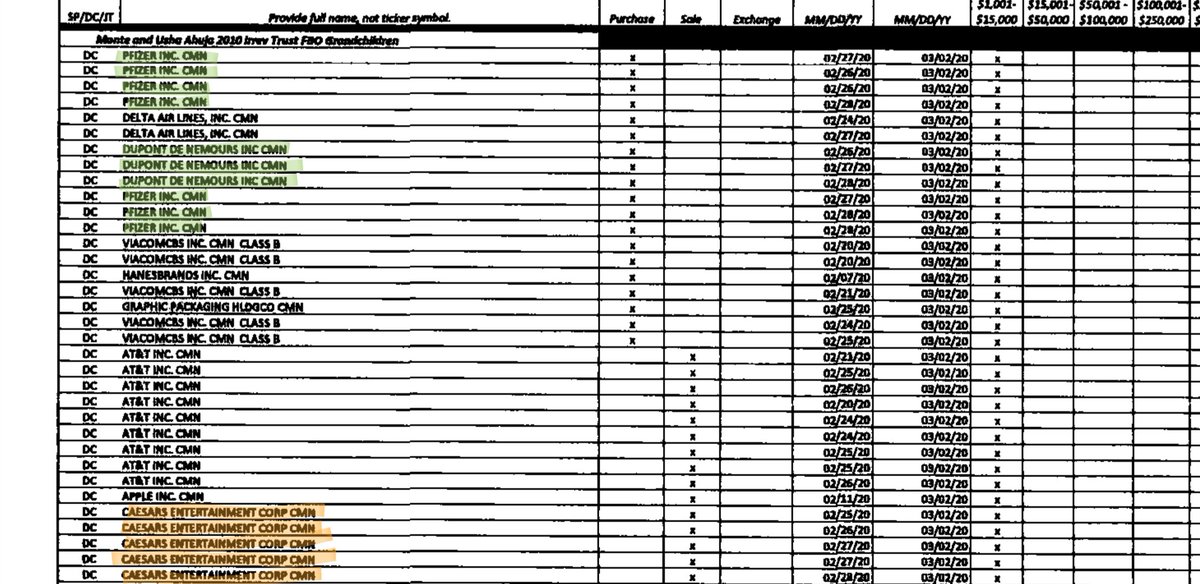

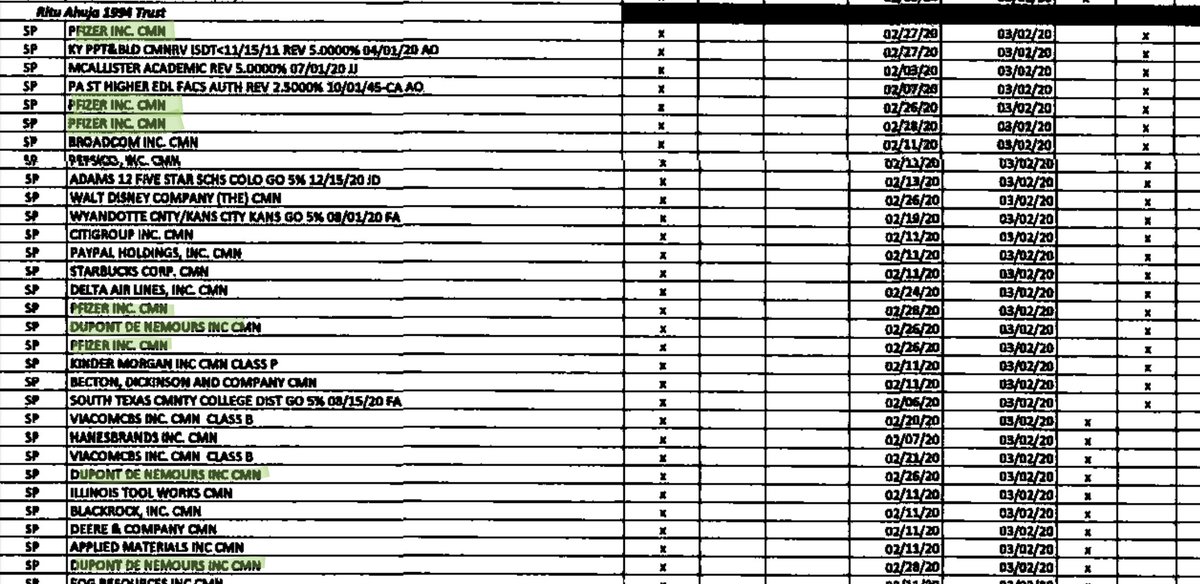

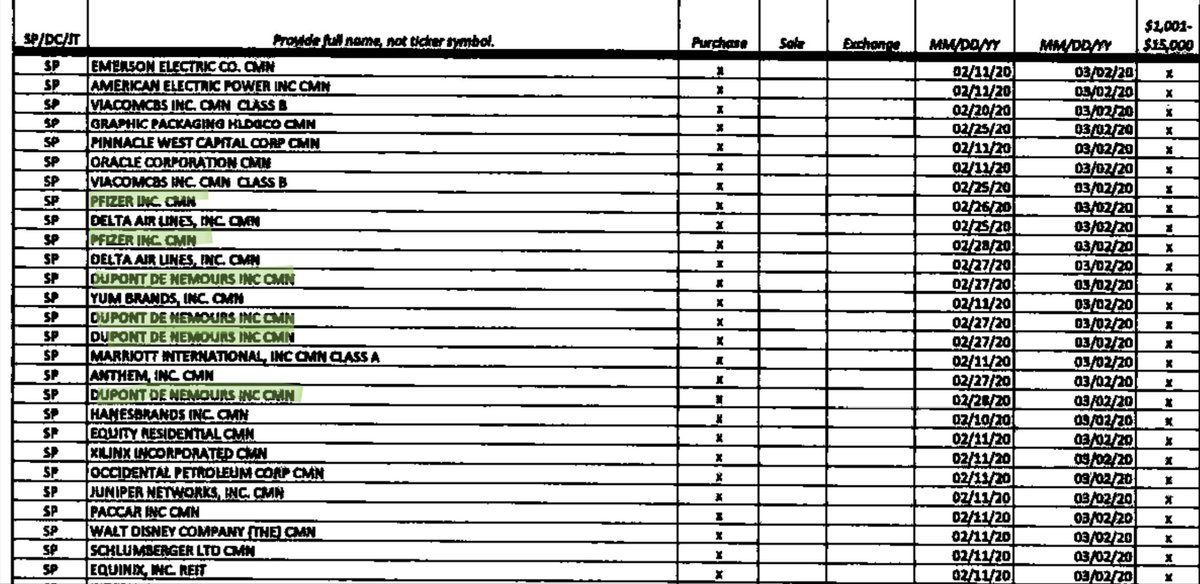

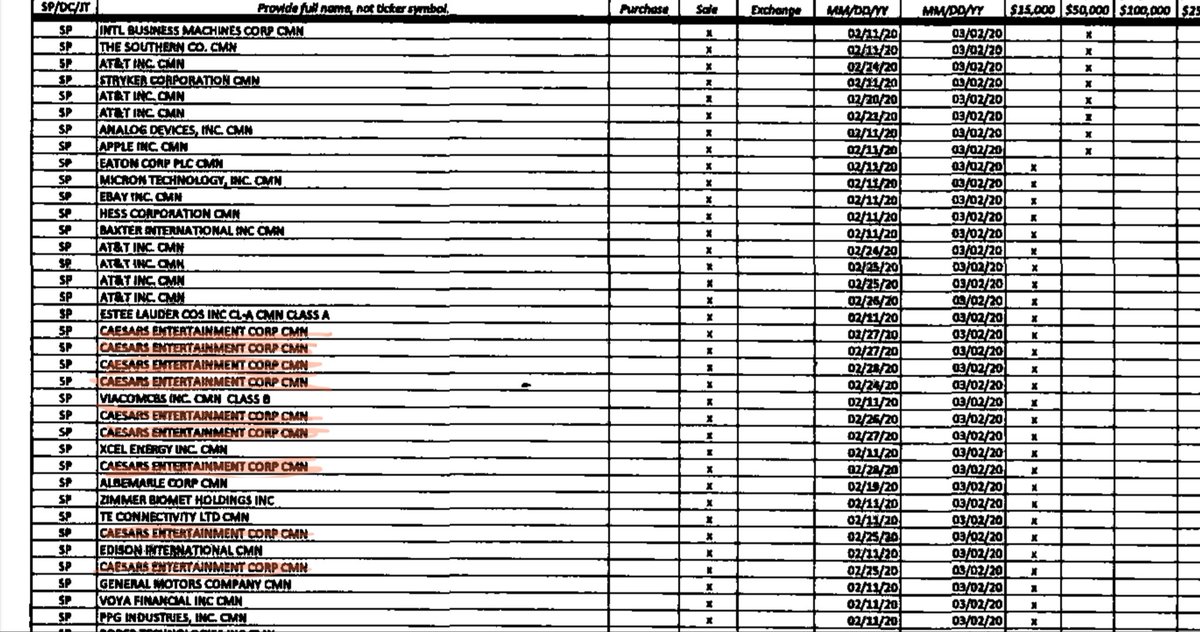

According to financial disclosures, Rep. Ro Khanna& #39;s many portfolios reflect numerous purchases of Pfizer ($87K—$430K) and Dupont ($23K—$170K), as well as multiple sales of Caesar& #39;s Entertainment stock ($15K—$235K) with transactions beginning around 2/24.

Many elected officials got into hot water for making big trades before the Covid-19 stock market plunge, including Sen. Kelly Loeffler.

Her recent purchases of Dupont, who makes protective equipment in high demand now, have come under scrutiny as well. https://time.com/5814158/georgia-kelly-loeffler-stocks-coronavirus/">https://time.com/5814158/g...

Her recent purchases of Dupont, who makes protective equipment in high demand now, have come under scrutiny as well. https://time.com/5814158/georgia-kelly-loeffler-stocks-coronavirus/">https://time.com/5814158/g...

According to disclosures, Rep. Ro Khanna and his multi-millionaire wife made several purchases of up to $170K of Dupont starting 2/24—just before the crash.

While Dupont& #39;s stock has suffered, it& #39;s recovering due to their services in relation to Covid 19.

While Dupont& #39;s stock has suffered, it& #39;s recovering due to their services in relation to Covid 19.

Rep. Khanna& #39;s several portfolios also reflect purchases of Pfizer ranging from $87K to $430K—in what appears to be an attempt to use coronavirus to make money in the stock market.

Pfizer is currently at the forefront of treatment development. https://www.google.com/amp/s/nypost.com/2020/04/09/pfizer-working-on-promising-coronavirus-treatment-vaccine/amp/">https://www.google.com/amp/s/nyp...

Pfizer is currently at the forefront of treatment development. https://www.google.com/amp/s/nypost.com/2020/04/09/pfizer-working-on-promising-coronavirus-treatment-vaccine/amp/">https://www.google.com/amp/s/nyp...

It should be noted that both Pfizer and Dupont have suffered losses since the market plunge, but both are also quickly rebounding due to their services in relation to the pandemic.

These purchases reflect an attempt to play the pandemic against the market for financial gain.

These purchases reflect an attempt to play the pandemic against the market for financial gain.

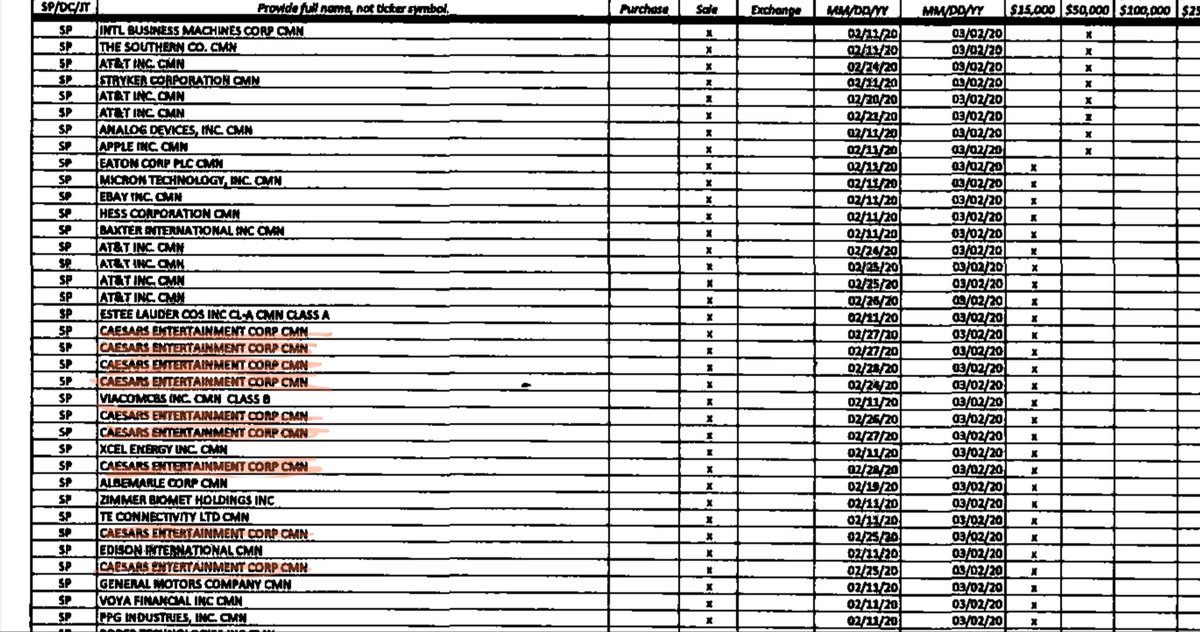

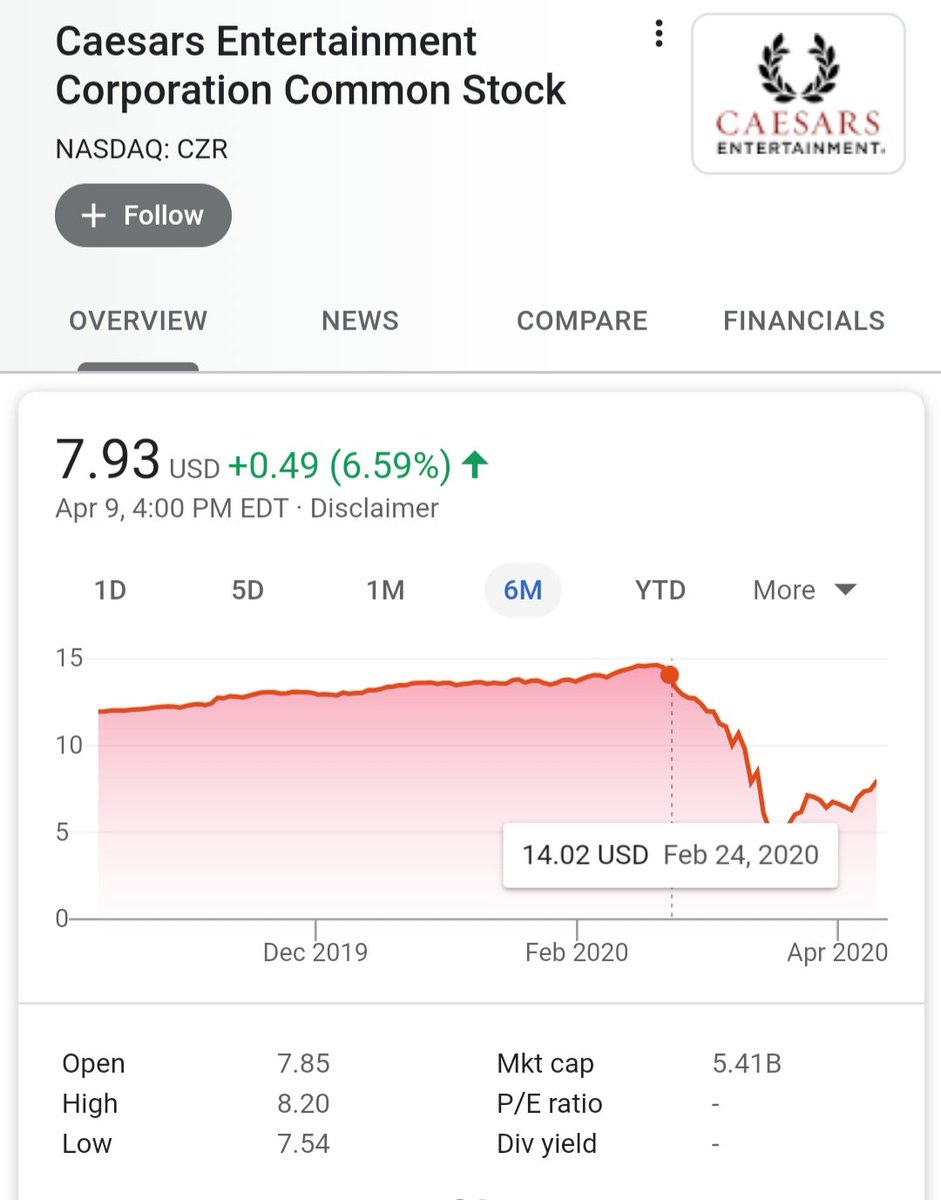

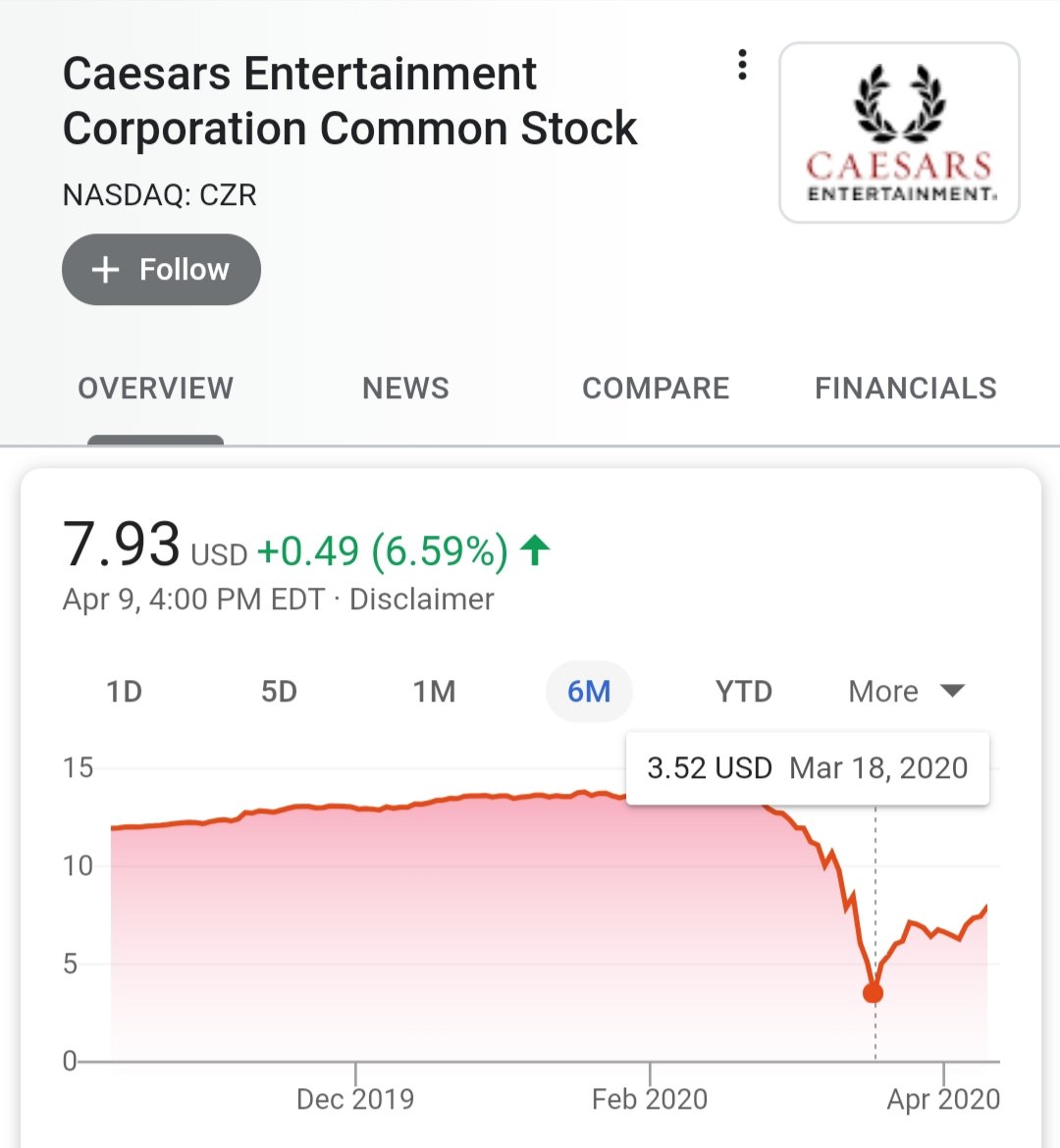

One transaction that the Khanna family definitely benefited from was the numerous sales totaling $15K—$235K) in Caesar& #39;s Entertainment/Casinos.

Within a month, Caesars stock would drop %75 to their 6 mo. low—saving them $11K to $176K from the sale.

Within a month, Caesars stock would drop %75 to their 6 mo. low—saving them $11K to $176K from the sale.

It should be noted that Khanna& #39;s wife is a multi-millionaire heiress and with numerous trusts so their finances are crazy convoluted.

Their stock portfolios however, reflect something less than "Progressive".

Their stock portfolios however, reflect something less than "Progressive".

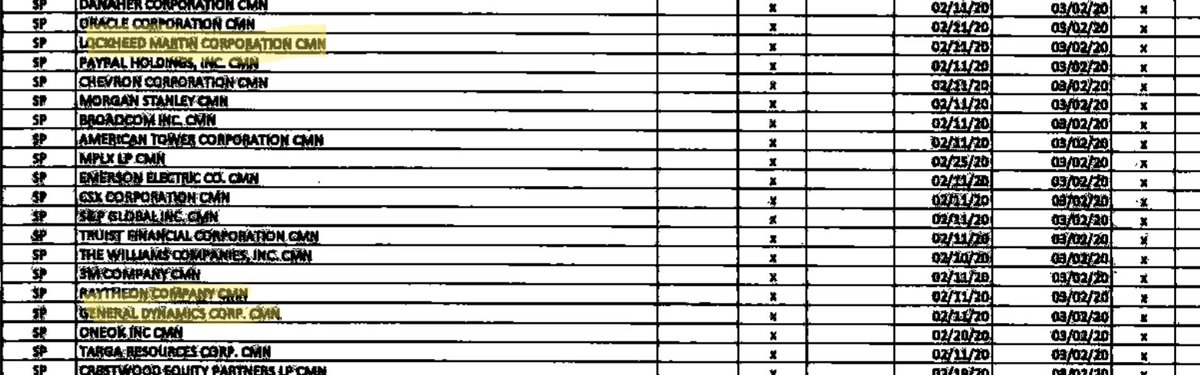

For instance, Rep. Khanna& #39;s financials reflect free-flowing transactions involving defense contractors such as:

—General Dynamics

—Boeing

—Northrop Grumman

—United Technologies

—Raytheon

—Lockheed Martin

—General Dynamics

—Boeing

—Northrop Grumman

—United Technologies

—Raytheon

—Lockheed Martin

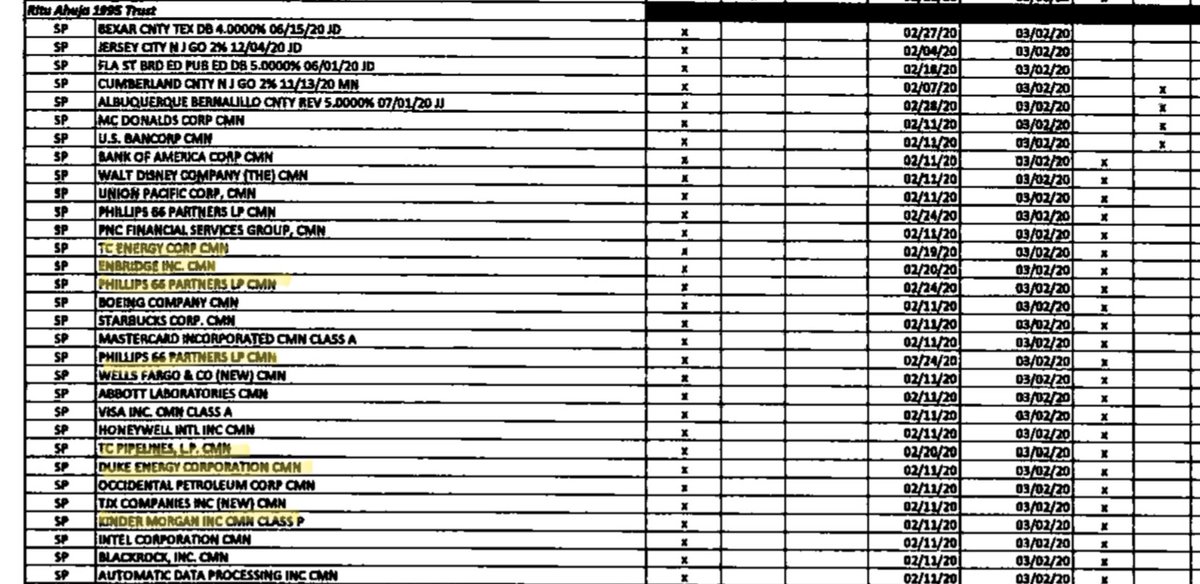

Alot of Oil and Pipeline money flows through Rep. Ro Khanna& #39;s family portfolios as well, regularly buying and selling companies like:

—Exxon

—TC Pipelines

—Phillips 66

—Marathon

—Kinder Morgan

—Enbridge

And more.

That list includes the owners of DAPL.

—Exxon

—TC Pipelines

—Phillips 66

—Marathon

—Kinder Morgan

—Enbridge

And more.

That list includes the owners of DAPL.

Read on Twitter

Read on Twitter