[Thread]: A collection of thoughts on crypto, stocks, fixed income... and why "not being bullish" doesn& #39;t mean you have to be bearish.

$BTC $SPY $JNK

$BTC $SPY $JNK

1) Stocks are VERY expensive. From @CecchiniPeter at Cantor:

"The S&P 500 is +22.4% from 3/23 lows, pushing P/E multiples to 19.0x forward earnings (based on fresh downwardly revised earnings estimates). This is the same P/E level as on Feb 19, the all-time high for stocks."

"The S&P 500 is +22.4% from 3/23 lows, pushing P/E multiples to 19.0x forward earnings (based on fresh downwardly revised earnings estimates). This is the same P/E level as on Feb 19, the all-time high for stocks."

2) IMO, those downwardly revised earnings estimates are still too high. But forward guidance from companies is most important now. 1Q earnings won& #39;t matter since most of the 1Q was pre-quarantine. The outlook for 2Q doesn& #39;t matter either since everyone knows it is horrific.

3) But after 2Q, that& #39;s when the divergent opinions start. Some think fast V-shaped recovery, others don& #39;t. What companies say about 3Q and 4Q outlook will matter most.

THUS - the next real important catalyst is NOT UNTIL JULY. That& #39;s a long time from now in trading terms.

THUS - the next real important catalyst is NOT UNTIL JULY. That& #39;s a long time from now in trading terms.

4) Just because stocks are expensive doesn& #39;t mean shorts will work. They have been expensive for a long time. You need a catalyst. And I think being short from now until July is going to be a tough trade, in any asset class. It& #39;s just too expensive and most likely dead money.

5) Now, I& #39;m not bullish on equities at all, nor am I bullish on corporate bonds. I& #39;ve simply done this long enough to know that forcing shorts doesn& #39;t work when there is no catalyst. This is going to take 2-3 years to play out -- trying to force it in 2-3 months is dangerous.

6) But why are global assets going higher including $SPY, $JNK, $BTC and other risk assets? Simple -- so much cash, and very few actual defaults (yet). We alluded to his here: https://www.ar.ca/blog/crypto-market-recap-04-06-20">https://www.ar.ca/blog/cryp...

7) Investors who panic and pull all of their money out of markets have already done that... those that are left are going to be more methodical. In the meantime, cash builds:

a) Coupons still get paid on bonds (so fixed income funds will be flush with cash to redeploy)

a) Coupons still get paid on bonds (so fixed income funds will be flush with cash to redeploy)

8) b) Dividends will still be paid on some stocks (which means equity funds are flush with cash to redeploy)

c) 401ks will still auto-deploy to equities (for those that still have jobs)

You don& #39;t need inflows to support equity or debt prices. You just need to avoid outflows.

c) 401ks will still auto-deploy to equities (for those that still have jobs)

You don& #39;t need inflows to support equity or debt prices. You just need to avoid outflows.

9) Specific to crypto: $BTC definitely has a higher floor right now, and an incredible long-term catalyst (Monetary/fiscal stimulus, MMT, etc). The rest of the digital assets space is on hold right until a new catalyst emerges, but again, that doesn& #39;t mean shorting will work.

10) The 3 things I& #39;m watching in crypto are:

a) Cash on Exchanges -- all time highs https://www.viewbase.com/coin/tether

b)">https://www.viewbase.com/coin/teth... Sentiment -- still near all time lows https://alternative.me/crypto/fear-and-greed-index/

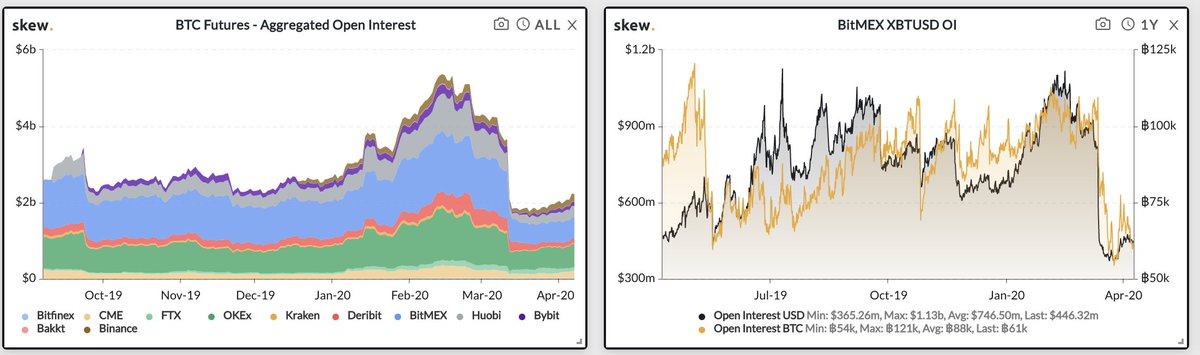

c)">https://alternative.me/crypto/fe... Leverage -- 2-year lows (as measured by @skewdotcom)

These metrics are very supportive of prices

a) Cash on Exchanges -- all time highs https://www.viewbase.com/coin/tether

b)">https://www.viewbase.com/coin/teth... Sentiment -- still near all time lows https://alternative.me/crypto/fear-and-greed-index/

c)">https://alternative.me/crypto/fe... Leverage -- 2-year lows (as measured by @skewdotcom)

These metrics are very supportive of prices

11) With that backdrop, it is VERY hard to short risk assets right now into a wall of cash, including #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/hashflags... draggable="false" alt="">.

Prices can certainly go down. But I wouldn& #39;t be surprised if they keep melting up, including stocks.

Longer-term: very bullish $BTC, very concerned $SPY and $JNK

Prices can certainly go down. But I wouldn& #39;t be surprised if they keep melting up, including stocks.

Longer-term: very bullish $BTC, very concerned $SPY and $JNK

Read on Twitter

Read on Twitter