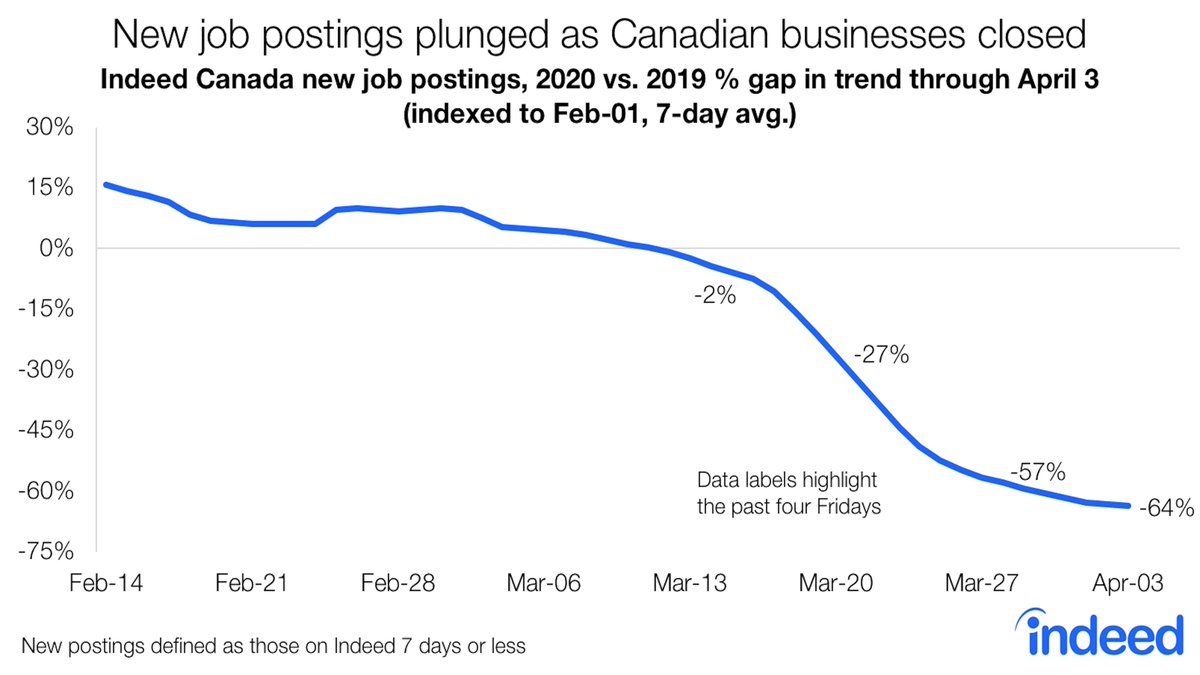

Tomorrow& #39;s March 15-21 LFS report is surely the most anticipated in HISTORY. Here are some things I& #39;ll be watching (thread)

https://www.hiringlab.org/en-ca/2020/04/07/march-lfs-preview/">https://www.hiringlab.org/en-ca/202... (1/n)

https://www.hiringlab.org/en-ca/2020/04/07/march-lfs-preview/">https://www.hiringlab.org/en-ca/202... (1/n)

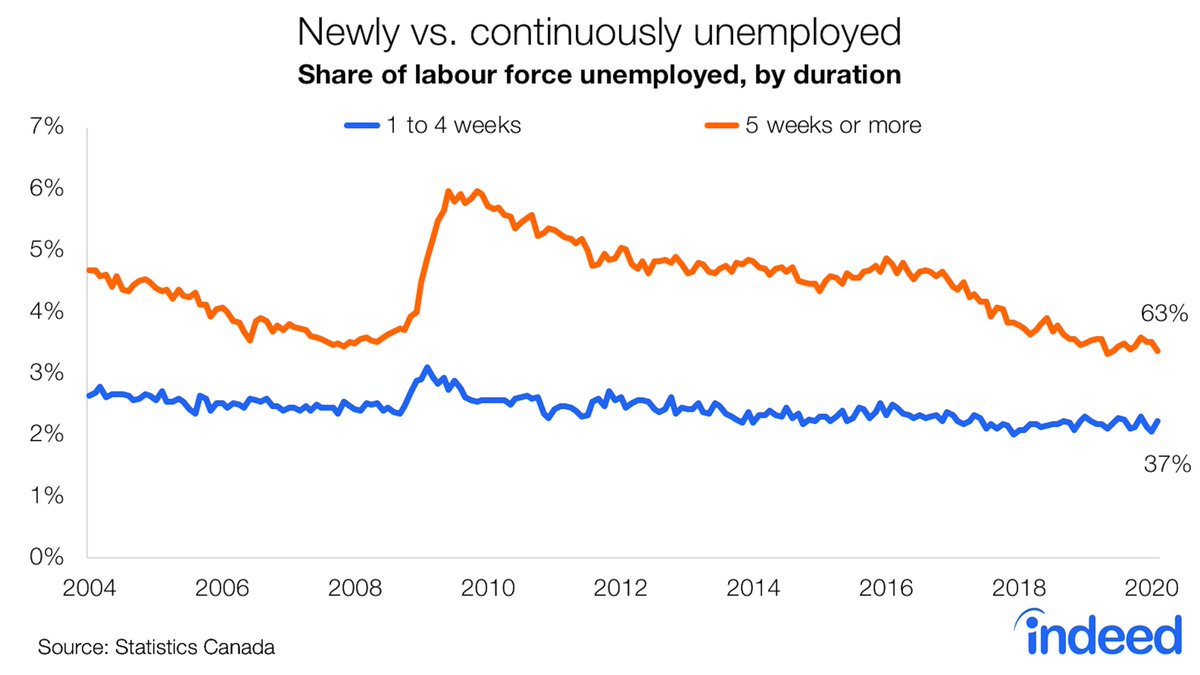

1. Unemployment will rise not only from COVID-related layoffs, also because some of those already jobless who would have typically found new work won& #39;t be able to. (2/n)

One way to distinguish btw these trends will be to separately track the change in unemployment among those out of work less than a month with those who’ve been jobless for longer. (3/n)

This post by @MilesCorak provides other important detail on how to track who& #39;s become unemployed, and why

https://milescorak.com/2020/04/03/what-you-need-to-know-about-statistics-canadas-survey-of-the-labour-market/">https://milescorak.com/2020/04/0... (4/n)

https://milescorak.com/2020/04/03/what-you-need-to-know-about-statistics-canadas-survey-of-the-labour-market/">https://milescorak.com/2020/04/0... (4/n)

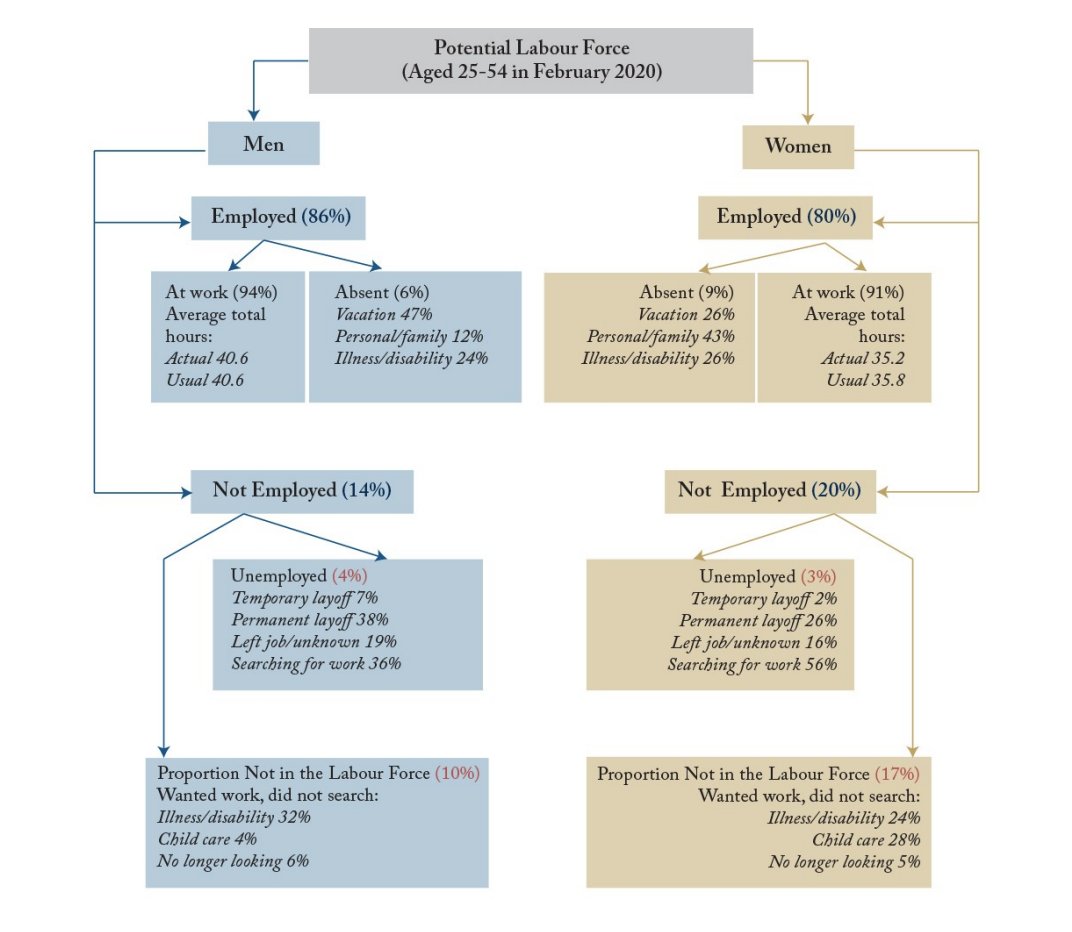

2. To be considered unemployed, one has to be looking and available for work, unless one’s employer has indicated they’ll be rehired. However, right now is a tough time to look for a job for a variety of reasons. (5/n)

As a result, the hit to the job market is likely to show up in both lower labour force participation and higher unemployment. Tracking both will be important, alongside the overall employment rate will be key for putting the hit to the job market in context. (6/n).

On the employment rate - if you& #39;re tracking it over time, PLEASE use either the working-age (15-64) or prime-age (25-54) employment rates. The rising share of population age 65+ has had a major impact on the overall rate over the past decade. (7/n) https://www.hiringlab.org/en-ca/2018/07/03/canada-june-jobs-report-preview/">https://www.hiringlab.org/en-ca/201...

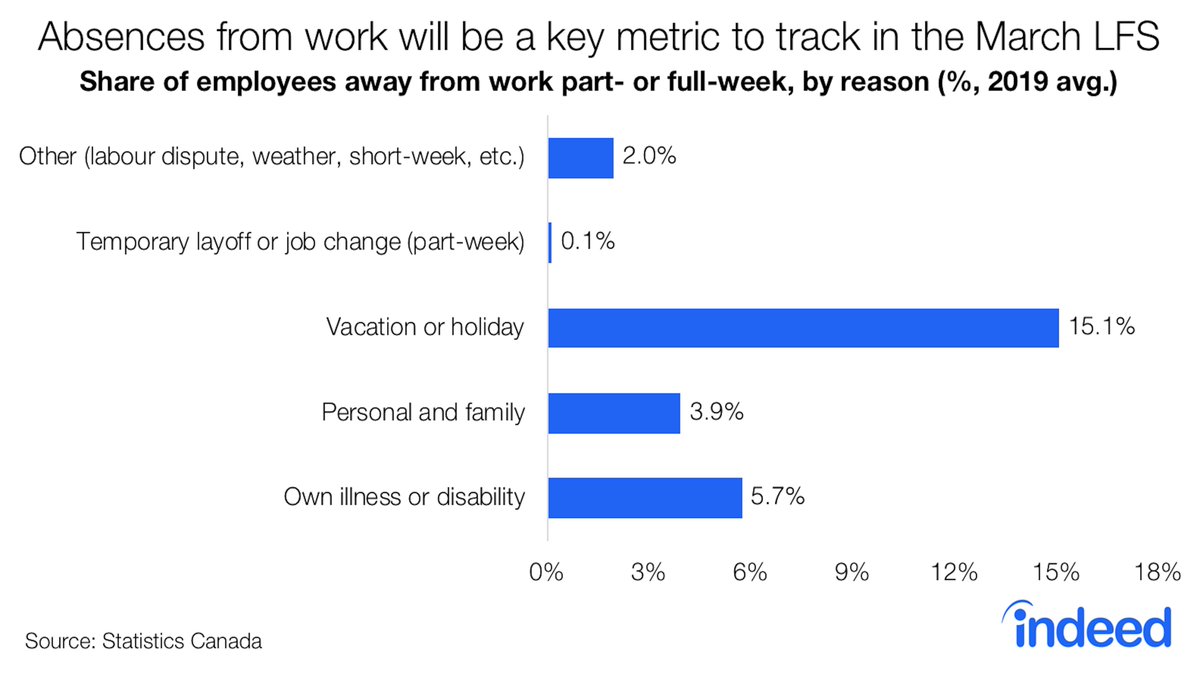

3. It rarely gets coverage, but the LFS tracks employees who worked less than their usual hours during the survey-week, and asks them the reason for their absence and # of hours lost. There’s going to be a TON to explore in this series: (8/n)

Absences from work, either part or full-week, are quite common. In 2019, on average 27% of all employees each month worked less than their usual weekly hours, primarily due to vacations and public holidays - March break will influence tomorrow’s numbers too! (9/n)

Other categories will be more interesting to watch:

a) Own illness/disability (1.05 million employees missed at least some time in Feb-2020).

Does self-isolation/quarantining boost these numbers? (10/n)

a) Own illness/disability (1.05 million employees missed at least some time in Feb-2020).

Does self-isolation/quarantining boost these numbers? (10/n)

b) Personal & family reasons (695K ppl in Feb 2020) - with schools closed/closing many parents might be forced to stay home and take care of the kids. How will this affect men & women differently? (11/n)

c) Mid-week "job changes" (9.6K last month) and temporary layoffs (12K) - as @lbseconomics notes, those who’ve lost their job mid-way through the ref. week will still be considered employed - but they& #39;ll also be recorded as "absent" part-week (12/n) https://twitter.com/lbseconomics/status/1247580140235784193">https://twitter.com/lbseconom...

d) Employees who& #39;s workplace is closed but are still getting a paycheck - I& #39;m not sure how these workers will be recorded! (asked StatCan, but they’re busy!)

They could classified as part-week absent due to “short week” (50.5K last month) or "other" (186K) (13/n)

They could classified as part-week absent due to “short week” (50.5K last month) or "other" (186K) (13/n)

In general as @kevinmilligan and @tammyschirle note, the best aggregate measure we should be tracking is the change in Canadians "employed and at work". They also provide a handy graphic on how to keep track of all this! (14/n)

https://www.cdhowe.org/intelligence-memos/milligan-schirle-%E2%80%93-labour-force-survey-pandemic-primer">https://www.cdhowe.org/intellige...

https://www.cdhowe.org/intelligence-memos/milligan-schirle-%E2%80%93-labour-force-survey-pandemic-primer">https://www.cdhowe.org/intellige...

All this absences data - as well as other interesting indicators like PT for economic reasons - aren& #39;t seasonally adjusted! Navigating between SA and NSA data will be a cumbersome - need to keep track of both! (15/n)

Read on Twitter

Read on Twitter