Until last year, the 100% state-owned Dutch public railways owned an Irish subsidiary whose only function was to formally own trains that were leased in the Netherlands. This way NS could shift profits and pay lower corporation taxes in Ireland https://www.irishtimes.com/business/transport-and-tourism/dutch-state-railway-formally-winds-up-irish-tax-avoidance-structure-1.3875425">https://www.irishtimes.com/business/...

A 100% STATE-OWNED COMPANY CAME UP WITH A SCHEME TO EVADE PAYING TAXES TO THE STATE.

"Since the end of the 1990s, NS purchased trains via Ireland to rent them out to itself for transport in the Netherlands" https://www.trouw.nl/nieuws/ns-gestopt-met-ontwijking-via-ierland-85-miljoen-extra-belasting-in-nederland~b890f6c4/">https://www.trouw.nl/nieuws/ns...

NB: this is the same scheme that Starbucks and others use. Starbucks sets up a company in the NL whose only function is to own the right to use the brand. Starbucks UK pays Starbucks NL for this right, allowing to shift profits to a jurisdiction where corporate taxes are lower.

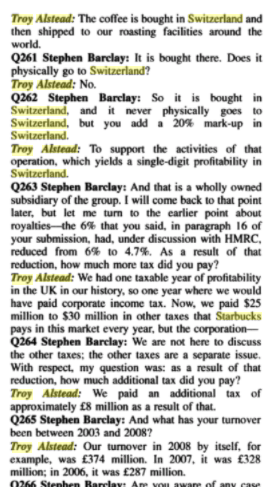

If I remember correctly, Starbucks also owned a company in Switzerland with a couple of employees but a huge turnover who sold coffee beans at inflated prices to Starbucks (so Starbucks selling coffee to itself), also allowing to shift profits to a country with lower taxes.

This was Starbucks& #39;s coffee selling scheme

https://www.rts.ch/info/economie/5178524-la-firme-starbucks-echappe-en-partie-a-l-impot-grace-a-sa-filiale-suisse.html">https://www.rts.ch/info/econ...

https://www.rts.ch/info/economie/5178524-la-firme-starbucks-echappe-en-partie-a-l-impot-grace-a-sa-filiale-suisse.html">https://www.rts.ch/info/econ...

#v=onepage&q=starbucks%20switzerland%20troy%20alstead&f=false">https://books.google.nl/books?id=QXU2E8RCZqIC&pg=RA1-PA27&lpg=RA1-PA27&dq=starbucks+switzerland+troy+alstead&source=bl&ots=j8pee1D0sw&sig=ACfU3U01N4U9OxLAV3QVIm6us6aB1kLyIg&hl=en&sa=X&ved=2ahUKEwjukoji9dnoAhVB2-AKHVyEAQ8Q6AEwAnoECFoQKQ #v=onepage&q=starbucks%20switzerland%20troy%20alstead&f=false">https://books.google.nl/books...

This is another 100% state-owned transport company in Switzerland that siphoned off state subsidies to France to undercut rivals there and claim ever more state subsidies in Switzerland

https://www.swissinfo.ch/eng/carpostal-france_swiss-post-sells-off-french-bus-unit-at-heart-of-subsidy-scandal/45271476">https://www.swissinfo.ch/eng/carpo...

https://www.swissinfo.ch/eng/carpostal-france_swiss-post-sells-off-french-bus-unit-at-heart-of-subsidy-scandal/45271476">https://www.swissinfo.ch/eng/carpo...

Apparently this train lease scheme via Ireland was also used by major UK train companies. You know, the ones that are asking for bailouts now.

https://www.theguardian.com/business/2018/apr/22/abellio-ns-amsterdam-express-goes-via-dublin-ireland-low-tax?CMP=Share_AndroidApp_Copy_to_clipboard">https://www.theguardian.com/business/...

https://www.theguardian.com/business/2018/apr/22/abellio-ns-amsterdam-express-goes-via-dublin-ireland-low-tax?CMP=Share_AndroidApp_Copy_to_clipboard">https://www.theguardian.com/business/...

Read on Twitter

Read on Twitter