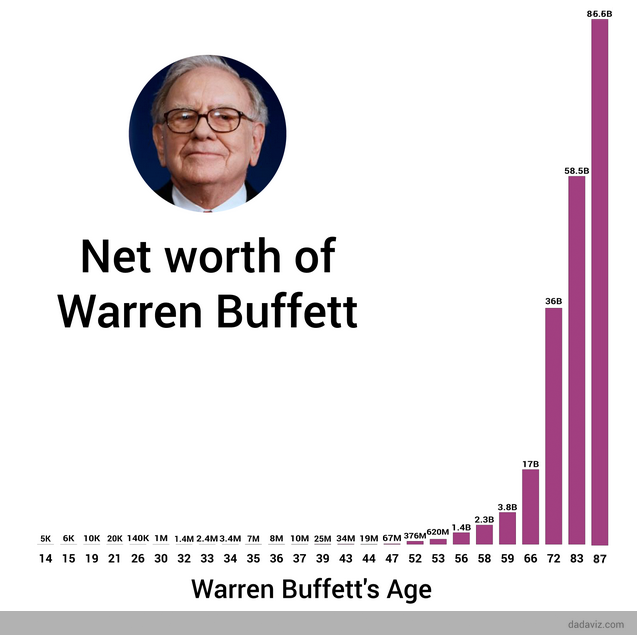

I recently watched a documentary about one of my favorite investors Warren Buffett. Some interesting takeaways:

1) Started investing w/ $105k w/ friends and family $$. Took no salary. Earned only profit share from gains over 6%.

1) Started investing w/ $105k w/ friends and family $$. Took no salary. Earned only profit share from gains over 6%.

2) In < 10 yrs turned $105k into $7m!!

3) In order to run this small "fund", he moved back to Omaha from NYC and had cheap housing. Often cheaper cities are great for bootstrapping.

4) Shut down the partnership once the markets got too frothy. Believed he couldn& #39;t make money, because valuations were too high. He could have gotten more AUM and charged whatever but didn& #39;t think he could deliver strong gains.

5) He made the mistake in buying a textile co (called Berkshire Hathaway) basically out of spite and thought he could turn it around. The textile biz continued to flounder.

6) But he was smart enough to realize that and decided to use it& #39;s cashflows to build out an insurance business. In insurance businesses, customers pay you upfront and you don& #39;t do payouts later. Great cashflow business for recessions.

7) With the upfront cash from the insurance business, he went and bought positions in other companies - this is basically the Berkshire Hathaway we know today.

8) Initially he went into business alone but later brought Charlie Munger into the company. Charlie changed his thinking around types of companies to buy. Prev Warren focused on buying "deals" & optimizing. Charlie changed the strat to paying up for "great companies" & waiting.

9) It is a lot less work to just let an already great management team continue to operate and wait for gains than it is to try to change out teams and deal w/ ppl issues.

10) Warren is focused on the qualities that he& #39;s looking for in a company. He uses a Ted Williams& #39; strike zone analogy. Ted would bat 40% if a ball was thrown in a specific area. His batting ave was much lower outside of that. Warren only invests if a company fits his criteria.

11) Most ppl think Warren is super rich (and he is), but for many yrs, building this firm / Berkshire was like building a startup. Keeping his expenses low was key to compound wealth growth. (Living in Omaha, renting a house at first, having a frugal lifestyle, etc)

12) Lastly, the thing I like best is that many ppl try to go into investing to make lots as a means to an end. For Warren, investing is the end goal - it& #39;s a fun project that isn& #39;t a job.

Oh final final thought -- this is the documentary: https://www.youtube.com/watch?v=RYHPlLsdW0A">https://www.youtube.com/watch...

Read on Twitter

Read on Twitter