Very interesting cryptocurrency-related opinion out of New Zealand. See below thread for why this is an interesting & good result for crypto holders:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://twitter.com/CourtsofNZ/status/1247770583737102336">https://twitter.com/CourtsofN...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">Cryptopia suffered a large hack and filed for bankruptcy

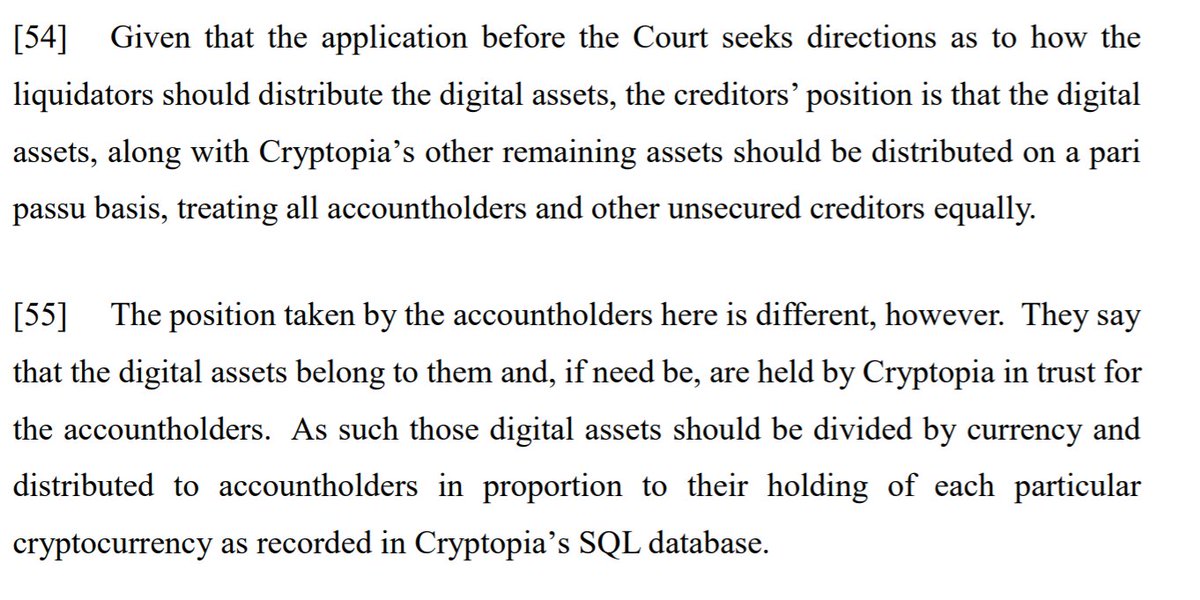

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">this pitted Cryptopia&

#39;s creditors against its users--do users have a first-priority claim to Cryptopia&

#39;s crypto on deposit, or are users and creditors "pari passu," with equal rights to get paid on their claims?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">if Cryptopia was holding the cryptocurrency for users in trust, then users had the better claim to get paid first; if there was no trust, then users were just general creditors like all others

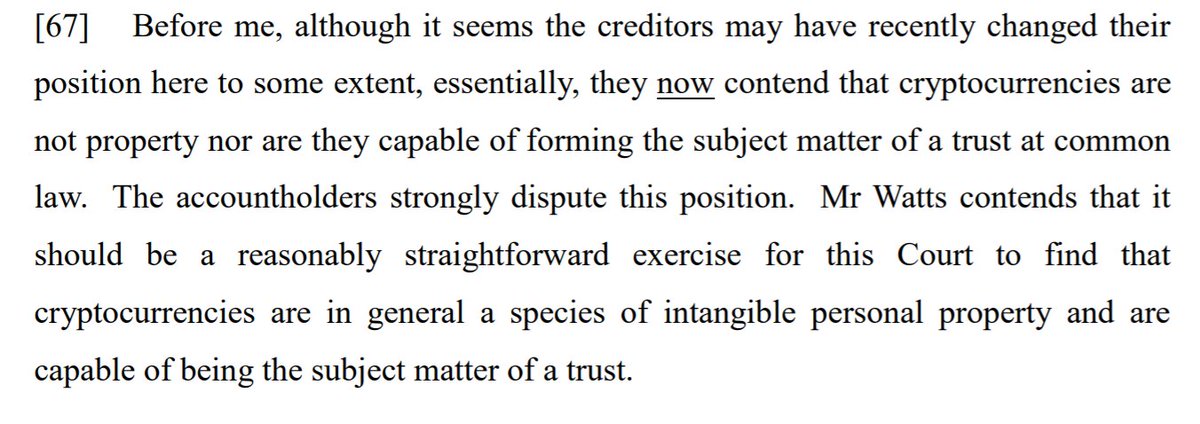

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">creditors argued that cryptocurrencies are not "property" and therefore cannot be part of a "trust"

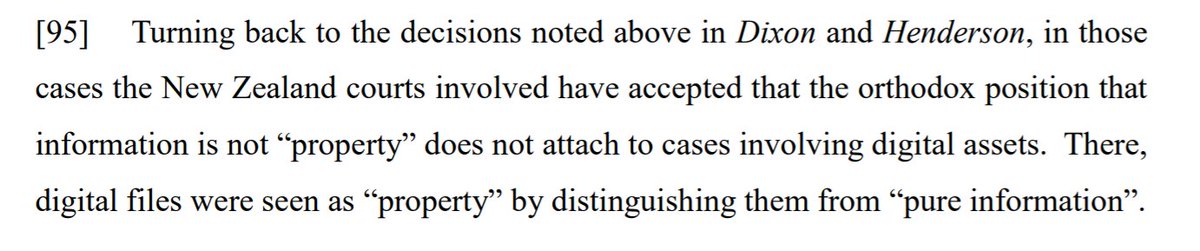

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">one possible argument is that "information" is often not treated as "property" and cryptocurrencies are just "information"

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">court rejected this view while giving us an international survey of court opinions on related issues--at one point analogizing stealing cryptocurrencies to unauthorized copying of a CCTV footage video file, which was deemed a "taking" of property in another NZ case!

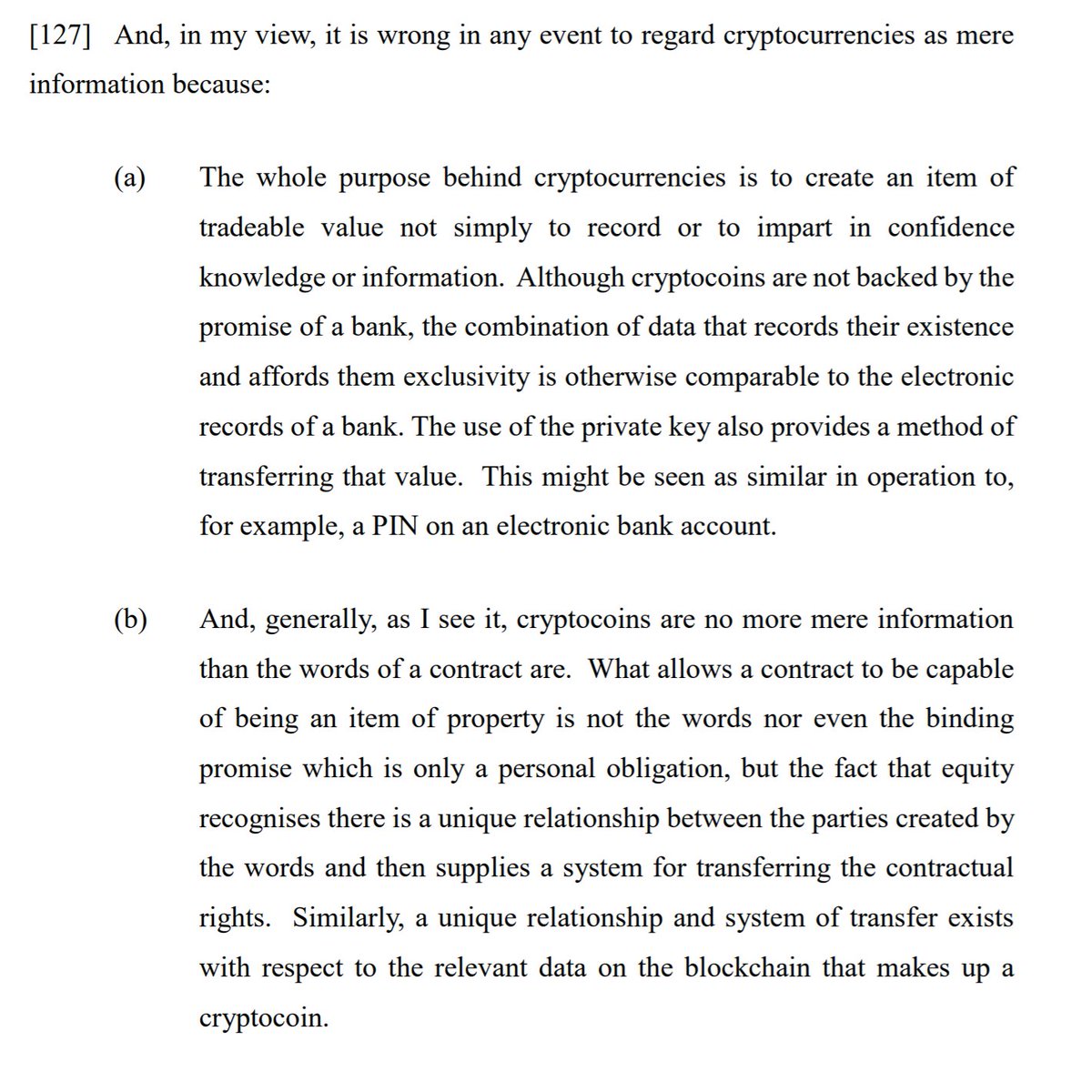

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">the court analogizes the information involved in cryptocurrency allocation to "the words in a contract";

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">just as words in a contract being information does not prevent them from determining property rights, so, too, with crypto data

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">court found that the cryptocurrency was held in trust by Cryptopia for the users and they were not general creditors--cites various facts as evidence for intention of forming trust, including marketing language about "ensuring YOU can trade YOUR cryptocurrency..."

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">each type of cryptocurrency was in a separate trust; therefore, since ETH was hacked, ETH holders will suffer a loss and that loss will not be subsidized by other types of cryptocurrency holders

Overall, very interesting (if somewhat unsurprising) case. Nice to have these matters reasoned out and confirmed. Going forward, expect that creditors of exchanges will assume cryptocurrency deposits are not up for grabs in a bankruptcy and to insist on other protections.

h/t to the awesome Canadian cryptoattorney

@evanmthomas who alerted me to this opinion

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/CourtsofNZ/status/1247770583737102336">https://twitter.com/CourtsofN...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://twitter.com/CourtsofNZ/status/1247770583737102336">https://twitter.com/CourtsofN...

Read on Twitter

Read on Twitter if Cryptopia was holding the cryptocurrency for users in trust, then users had the better claim to get paid first; if there was no trust, then users were just general creditors like all others" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">if Cryptopia was holding the cryptocurrency for users in trust, then users had the better claim to get paid first; if there was no trust, then users were just general creditors like all others" class="img-responsive" style="max-width:100%;"/>

if Cryptopia was holding the cryptocurrency for users in trust, then users had the better claim to get paid first; if there was no trust, then users were just general creditors like all others" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">if Cryptopia was holding the cryptocurrency for users in trust, then users had the better claim to get paid first; if there was no trust, then users were just general creditors like all others" class="img-responsive" style="max-width:100%;"/>

creditors argued that cryptocurrencies are not "property" and therefore cannot be part of a "trust"https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">one possible argument is that "information" is often not treated as "property" and cryptocurrencies are just "information"" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">creditors argued that cryptocurrencies are not "property" and therefore cannot be part of a "trust"https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">one possible argument is that "information" is often not treated as "property" and cryptocurrencies are just "information"" class="img-responsive" style="max-width:100%;"/>

creditors argued that cryptocurrencies are not "property" and therefore cannot be part of a "trust"https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">one possible argument is that "information" is often not treated as "property" and cryptocurrencies are just "information"" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">creditors argued that cryptocurrencies are not "property" and therefore cannot be part of a "trust"https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">one possible argument is that "information" is often not treated as "property" and cryptocurrencies are just "information"" class="img-responsive" style="max-width:100%;"/>

court rejected this view while giving us an international survey of court opinions on related issues--at one point analogizing stealing cryptocurrencies to unauthorized copying of a CCTV footage video file, which was deemed a "taking" of property in another NZ case!" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">court rejected this view while giving us an international survey of court opinions on related issues--at one point analogizing stealing cryptocurrencies to unauthorized copying of a CCTV footage video file, which was deemed a "taking" of property in another NZ case!" class="img-responsive" style="max-width:100%;"/>

court rejected this view while giving us an international survey of court opinions on related issues--at one point analogizing stealing cryptocurrencies to unauthorized copying of a CCTV footage video file, which was deemed a "taking" of property in another NZ case!" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">court rejected this view while giving us an international survey of court opinions on related issues--at one point analogizing stealing cryptocurrencies to unauthorized copying of a CCTV footage video file, which was deemed a "taking" of property in another NZ case!" class="img-responsive" style="max-width:100%;"/>

the court analogizes the information involved in cryptocurrency allocation to "the words in a contract"; https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">just as words in a contract being information does not prevent them from determining property rights, so, too, with crypto data" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">the court analogizes the information involved in cryptocurrency allocation to "the words in a contract"; https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">just as words in a contract being information does not prevent them from determining property rights, so, too, with crypto data" class="img-responsive" style="max-width:100%;"/>

the court analogizes the information involved in cryptocurrency allocation to "the words in a contract"; https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">just as words in a contract being information does not prevent them from determining property rights, so, too, with crypto data" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">the court analogizes the information involved in cryptocurrency allocation to "the words in a contract"; https://abs.twimg.com/emoji/v2/... draggable="false" alt="⚖️" title="Scales" aria-label="Emoji: Scales">just as words in a contract being information does not prevent them from determining property rights, so, too, with crypto data" class="img-responsive" style="max-width:100%;"/>