1/ #PPP update 4/9: My biggest concern today is that until all qualified & legitimate lenders are approved to participate, millions of SMBs are at a disadvantage to getting a PPP loan - which puts their survival at risk.

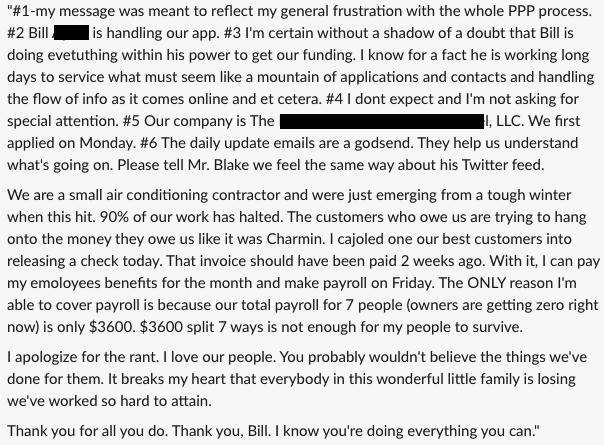

Here& #39;s a story of 1 of the SMBs that we are helping:

Here& #39;s a story of 1 of the SMBs that we are helping:

2/Here& #39;s why:

There are millions of small businesses in limbo bc they historically & likely unknowingly picked the “wrong” banking partner. That’s not their fault. As of now, only SBA-licensed lenders are able to participate in PPP & there is nowhere near enough SBA-approved..

There are millions of small businesses in limbo bc they historically & likely unknowingly picked the “wrong” banking partner. That’s not their fault. As of now, only SBA-licensed lenders are able to participate in PPP & there is nowhere near enough SBA-approved..

3/ ..lenders to efficiently handle this unprecedented demand volume from Main Street businesses. Rightfully so, banks are prioritizing that demand based on existing banking customer relationships & then, and only then, first-come-first-served for the de-prioritized masses...

4/ That leaves FDIC banks, CUs, & FinTech lenders on the sidelines helplessly watching their SMB customers unnecessarily suffer, when they can & want to help.

Let’s put this into perspective. There are 2 family-owned restaurants on the same corner in your neighborhood.

Let’s put this into perspective. There are 2 family-owned restaurants on the same corner in your neighborhood.

5/ Imagine it. 1 of those businesses is MORE likely to go out of business bc of the seemingly arbitrary decision to bank w/ a non-SBA lender. Is that right? This is how they lose their livelihood & decades of family work? It’s not the business that failed, it is the process.

6/ We know that& #39;s not the intent of this program, but we can’t unintentionally be giving certain small businesses in America a real disadvantage just bc of the bank they chose to work with when their grandmother opened the restaurant 30 years ago!

7/If @USTreasury and @SBAgov truly want to help EVERY business (no business left behind), they need to accelerate the approval of FDIC banks & CUs, and give everyone an equal opportunity to recover & keep their employees. If they want every business in America to get capital..

8/..more efficiently, they need to approve FinTech lenders. And soon. FinTech lenders are crucial because they leverage tech to efficiently fund the high volume of very small businesses that the other institutions can’t handle. Processing high volumes of smaller loans IS...

9/ ..FinTech’s superpower. Throw up the bat signal and let them rescue who they can!

America is the greatest economy in the world & it evolved and innovated to meet the capital needs of medium, small, and very small businesses across the country. SBA lenders, banks, CUs &...

America is the greatest economy in the world & it evolved and innovated to meet the capital needs of medium, small, and very small businesses across the country. SBA lenders, banks, CUs &...

10/ ..FinTech lenders all have unique roles. The challenge facing these SMBs is unprecedented; let& #39;s not choose to fight it w/ some of our super heroes on the sidelines.

@SBAJovita & @stevenmnuchin1: PLEASE accelerate approval these non-SBA lenders (banks/CUs, & FinTechs)...

@SBAJovita & @stevenmnuchin1: PLEASE accelerate approval these non-SBA lenders (banks/CUs, & FinTechs)...

11/ ..and let’s bring everything we have to this good fight!

First step? non-sba lender application released 4/8!

Next step? Accelerate approval.

First step? non-sba lender application released 4/8!

Next step? Accelerate approval.

Read on Twitter

Read on Twitter