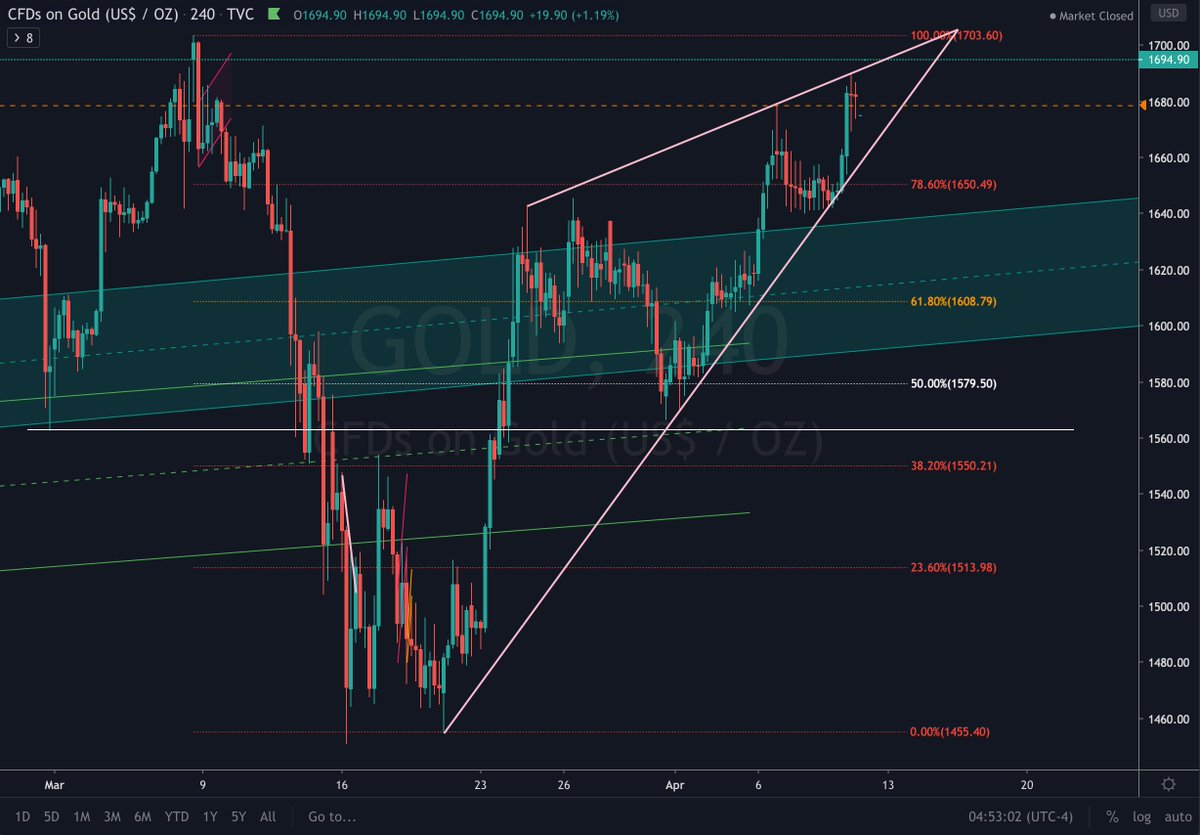

$GOLD CFDs 4HR suggests a possible ST pullback here at the top of the rising wedge may already be underway. If confirmed, then the question turns to whether the wedge breaks down or not. We also happen to be near the full retrace of the March correction range. https://twitter.com/jfhksar88/status/1248303226107170816">https://twitter.com/jfhksar88...

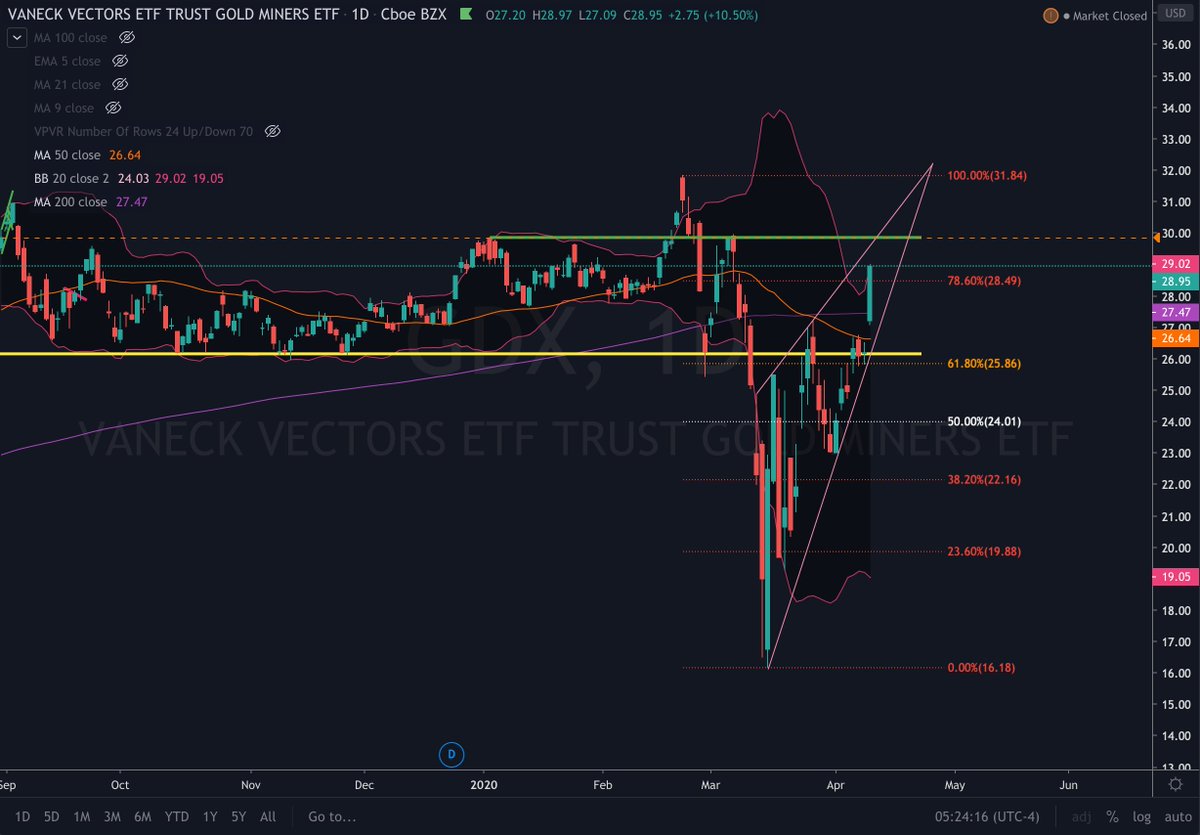

$GDX started with a 3-day consolidation between 61.8FIB / 50DMA at 26 horizontal resistance. Powell& #39;s bazooka gapped $GDX clear of everything, sending it > 200DMA. COD poked through upper BB inside a rising wedge from March lows. Resistance shy of 30.

$GDXJ closed just shy of the 50DMA.

On next inevitable $SPX pullback, I wonder if everything - including gold miners $GDX - sells off again per march to meet margin calls / need to raise cash, or if the allure and appeal of gold saves the day this time. Would also watch gold and miners correlation in that scenario.

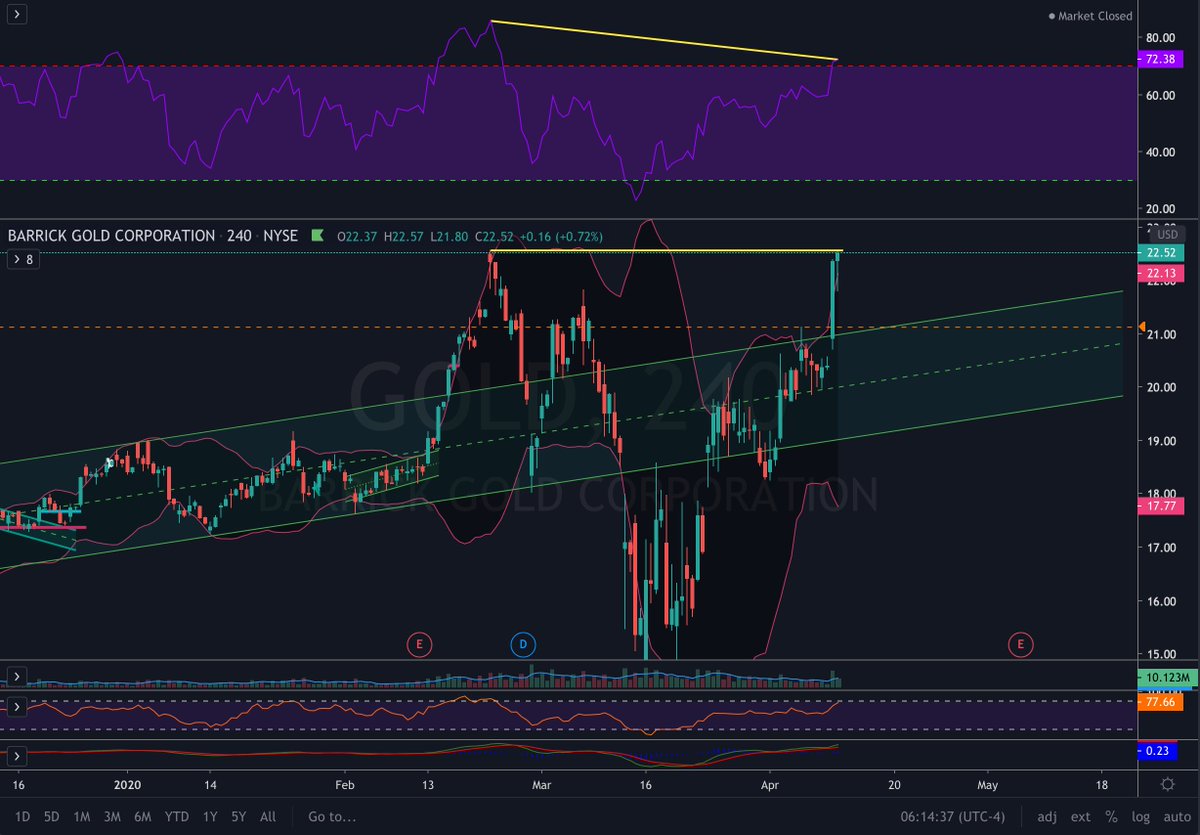

Barrick $GOLD has spent two days wayyyyy outside its upper BB. Negative RSI divergence and possible double top suggests some caution is warranted here IMO.

$NEM also with massive excess > the upper BB and a negative divergence worth keeping an eye on. This thing is begging for some consolidation to burn off RS.

Read on Twitter

Read on Twitter