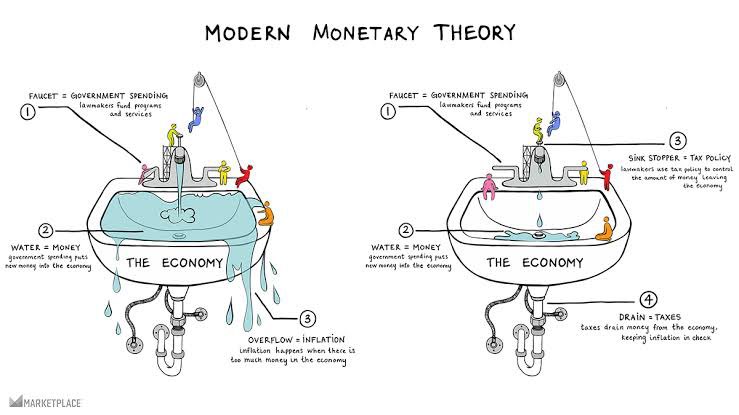

MMT advocates for coordination between Monetary and Fiscal policy. It argues that highly developed economies must not be constrained by deficits, suggesting they can infinitely borrow (in their own currency) and pay it back by printing money. (Opinion Thread, focusing on U.S.).

Despite its controversial status, MMT is silently being implemented across the globe. What are the economic consequences of MMT? What sort of distortions can it cause to asset prices? Should/are we (going to) fully implement MMT? Here is what we know so far:

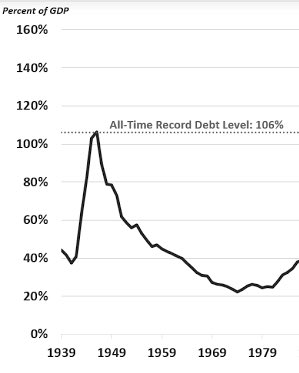

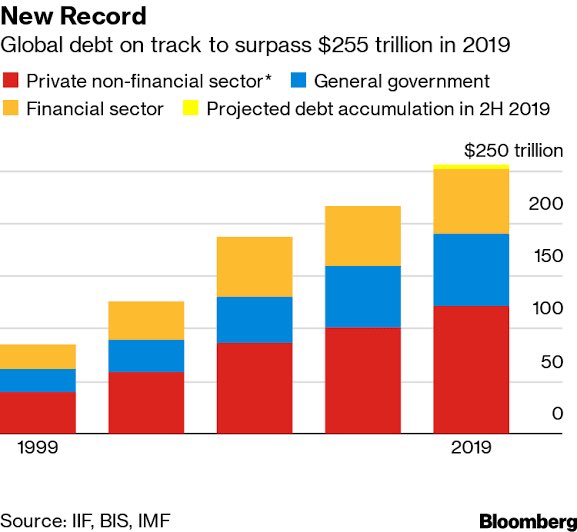

During the last expansion cycle, Corps and Govts exploited the low interest rate environment and increased debt levels to record nominal amounts. In theory, expansions should entail deleveraging, so that borrowing can be done when cash is needed. (E.g. post-WW2 deleveraging  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)

This notion is now dead. As Howard Marks described in a recent call with XP inc, the discussion in the past was whether Governments could have ANY debt. Current debt levels were unthinkable back then (70’s). Now the discussion is whether some countries can have INFINITE debt.

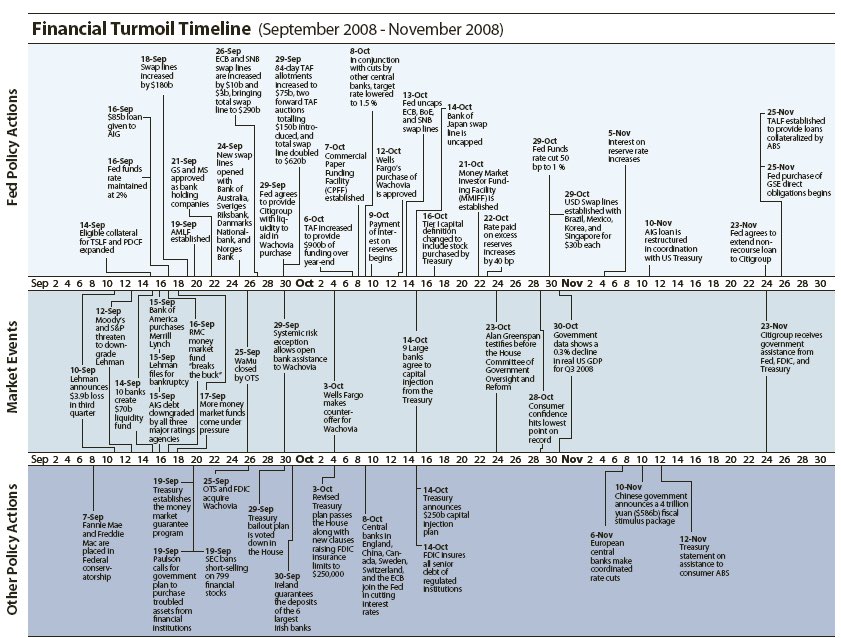

It’s the first crisis in recent history where we’re merely buying time by using unconventional tools (aggressively). In previous crises, policy makers ultimately did their best to fix what had caused the problem (while minimizing Moral Hazard) as they were endogenous. (GFC  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)

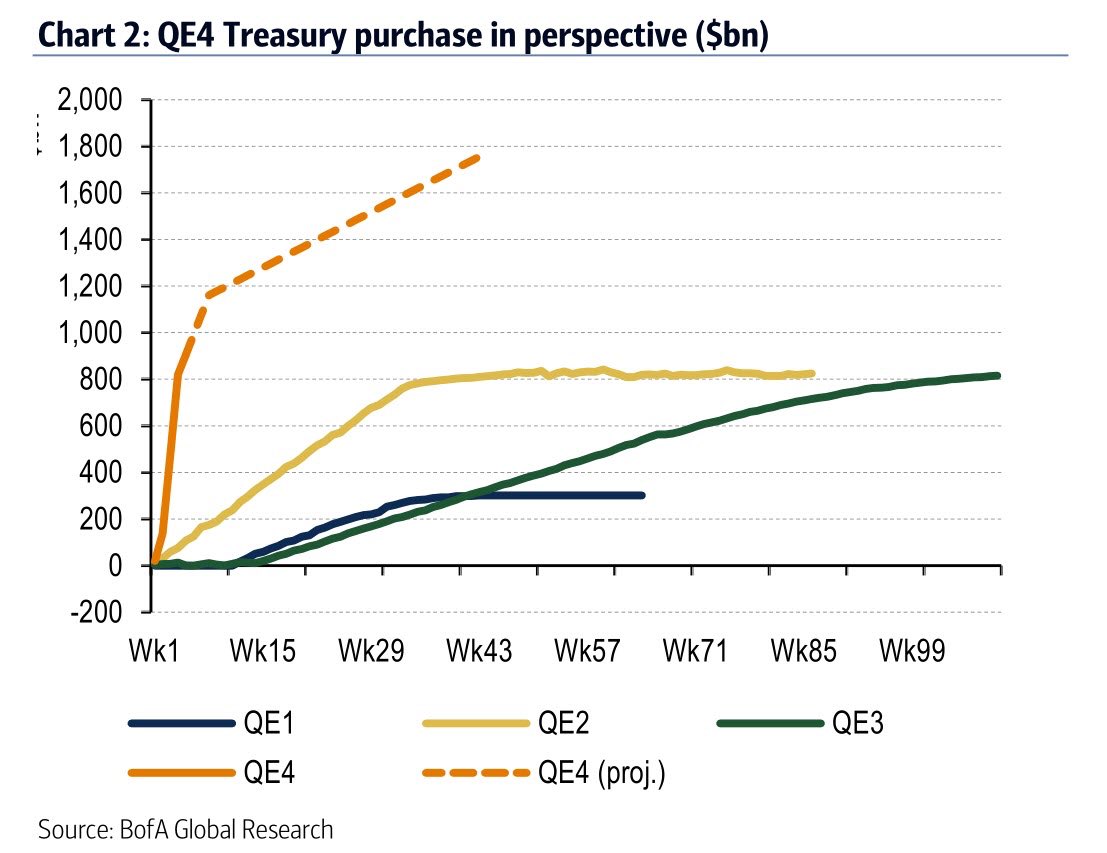

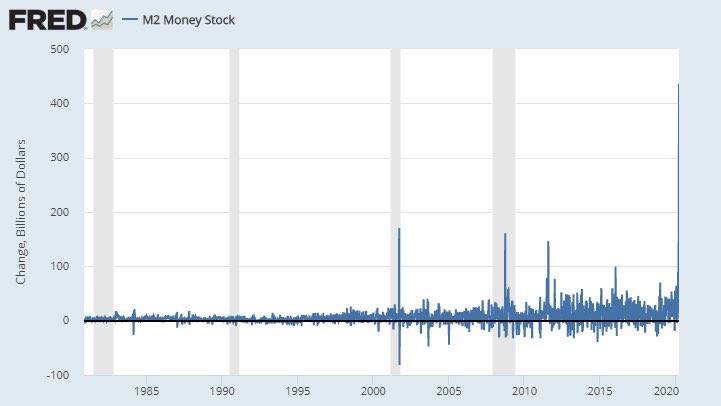

It’s too early to conclude the long-run effects of the stimulus being pursued worldwide. This a new economic territory, and all we can do is use theory and evidence to speculate possible outcomes. The rate of purchases in QE4 is incomparable to previous QE programs ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">).

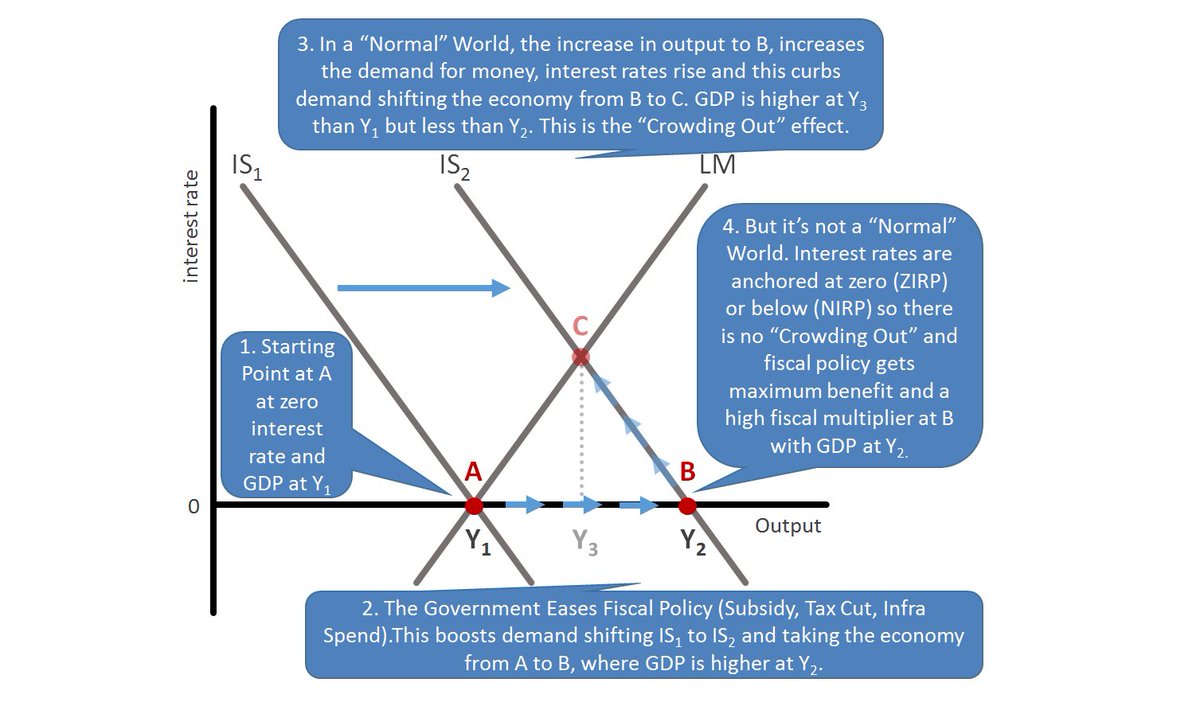

Orthodox economic theory suggests that fiscal policy is particularly potent during periods of low rates, especially in the zero-bound (ZIRP), leading to a high Fiscal Multiplier on GDP (x>1)& higher debt efficiency. The FED essentially laid the foundation for the fiscal stimulus.

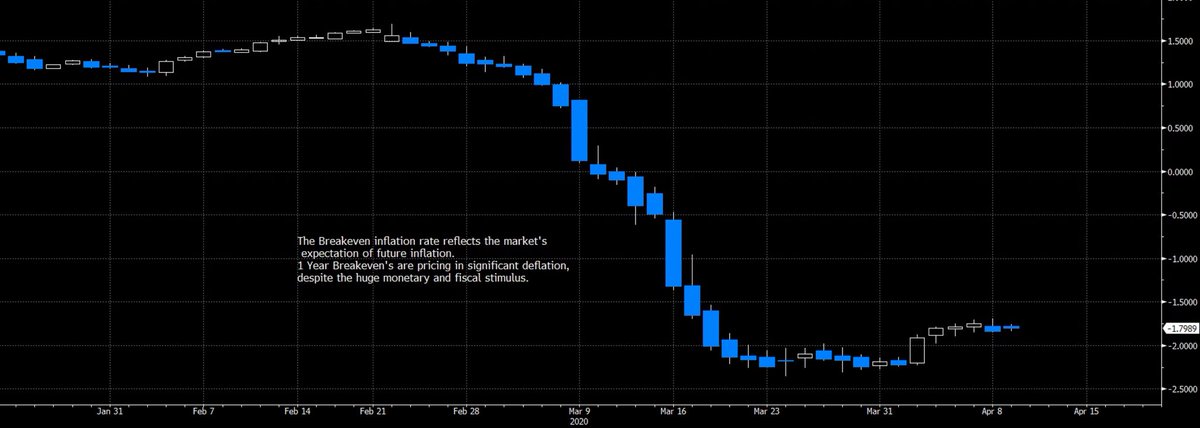

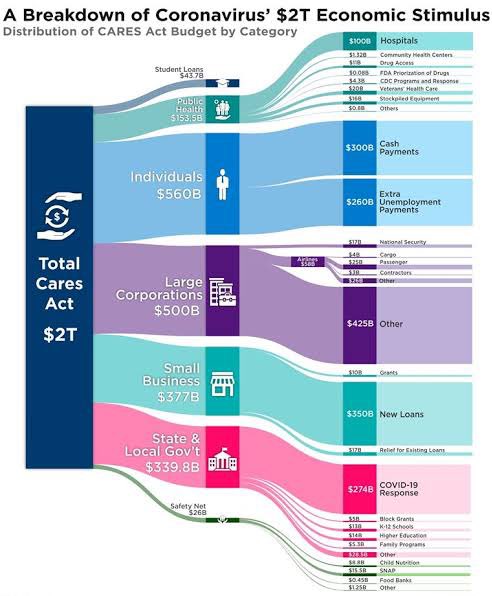

The FED implemented ZIRP & an unlimited QE program to provide liquidity, and diminish the economic shock. In addition, a $2 trillion-dollars bill was passed (CARES act) to further diminish the economic disaster caused by the exogenous shock. How is this stimulus being financed?

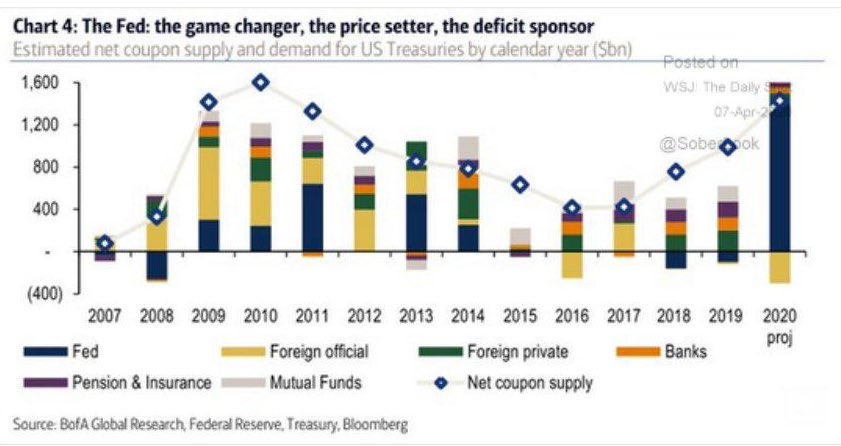

The U.S has already silently adopted MMT. To finance the stimulus, the UST is issuing debt at a pace higher than before. The strong dollar & low rates are causing Global CB& #39;s to sell their UST’s at extreme speed (EM selling to hold currencies). Guess who is buying UST? The FED.

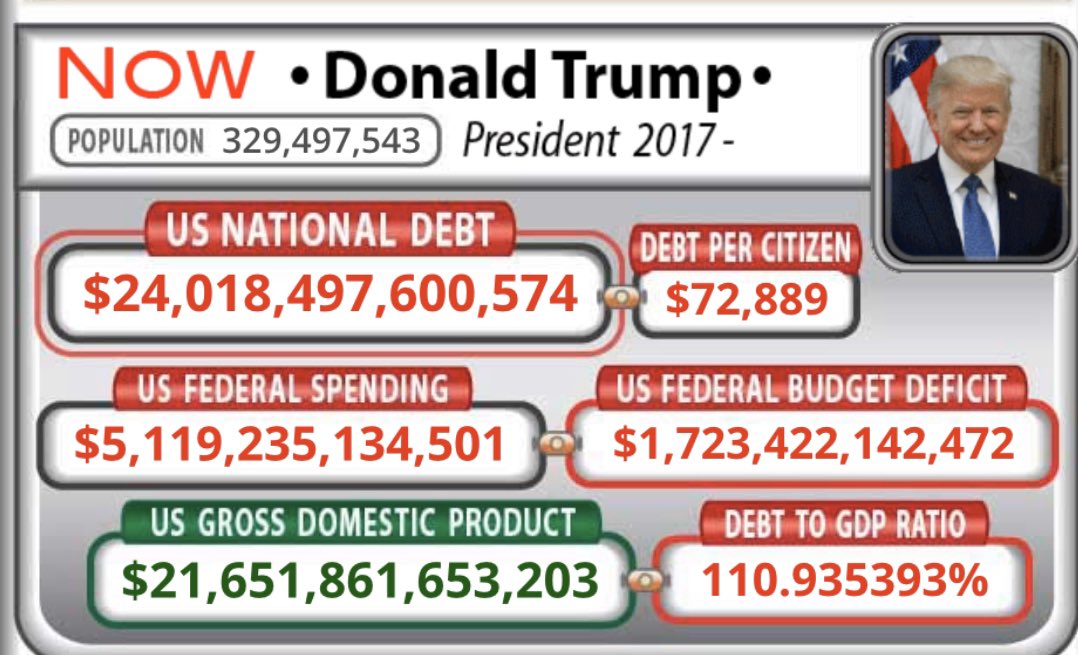

The U.S. debt is now being monetized by the FED (core idea of the MMT). The world’s most important CB is increasing its Money Supply at a rate of almost $1 million a second and the budget deficit is soaring. This week, the U.S. national debt exceeded the $24 trillion mark.

Meanwhile, M2 growth is ~12.5% YoY, the fastest in more than 20 years. The FED IS NOT the gambler in the casino. As long as faith in the U.S. dollar prevails, they have (in theory) unlimited printing power and the U.S. can borrow infinitely, as the FED will amortize the debt.

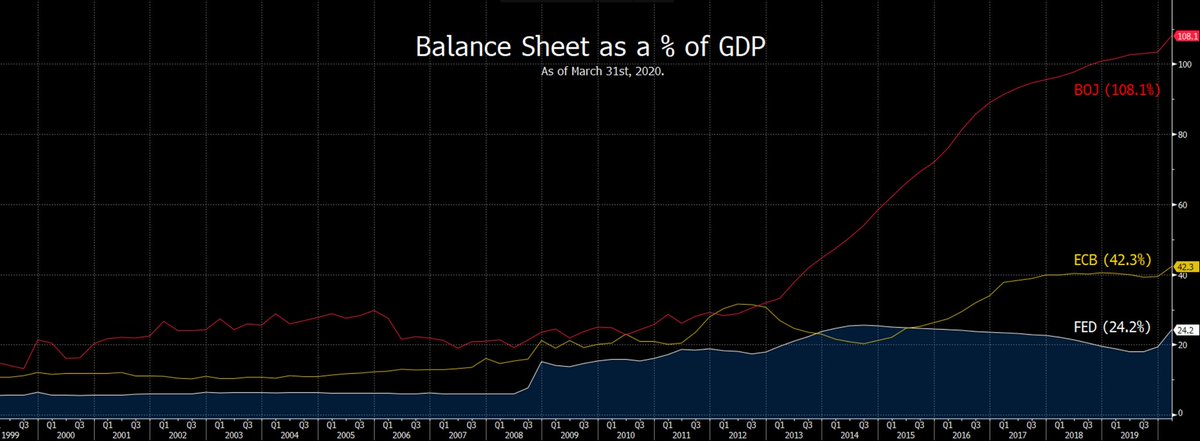

How big is the FED’s balance sheet compared to its peers? ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS.

The CARES act is approximately 10% of U.S. GDP ( https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?

Despite the actions of the FED, the USD remains strong and resilient. Some would have expected it to have weakened against peers after the Fed’s unprecedented panic attack (ZIRP, unlimited QE, FX swap lines, etc). However, the DXY remains at year highs and EMFX took huge losses.

Commodities: Oil & copper’s YTD highs were in Jan. They suffered due to COVID-19 impact (lower demand) was priced in weeks before other assets. Other metals (XAU, XAG,etc) have useful in measuring liquidity, and have all bounced from YTD lows. The XAUXAG made an ATH last month.

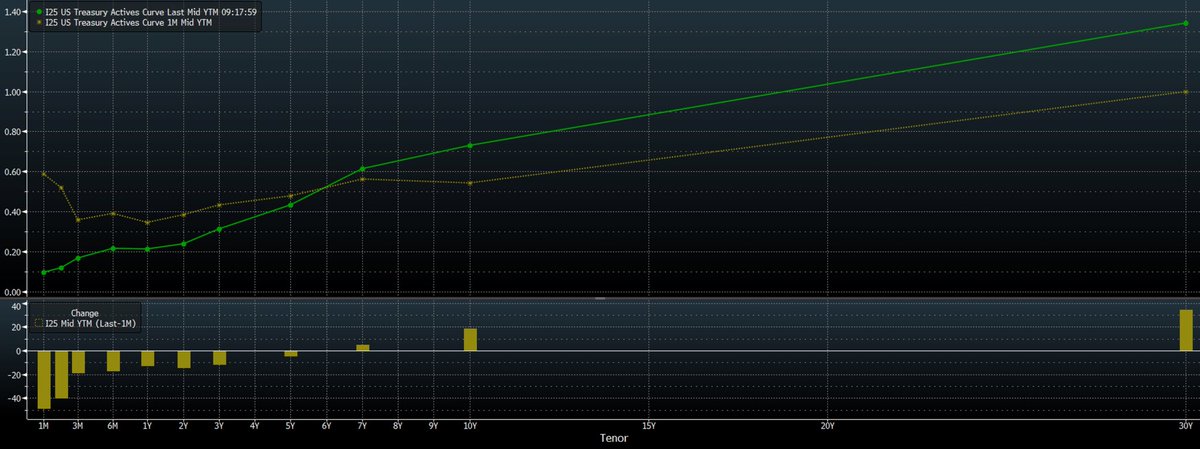

UST: Volatility is declining across all terms, and the curve is steepening (as expected https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.

A quantitative way of measuring the impact of the FED’s massive QE4 program in the Treasury market is the massive diversion between the MOVE index (VIX of UST) and the VIX index. The VIX-MOVE spread hit ATH, depicting the huge FED driven liquidity flow into the UST market.

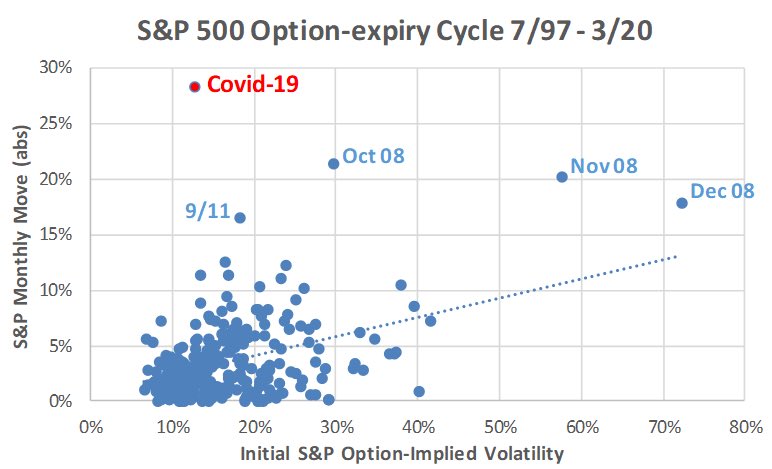

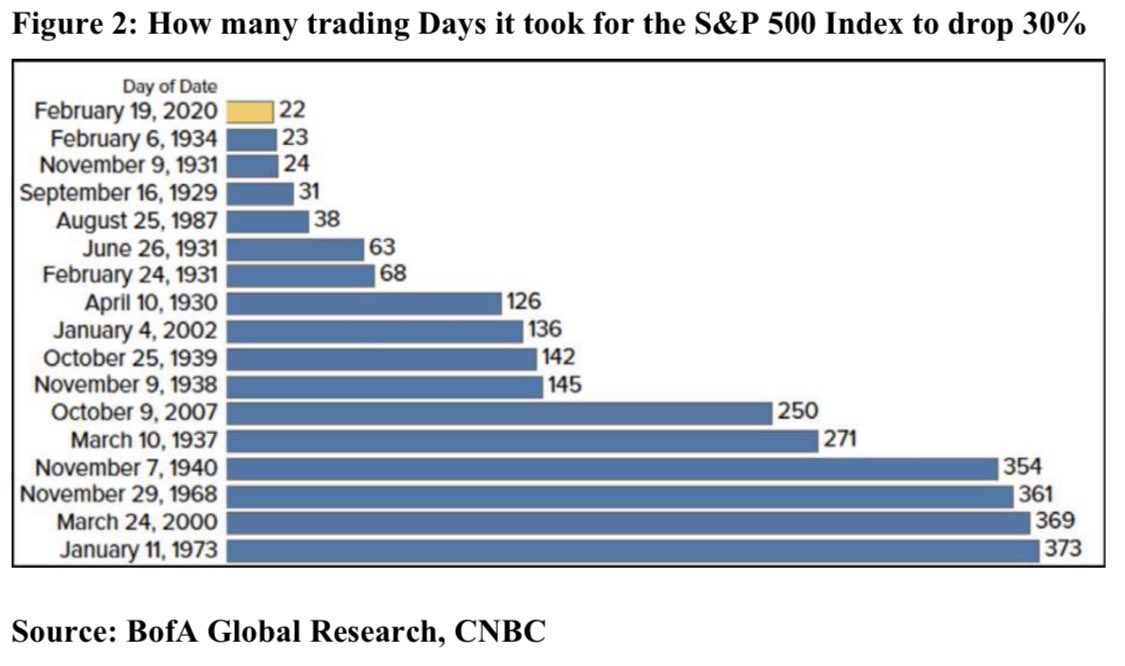

S&P 500 futures left an ATH on the 18th of Feb (3397.5). Less than a month later it had declined 36%. March was the most volatile month in history (in some metrics), but the narrative started changing once policy makers started panicking. $ES is now ~575pts (~25.5%) off lows.

It has been the quickest decline and the quickest recovery from a bear market in history. Evidence suggests that the aggressive way policy makers responded to the shock is the main factor leading to the sharp rebound in risk-assets. Underlying fundamentals remain awful.

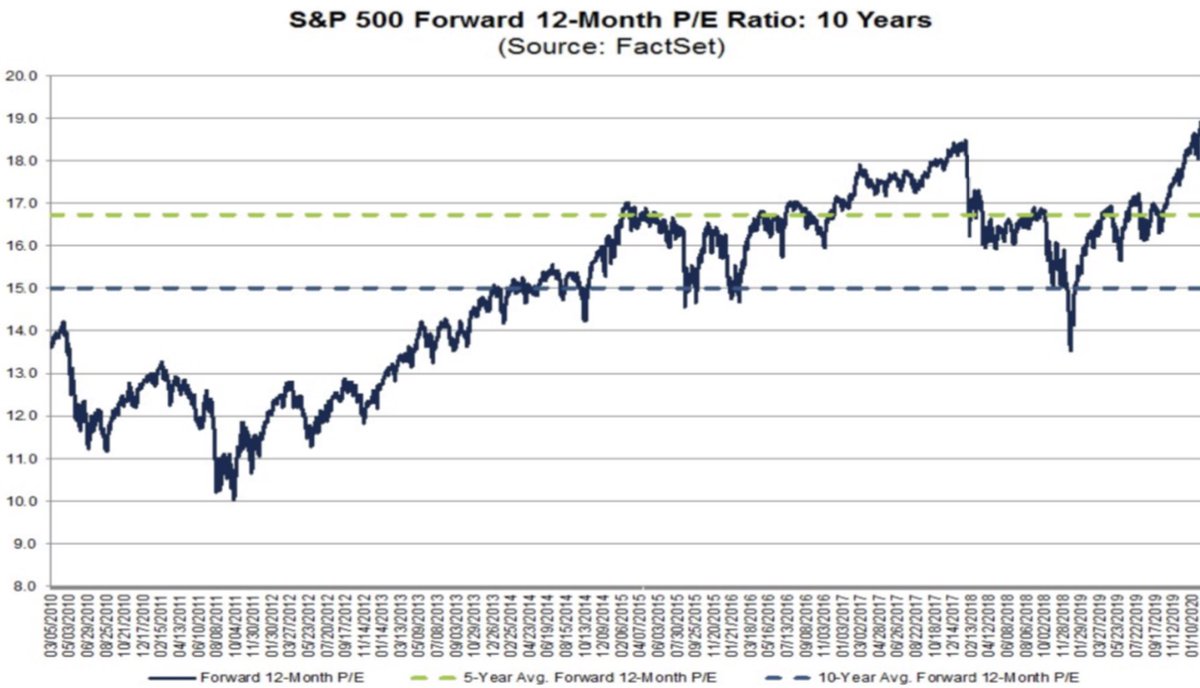

Fundamentals are potentially reflecting huge distortions. At ATH (3393) the S&P 500’s consensus EPS estimate for YE was 174.15. That yielded a YE P/E of ~19.5x. Currently at 2770 and estimated YE EPS of 110 (GS), YE P/E is ~25x. Will this level be the new normal? Is cash trash?

Ray Dalio still believes that “cash is trash.” He believes that current dovish expansionary Monetary policy, and high debt levels are two strong reasons why one should avoid having cash and globally diversify. Why? https://www.marketwatch.com/amp/story/guid/EE16DE44-799A-11EA-BBF8-398B2E43D0CA">https://www.marketwatch.com/amp/story...

“I believe that there will be questions by lenders who are receiving -ve real and nominal interest rates, while there is a lot of printing of money, about whether the assets they hold are good storeholds of wealth. I think that cash, will not be the safest asset.” - Ray. However:

Owning assets whose prices keep up with inflation (the “Silent tax) will not protect your purchasing power entirely and it will be diminished. Why? Governments tax nominal gains, even if these gains are solely comprised of currency debasement.

Inflation = Expropriation

Inflation = Expropriation

Inflation (or -ve Real rates) is one of the many “tools” Govts can use in the near future to amortize their huge debt piles. MMT theorists argue that taxes can act as a “release valve” for inflation, suggesting that appropriate taxation controls inflation & balances the budget.

It’s too early to conclude anything regarding the long-term results of this experiment. This is all unprecedented, and all we can do is use theory and evidence to build upon possible scenarios. MMT went from being a distant & controversial idea, to (possibly) our new reality.

Read on Twitter

Read on Twitter

)" title="During the last expansion cycle, Corps and Govts exploited the low interest rate environment and increased debt levels to record nominal amounts. In theory, expansions should entail deleveraging, so that borrowing can be done when cash is needed. (E.g. post-WW2 deleveraging https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)" class="img-responsive" style="max-width:100%;"/>

)" title="During the last expansion cycle, Corps and Govts exploited the low interest rate environment and increased debt levels to record nominal amounts. In theory, expansions should entail deleveraging, so that borrowing can be done when cash is needed. (E.g. post-WW2 deleveraging https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)" class="img-responsive" style="max-width:100%;"/>

)" title="It’s the first crisis in recent history where we’re merely buying time by using unconventional tools (aggressively). In previous crises, policy makers ultimately did their best to fix what had caused the problem (while minimizing Moral Hazard) as they were endogenous. (GFC https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)" class="img-responsive" style="max-width:100%;"/>

)" title="It’s the first crisis in recent history where we’re merely buying time by using unconventional tools (aggressively). In previous crises, policy makers ultimately did their best to fix what had caused the problem (while minimizing Moral Hazard) as they were endogenous. (GFC https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)" class="img-responsive" style="max-width:100%;"/>

)." title="It’s too early to conclude the long-run effects of the stimulus being pursued worldwide. This a new economic territory, and all we can do is use theory and evidence to speculate possible outcomes. The rate of purchases in QE4 is incomparable to previous QE programs (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)." class="img-responsive" style="max-width:100%;"/>

)." title="It’s too early to conclude the long-run effects of the stimulus being pursued worldwide. This a new economic territory, and all we can do is use theory and evidence to speculate possible outcomes. The rate of purchases in QE4 is incomparable to previous QE programs (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">)." class="img-responsive" style="max-width:100%;"/>

). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS." title="How big is the FED’s balance sheet compared to its peers? (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS." class="img-responsive" style="max-width:100%;"/>

). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS." title="How big is the FED’s balance sheet compared to its peers? (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). The FED was/is best positioned and still has more ammo than its main peers (ECB & BOJ) to use if needed. BOJ’s current BS to GDP ratio is 108%, ECB 42.3% & Fed 24.2%. The has more ammo and + space to grow it’s BS." class="img-responsive" style="max-width:100%;"/>

). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?" title="The CARES act is approximately 10% of U.S. GDP (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?" class="img-responsive" style="max-width:100%;"/>

). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?" title="The CARES act is approximately 10% of U.S. GDP (https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">). Nevertheless, policy makers are drafting an additional $1 trillion-dollars bill(~5% of GDP, the sky is the limit!) Pelosi said this week that ‘current aid measures aren’t sufficient’. Meanwhile, how are the markets behaving?" class="img-responsive" style="max-width:100%;"/>

#1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC." title="UST: Volatility is declining across all terms, and the curve is steepening (as expectedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.">

#1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC." title="UST: Volatility is declining across all terms, and the curve is steepening (as expectedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.">

#1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC." title="UST: Volatility is declining across all terms, and the curve is steepening (as expectedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.">

#1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC." title="UST: Volatility is declining across all terms, and the curve is steepening (as expectedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #1). Market functionality (liquidity https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow"> #2) improved massively after the FED stepped in, and the volatility surface now has similar profile to when the FED started QE1 during the GFC.">