Thread on portfolio flows & ‘hot money’:

As per @StateBank_Pak’s update from 7/04/20 Pak’s flows since July’19 were as per below:

Equity inflow: $647m

Equity outflow: $847m

Net *out*flow: -$200m

Debt inflow:$3,492m

Debt outflow: $2,292m

Net *in*flow: +$1,199m

1/N

As per @StateBank_Pak’s update from 7/04/20 Pak’s flows since July’19 were as per below:

Equity inflow: $647m

Equity outflow: $847m

Net *out*flow: -$200m

Debt inflow:$3,492m

Debt outflow: $2,292m

Net *in*flow: +$1,199m

1/N

Term ‘hot money’ (v.topical in Pak debt mkts) is derived from the perceived temporary nature of such investments & how they tend to evaporate when things go sour.

Case made against such flows is based on instability such a sudden outflow would cause to fx/fixed income mkts 2/N

Case made against such flows is based on instability such a sudden outflow would cause to fx/fixed income mkts 2/N

Broad brush parallel is drawn with the Asian financial crisis w/o understanding the dissimilarities to Pak’s situation - e.g. Asian countries had fixed exchange rates w/$ denominated *PRIVATE* (not public/govt) debt which was impacted through the balance sheet effect etc. 3/N

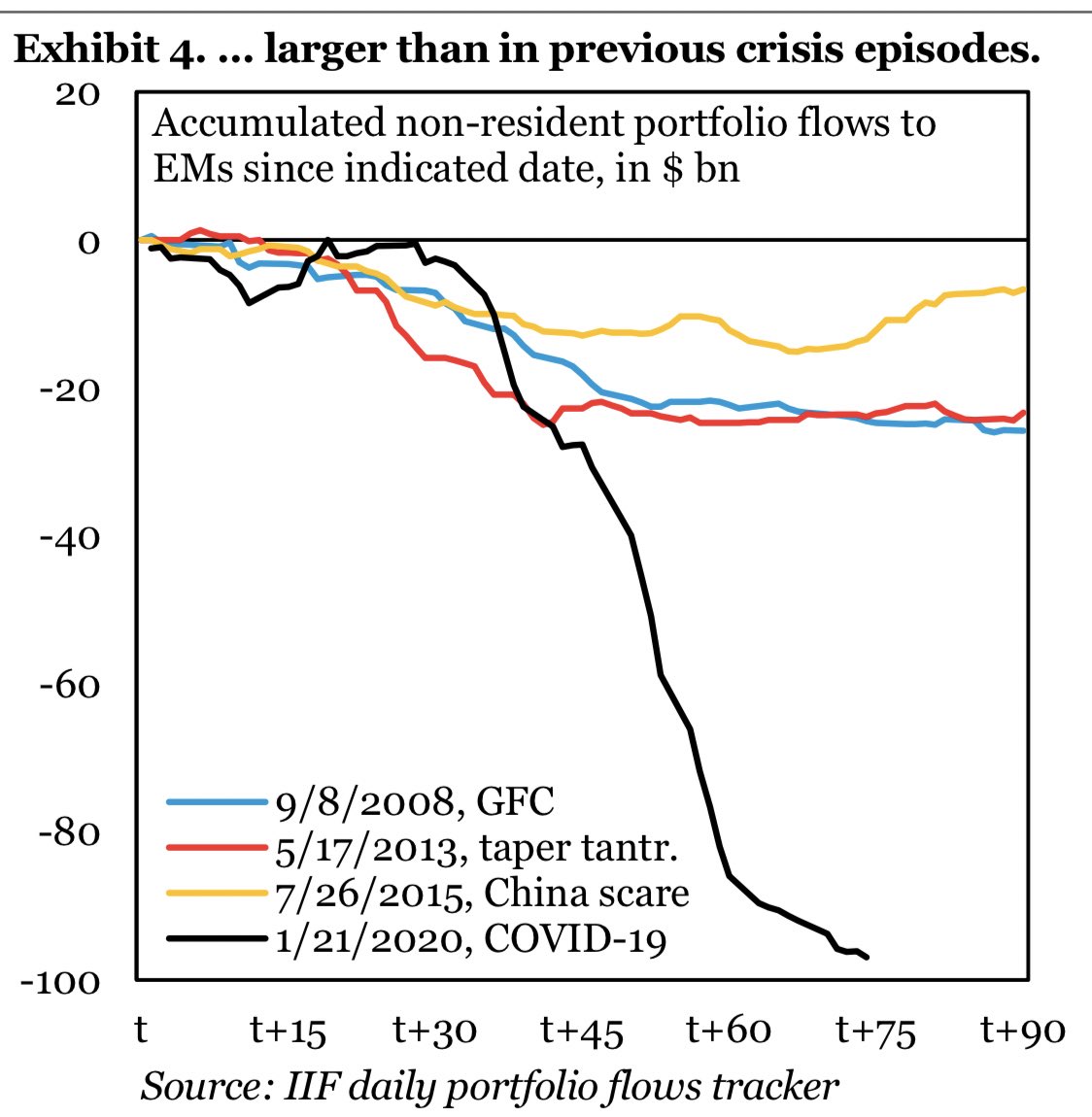

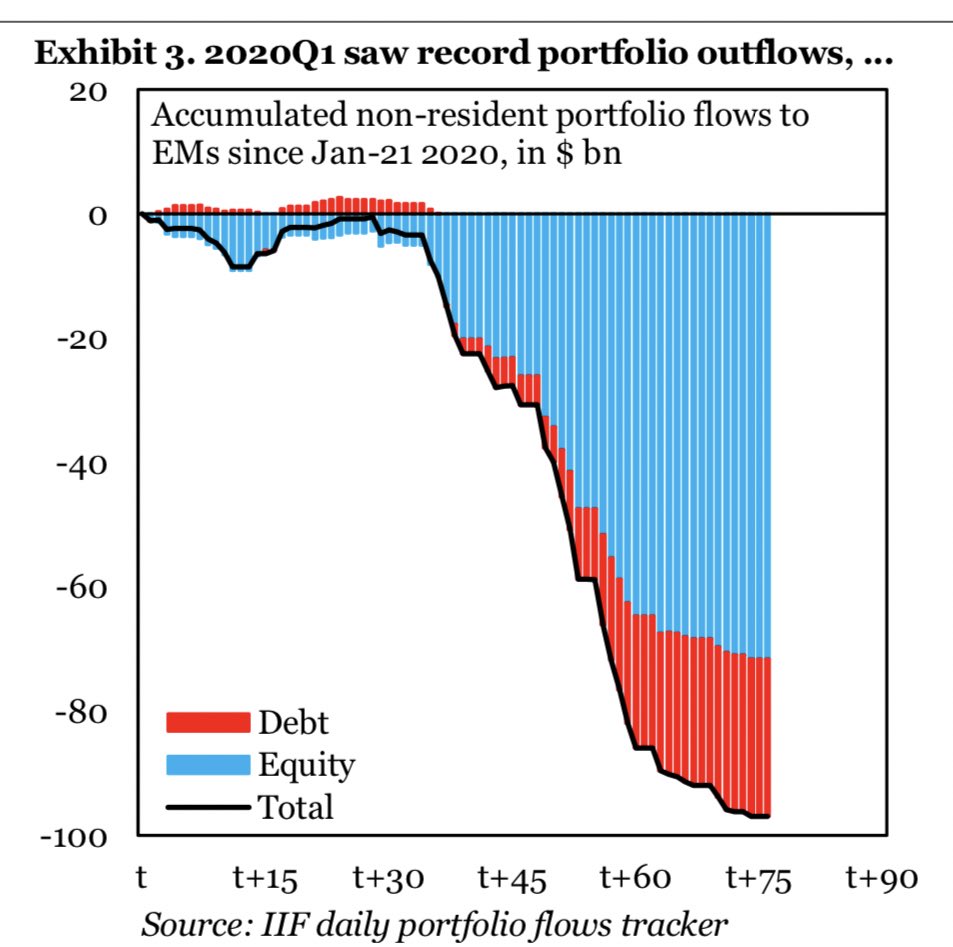

The COVID-19 crisis & ensuing financial stress has seen one of the greatest capital outflows from emerging markets EVER @$100bn which is almost 4x level seen in the 2008 financial crisis. Chart below by @IIF 4/N

Yet...for PK year-to-date outflow is in equities & not in debt (so called “hot money”)? Doesn’t mean this can’t change but raises *key* question on why flows into equities, which has been case for years wasn’t seen with same distrust or considered “hot”/temporary/dangerous? 5/N

However if we look at a global scale, as per @IIF’s report most outflows have indeed been in equities (~75%) & not debt which goes to show how foreign portfolio flows into equity are more or less equally flimsy/temporary vs. debt when things go bad at a global scale. 6/N

One thing to note is PK’s equity mkt has been seeing persistent piecemeal outflows through last 9 months whereas debt flows were mostly concentrated in March’20.

However point still stands as to such flows presenting a similar macro-prudential risk when there is a crisis 7/7

However point still stands as to such flows presenting a similar macro-prudential risk when there is a crisis 7/7

Read on Twitter

Read on Twitter