WEDNESDAY MORNING: And much going on, so let’s get at it, a bit, anyway.

The big thing remains OPEC – and really, the question of whether Russia and Saudi Arabia accept the explanation that “we’re already cutting because of prices being so bad” is enough to hear from the United States…

#OOTT #OPEC

#OOTT #OPEC

…or if the US just throws enough sticks (instead of carrots) at this situation that the Saudis knuckle under and cut without accompanying responses from the US and others.

Now, to recap – the Saudis have been pumping full-tilt for a month ever since they and Russia scuttled a three-year-plus deal to curb supply in the markets. #OOTT #OPEC https://www.reuters.com/article/oil-opec-saudi/update-1-saudi-arabia-floods-europe-with-25-oil-as-fight-with-russia-escalates-idUSL8N2B63Y6">https://www.reuters.com/article/o...

That made prices go bananas, selling off like mad. That dropped US crude to $20 and Brent below $25; they’ve since done some recovery on the hopes for a deal… https://graphics.reuters.com/USA-OIL/0100B5LV472/index.html">https://graphics.reuters.com/USA-OIL/0...

…even if ultimately we still haven’t seen the full brunt of the demand fall and the extra supply and what kind of overhang that’s going to create. #OOTT #OPEC

That sort of brings us up here to the present day, now – and the reality is that Russia, #OPEC and Saudi Arabia do want to cut back production – some say by as much as 10-15% of world supply (roughly 10-15 mln bbls).

Trump was crowing about this like mad last week, that this was the big deal he brokered, but of course details are wanting. #OOTT #OPEC https://www.reuters.com/article/us-global-oil-saudi-russia/trump-touts-great-saudi-russia-oil-deal-to-halt-price-rout-but-details-unclear-idUSKBN21K0EA">https://www.reuters.com/article/u...

Thing is, OPEC – and that’s everybody, including Iran, the Russians, et al – want cuts from non- #OPEC+ types.

Iran& #39;s the most vocal today - https://www.reuters.com/article/us-global-oil-opec-iran/worlds-biggest-oil-producers-still-at-odds-before-talks-on-major-cuts-idUSKBN21Q0EI">https://www.reuters.com/article/u...

Iran& #39;s the most vocal today - https://www.reuters.com/article/us-global-oil-opec-iran/worlds-biggest-oil-producers-still-at-odds-before-talks-on-major-cuts-idUSKBN21Q0EI">https://www.reuters.com/article/u...

Iranian Oil Minister Bijan Zanganeh said that, “in the absence of any clear and consensual outcome”, a failure of talks could “aggravate the current low price environment even further”. He says they should have agreed to something - with the US/Canada too - before even meeting.

Some outside nations are more or less in already – Brazil’s Petrobras is already cutting on terrible prices. Norway has said it would (and has done this in the past).

And Canada has signaled some intent, but they’re doing something similar to the US – saying bad economics are doing the trick.

https://www.reuters.com/article/us-global-oil-canada/canada-oil-cuts-set-to-deepen-as-alberta-province-eyes-global-deal-idUSKBN21P319

https://www.reuters.com/article/u... href="https://twtext.com//hashtag/OOTT"> #OOTT #shale #bitumen #tar #lotsofhashtags

https://www.reuters.com/article/us-global-oil-canada/canada-oil-cuts-set-to-deepen-as-alberta-province-eyes-global-deal-idUSKBN21P319

But Canada, while a big producer, occupies a pretty unique corner of the market in that it produces super-heavy oil (tarry bitumen)…

…and they’re not the key player. The US is – now producing 13 mln bpd, and there’s been a big to-do about the US ‘cutting’ output.

But Trump, Exxon, Occidental, the API, name ‘em – they don’t want to interfere in markets (Trump’s reluctance to push business is well-noted).

But Trump, Exxon, Occidental, the API, name ‘em – they don’t want to interfere in markets (Trump’s reluctance to push business is well-noted).

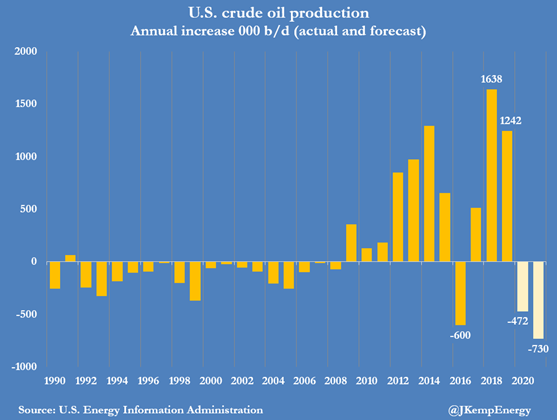

And so that doesn’t leave much. So the US Energy Dept was out yesterday with its monthly demand/supply forecast, and it bets on a supply drop to about 11 mln bpd as an average for 2021. #OOTT

(Here& #39;s @JKempEnergy& #39;s nice chart)

(Here& #39;s @JKempEnergy& #39;s nice chart)

And the DOE took that opportunity to comment on this release – a boring, staid, typical monthly economic report – and get all puffy about it and say, “See?" https://www.energy.gov/articles/statement-eia-short-term-energy-outlook">https://www.energy.gov/articles/...

Which, yeah, but that won’t be until the end 2021. I remind you again of anti-trust laws, and how companies can’t coordinate (but states could, or the president could order some move that he seems disinclined to do at the moment).

So is that enough for the Saudis and Russians? We’ll see.

The Kremlin, of course, doesn& #39;t think so: #OOTT @dmitryZ_reuters @vsoldatkin https://www.reuters.com/article/us-oil-opec-russia/kremlin-says-natural-fall-in-oil-output-separate-from-joint-action-idUSKBN21Q18I">https://www.reuters.com/article/u...

The Kremlin, of course, doesn& #39;t think so: #OOTT @dmitryZ_reuters @vsoldatkin https://www.reuters.com/article/us-oil-opec-russia/kremlin-says-natural-fall-in-oil-output-separate-from-joint-action-idUSKBN21Q18I">https://www.reuters.com/article/u...

You are comparing overall decline in demand with cuts aimed at stabilising global markets,” Dmitry Peskov, Kremlin spokesman, said. “These are different concepts and they could not be equalled.” #OOTT

Meanwhile, the US is throwing other sticks into this:

Two GOP senators have now started to push a bill to try to get US troops out of Saudi Arabia.

https://www.reuters.com/article/us-global-oil-usa-saudi/u-s-oil-state-senators-to-talk-crude-markets-with-saudi-officials-saturday-source-idUSKBN21Q03M

https://www.reuters.com/article/u... href="https://twtext.com//hashtag/OOTT"> #OOTT #OPEC

Two GOP senators have now started to push a bill to try to get US troops out of Saudi Arabia.

https://www.reuters.com/article/us-global-oil-usa-saudi/u-s-oil-state-senators-to-talk-crude-markets-with-saudi-officials-saturday-source-idUSKBN21Q03M

They’re talking to them via conference call on Saturday – per @TimOGard. That bill may face some opposition, even from within the GOP caucus.

Realistically tho, the Saudis don’t have a big friend group on Capitol Hill, even if this bill won’t go anywhere, Trump could think tariffs, too. We’ll see.

#OOTT #OPEC

#OOTT #OPEC

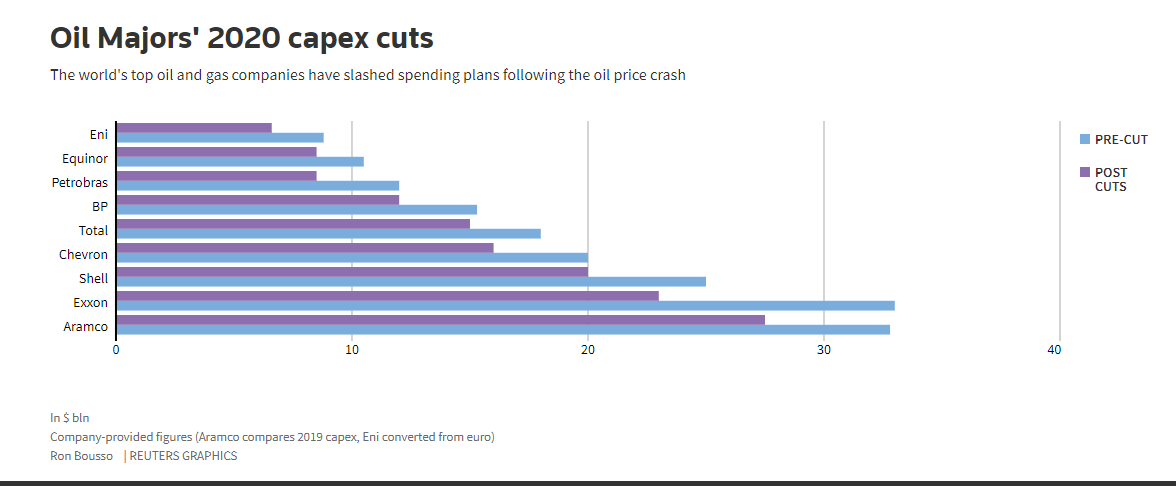

As said, production is going to come down, but slowly. #Exxon said it sees production in the Permian falling 15K bpd this yr, another 100-150 next yr. @Jennifer_Hiller https://www.reuters.com/article/us-global-oil-exxon-mobil/exxon-lops-30-off-2020-spending-deeper-and-later-than-rivals-idUSKBN21P1II">https://www.reuters.com/article/u...

So now we& #39;ve seen companies throttle back across the board, though the current production drop is a trickle, whereas the petrostates of course can shut the taps off.

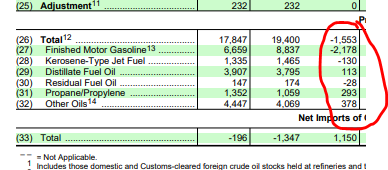

Either way, today& #39;s red-letter event is #EIA data, coming in about 2 hours 15 min. Expect yet another massive build in US inventories and we shall see what is and is not “priced in.” Consensus is for a 12-million-barrel build, tho it could be more.

Again, what to look for:

* Big builds in crude and gasoline stocks are a given. Let& #39;s go beyond that.

* Watch for refining capacity use, a signal of how much of a drop-down the refiners are doing.

* Big builds in crude and gasoline stocks are a given. Let& #39;s go beyond that.

* Watch for refining capacity use, a signal of how much of a drop-down the refiners are doing.

Our @LauraSanicola and @E3Seba have been all over this, but basically we& #39;ve got BP/Phillips 66/PBF/Exxon and a number of others pulling back a lot, some at minimum levels, some down 15-20%. So that& #39;s notable.

But I say this again - also watch "product supplied." Normally one-week moves are to be ignored - you don& #39;t want to get too crazy about a one-week change. But for now, it& #39;s important, b/c of how far and how fast this is falling. #OOTT

Read on Twitter

Read on Twitter