1/x facts

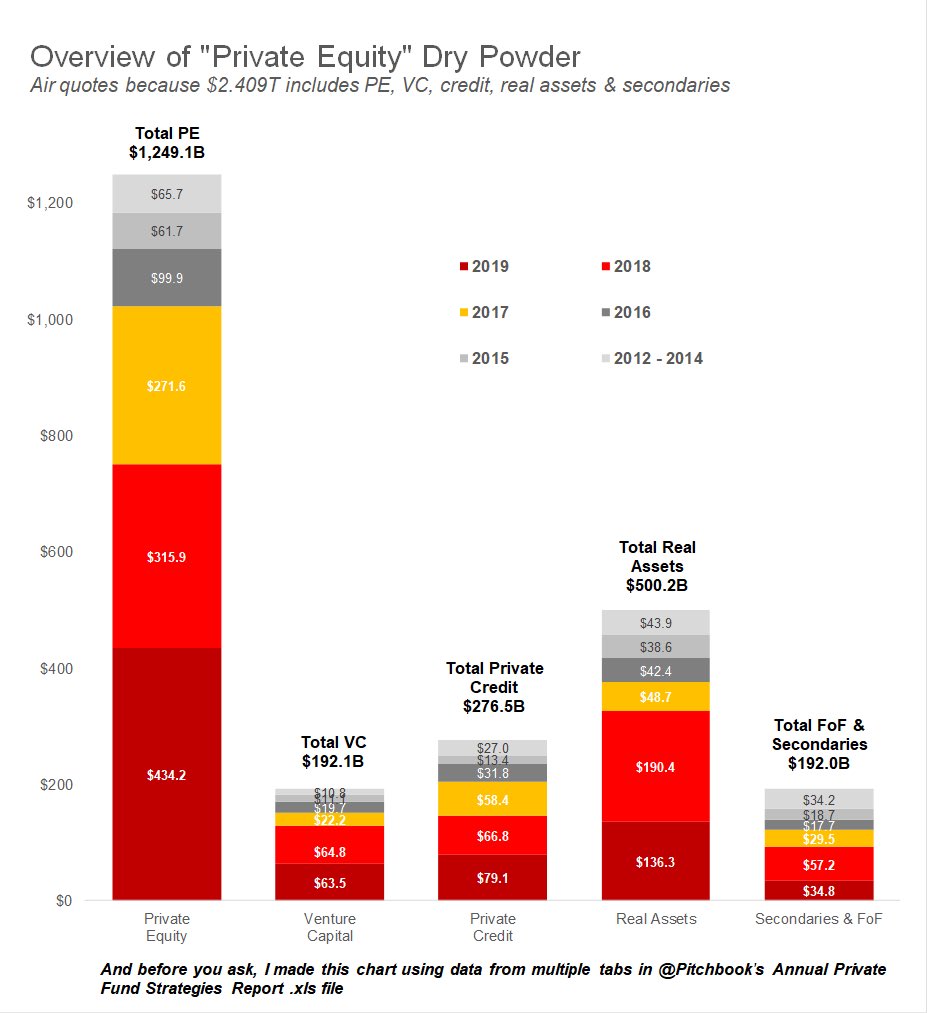

$2.409T in dry powder IS NOT just PE; it’s ALL private strategies, regions, & vintage years. In private equity (1st bar):

1. Docs often req deploy <5yrs (~’15-‘19 vintages)

2. ~80% per yr designated ‘buyout’

2. ~70% of that is U.S.

US PE dry powder = $600B - $800B

$2.409T in dry powder IS NOT just PE; it’s ALL private strategies, regions, & vintage years. In private equity (1st bar):

1. Docs often req deploy <5yrs (~’15-‘19 vintages)

2. ~80% per yr designated ‘buyout’

2. ~70% of that is U.S.

US PE dry powder = $600B - $800B

2/deploying dry powder challenging:

* Teams focused assessing current portfolio co financials/impact.

* direct lending (private credit) wants cash infusions for sponsor backed firms for concessions

* onsite DD w/ new teams & companies nearly impossible

* Teams focused assessing current portfolio co financials/impact.

* direct lending (private credit) wants cash infusions for sponsor backed firms for concessions

* onsite DD w/ new teams & companies nearly impossible

3/x soapbox

I get that you may be angsty re ‘greedy’ PE-backed firms benefiting from gov’t stimulus, but PE is not limitless and the $$ at risk belongs almost entirely to 501c3 & pensions

Plus, you prob own an index fund, so enjoy your airline & retail, &etc bailouts

I get that you may be angsty re ‘greedy’ PE-backed firms benefiting from gov’t stimulus, but PE is not limitless and the $$ at risk belongs almost entirely to 501c3 & pensions

Plus, you prob own an index fund, so enjoy your airline & retail, &etc bailouts

4/ w/that said investing in equity, public or private, has (historically) been handsomely rewarded. But investors accept risk as part of the rules of the game. While a novel global pandemic is a true black swan, why is it unpopular to say that equity should get wiped out?

Read on Twitter

Read on Twitter