1/ Fantastic work by @HyunSongShin on how moving away from original sin @upanizza doesn’t solve all problems as large foreign ownership of local debt still links them into global financial cycles @helene_rey https://twitter.com/bis_org/status/1247464388216467456?s=21">https://twitter.com/bis_org/s...

2/ But why some countries do better than others?

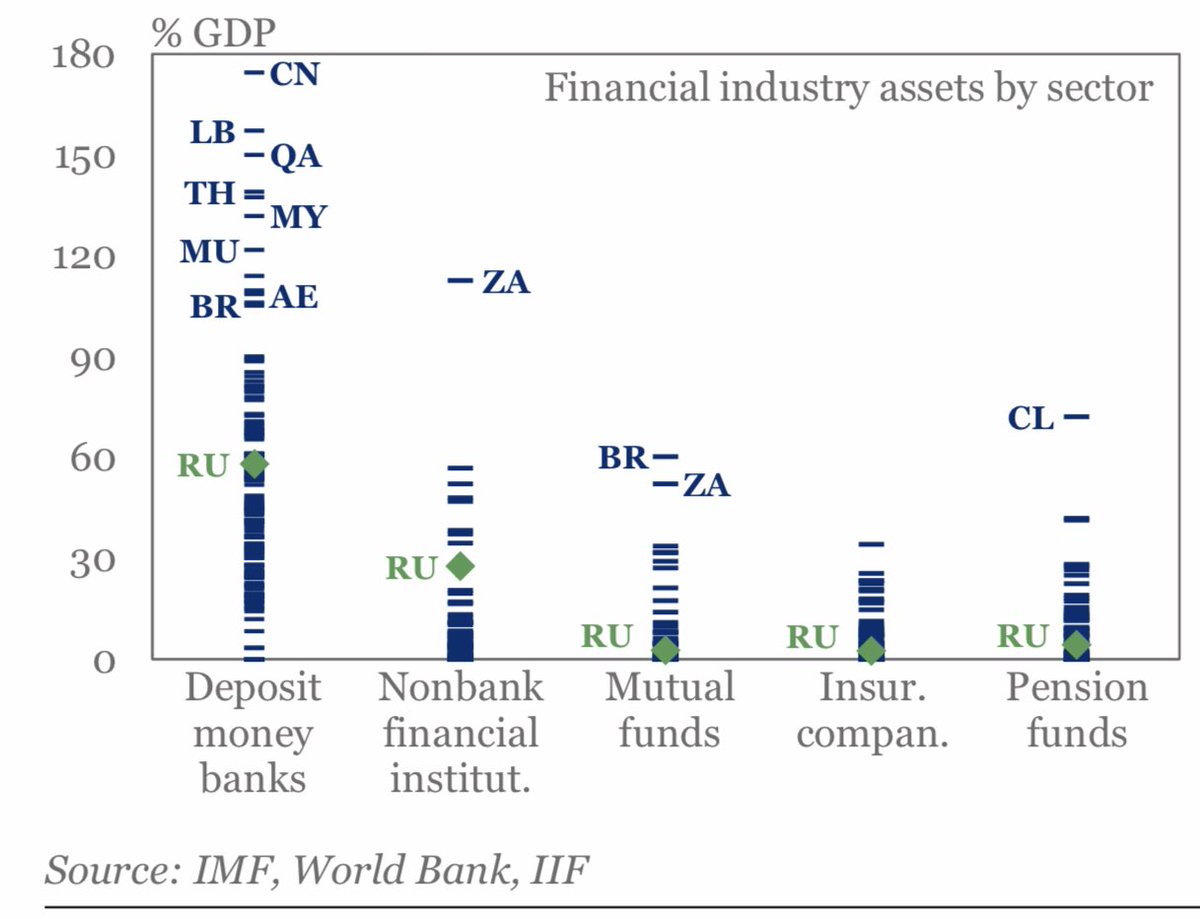

Depth and access to domestic long term funding matters in addition to market fundamentals.

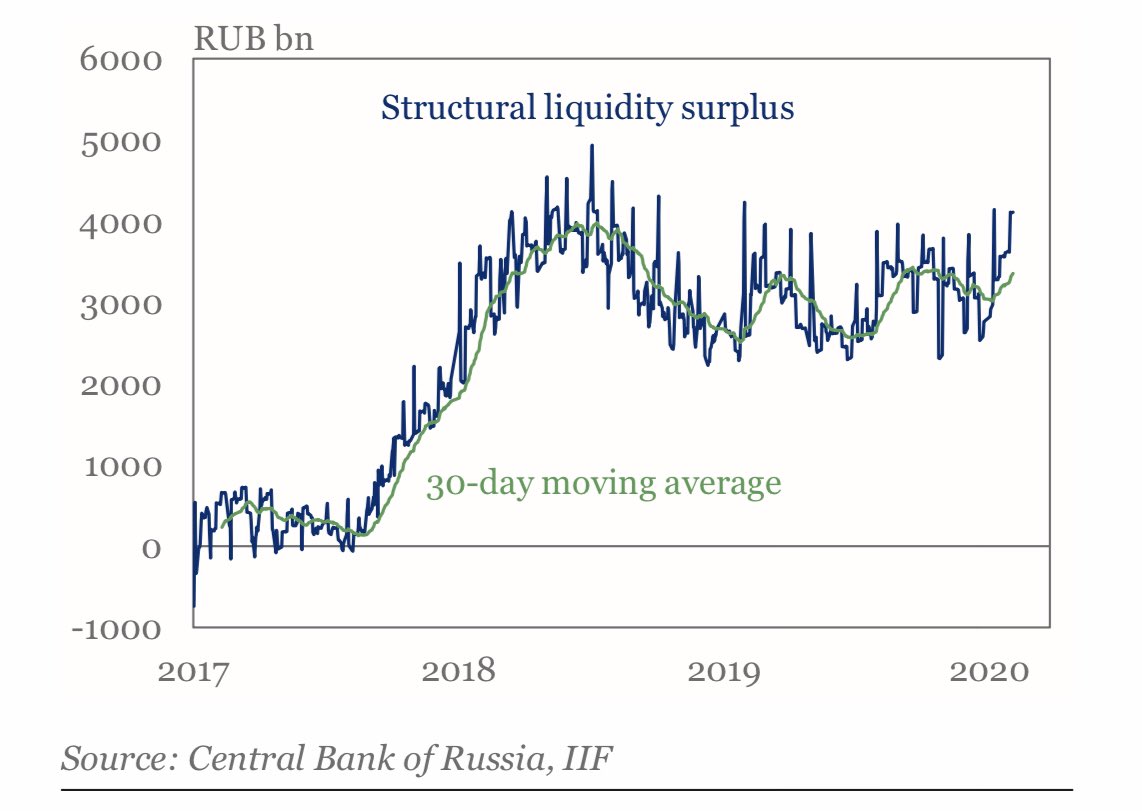

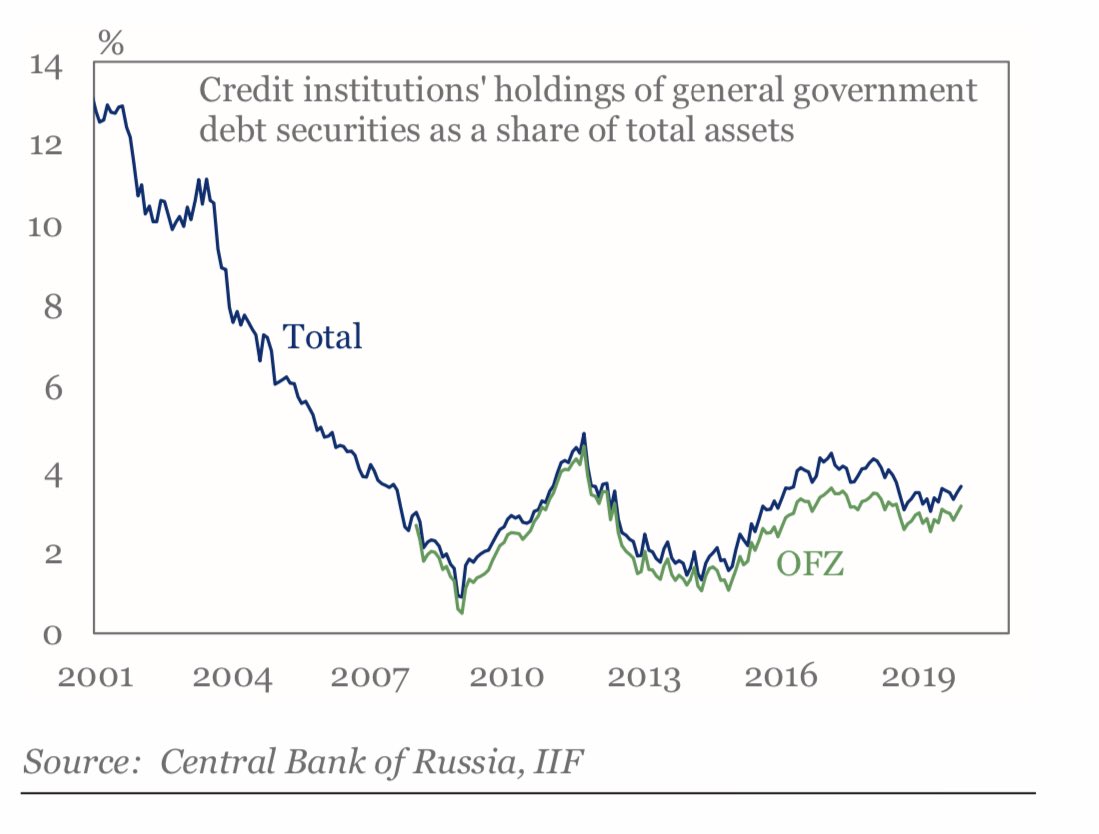

Example #Russia. Local banks are highly liquid and little government debt.

Depth and access to domestic long term funding matters in addition to market fundamentals.

Example #Russia. Local banks are highly liquid and little government debt.

3/ As a result OFZ (Ruble denominated local debt) stabilized earlier in the #COVID19 crisis even if Russia is also massively exposed to #OilPriceWar #OOTT

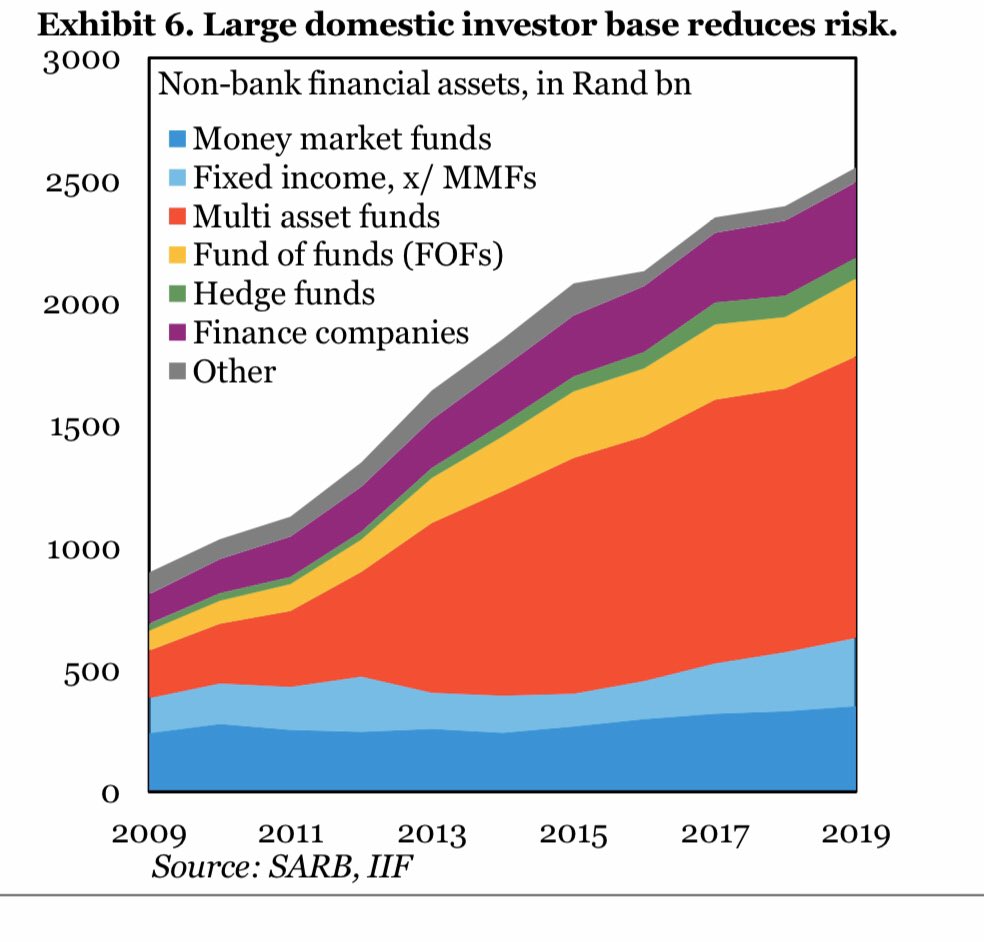

4/ A different example of South Africa where fiscal challenges are significant. Debt to GDP could increase to up to 100% and deficit 10% of GDP. Where do you think local rates should be to a country like this? Surprise, auction went relatively well and we are back sub-10%.

5/ Of course DM CB support helps as well as talk of possible multilateral support if and when. But having long-term domestic real money investors is critical as well as banks. See how South Africa stands out with the share of nonbank assets in % of GDP.

6/ Diverse and deep domestic markets help during global shocks. One could say, indirectly postpone fiscal adjustment too in case of South Africa. https://www.iif.com/Portals/0/Files/content/2_IIF20191211_MN.pdf">https://www.iif.com/Portals/0...

Read on Twitter

Read on Twitter