirzada...

(9/n) Fifth, Svensson (2010) notes that adopting IT also stabilises infl expectations. A 2008 study by IMF showed that infl expectations in emerging economies which had adopted IT remained stable even in the face of large oil & food price shocks https://www.nber.org/papers/w16654.pdf">https://www.nber.org/papers/w1...

(10/n) This is super important. Why? Because stable expectations about future inflation lower the cost of stabilising current inflation. Meaning, CB does not need to slowdown economy by much to bring inflation down when the economy is hit by different shocks.

(11/n) This is not to say tht implementing IT is cost-less. Initial cost of putting such a regime in place is often higher. CBs need to convince everyone tht they indeed care about stabilising infl. But once in place, it significantly decreases cost of stabilising infl in future.

(12/n) Sixth, a more recent paper by Brandao-Marques et al (2020) goes on to show that monetary policy is also more effective in developing countries which have adopted IT (thanks to @rooshanaziz for sharing this paper) https://bit.ly/2xcXu4j ">https://bit.ly/2xcXu4j&q...

(13/n) While there have been some criticisms of IT, Svensson (2010) notes, "infl targeting has proved to be a most flexible & resilient monetary-policy regime & has succeeded in surviving a # of large shocks & disturbances, including the recent financial crisis & deep recession"

(14/n) Though several countries hav made & #39;financial stability& #39; a part of CB& #39;s mandate, CB& #39;s use macro prudential policies to achieve this. This is imp bec using 1 policy instrument (i.e. policy rate) to achieve multiple policy objectives can undermine effectiveness & transparency

(15/n) Cut long story short, adopting infl targeting does NOT come at cost of output growth. Instead, evidence shows tht developing countries which adopted IT experienced lower & stable infl; less volatility in both output growth & exchange rate; & lower prob of currency crisis.

(n/n) This is not to say that there will be no booms or busts. There are many other factors which affect the economy. But adopting inflation targeting regime will definitely help reduce the frequency & magnitude of boom-bust cycles we have observed over last few decades.

Read on Twitter

Read on Twitter