Thanks for today& #39;s webinar on how #nonprofits can apply for the PPP, @SmartNonprofits @PropelNP @SunriseBanks. Helpful and timely resource! Notes follow in this thread. #savemainstreet

@KateSBarr @PropelNP begins with an overview of the terms and details of the loan and application. Find Propel& #39;s #covid19 resources for #nonprofits here: https://www.propelnonprofits.org/covid-19-resources-for-nonprofits/">https://www.propelnonprofits.org/covid-19-...

Payroll calculation: [Payroll over 12 months] / [12 months] * 2.5

The period of time for the payroll calculation can be the previous 12 months, or the 12 months of 2019.

Therefore, a first step: get GOOD payroll info, and do your calculation.

The period of time for the payroll calculation can be the previous 12 months, or the 12 months of 2019.

Therefore, a first step: get GOOD payroll info, and do your calculation.

Note for organizations with independent contractors: payments to independent contractors are not included in the payroll calculation. Contractors will be able to apply on their own.

If your organization& #39;s usual services are on hold, consider bringing people back on payroll and using the time for professional development or team building.

How do you get the loan forgiven, functionally converting it into a grant? Here& #39;s what @KateSBarr @PropelNP says. The full guidelines on forgiveability aren& #39;t yet released by the SBA. @SmartNonprofits

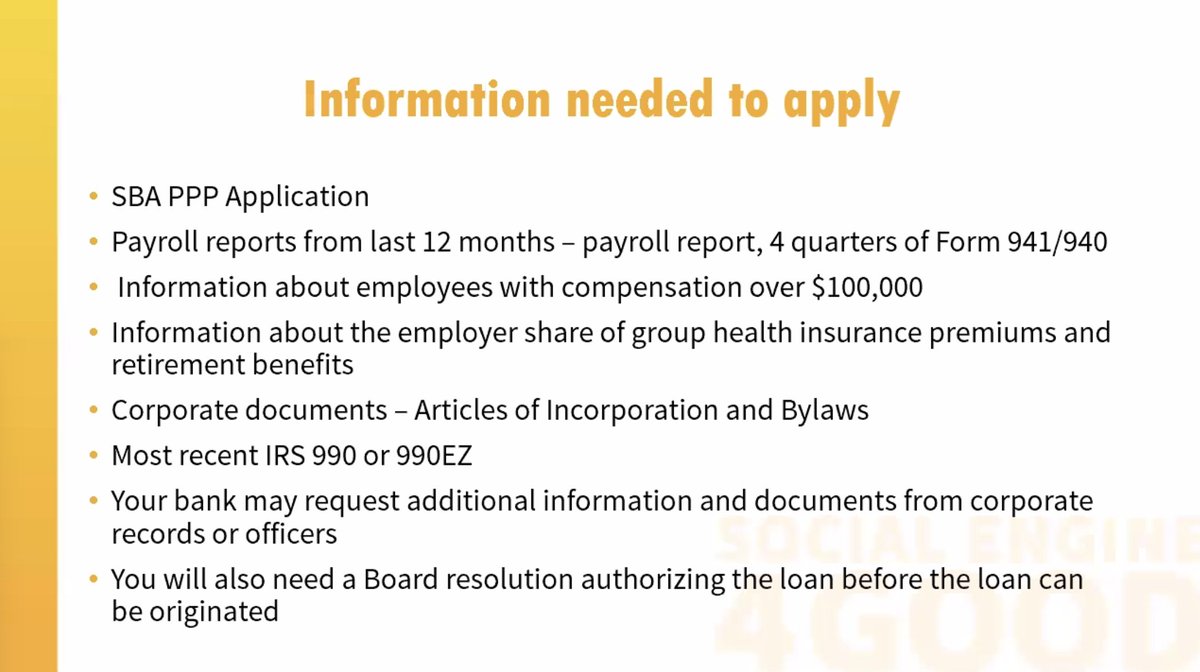

Here& #39;s what a #nonprofit needs in order to apply for a PPP #CARESact loan. @KateSBarr @PropelNP @SmartNonprofits

@rickbees @SunriseBanks notes that early applicants may need to prepare for amendments, as the @SBAgov releases more guidelines. Rick advocates for nonprofits to be more fully included going forward, recognizing the industry is part of the US& #39; economic engine.

Banks& #39; acceptance and process with applications varies widely across the nation. @SunriseBanks decided initially to accept all applications and is working through them now. https://sunrisebanks.com/paycheck-protection-program/">https://sunrisebanks.com/paycheck-... SBA is now supporting banks with liquidity so they can fund the loans.

It& #39;s possible more money will be appropriated for the program to aid a lingering recovery period. There are lagging industries which will encounter seasonal challenges and need support, and which are motivated to time their application to claim as $ as they can through rehiring.

@rickbees says the PPP seems to be a solid and important program. In addition to applying for the PPP, contact your current lenders for flexible options, and look into CARES Act support if you& #39;d like to hire *more* people.

Q&A for the @SmartNonprofits webinar on how nonprofits can apply for the #PPP:

Q1: Where should nonprofits turn for specialized help? A1: Try emailing your bank. @PropelNP can provide general and limited guidance.

Q1: Where should nonprofits turn for specialized help? A1: Try emailing your bank. @PropelNP can provide general and limited guidance.

Q2: Should nonprofits apply at multiple banks at a time?

A2: It& #39;s an option. Just make sure the lender is active, engaged and ready to prioritize this. But once the application reaches the SBA, only one application will remain eligible.

A2: It& #39;s an option. Just make sure the lender is active, engaged and ready to prioritize this. But once the application reaches the SBA, only one application will remain eligible.

Q3: Can any nonprofit apply for the #PPP at @SunriseBanks?

A3: Yes, and (as of now!) any nonprofit can also now apply at @BremerBank.

A3: Yes, and (as of now!) any nonprofit can also now apply at @BremerBank.

Q4: What about other sources of funding?

A4: If you need more than what you will receive from PPP, look into state and city funding and loan programs.

A4: If you need more than what you will receive from PPP, look into state and city funding and loan programs.

Q5: What about organizations with healthy reserves, which may run into difficulty later in the year?

A5: Your org& #39;s financial condition has nothing to do with the forgiveness or the application. There& #39;s no underwriting.

A5: Your org& #39;s financial condition has nothing to do with the forgiveness or the application. There& #39;s no underwriting.

"I& #39;d be shocked if this program didn& #39;t continue to change as we go along." More financial support may be made available to #nonprofits. Nevertheless, @rickbees @SunriseBanks recommends applying for PPP support now. "A bird in the hand is worth two in the bush."

@PropelNP @KateSBarr& #39;s quick summary of the decision-making process for applying for the PPP loan:

1) Are you eligible?

2) Do you have payroll?

3) Will you use the loan over 8 weeks to pay people on payroll?

1) Are you eligible?

2) Do you have payroll?

3) Will you use the loan over 8 weeks to pay people on payroll?

Q6: Does a coworking space membership count in the rent/utilities category?

A6: If rent is paid for space, definitely. There must be a cash payment. (Still unsure whether a "hot desk" membership counts.)

A6: If rent is paid for space, definitely. There must be a cash payment. (Still unsure whether a "hot desk" membership counts.)

Q7: Can we pay our workers without giving them hours?

A7: SBA doesn& #39;t say what you should do specifically, just that you should pay people. There may be room for a conversation about expectations, which is held at the leadership and board level—especially for "mothballed" orgs.

A7: SBA doesn& #39;t say what you should do specifically, just that you should pay people. There may be room for a conversation about expectations, which is held at the leadership and board level—especially for "mothballed" orgs.

Final words from the @SmartNonprofits webinar on nonprofit access to the PPP. Banks and accountants have been heroes. Things are getting clearer. Anxiety levels can start to come down.

Next week& #39;s virtual finance conference on 4/14 and 4/21—in partnership between @SmartNonprofits @PropelNP—will provide a space to dig in even more deeply on #nonprofit finance. https://www.minnesotanonprofits.org/events/conferences/finance-conference">https://www.minnesotanonprofits.org/events/co...

Read on Twitter

Read on Twitter