During times like these it& #39;s nice to go back to first principles and better understand how things work so we can understand why/how we navigate financial problems.

The 2008/9 crisis was the greatest learning experience of my life.

The 2008/9 crisis was the greatest learning experience of my life.

It was the reason I wrote this paper, which helped me formulate a better understanding of the monetary system and how things work at an operational level. More facts, less ideology!

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1905625">https://papers.ssrn.com/sol3/pape...

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1905625">https://papers.ssrn.com/sol3/pape...

Today I want to talk briefly about the Fed at a first principles level so we can better appreciate what they& #39;re doing and why.

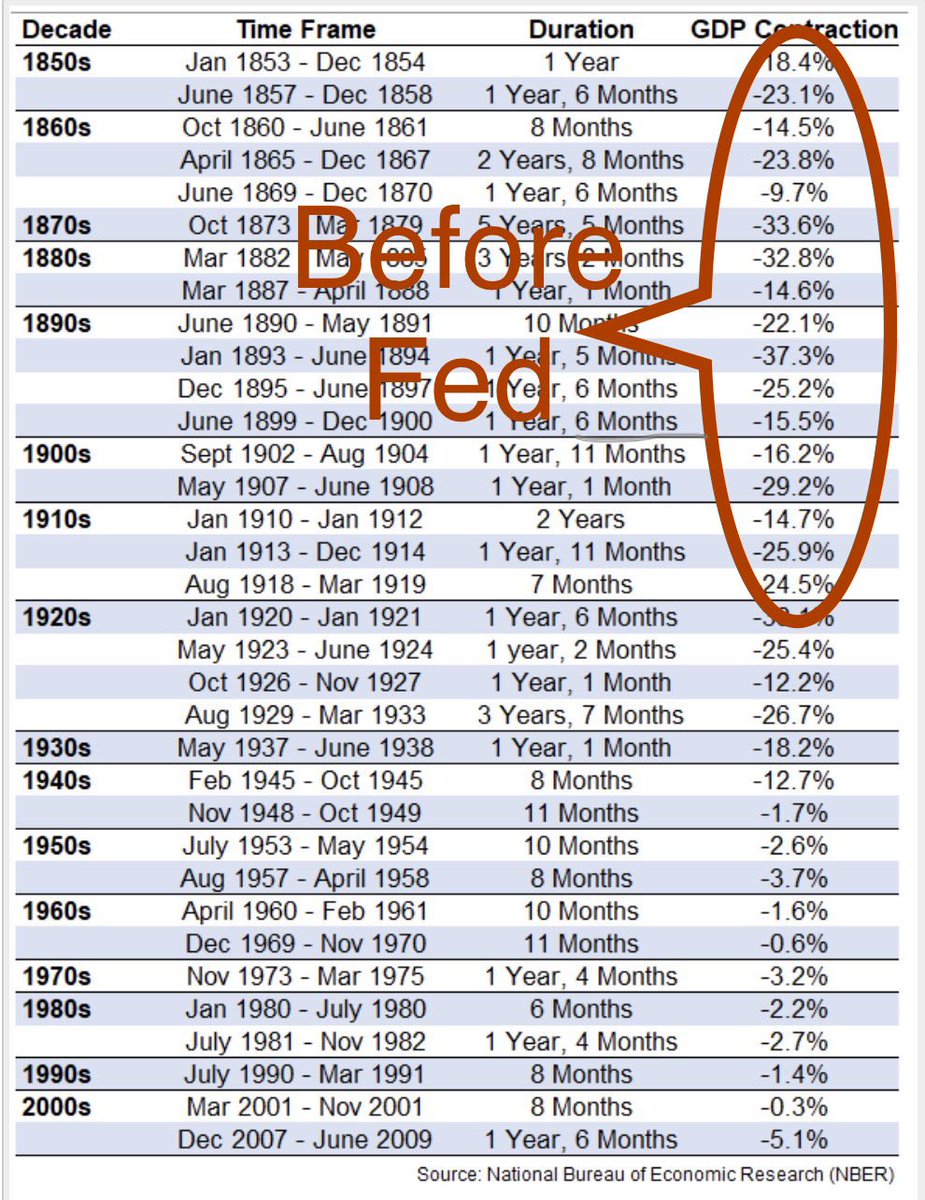

Let& #39;s start with some history. The 1800s were a mess of economic booms/busts with an average -22% GDP contraction every FOUR years.

via @UfukInceCFA

Let& #39;s start with some history. The 1800s were a mess of economic booms/busts with an average -22% GDP contraction every FOUR years.

via @UfukInceCFA

A big part of this was our fragmented banking system. Before the Fed banks would settle payments at local private clearinghouses.

Bank A would conduct biz with someone who banked at Bank B and the two banks would settle up at the end of the day. All good.

Bank A would conduct biz with someone who banked at Bank B and the two banks would settle up at the end of the day. All good.

The problem was, when the shit hit the fan, Bank B would look at Bank A like, "wait, can I trust your balance sheet to settle this payment?"

So, what would happen is a garden variety economic downturn would turn into a banking crisis which would exacerbate the economic downturn.

Joe Schmo, who did nothing wrong during the boom, would go out of business because his bank couldn& #39;t settle payments for him. Not cool.

Joe Schmo, who did nothing wrong during the boom, would go out of business because his bank couldn& #39;t settle payments for him. Not cool.

After a huge panic in 1907 it was clear that private capitalist based clearing systems didn& #39;t work.

So we formed the Fed, which is just a big clearinghouse that NEVER shuts down, even during a panic.

So we formed the Fed, which is just a big clearinghouse that NEVER shuts down, even during a panic.

This helps smooth the business cycle by keeping recessions within the real economy rather than being exacerbated by silly bankers.

2008 was a case in point. What would have been a very deep depression without the Fed turned out to just be a severe recession.

2008 was a case in point. What would have been a very deep depression without the Fed turned out to just be a severe recession.

As I& #39;ve noted before, today& #39;s actions are a bit different. This isn& #39;t a real economic downturn. It& #39;s an exogenous virus that& #39;s hurting a lot of innocent people and the Fed is just trying to make sure the banking system doesn& #39;t collapse and hurt even more innocent people.

Read on Twitter

Read on Twitter