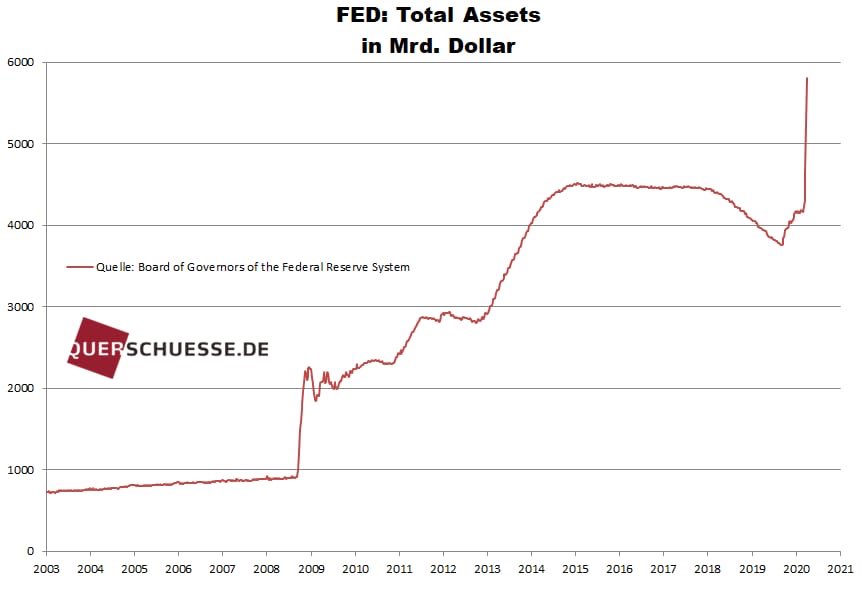

#FED balance goes nuts: +$1,143 trillion in 2 weeks!!!

Who thinks that should do the job is completely wrong. The FED is in a shopping spree to save the system and pump the markets to a last parabolic high - the big finale!

Here we go: that’s the Programms with fancy names:

Who thinks that should do the job is completely wrong. The FED is in a shopping spree to save the system and pump the markets to a last parabolic high - the big finale!

Here we go: that’s the Programms with fancy names:

Now they want to pump another $2,3 trillion in the market and even buy junk bonds!

With the Paycheck Protection Program (PPP) the FED gives loans to small and medium sized companies so they can pay their employees.

Another $600 billion to buy loans from this https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Up pointing backhand index" aria-label="Emoji: Up pointing backhand index">companies

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👆" title="Up pointing backhand index" aria-label="Emoji: Up pointing backhand index">companies

With the Paycheck Protection Program (PPP) the FED gives loans to small and medium sized companies so they can pay their employees.

Another $600 billion to buy loans from this

above.

Stopp!

Wait a second. Isn’t this a old school #Ponzi scheme? The FED gives loans to companies and then they buy their credits back?

Just has a better name than ponzi: Main Street Lending Program.

But there is more:

Stopp!

Wait a second. Isn’t this a old school #Ponzi scheme? The FED gives loans to companies and then they buy their credits back?

Just has a better name than ponzi: Main Street Lending Program.

But there is more:

The $850 billion TALF-Programm (Term Asset-Backed Securities Loan Facility) to buy bigger credits and secure liquidity.

Furthermore $500 billion for local and regional governments so they can act and secure liquidity.

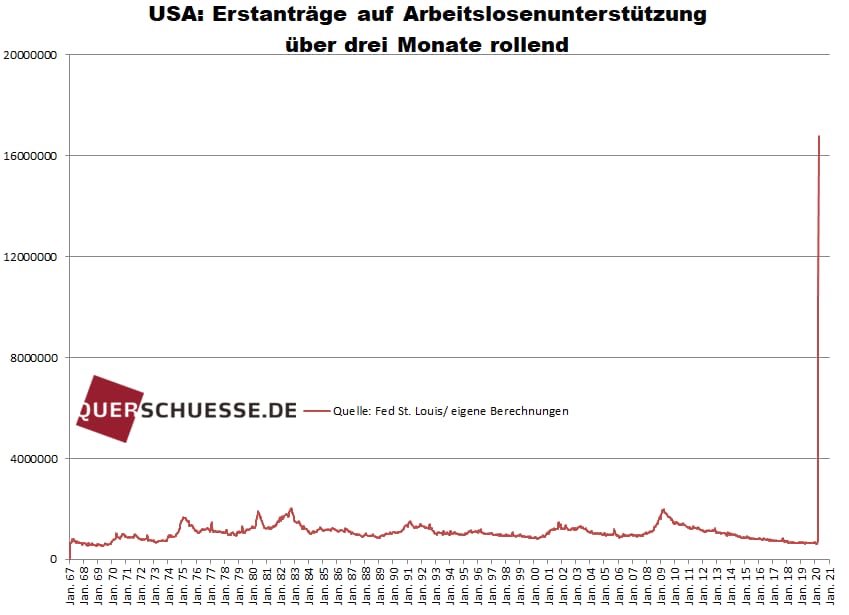

With 16,78 million jobless claims in only 3 weeks and more

Furthermore $500 billion for local and regional governments so they can act and secure liquidity.

With 16,78 million jobless claims in only 3 weeks and more

to come this won’t be the end. More to come. This is the biggest monetary experiment of all times! And we are watching it and we will pay for it.

The system is in the endgame. Please prepare! Look at #Gold. Soon new ATH also in USD. I recommended Gold since I startet on twitter

The system is in the endgame. Please prepare! Look at #Gold. Soon new ATH also in USD. I recommended Gold since I startet on twitter

and still do! It’s a safe haven. The more money the crazy crackers at the centralbanks print the more you want limited assets like Gold, #Silver, Land, #diamonds, #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> ....

https://abs.twimg.com/hashflags... draggable="false" alt=""> ....

More in my books and you tube Chanel https://m.youtube.com/channel/UCSiFC1DCXr3p1YDzyu9rogA

They">https://m.youtube.com/channel/U... only will buy time within the system

More in my books and you tube Chanel https://m.youtube.com/channel/UCSiFC1DCXr3p1YDzyu9rogA

They">https://m.youtube.com/channel/U... only will buy time within the system

is no solution! Perhaps they will win on more time and buy more time but in the end this whole house of cards will collapse and it will the biggest crash of all times.

Historic times, prepare accordingly, stay healthy and please follow me and retweet this thread so people know.

Historic times, prepare accordingly, stay healthy and please follow me and retweet this thread so people know.

Read on Twitter

Read on Twitter