0/10 - The real economy is in a DEEP recession.

Real GDP could drop by as much as 30%.

And consumer spending won& #39;t be returning to where it was in the past

(bear in mind consumer spending is 70% of GDP).

Against this backdrop, the stock market has retraced 50% of its decline.

Real GDP could drop by as much as 30%.

And consumer spending won& #39;t be returning to where it was in the past

(bear in mind consumer spending is 70% of GDP).

Against this backdrop, the stock market has retraced 50% of its decline.

1/10 - So where do we go from here?

As an investor, what should you be doing with your money?

1. we don& #39;t& #39; always have to be doing something

2. doing nothing is doing something

3. waiting is doing something

If you have to do something, then you probably want to bet with the Fed

As an investor, what should you be doing with your money?

1. we don& #39;t& #39; always have to be doing something

2. doing nothing is doing something

3. waiting is doing something

If you have to do something, then you probably want to bet with the Fed

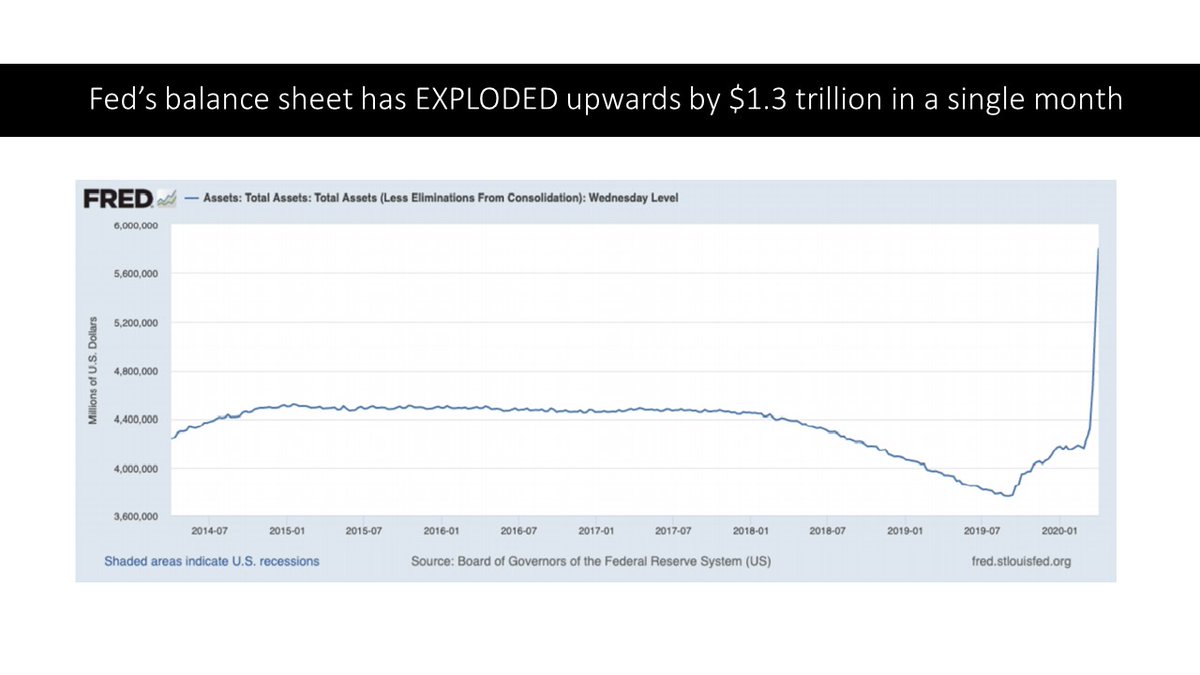

2/10 - this chart is BEFORE the Fed made its announcement yesterday adding an additional $2.3 trillion. If the Fed balance sheet can hit $6 trillion, why not $10, why not 20 trillion or more?

Do Balance sheets matter and if so, how far can they go?

Do Balance sheets matter and if so, how far can they go?

3/10 - For comparison, The Bank of Japan’s balance sheet is over 100% of Japan’s GDP whereas the Fed’s balance sheet is currently only 30% of the U.S.’s GDP.

The Fed growing balance sheet to even 50% of U.S. GDP, would only mean $10 trillion, or another $4 trillion from here

The Fed growing balance sheet to even 50% of U.S. GDP, would only mean $10 trillion, or another $4 trillion from here

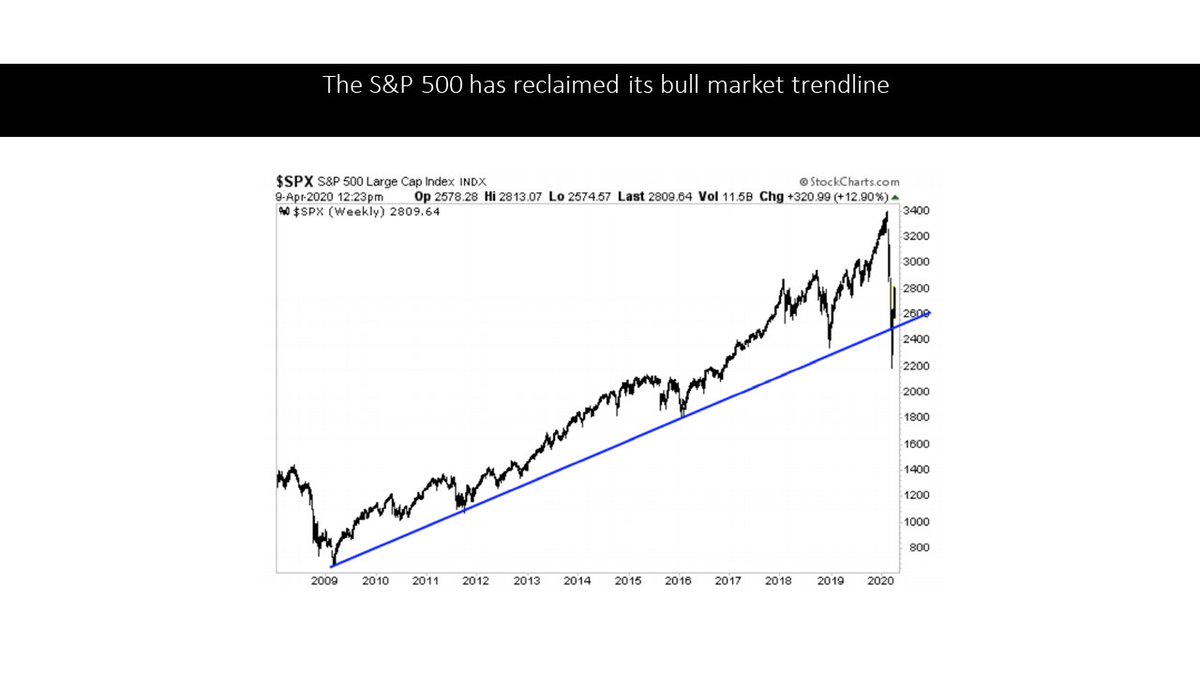

4/10 - Will it work to save a market that is neither showing earnings or profits? that lost 16m jobs in weeks, with no real end in sight?

it sure seems to be working just fine, at least for now...

The S&P 500 has reclaimed its bull market trendline

it sure seems to be working just fine, at least for now...

The S&P 500 has reclaimed its bull market trendline

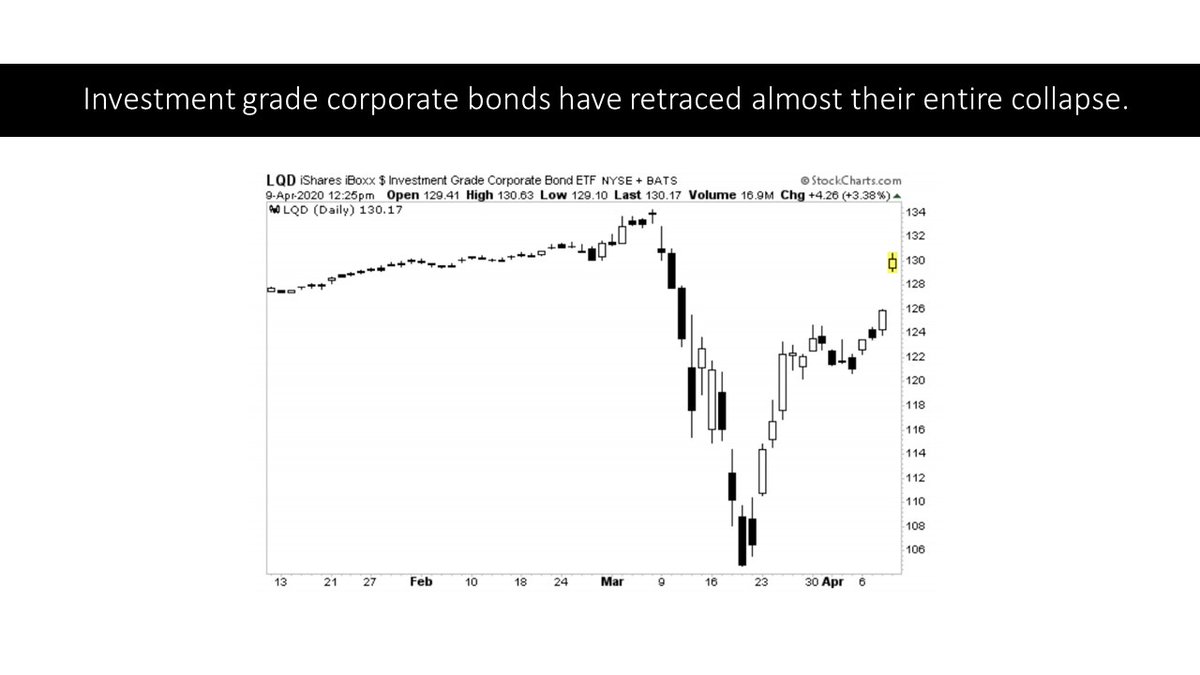

5/10 - And the Bond markets are recovering fast, which has big the bigger deeper cause of concern and trouble. Investment-grade corporate bonds have retraced almost their entire collapse.

Even High Yield Corp Bonds and High Yield Muni& #39;s are shooting higher

Even High Yield Corp Bonds and High Yield Muni& #39;s are shooting higher

6/10 - so like we have seen in other bubbles, when it bursts, the Fed moves in to reflate it, and it appears the Fed is moving fast and buying everything in sight, and it appears to be working, for now

Read on Twitter

Read on Twitter