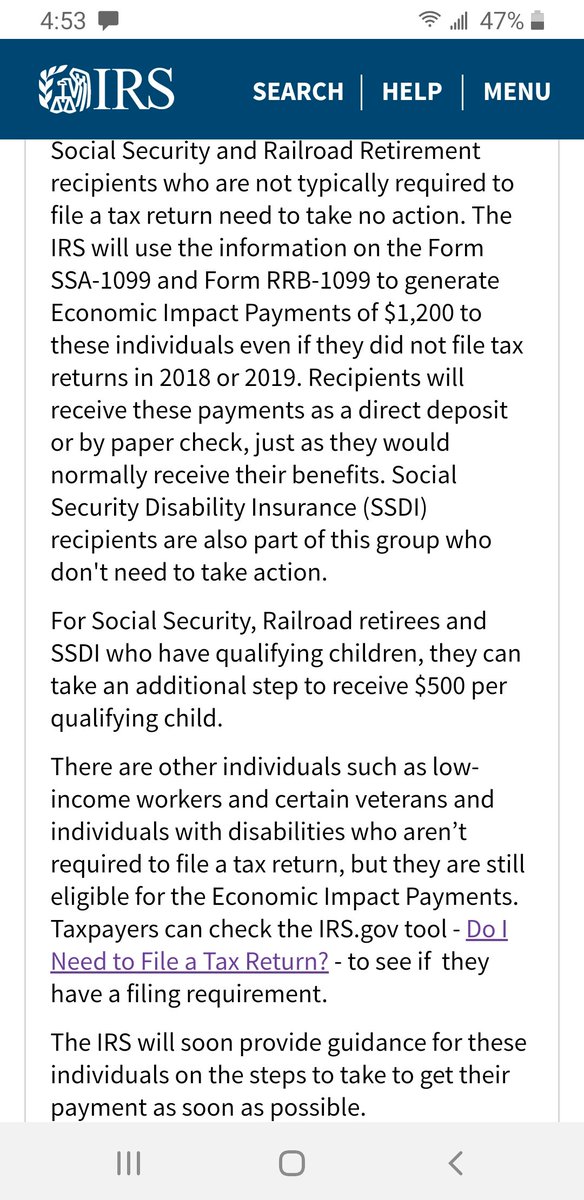

IRS website now says SSI disability recipients don& #39;t have to file taxes under the "Who is eligible?" section, but then don& #39;t explain how they& #39;ll pay us under the "Do I need to take action?" section like everyone else listed in the former section. Hmm. https://www.irs.gov/coronavirus/economic-impact-payment-information-center">https://www.irs.gov/coronavir...

I used the IRS& #39; linked "Do I Need To File A Tax Return?" tool and got the answer no, of course, because SSI disability benefits do not count as taxable income.

Initially SSI disability recipients were told we& #39;d have to file a 2019 tax return to get the COVID-19 coronavirus pandemic $1,200 Economic Impact Payment from the government to give the IRS our direct deposit bank account info, even though the Social Security Administration...

...already has it on file and could easily share.

Senators then sent a letter saying we must be automatically included too, as the Social Security Administration was already ordered to share direct deposit bank account information for others, like SSDI disability recipients.

Senators then sent a letter saying we must be automatically included too, as the Social Security Administration was already ordered to share direct deposit bank account information for others, like SSDI disability recipients.

So what& #39;s the deal here? How do I get the COVID-19 coronavirus pandemic $1,200 Economic Impact Payment from the government? I& #39;m so confused. I haven& #39;t heard that we no longer need to file 2019 taxes from any disability community leader I trust yet. Ugh. This is so frustrating.

Literally the whole point in making us SSI disability recipients have to jump through extra hoops to get the COVID-19 coronavirus pandemic $1,200 Economic Impact Payment is to save the government money from the people who don& #39;t have the time/energy/resources to do more paperwork.

Historically, there& #39;s a lot of unclaimed stimulus money by the poorest people who obviously need it the most as a result from adding extra bureaucratic hoops to jump through.

It& #39;s just like the SSI disability program& #39;s -- and every other government benefits program -- strategy for drowning us in paperwork until we give up. It& #39;s all to save them money. Those filing for SNAP food stamps and unemployment are finally discovering we weren& #39;t lying!

Does anyone have more recent info on this? Is the IRS going to use Social Security Administration banking info already on file to pay SSI disability recipients our $1,200 COVID-19 coronavirus pandemic Economic Impact Payment?

Or do SSI disability recipients still have to file 2019 tax returns to get our $1,200 COVID-19 coronavirus pandemic Economic Impact Payment from the government, and the IRS screenshot at the top of this thread is a lie...?

Read on Twitter

Read on Twitter