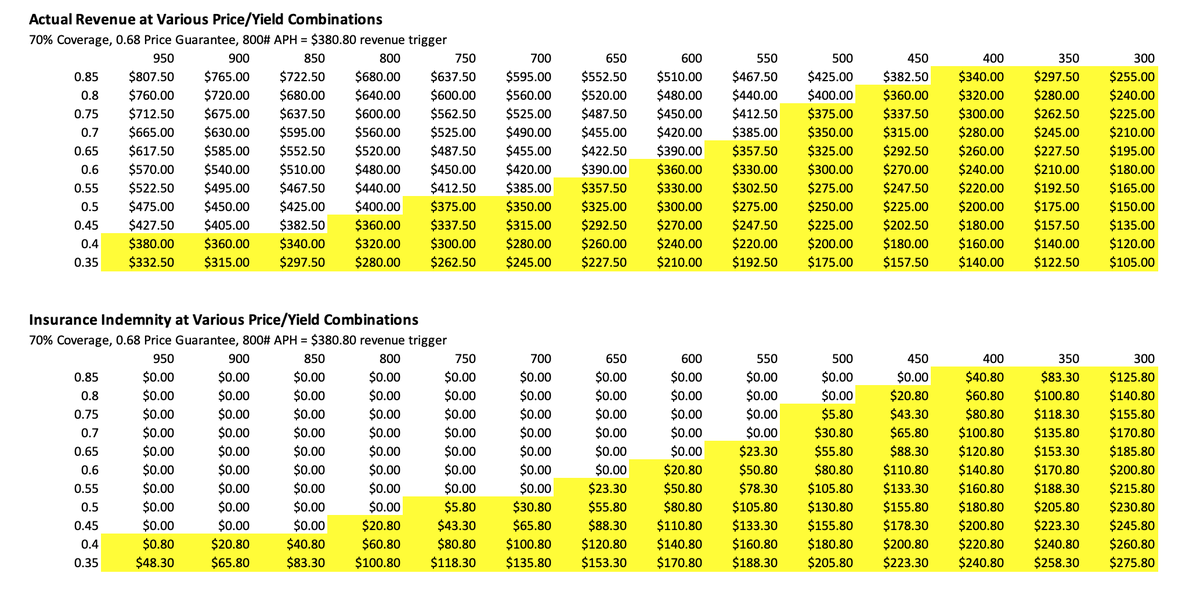

Ok, here is what worries me a bit in #cotton and other #ag #commodities. This is an example of a #Texas High Plains cotton farm with an 800# APH yield and a $0.68/lb insurance price. At $0.55 you could still make as much as near 650# and not receive an indemnity. (1/n)

So, given that price has fallen about 20% since insurance price discovery time, producing an average crop results in no revenue protection. Now, that is the deductible that was chosen by the producer (70% revenue coverage here), and that is the doughnut hole that results. (2/n)

But, normally, we expect yield and price to move (at least somewhat) in the opposite direction. So what? you ask. Well, let& #39;s just consider revenue. The revenue at the ins price is about $600/ac but about $440/ac at current price. That is a 26% decline. (3/n)

So even if the producer went from 800# to 950# at the same price, added revenue from yield does not compensate for the loss in price since Feb. (4/n)

So, the worst possible place to be is producing a decent crop and have the price rise a little from here to the 60 cent range. Even at $0.65, the producer has to yield closer to 900# to achieve similar revenue per acre as with the APH and ins price.

Read on Twitter

Read on Twitter