Let me unpack this mind-blowing announcement from the @federalreserve a little more https://twitter.com/oscarthinks/status/1248262913149861888">https://twitter.com/oscarthin...

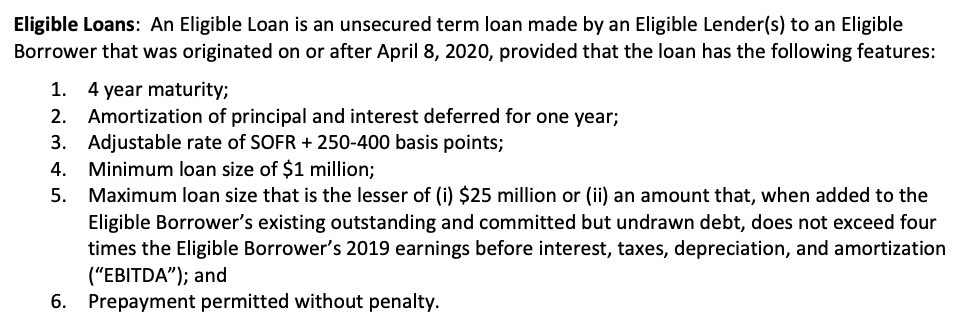

Any bank or credit union can make a loan under the terms below, and then the Fed will come in on the back end to essentially provide 95% of the borrowed amount.

So you don& #39;t apply directly to the Fed, you apply to your bank or credit union and they deal with the Fed.

So you don& #39;t apply directly to the Fed, you apply to your bank or credit union and they deal with the Fed.

It makes it easier for smaller banks & credit unions to make a lot of these loans & fast, because they only have to hold 5% of the loan amount on their books. Otherwise they might struggle to have enough cash in their own coffers to make more loans in a short period of time.

So the bottom line is, the Federal Reserve is making it easier than ever for banks and credit unions to make a lot of these kinds of loans to eligible businesses in a very short period of time.

Eligible business include any business with up to 10,000 employees or up to $2.5 billion in 2019 annual revenues, created or organized in the United States or under the laws of the United States, w/significant operations in & a majority of employees based in the United States.

They also have to promise not to use these loans to repay other debt, and to make "reasonable efforts" to retain employees over the term of the loan. They also cannot use the loan to make stock repurchases.

More terms and caveats on the full term sheet: https://www.federalreserve.gov/.../monetary20200409a7.pdf">https://www.federalreserve.gov/.../monet...

More terms and caveats on the full term sheet: https://www.federalreserve.gov/.../monetary20200409a7.pdf">https://www.federalreserve.gov/.../monet...

I am trying to find out the chances that they lower the minimum loan. $1M seems a bit high, especially for businesses in the most vulnerable communities.

You can ask the Fed directly to lower the minimum loan amount. Comment deadline 4/16: http://www.federalreserve.gov/.../contactus/feedback.aspx">https://www.federalreserve.gov/.../conta...

You can ask the Fed directly to lower the minimum loan amount. Comment deadline 4/16: http://www.federalreserve.gov/.../contactus/feedback.aspx">https://www.federalreserve.gov/.../conta...

This move is unprecedented for the Fed, but it is not entirely without precedent.

In North Dakota, the state-owned @BankofND’s main business is buying participations from private lenders all over the state. Here’s my @yesmagazine feature article on it: https://www.yesmagazine.org/issue/world-we-want/2020/02/19/public-bank-north-dakota/">https://www.yesmagazine.org/issue/wor...

In North Dakota, the state-owned @BankofND’s main business is buying participations from private lenders all over the state. Here’s my @yesmagazine feature article on it: https://www.yesmagazine.org/issue/world-we-want/2020/02/19/public-bank-north-dakota/">https://www.yesmagazine.org/issue/wor...

Okay I ran some numbers.

The current Main Street Lending program minimum loan is $1m.

To be eligible for that, if my calculations are correct using the term sheet formula, using Experian’s avg small biz debt load of $195k, you’d need an EBITDA (gross revenue) of $298,750.

The current Main Street Lending program minimum loan is $1m.

To be eligible for that, if my calculations are correct using the term sheet formula, using Experian’s avg small biz debt load of $195k, you’d need an EBITDA (gross revenue) of $298,750.

Assuming you need ~$300k in revenue to be eligible for a minimum $1m Main Street Loan…

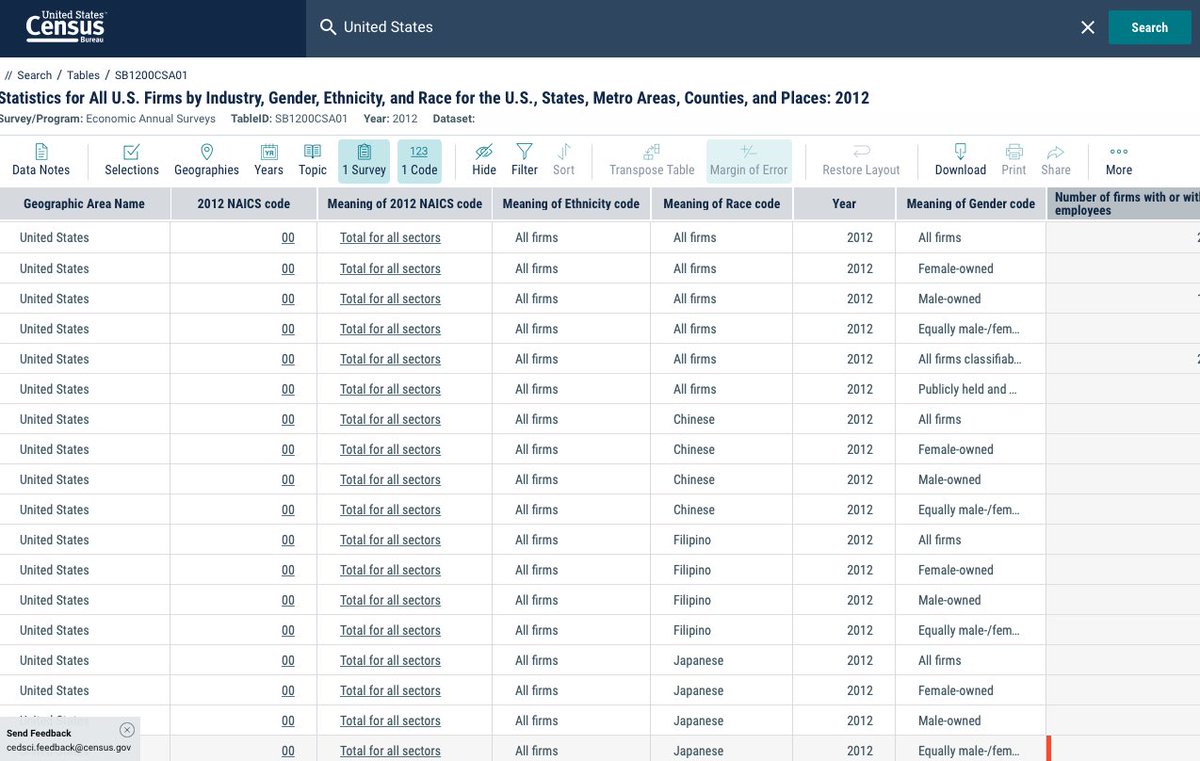

Avg revenue across U.S. for

Male-owned firm $638k

Female-owned $144k

White-owned $508k

Black-owned $58k

Native-owned $142k

Asian-owned $365k

Much deeper disparities locally

Avg revenue across U.S. for

Male-owned firm $638k

Female-owned $144k

White-owned $508k

Black-owned $58k

Native-owned $142k

Asian-owned $365k

Much deeper disparities locally

& for the curious among us, if the minimum Main Street Loan was say, $250k.

$250k plus average small business debt load of $195k equals $445k, divided by 4 = $111,250 EBITDA to be eligible for a $250k minimum loan.

$250k plus average small business debt load of $195k equals $445k, divided by 4 = $111,250 EBITDA to be eligible for a $250k minimum loan.

Or what if the minimum Main Street Loan was $50k.

$50k plus $195k = $245k, divided by 4 = $61,250 EBITDA to be eligible for a $50k minimum Main Street Loan.

It looks like the Main Street Loan minimum needs to be $50k for this to really work at all for black-owned businesses.

$50k plus $195k = $245k, divided by 4 = $61,250 EBITDA to be eligible for a $50k minimum Main Street Loan.

It looks like the Main Street Loan minimum needs to be $50k for this to really work at all for black-owned businesses.

& that would still depend on having at least some lenders even interested in originating these loans for black-owned businesses.

As it is under current terms, lenders who want to make these loans to black-owned businesses won’t find many who are eligible. https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200409a7.pdf">https://www.federalreserve.gov/newsevent...

As it is under current terms, lenders who want to make these loans to black-owned businesses won’t find many who are eligible. https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200409a7.pdf">https://www.federalreserve.gov/newsevent...

Read on Twitter

Read on Twitter