Wid lot of buzz on #pharma sector, spoke to Sailesh Raj Bhan n Aditya Khemka

Top 10 takeaways

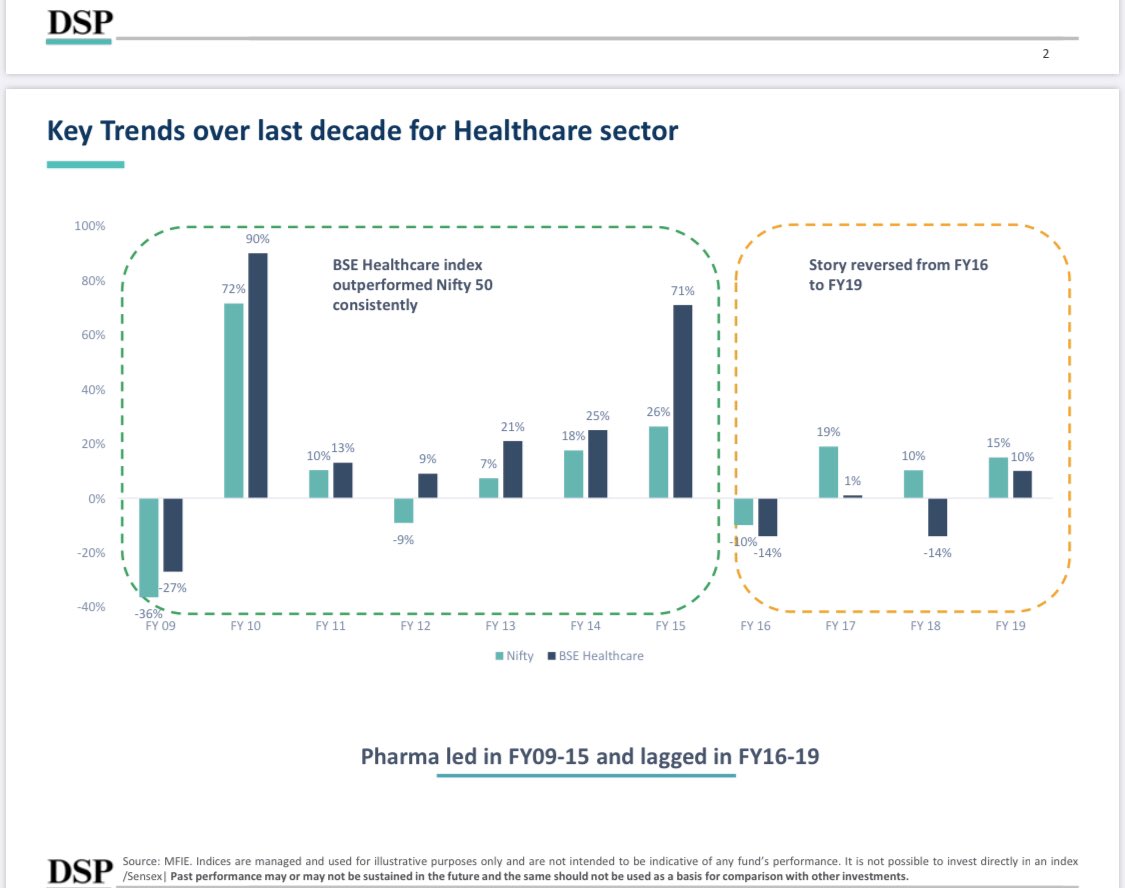

1.Pharma always outperformed broader index till 2015. Frm 2016-2019 it underperformed

2.Export to US & pricing issues, IPM growth slowdown led to sub optimal return ratios

Top 10 takeaways

1.Pharma always outperformed broader index till 2015. Frm 2016-2019 it underperformed

2.Export to US & pricing issues, IPM growth slowdown led to sub optimal return ratios

3. Excluding #COVID__19 last 12-18 months earnings started to improve

4. Leading cos showed high single digit volume growth n 13-15% earnings growth in last 5-6 qtrs

5. Domestic business share improved from 30% in 2015 to 50% plus giving stability

4. Leading cos showed high single digit volume growth n 13-15% earnings growth in last 5-6 qtrs

5. Domestic business share improved from 30% in 2015 to 50% plus giving stability

6. Most global & competitive sectors in India. Sells in over 100 countries, branded presence in 20. 40% of Oral generics sold in US r manufactured in India, so are 20% of all injectables

7. US-after a double decline in prices for 2 yrs,decline is now 3-4% implying stabilization

7. US-after a double decline in prices for 2 yrs,decline is now 3-4% implying stabilization

8. Despite secular earnings growth & mix of profitability, representation of sector in various indices low: 3-3.5% from 12-13% peak levels in 2013

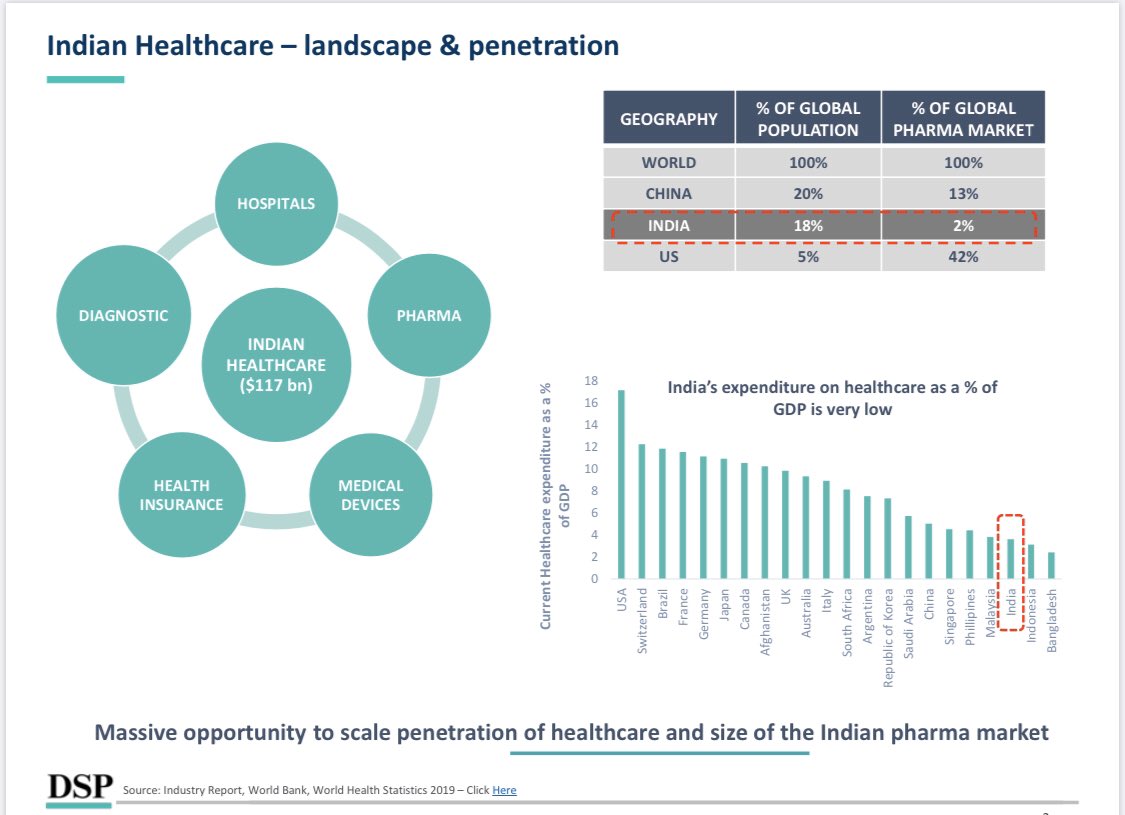

9. 8-10% vol growth in 20 yrs, level of under-penetration & chronic disease profile of Indians (diabetes,cardiac,thyroid)

9. 8-10% vol growth in 20 yrs, level of under-penetration & chronic disease profile of Indians (diabetes,cardiac,thyroid)

10. Sub-Sectors

1. Pharma

-Domestic business

-Export opportunity

2.Hospitals

-overall scale & quality infrastructure needs improvement

3.Diagnostics

4. US medical devices

Top holdings - IPCA, Divis ,DRL, Abbott, cipla ,sun, thyrocare,Apollo ,Abiomed Inc(US)

1. Pharma

-Domestic business

-Export opportunity

2.Hospitals

-overall scale & quality infrastructure needs improvement

3.Diagnostics

4. US medical devices

Top holdings - IPCA, Divis ,DRL, Abbott, cipla ,sun, thyrocare,Apollo ,Abiomed Inc(US)

Read on Twitter

Read on Twitter