As stocks rip and the worst seems over, let& #39;s take a moment to reflect on the fact that while the financial crisis *may* be over, the economic crisis has barely begun its fallout.

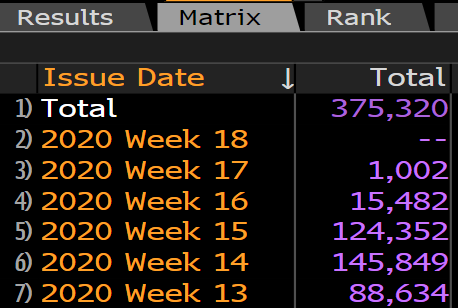

Are businesses strong enough to weather the storm? Here it is in numbers.

Are businesses strong enough to weather the storm? Here it is in numbers.

In the last 11 years, interest coverage has all but dissipated. The average of SPX as a whole went from 133x to 18.4x currently. The biggest culprits? Consumer, energy, industrials and materials.

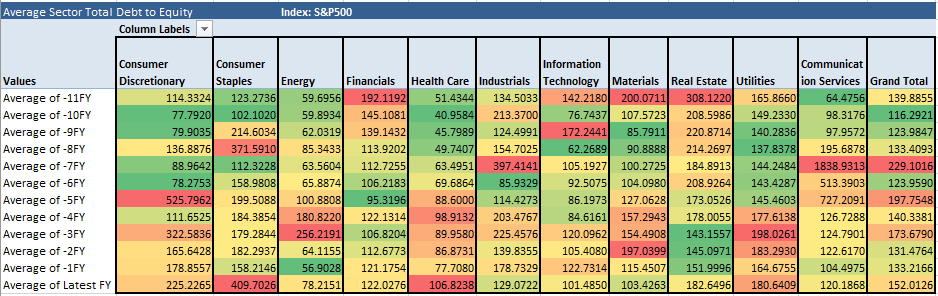

In terms of gearing, we& #39;re looking at consumers again and communications.

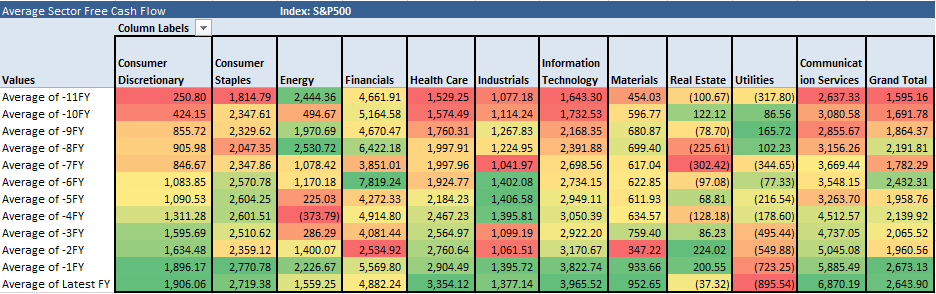

Consumers shine in terms of FCF, building it up over the years while utilities just keep burning it up. Tech and healthcare making some good headway, while communications as well has been increasing FCF.

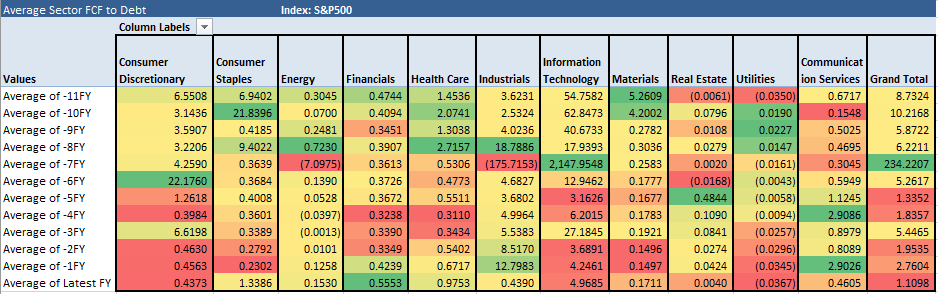

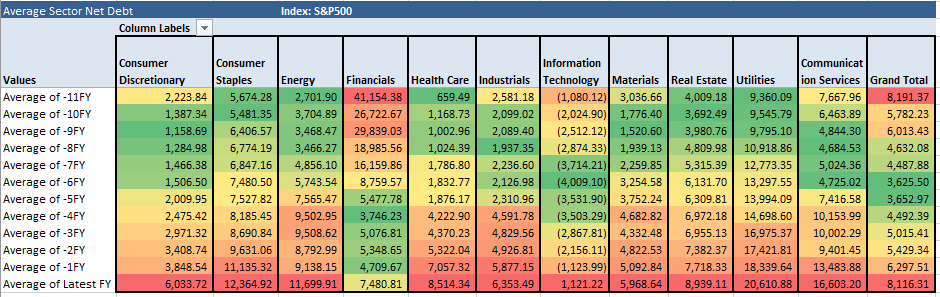

But then the other shoe drops, they& #39;ve all gorged on so much debt, the FCF doesn& #39;t even matter. Consumer stocks barely generate any FCF to cover debt, while tech has just feasted at the trough and forgot to save for winter.

And this is it really - All. That. Debt. every single one of them has just been filling their gut with it. Till the average FCF to Debt (previous tweet) for the whole index went from 8x to 1x.

So if liquidity dries up, and credit washes out to sea, what then?

So if liquidity dries up, and credit washes out to sea, what then?

Read on Twitter

Read on Twitter