To all the people who recently connected with me on Twitter, thank you for your interest. To all my long-time friends, thank you as well. Here are 10 of the foundational lessons I learned as an analyst @themotleyfool. I hope they& #39;ll be as helpful to you as they& #39;ve been to me

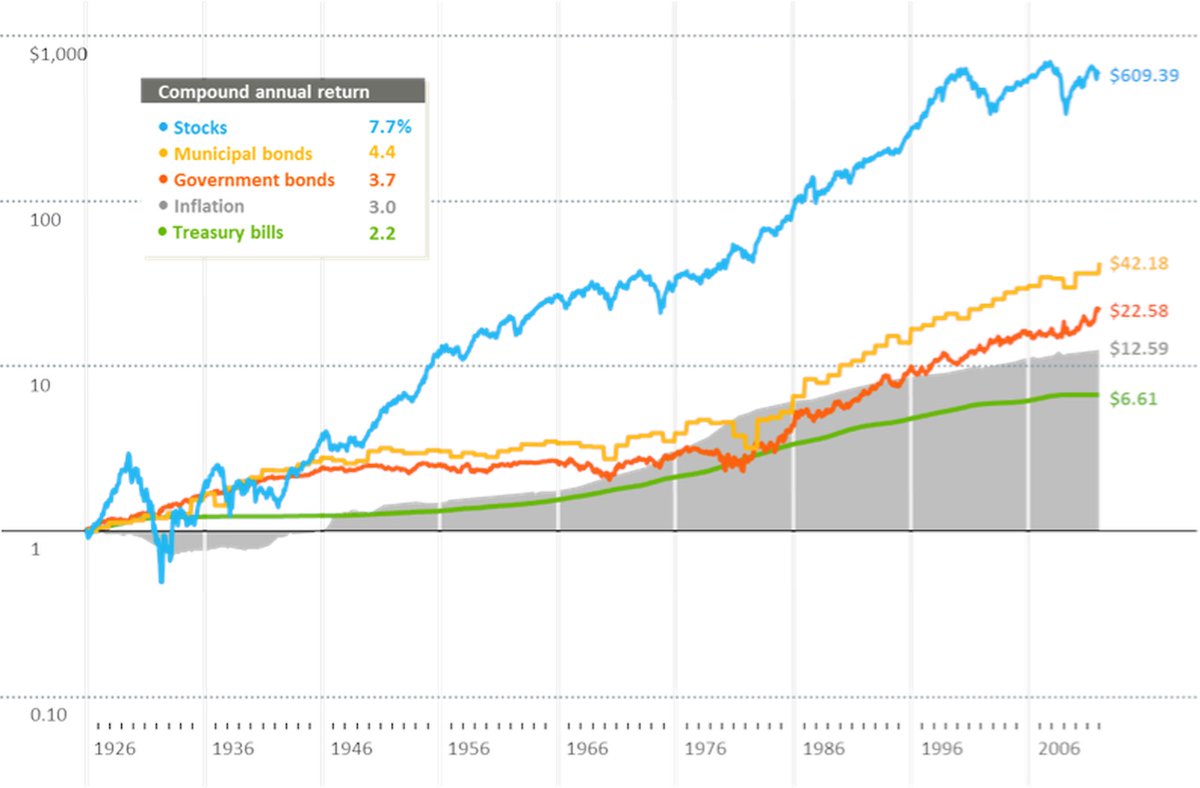

1. Investing in stocks is one of the best ways to build lasting, long-term wealth.

Cases can be made for achieving wealth through real estate or the creation and ownership of private businesses, but few asset classes have a track record of wealth creation as solid as public stock ownership, especially on a real (inflation-adjusted) basis.

2. Stocks represent an ownership stake in a real business.

Stocks aren& #39;t just flashing blips on a computer screen. They& #39;re legal claims on the current and future cash flow of a business and should be treated as such. When viewed through this lens, the fundamental drivers of long-term investing success become clearer and easier to grasp.

3. As such, buy shares in the best businesses you can find...

Those with the strongest competitive advantages, largest growth opportunities, and best management. The innovators, disruptors, and best of breed. These businesses are ... Tier 1. And they tend to create tremendous wealth for their shareholders as they lead the world forward.

4. Buy stocks with the intent of holding them for as long as you possibly can.

Warren Buffett has said his "favorite holding period is forever." Here at The Motley Fool, @TomGardnerFool has implemented a minimum five-year holding period requirement in his Everlasting Portfolio, because he, too, is a big believer in the power of long-term stock ownership.

While I don& #39;t impose that restriction on myself, I do strive to only purchase stock in businesses that I plan to hold for years -- and potentially even decades -- to come. I& #39;m talking about outstanding businesses such as $AMZN $GOOG and $MSFT

These companies have dominant competitive advantages that provide a wide moat around their cash flow, yet they still have tremendous runways for growth. I wouldn& #39;t be surprised if they form the foundation of my children& #39;s portfolios decades from now.

5. Winners tend to keep on winning.

This is another valuable lesson I learned from Tom and @DavidGFool. I like to invest in companies & management teams with proven track records of success. That& #39;s because I believe past success is one of the best indicators of future success. It& #39;s certainly not a guarantee, but...

Winning is a habit. The confidence and momentum achieved from past and current wins tend to pave the way for further risk-taking. Not blind risk predicated on arrogance, but prudent, calculated risks based on optimistic and opportunistic bets on a brighter future.

6. Strive to buy these great companies early in their growth cycles.

The earlier you invest in a great business, the more you can profit as other investors catch on to the company& #39;s success. This is where fortunes are made, where the 10- and even 100-baggers are found.

https://www.fool.com/investing/general/2013/11/01/motley-fool-co-founder-david-gardner-on-his-first.aspxr">https://www.fool.com/investing...

https://www.fool.com/investing/general/2013/11/01/motley-fool-co-founder-david-gardner-on-his-first.aspxr">https://www.fool.com/investing...

I& #39;ve achieved multibagger returns in CAPS with several stocks, including 1,000+% gains in $AAPL $AMZN & $SHOP. It& #39;s a goal of mine to find more of them going forward so that I can help more people achieve these types of market-crushing -- and potentially life-changing -- returns.

7. Make your portfolio your best expression of the world.

David Gardner once urged me to "Find out where the world is going -- and get there as soon as possible."

Your portfolio should reflect your passions, interests, field of study, and/or profession -- this is where your edge lies. But most of all, your portfolio should be positioned according to your vision of the future, and the more optimistic, the better. https://www.fool.com/investing/general/2013/06/04/why-im-an-optimist.aspx">https://www.fool.com/investing...

8. Never stop learning.

To have an informed opinion of where the world is going, we should seek to expand our horizons and circle of competencies beyond investing and business, to include a wide array of disciplines such as psychology and the sciences.

For the market moves not solely on others& #39; rational thinking, and it& #39;s often swayed by the biases and other intricacies of human behavior.

Each day, I strive to learn more about the world in which we live. I hope you& #39;ll do the same.

9. Never quit.

There will be times when you throw up your hands in frustration and question whether it& #39;s worth all the trouble.

Seemingly irrational short-term volatility and vicious bear market declines tend to be brutal on high-quality yet often premium-priced businesses. These difficult market times can play havoc on your emotions.

However, the only way to win is to stay the course through the inevitable downturns. Steel yourself with the knowledge that this, too, shall pass, and that your best-of-breed businesses will likely emerge from the rubble even stronger as they take share from weaker rivals.

As such, learn to look at these sell-offs as opportunities to add to your positions at even better prices, and you will magnify your long-term gains.

10. Use for good the tremendous wealth these principles will help you create.

Along with investing in businesses that lead the world forward, strive to have a positive impact on the world around you. Help others. Donate what you can to worthy causes. And pass on what you have learned, as I have attempted to do here.

On that note, I& #39;d like to ask all of you reading this thread to list the lessons you would like to pass on in the replies below.

Read on Twitter

Read on Twitter