Some math for perspective:

*There are approximately 124 million taxpayers in America

*Every Trillion dollars spent equals $8000 per taxpayer

*National debt is 24.2 Trillion, almost 200k per taxpayer

*The 2.3T Fed announcement Friday equals $18,500 per taxpayer

*There are approximately 124 million taxpayers in America

*Every Trillion dollars spent equals $8000 per taxpayer

*National debt is 24.2 Trillion, almost 200k per taxpayer

*The 2.3T Fed announcement Friday equals $18,500 per taxpayer

*The airlines are seeking a $54B bailout. Small change, right? It& #39;s a per-taxpayer check of $435. Remember when they charged you $60 bc your suitcase was too heavy? Or when they wouldn& #39;t let you take the *empty* seat on the earlier flight? Same people, asking for you to pay them.

*The Fed Funds rate is now 0%. That means that the government is making unlimited free loans to banks to spur activity.

But are they making free loans to you? Check your credit card statement and tell me if 0% has trickled down.

But are they making free loans to you? Check your credit card statement and tell me if 0% has trickled down.

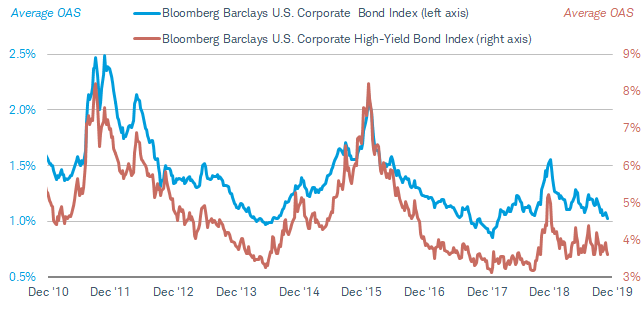

*For all of 2019 the bond market had historically low credit spreads, which means that investors did not expect bad companies to go bankrupt. At the same time there were arguments that much of the investment grade (good) bonds should have been classified as "junk".

...prudent investors left yield (returns) on the table by avoiding the high yield (junk) bonds. Meanwhile, people like @TruthGundlach @benjaminMlavine and too many more to count made the case that a LOT of the investment grade bonds deserved to be reclassified as junk.

At the first exogenous event, the spreads predictably widened. Prudent investors were smart and greedy investors were left exposed.

So the Fed, under the guidance of Blackrock who had been immediately hired to buy bonds on behalf of the Fed, started buying junk bonds.

So the Fed, under the guidance of Blackrock who had been immediately hired to buy bonds on behalf of the Fed, started buying junk bonds.

The Fed is now paying Blackrock to make purchases, buying Blackrock ETFs (fees waived), and supporting the bonds that would have left Blackrock and their clients exposed.

The prudent investors are not vindicated.

The bagholder is the taxpayer.

The prudent investors are not vindicated.

The bagholder is the taxpayer.

Meanwhile on Main Street: 10% of the US workforce has filed for unemployment in just three weeks of the shutdown.

17 million people in just three weeks. Disproportionately impacting low wage and non-corporate workers.

17 million people in just three weeks. Disproportionately impacting low wage and non-corporate workers.

Mom and Pop are decimated. Done. Talk to business owners. Ask them. Look inside the store fronts of your downtown. Dreams have been crushed. Most of these businesses will not come back.

Think about 10% newly unemployed, in just three weeks. What is that number in another month? People are stuck at home, afraid, and lost their income.

Which leads me to the correlation between unemployment and suicide.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3447773">https://papers.ssrn.com/sol3/pape...

Which leads me to the correlation between unemployment and suicide.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3447773">https://papers.ssrn.com/sol3/pape...

In this environment, in the heart of a terrifying and scarring pandemic, the Fed& #39;s first response was to save asset owners (rich people). Investors in junk bonds and investors in stocks that couldn& #39;t survive a 30% pullback, to 2018 levels.

The Fed& #39;s tone deaf response to the GFC led to an increasing wealth gap and movements like Occupy Wall Street. What is on the horizon this time?

It is surely going to be worse.

It is surely going to be worse.

It& #39;s not all negative. We are in dark times, but we won& #39;t be forever. Business, schools, weddings and family reunions will again re-open. Vaccines are being developed by the smartest in the world.

Humans are undefeated against pandemics.

Optimism will be back.

Humans are undefeated against pandemics.

Optimism will be back.

I just hope people think through the Fed& #39;s actions, and speak out against it. Speaking out seems to be the only tool we have to oppose it.

/finito

/finito

Read on Twitter

Read on Twitter