A lot of crazy stuff happening in the energy world right now: a thread.

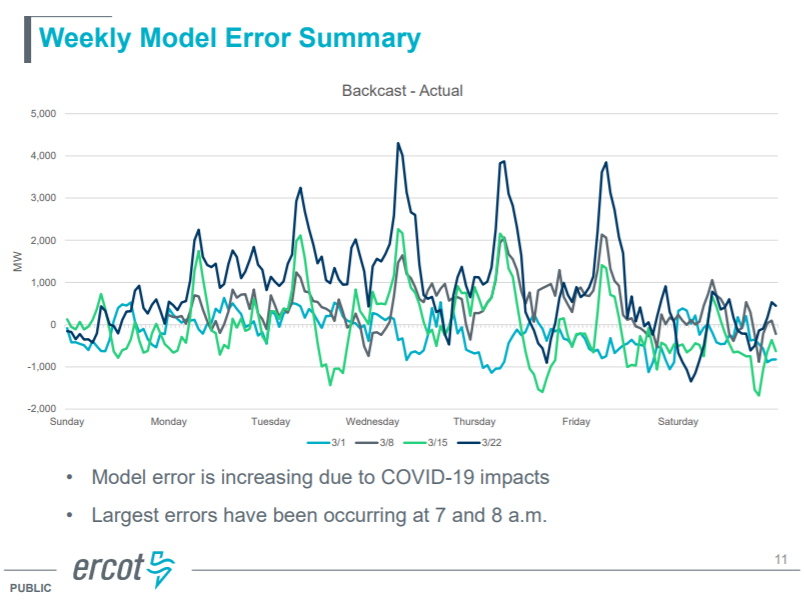

One big one is the impact of quarantine on load. In ERCOT, they are seeing modeling errors get wider every day

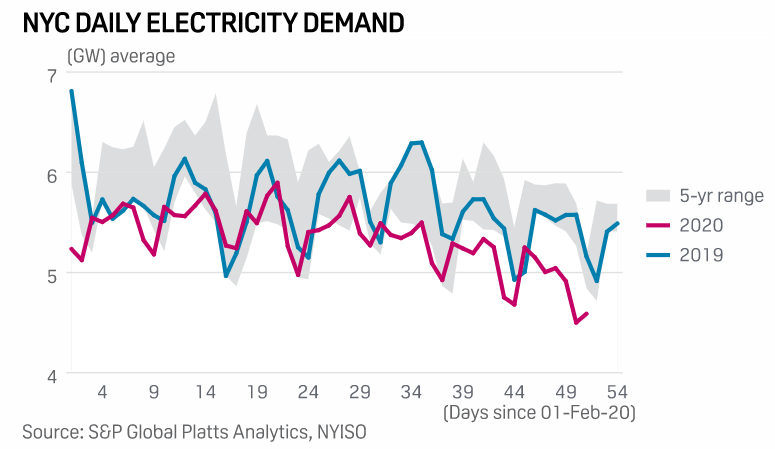

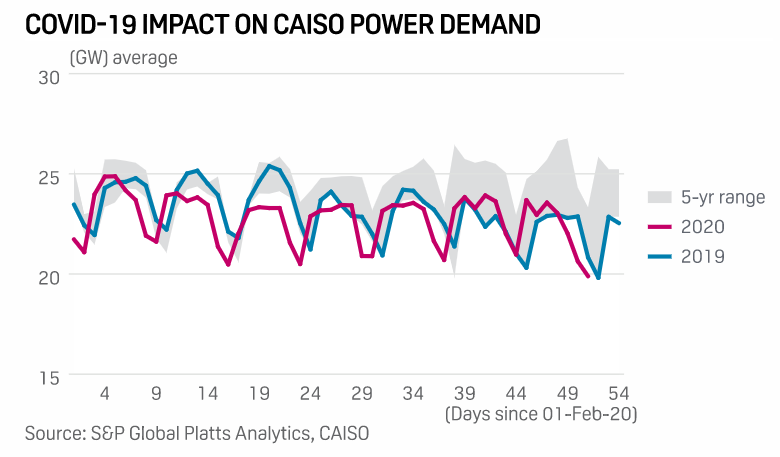

New York City daily demand is way down (although apparently not making a statewide impact yet) and CAISO is down, although not as dramatically as NYC

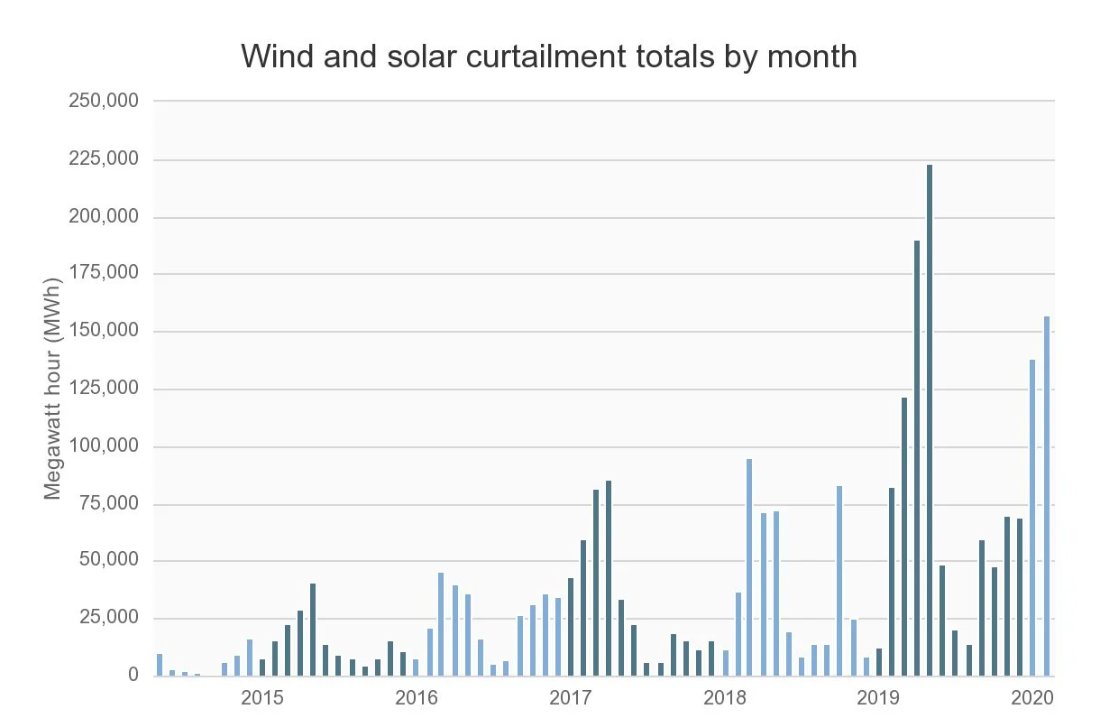

Speaking of CAISO, while curtailments were already high due to more renewables: the load drop has sustained that trend (>10x y/y for Jan) via @greentechmedia

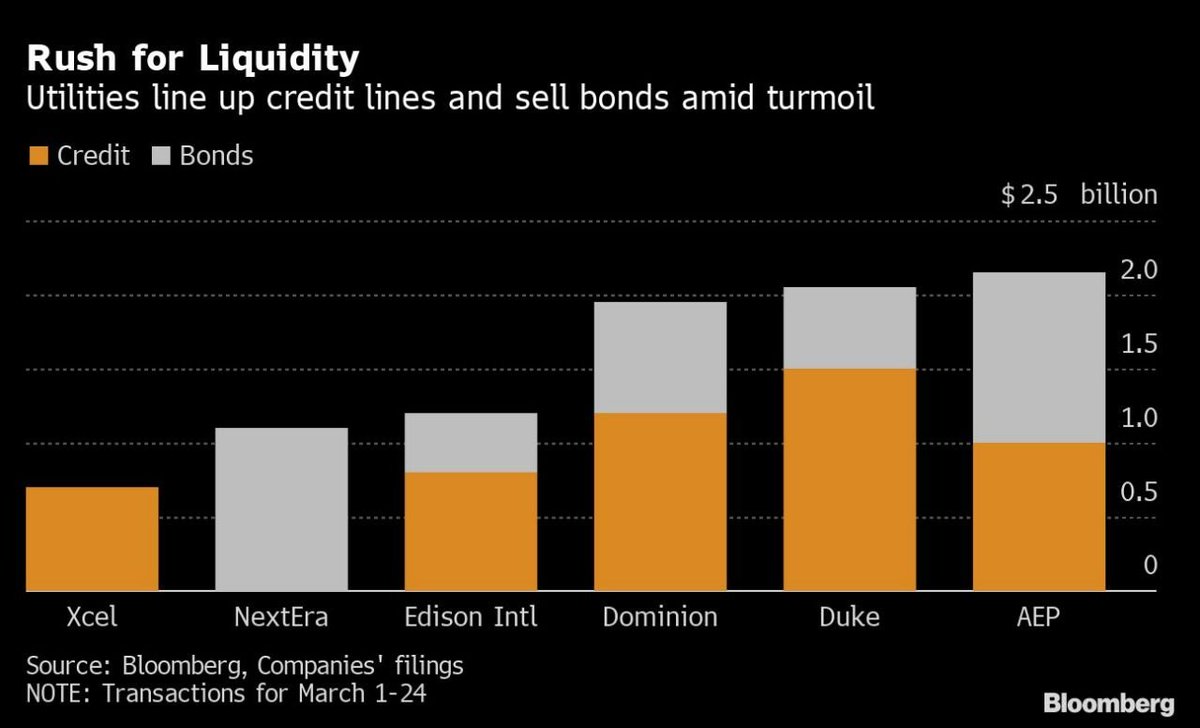

While that is all going on, utilities haven& #39;t had a tough time accessing capital: $15B in credit lines/bonds tapped - in March! And at such prices- NextEra at 237.5 bps over treasuries. https://finance.yahoo.com/news/u-utilities-line-14-billion-160915814.html">https://finance.yahoo.com/news/u-ut...

Speaking of low oil prices: WoodMac forecasts a 43% drop in EV demand this year. But the big trend to electrification may be ok -- VW says a yearlong slump won& #39;t slow their shift to EVs.

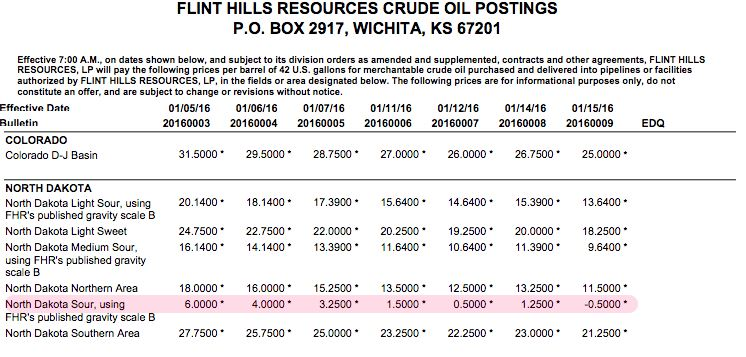

Low oil prices have had a surprising upside for clean energy, though! Read this amazing thread from @TimMLatimer on the relationship between oil prices and geothermal development costs. https://twitter.com/TimMLatimer/status/1244641415419899910">https://twitter.com/TimMLatim...

Also crazy: how LNG is getting thrown into two-pronged turmoil as major importers deal with outbreaks -- and oil prices collapse driving competition as a marginal fuel. https://gjia.georgetown.edu/2020/03/27/the-oil-price-collapse-could-reshape-global-natural-gas-markets/">https://gjia.georgetown.edu/2020/03/2...

Also, could the our real climate champion wind up being... the Fed? By putting Blackrock in charge of directing funds -- this is the Blackrock who just committed to ESG in a big way -- we may see this capital all invested via a climate lens. https://www.ft.com/content/f9c7e4de-6e25-11ea-89df-41bea055720b">https://www.ft.com/content/f...

Maybe more added later, but FIN for now

Read on Twitter

Read on Twitter