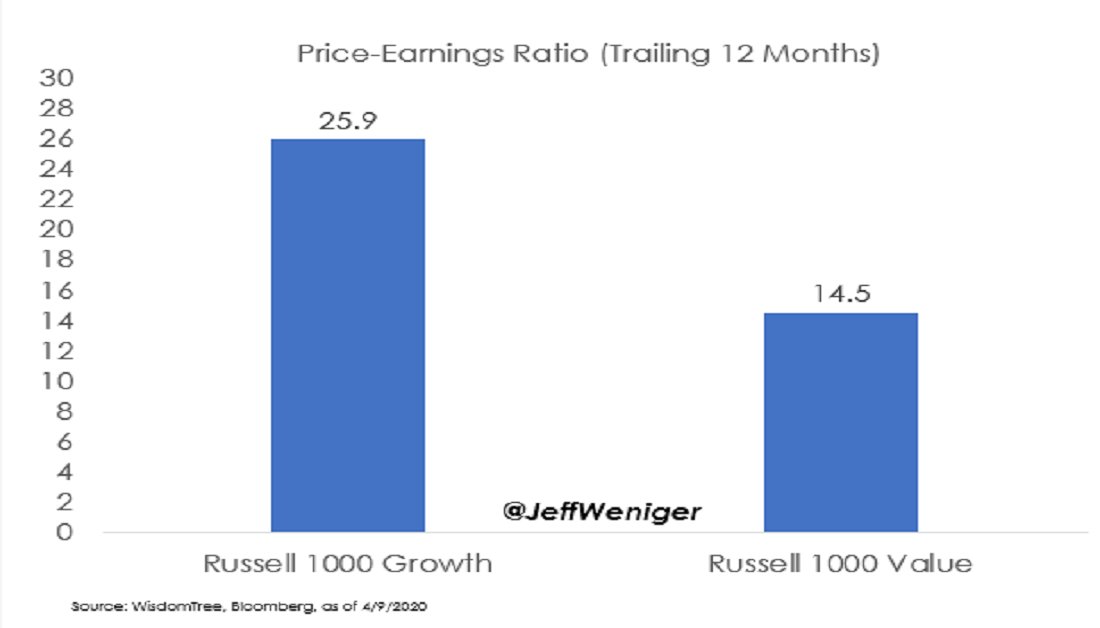

We need to talk about why you’re out there paying 26 times trailing earnings for the Russell 1000 Growth index (U.S. Large Cap Growth stocks).

Thread

1/5

Thread

1/5

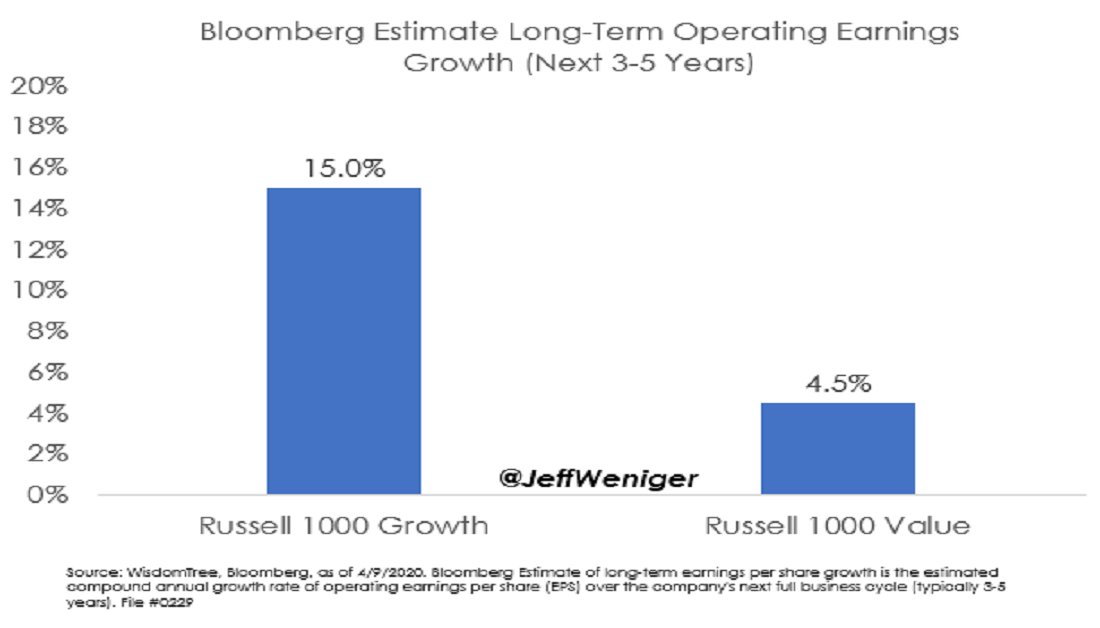

2/ Oh, here’s why. Because Growth stocks grow earnings so much faster than unloved Value stocks, right? These are Bloomberg earnings growth estimates for the next 3-5 years. Lights out for Growth.

Unfortunately, I have something I need to tell you….

Unfortunately, I have something I need to tell you….

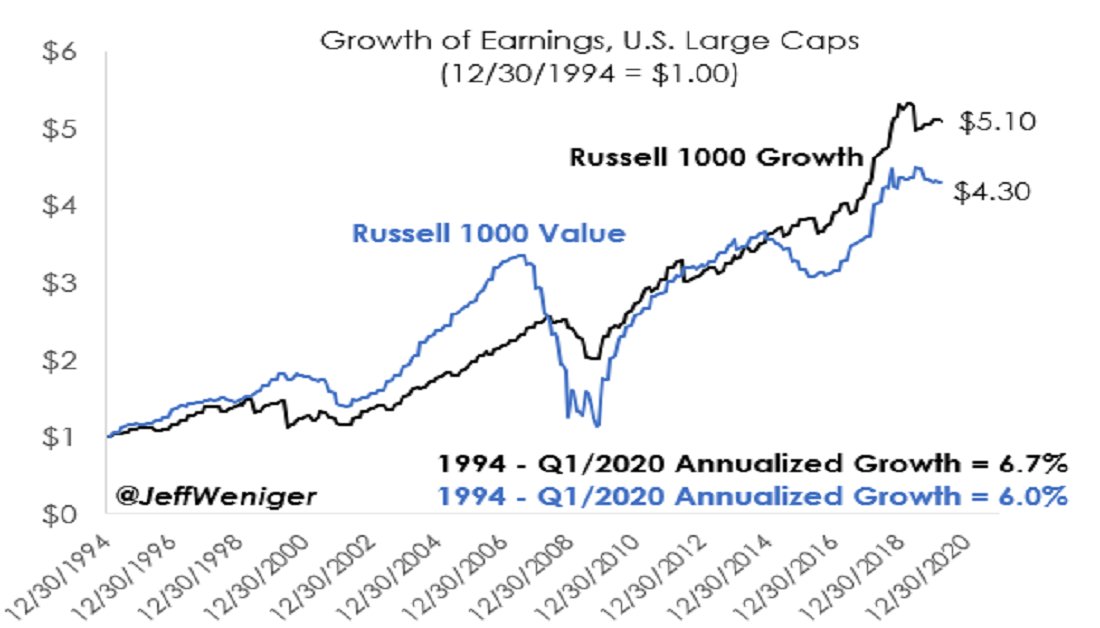

3/ …The data goes back to 1994, and in that time, the Russell 1000 Growth index increased earnings at a 6.7% annualized clip, only slightly faster than Value’s 6.0% annual growth. Your “growth” in Growth stocks& #39; earnings is an illusion.

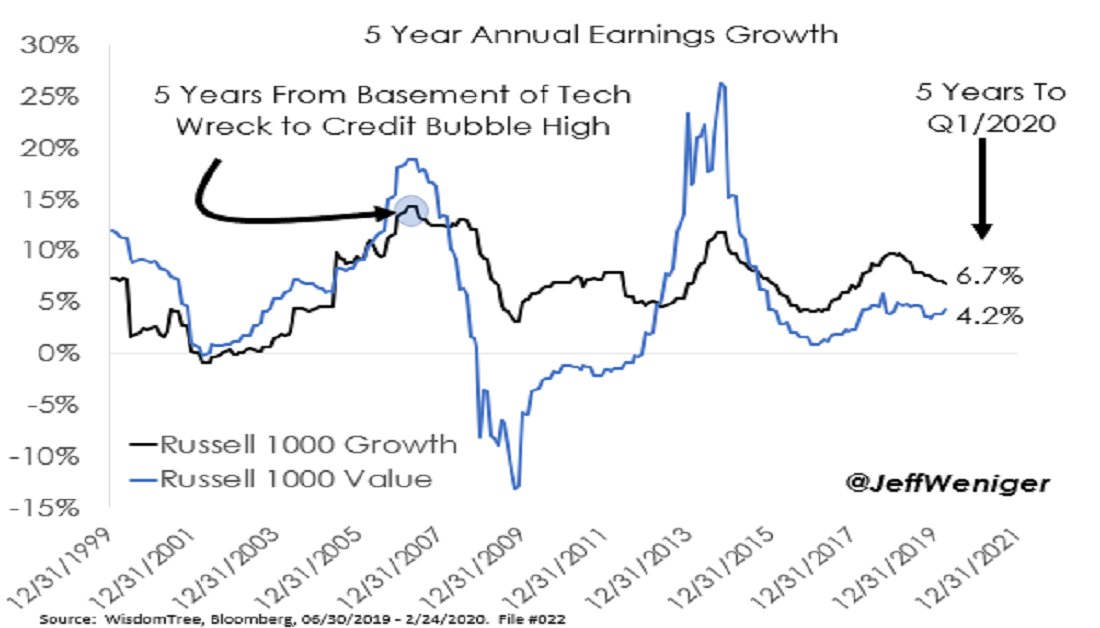

4/ Coincidentally, in the 5 years to Q1/2020 – a period of economic expansion -- Russell 1000 Growth earnings increased at exactly the same clip as history: 6.7%. And now we& #39;re supposed to see 15% a year for 3-5 years, starting at already-peak earnings and ignoring Covid19?

5/ Russell 1000 Growth is at 1,619, a P/E of 25.9 on the $62.41 it earned in the year to March. 2020 earnings will collapse. It could be a long time before we see $62.41 again, let alone the sky high $94.90 or $125.49 Bloomberg estimates.

US Large Cap Growth? Avoid.

-

End Thread

US Large Cap Growth? Avoid.

-

End Thread

. @threadreaderapp unroll.

Read on Twitter

Read on Twitter