Bubbles #1-3 from @QWQiao& #39;s latest macro piece... "A tale of ten bubbles"

Bubble #1: The passive Investment Bubble

The price of one of the largest providers of market indices, MCSI, went 10X over the last decade

Bubble #1: The passive Investment Bubble

The price of one of the largest providers of market indices, MCSI, went 10X over the last decade

A cult of passive investing was fueled by:

+ ability to easily park money in 500 stocks at once

+ public encouragement from investors like @WarrenBuffett

+ the longest bull market in history

Momentum outperformed value; a vicious circle

+ ability to easily park money in 500 stocks at once

+ public encouragement from investors like @WarrenBuffett

+ the longest bull market in history

Momentum outperformed value; a vicious circle

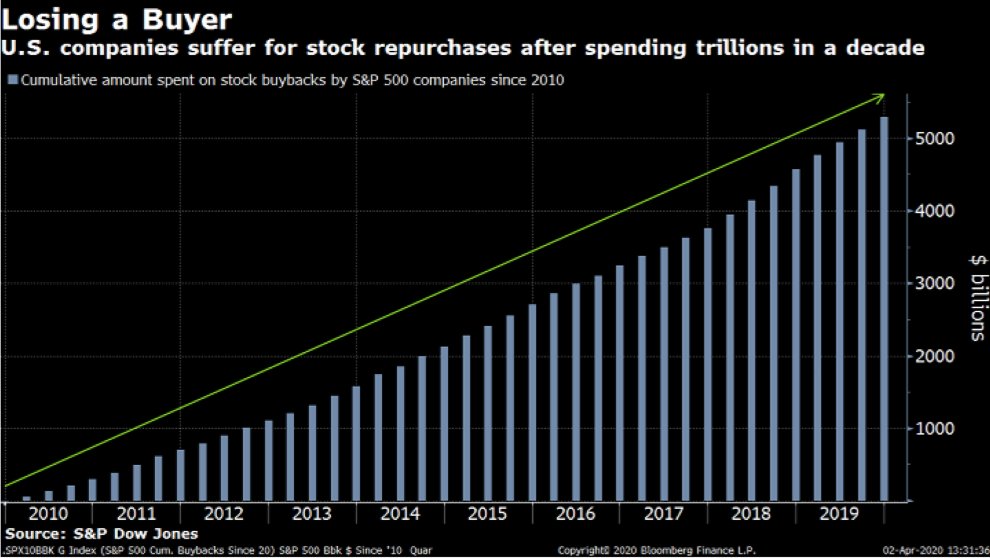

Bubble #2: The buyback bubble

From 2009 to 2019, companies in the S&P500 bought $5.3 trillion of their own shares.

FIVE TRILLION

From 2009 to 2019, companies in the S&P500 bought $5.3 trillion of their own shares.

FIVE TRILLION

Buybacks fueled by:

+ Trump& #39;s corporate tax cuts

+ historically low interest rates

+ few investment opportunities

+ misaligned executive incentives

Executives used tax cuts & cheap capital to pump their shares and boost their bonuses

Now the largest market bidders are gone

+ Trump& #39;s corporate tax cuts

+ historically low interest rates

+ few investment opportunities

+ misaligned executive incentives

Executives used tax cuts & cheap capital to pump their shares and boost their bonuses

Now the largest market bidders are gone

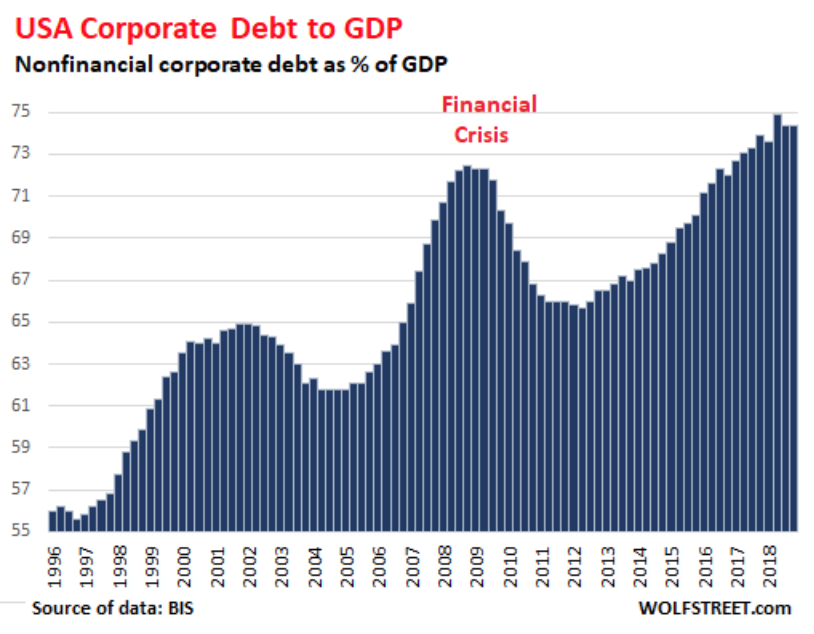

Bubble #3: Corporate debt bubble

The US currently has the largest corporate debt burden in US history, overtaking the prior record of 72% set in 2008

The US currently has the largest corporate debt burden in US history, overtaking the prior record of 72% set in 2008

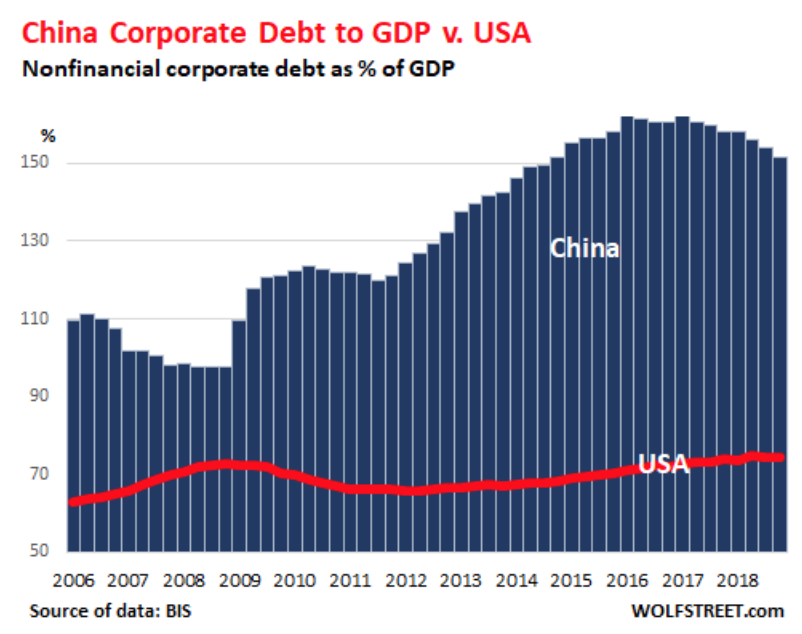

If you overlay China& #39;s corporate debt, the US& #39;s pales in comparison

Borrowing money to fuel growth is the core of capitalism

There is a tipping point however, when companies have too much debt to service and not enough cash to weather a downturn. Like right now.

Borrowing money to fuel growth is the core of capitalism

There is a tipping point however, when companies have too much debt to service and not enough cash to weather a downturn. Like right now.

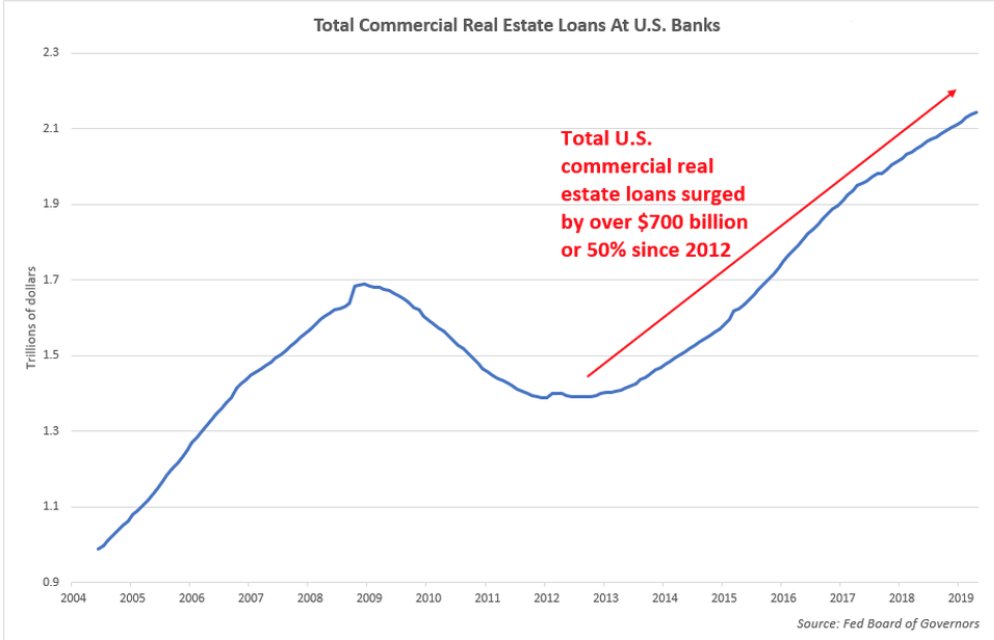

Bubble #3: The commercial real estate bubble

In 2008, we had a residential real estate crisis. This time, it’s their commercial counterpart.

Total commercial real estate loans at U.S. banks have surged by over 50% ($700B) since 2012

In 2008, we had a residential real estate crisis. This time, it’s their commercial counterpart.

Total commercial real estate loans at U.S. banks have surged by over 50% ($700B) since 2012

The largest real estate ETF, $VNQ, quintupled over the last decade

This surge is greater than that of the S&P500& #39;s, in part due to the enormous amount of leverage used in commercial REITs

Adding insult to injury, commercial real estate will be hit hardest by #COVID

This surge is greater than that of the S&P500& #39;s, in part due to the enormous amount of leverage used in commercial REITs

Adding insult to injury, commercial real estate will be hit hardest by #COVID

Stay tuned for bubbles #3-6. Messari Pro subscribers can read all 10 bubbles here https://messari.io/article/tale-of-ten-bubbles">https://messari.io/article/t...

Read on Twitter

Read on Twitter