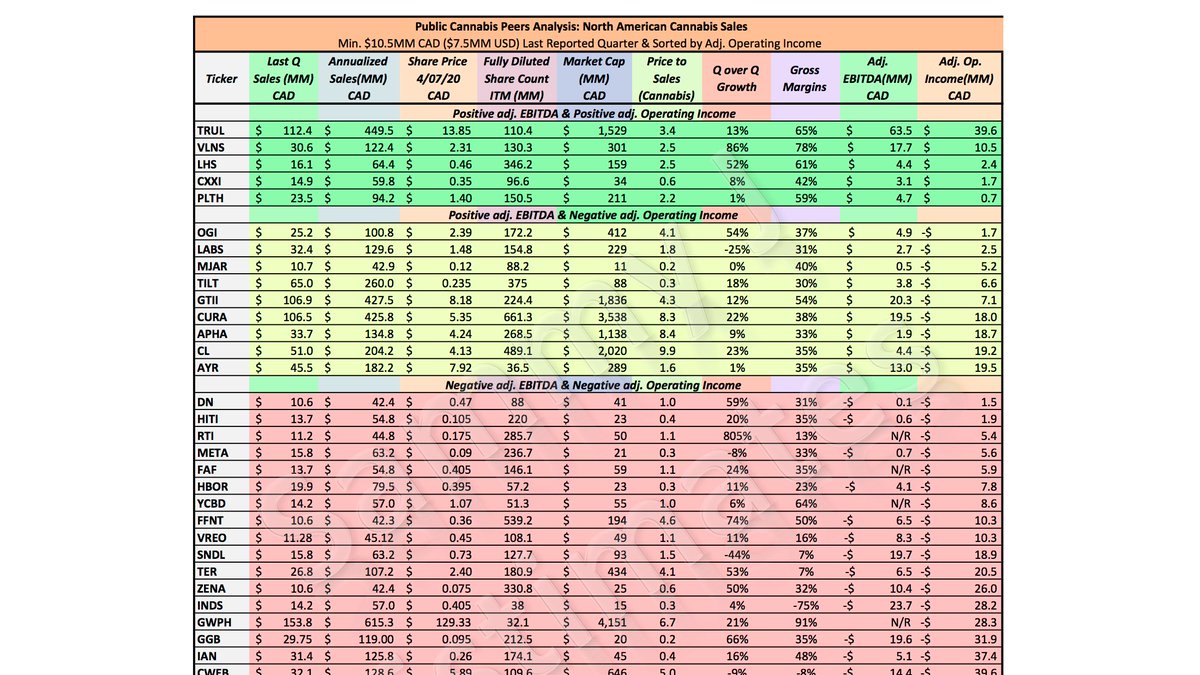

1. Updated N.A. Cannabis Chart (4/07/20):

Top 39 Revenue Generating Public Cos, min. $42M CAD ($30M USD) Annualized Cannabis Sales as of Last Reported Quarter

Inc. GMs, adj. EBITDA, & sorted by adj. Operating Income. USD/CAD @ $1.41

Green: $LHS joins $TRUL, $VLNS, $CXXI, $PLTH

Top 39 Revenue Generating Public Cos, min. $42M CAD ($30M USD) Annualized Cannabis Sales as of Last Reported Quarter

Inc. GMs, adj. EBITDA, & sorted by adj. Operating Income. USD/CAD @ $1.41

Green: $LHS joins $TRUL, $VLNS, $CXXI, $PLTH

2. Added (red):

$DN $HITI $RTI $ZENA

Updated (Reported since Jan. 15th):

$TRUL, $VLNS, $LABS, $GTII, $CURA, $AYR.a, $META, $YCBD, $SNDL, $GWPH, $GGB, $CWEB, $CCHW, $HARV, $MMEN, $ACRG, $ACB, $WEED, $HEXO, $TLRY

$DN $HITI $RTI $ZENA

Updated (Reported since Jan. 15th):

$TRUL, $VLNS, $LABS, $GTII, $CURA, $AYR.a, $META, $YCBD, $SNDL, $GWPH, $GGB, $CWEB, $CCHW, $HARV, $MMEN, $ACRG, $ACB, $WEED, $HEXO, $TLRY

3. Removed (no longer meet minimum cannabis sales):

$CRON, $VFF, $FIRE

Green to Yellow: $LABS

Yellow to Red: $CWEB

No Updated Fins: $CXXI $PLTH $OGI $MJAR $TILT $APHA $CL $FAF $HBOR $FFNT $VREO $TER $INDS $IAN

Shout out to @Invest420 & @ncvmedia for requisite revenue tracker.

$CRON, $VFF, $FIRE

Green to Yellow: $LABS

Yellow to Red: $CWEB

No Updated Fins: $CXXI $PLTH $OGI $MJAR $TILT $APHA $CL $FAF $HBOR $FFNT $VREO $TER $INDS $IAN

Shout out to @Invest420 & @ncvmedia for requisite revenue tracker.

4. Don& #39;t know if many care about these metrics any longer but had a bunch of requests to update. Still planning on adding EV and fine-tuning fully diluted in-the-money share counts, due to the massive sector rug pull pricing a ton of FD paper considerably out of the money now.

5. Also, don& #39;t know if or when this sector ever gets sorted by consolidating &/or a catalyst, but just a reminder that you need to look at burn rate. Whether $IAN& #39;s news or recent bad raises around town, here is a thread I made months ago about GP & OpEx: https://twitter.com/sammyj_19/status/1210623257210175488">https://twitter.com/sammyj_19...

6. $TRUL again showing best-in-class fins. They& #39;re the exception to the repriced sector and I suspect they push back share unlocks in this environment. Somehow, along with $VLNS, $CXXI, & $LHS, they trade at lowest EV/EBITDA multiples in the sector. Babies with the bath water./

7. Redo without the chart being cut off  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Upside-down face" aria-label="Emoji: Upside-down face">:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Upside-down face" aria-label="Emoji: Upside-down face">:

$TRUL $VLNS $LHS $CXXI $PLTH

$OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a

$DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY

$TRUL $VLNS $LHS $CXXI $PLTH

$OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a

$DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY

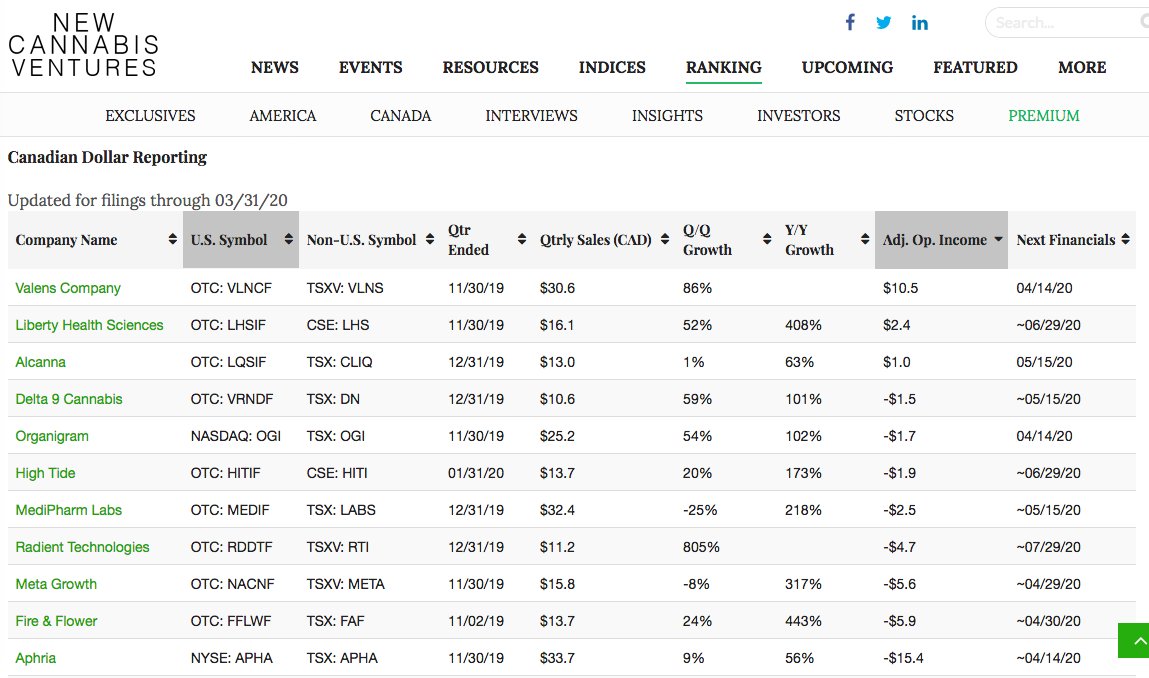

8. Forgot to add, here is @ncvmedia& #39;s updated tracker reference, sorted by adj. Operating Income, which is where I based the foundation for my chart. You will see they have some ancillaries as well as OTC only #potstocks that I don& #39;t include (can& #39;t hold OTC stocks in TFSA etc).

Read on Twitter

Read on Twitter

: $TRUL $VLNS $LHS $CXXI $PLTH $OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a $DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY" title="7. Redo without the chart being cut off https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Upside-down face" aria-label="Emoji: Upside-down face">: $TRUL $VLNS $LHS $CXXI $PLTH $OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a $DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY" class="img-responsive" style="max-width:100%;"/>

: $TRUL $VLNS $LHS $CXXI $PLTH $OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a $DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY" title="7. Redo without the chart being cut off https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙃" title="Upside-down face" aria-label="Emoji: Upside-down face">: $TRUL $VLNS $LHS $CXXI $PLTH $OGI $LABS $MJAR $TILT $GTII $CURA $APHA $CL $AYR.a $DN $HITI $RTI $META $FAF $HBOR $YCBD $FFNT $VREO $SNDL $TER $ZENA $INDS $GWPH $GGB $IAN $CWEB $CCHW $HARV $MMEN $ACRG $ACB $WEED $HEXO $TLRY" class="img-responsive" style="max-width:100%;"/>