All data is pointing towards both retail and institutional demand for Bitcoin exploding.

This comes as BTC is about to see a 50% inflation cut and as monetary policy is more easy than ever — a perfect storm.

A quick thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

This comes as BTC is about to see a 50% inflation cut and as monetary policy is more easy than ever — a perfect storm.

A quick thread

Retail:

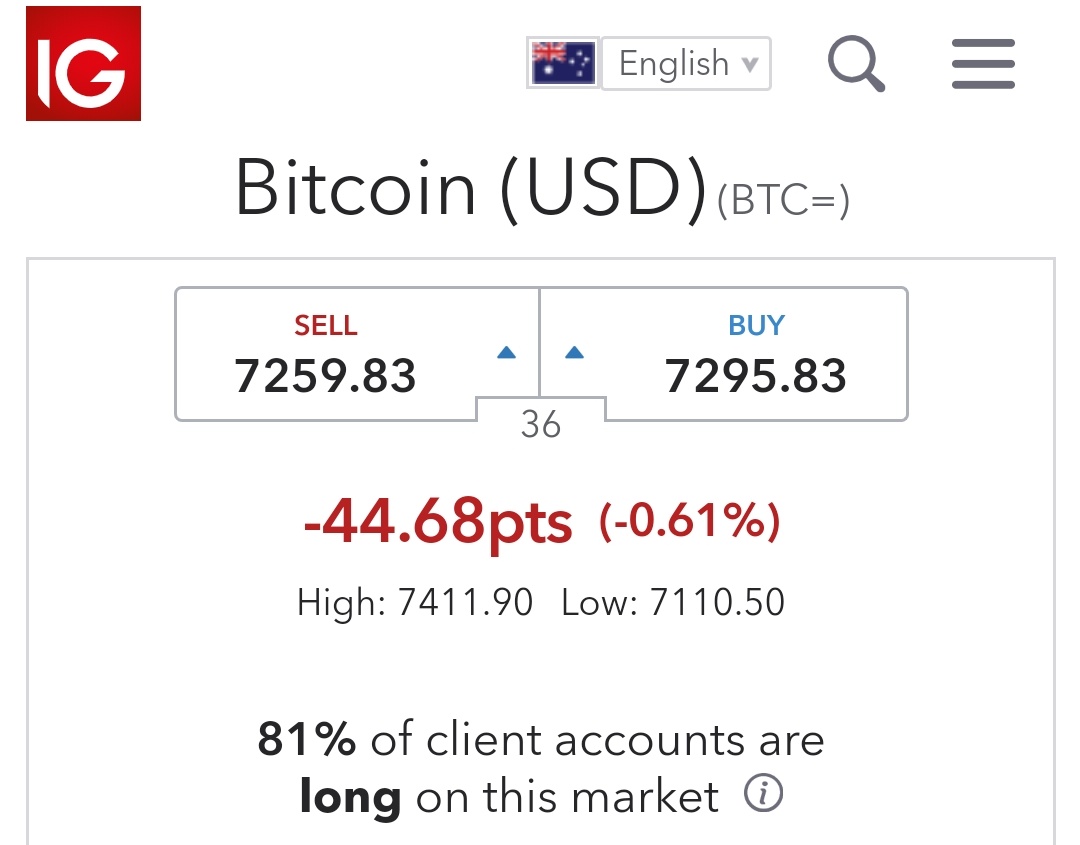

- 81% of IG& #39;s Bitcoin traders are long.

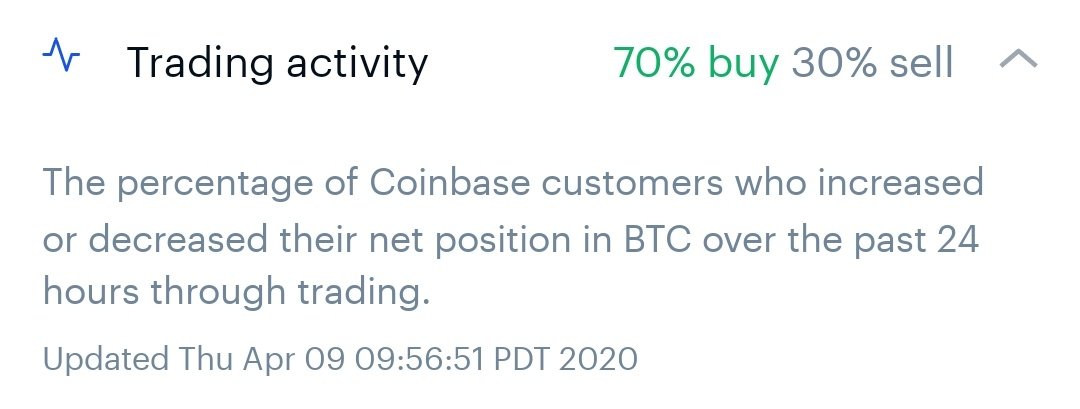

- 70% of Coinbase users are buying BTC. It& #39;s been higher over the last week.

- @decryptmedia reports Kraken, OKEx, Bitfinex, Paxful, and Luno have seen user sign-ups increase dramatically, some by 300%.

- 81% of IG& #39;s Bitcoin traders are long.

- 70% of Coinbase users are buying BTC. It& #39;s been higher over the last week.

- @decryptmedia reports Kraken, OKEx, Bitfinex, Paxful, and Luno have seen user sign-ups increase dramatically, some by 300%.

Retail (cont.):

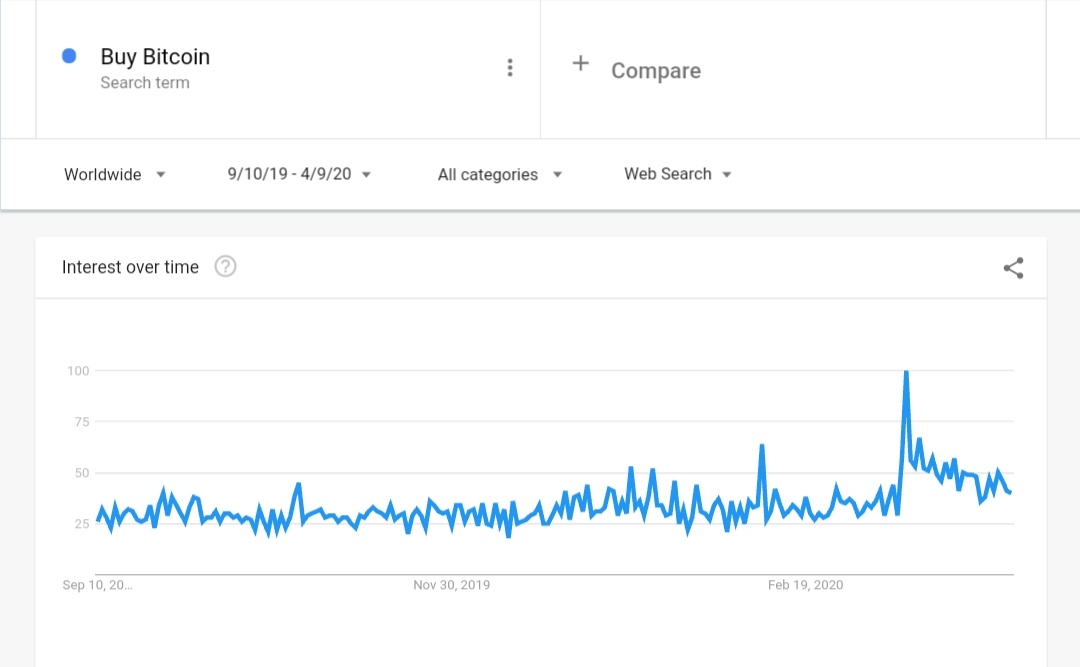

- "Buy Bitcoin" on Google Trends has seen a strong spike.

- Bitstamp has seen its Alexa ranking grow from #15,785 on the date of Black Thursday to #13,458 today.

- Anecdotally, I& #39;ve recieved (more) phone calls and texts from f&f about Bitcoin.

- "Buy Bitcoin" on Google Trends has seen a strong spike.

- Bitstamp has seen its Alexa ranking grow from #15,785 on the date of Black Thursday to #13,458 today.

- Anecdotally, I& #39;ve recieved (more) phone calls and texts from f&f about Bitcoin.

Institutional:

- @RaoulGMI said in an interview that he doesn& #39;t know of a family office that doesn& #39;t have exposure to Bitcoin.

- Fidelity confirmed today that it is onboarding pensions, family offices, and macro funds.

- Coinbase Pro& #39;s Bitcoin order book is stacked long.

- @RaoulGMI said in an interview that he doesn& #39;t know of a family office that doesn& #39;t have exposure to Bitcoin.

- Fidelity confirmed today that it is onboarding pensions, family offices, and macro funds.

- Coinbase Pro& #39;s Bitcoin order book is stacked long.

As aforementioned, the timing is perfect:

In ~5 weeks, the amount of Bitcoin issued each day will get cut in half.

Demand increasing + supply decreasing (kinda) traditionally equals higher prices.

It& #39;s a perfect storm.

In ~5 weeks, the amount of Bitcoin issued each day will get cut in half.

Demand increasing + supply decreasing (kinda) traditionally equals higher prices.

It& #39;s a perfect storm.

Read on Twitter

Read on Twitter