So obviously you’re all bored in quarantine, fed up with #Covid19 threads, and now what you really need is a nice #DeutscheBank thread to cheer you up! Here’s one! It’s about a mystery wrapped in riddle, etc.

As you all (should) know, we’re going to move capital regulations to Basel 4 in a few years’ time (regulators insist calling it Basel 3, to be sure you’re confused.) So the big question for analysts is how much more capital banks are going to need?

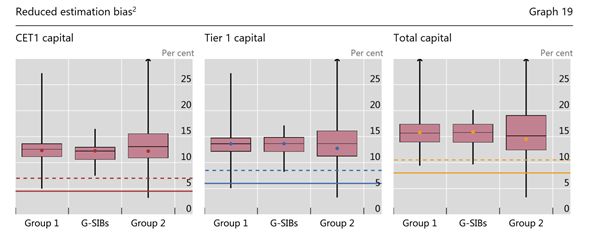

Lucky for us analysts, the EBA and the BIS publish estimates and the latest was out yesterday. The big picture is pretty straightforward, from this chart: capital requirements increase substantially in Europe, not in the rest of the world

Yeah yeah, but we don’t care about that, all we care about is Deutsche, right? (Well, I care about all of them, but I know you don’t, you evil creatures.)

So where is Deutsche on this?

The first clue we have is that chart from the BIS again.

So where is Deutsche on this?

The first clue we have is that chart from the BIS again.

Sorry what? What I can see there, is a GSIB with a future CET1 capital ratio barely above… 7% ? That’s waaaay below the minimum required which is around 12%. Who is this bank ? Well, let’s move on to the EBA’s report, which deals with EU banks. Maybe we& #39;ll get some clues.

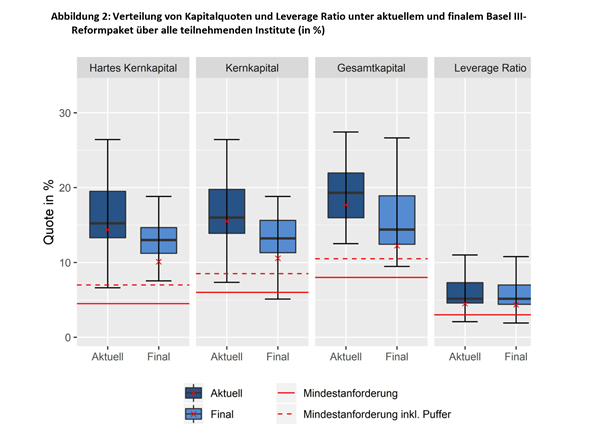

Hmmm so someone also looks barely above 7% CET1... who is this? Obviously, it’s not a GSIB so it can’t be Deutsche. Why do I say this?

Because we also have this chart which shows the increases in required capital (“MRC”) under the new package. The highest GSIB has a 25% impact which is only a 240bps drop if you have 12% CET1.

But wait a minute? What on earth is “reduced estimation bias” in the chart title? Turns out two GSIBs had “outliers” market risk impacts so the EBA simply… put them equal to 0! That does not make any sense AT ALL, especially as we know GSIB will have large market risk impacts.

Oh and by the way, you remember, that BIS chart with a GSIB barely above 7%? That chart was also with the same “reduced estimation bias” assumption… so logically that GSIB can& #39;t be in the EU!

Unfortunately, we do not know if the EBA chart showing CET1 post Basel 4 is with or without that reduced estimation bias. So, the bank with 7% CET1 could still be one of the two GSIBs with that outsized market risk impact…. The mystery remains.

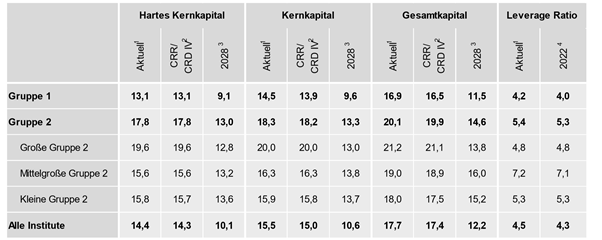

Lucky for us, we also have estimates from Germany! And here is what they show.

“Gruppe 1” has only 5 banks and Deutsche has 42% of all RWA in that group of 5… & for that group the impact is much more severe than in the EBA data: -400bps!

“Gruppe 1” has only 5 banks and Deutsche has 42% of all RWA in that group of 5… & for that group the impact is much more severe than in the EBA data: -400bps!

The distribution also shows a few outliers, but there are also outliers today (e.g. NDB had a very low CET1 on June 2019 which is the cutoff date) so it’s not really possible to say.

So let& #39;s wrap this up. What do we know? There is a (logically, non-EU) GSIB with a CET1 Basel 4, ex impact of market risk, which is at 7%-ish ! But there is also a EU GSIB with around 240bps impact, ex market risk, and probably an outsized market risk impact.

And the German supervisors tells us large German banks have an average drop of 400bps (including market risk) – knowing that Deutsche alone is 42% of that group. (And much more in % market risk)

Hmmmmmmmmmmm. I can’t be sure of course, but I think I have a pretty good idea where Deutsche& #39;s post Basel 4 CET1 ratio is. And that’s only the beginning of the mystery, because the official guidance of Deutsche is for only a 10%-15% increase of RWA…ex market risk! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

So where’s the truth?

Read on Twitter

Read on Twitter