https://www.federalreserve.gov/newsevents/pressreleases/monetary20200409a.htm">https://www.federalreserve.gov/newsevent...

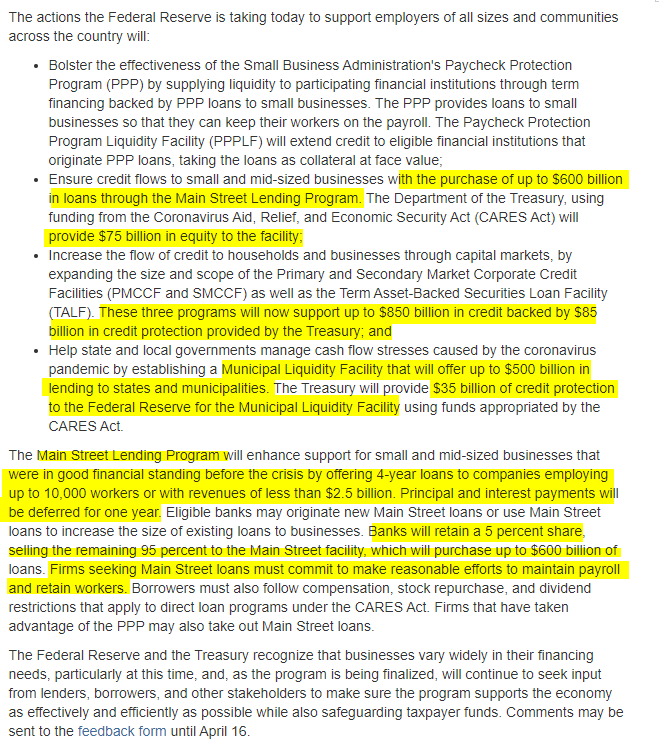

CARES Act gave authority for Treasury to capitalize Fed lending programs with up to $454bn (they can also do direct lending as well). These new programs use $195bn of that: $75bn for Main St Lending, $85bn for corporate bond buying and primary lending, and $35bn for munis.

Total size of programs are $600bn for Main St, $850 for corporate bonds, and $500bn for munis. Fed "leverage" = is 8x, 10x, and 14.3x respectively.

Main Street Lending is a less generous version of PPP: 4 year loans for companies with <10k workers/revenues of <$2.5bn. Deferred payments for a year. Banks have to keep 5% of the loan, sell the rest onward.

"Reasonable efforts" required to retain workers if you take these.

"Reasonable efforts" required to retain workers if you take these.

Also Main St lending program means no buybacks, dividends, restricted exec comp if you take from it.

Going to be REALLY interesting to see who takes them up on this.

Key thing: this is LOANS, not grants like SBA.

Also, a lot of this will refi existing debt, I think.

Going to be REALLY interesting to see who takes them up on this.

Key thing: this is LOANS, not grants like SBA.

Also, a lot of this will refi existing debt, I think.

Banks face less incentive to lend than w/ PPP loans. Those carry zero risk weight, these don& #39;t AFAICT. Yes, they sell on 95% of the loan, but they still have some credit exposure and don& #39;t get origination fees.

Think of this as TLTRO, as opposed to helicopter money or payroll subsidies.

Same basic description applies to munis, this isn& #39;t grants but will reduce borrowing costs and raise liquidity.

I argued last week that 1) CARES Act corporate provisions were not as generous as household provisions

2) corporates did not get only claim on the $454bn in CARES Act general lending authority.

Both are consistent with details of new Fed programs. https://www.businessinsider.com/coronavirus-aid-package-helps-workers-small-business-not-corporations-2020-4">https://www.businessinsider.com/coronavir...

2) corporates did not get only claim on the $454bn in CARES Act general lending authority.

Both are consistent with details of new Fed programs. https://www.businessinsider.com/coronavirus-aid-package-helps-workers-small-business-not-corporations-2020-4">https://www.businessinsider.com/coronavir...

Read on Twitter

Read on Twitter