Payment holiday, moratorium, forbearance, loan deferral – I am sure you have been hearing all these terms in light of the Covid-19 pandemic and may not have a clue what they are. What do they mean and how could they affect you?

A thread on loan refinancing

#financetwitterJa

A thread on loan refinancing

#financetwitterJa

If you currently have a mortgage, car loan, business loan, student loan, unsecured loan etc., then you may be able to seek some type of reprieve from making payments if your income has been cut or curtailed. How will taking advantage of one of these programmes affect you?

2/

2/

1st, there are four things that generally affect how much your loan payment is:

1. Principal (how much you borrow)

2. Interest (what rate is your lender charging you)

3. Tenure (how long will you have to repay)

4. Frequency of payment (monthly, quarterly, annually etc.)

3/

1. Principal (how much you borrow)

2. Interest (what rate is your lender charging you)

3. Tenure (how long will you have to repay)

4. Frequency of payment (monthly, quarterly, annually etc.)

3/

What would cause your loan payment to go down?

- Decrease in Principal – borrow less =pay less

- Decrease in interest Rate – lower financing cost = pay less

- Increase in Tenure – longer loan period = pay less monthly

- Increase in pmt frequency – monthly pmt vs annual

4/

- Decrease in Principal – borrow less =pay less

- Decrease in interest Rate – lower financing cost = pay less

- Increase in Tenure – longer loan period = pay less monthly

- Increase in pmt frequency – monthly pmt vs annual

4/

So back to loan deferrals. Because of Covid-19, many persons have either heard about or are thinking about some sort of reprieve from their loan payments. Financial Institutions have jumped to the cause and have responded with relief packages to aid their customers.

5/

5/

The Private Sector of Jamaica (PSOJ) has done a great job of collating the responses of the main financial institutions to the Covid-19 crisis currently being faced. That list can be accessed here:

https://psoj.org/wp-content/uploads/simple-file-list/Financial-Institution-COVID-19-Relief-Packages-v10.pdf

https://psoj.org/wp-conten... href="https://twitter.com/thePSOJ">@thePSOJ

6/

https://psoj.org/wp-content/uploads/simple-file-list/Financial-Institution-COVID-19-Relief-Packages-v10.pdf

6/

In general, local banks are offering 3 month, 6 month & 12 months deferrals and moratoriums. Reduced interest rates, waiver of transaction fees, increase in credit limits or extension of loan tenure. So two out of the four things that would reduce your pmts are being offered.

7/

7/

Payment holiday, deferral, forbearance or moratorium generally mean that an agreement is made that the customer is not required to make pmt for a specified time.

There may be different nuanced meanings at each financial institution so ensure you ask what it entails.

8/

There may be different nuanced meanings at each financial institution so ensure you ask what it entails.

8/

What does applying for a loan deferral, or extending your loan repayment period, or asking for other modifications to your loan terms mean financially? I& #39;m going to demonstrate with four scenarios. Ask your bank which of these are being applied (if any).

9/

9/

Scenario 1 - Deferral of both principal and interest.

This is rare but if your lender does this then your loan would just extend for the time that the loan was deferred.

10/

This is rare but if your lender does this then your loan would just extend for the time that the loan was deferred.

10/

Scenario 2 - Interest is accruing and added to your principal balance each month:

While interest is accruing, it means even though you are not making a payment, interest is still being charged on your outstanding principal balance.

11/

While interest is accruing, it means even though you are not making a payment, interest is still being charged on your outstanding principal balance.

11/

E.g. suppose you borrowed $20 M for 30 years and by year 5 you had a balance of $19 M. You then decided to defer the loan for one year. Interest will continue to be charged monthly on the $19M and by the end of the deferral, the principal outstanding would actually be $20.4 M.

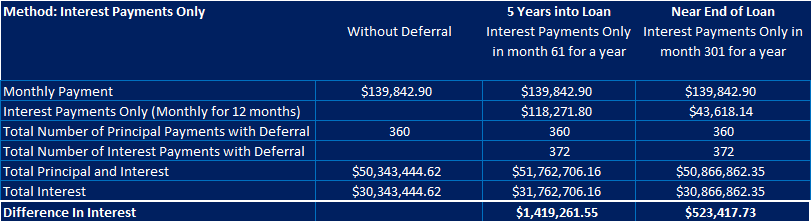

Scenario 3: Borrower continues to pay Interest only each month

For our example of a $20M, 30-year loan, in year 5 interest-only pmts would be $124k (in comparison to the payment before of $139k, which is not much of a big difference), but in year 25, the pmt would only be $43k.

For our example of a $20M, 30-year loan, in year 5 interest-only pmts would be $124k (in comparison to the payment before of $139k, which is not much of a big difference), but in year 25, the pmt would only be $43k.

Scenario 4: Interest is accumulated & paid as a one-time pmt at the end of the loan as a balloon payment.

In this scenario, the interest that you had not paid during the deferral period would accumulate & at the end of the loan, you would pay it in full as a one time pmt. /14

In this scenario, the interest that you had not paid during the deferral period would accumulate & at the end of the loan, you would pay it in full as a one time pmt. /14

So the longer you defer for, the earlier you are in your repayment schedule or the higher your interest rate is, the more interest you would have to pay if you chose to defer a loan. The disadvantage to a deferral is that there is always a cost (which is more interest paid)

15/

15/

The advantages of deferring are that you would have smaller or more manageable payments that can help you weather the storm and your Credit Bureau score would not be as severely impacted (you would not be reported as late or delinquent)

16/

16/

I explain other refinancing options like reducing the interest rate or increasing the loan term here http://financialcentsibility.com/loan-deferrals/

Visit">https://financialcentsibility.com/loan-defe... my loan calculators to see how doing either would impact your payments #gid=1076539018">https://docs.google.com/spreadsheets/d/10qHO6ZUn49iMkPocE9d4birm0CSuL12NKhAAYR1jDAc/edit #gid=1076539018">https://docs.google.com/spreadshe...

Visit">https://financialcentsibility.com/loan-defe... my loan calculators to see how doing either would impact your payments #gid=1076539018">https://docs.google.com/spreadsheets/d/10qHO6ZUn49iMkPocE9d4birm0CSuL12NKhAAYR1jDAc/edit #gid=1076539018">https://docs.google.com/spreadshe...

Read on Twitter

Read on Twitter