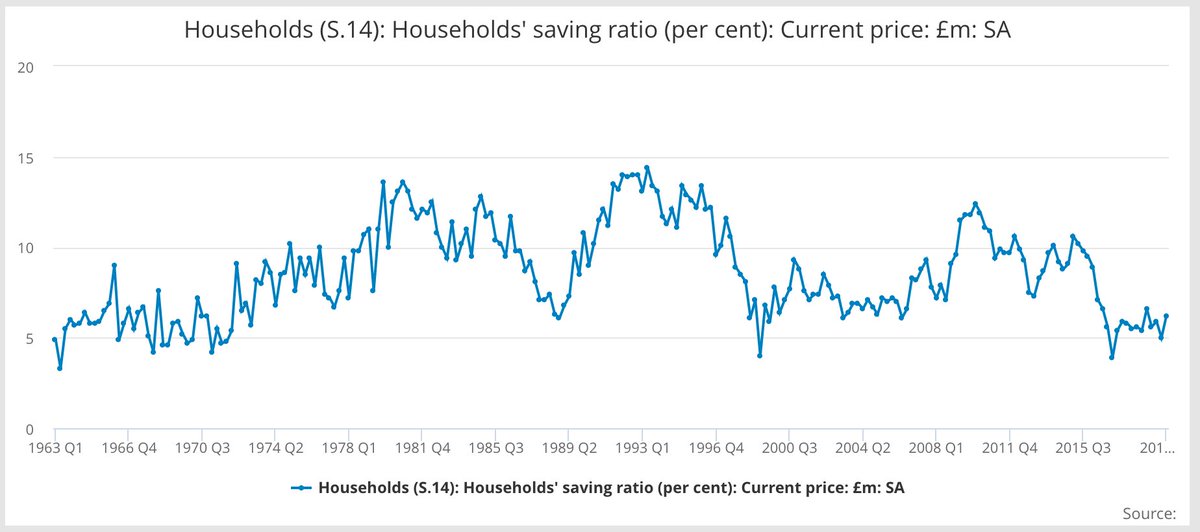

1/n. A prediction: household debt will become a big issue in coming months. Households entered this crisis in a historically weak position - near-zero income growth, historically low savings ratio. Around 7m have no savings.

2/n. Now our data has an ominous shape - first people came to us for help with cancelled holidays, then sick pay, then job losses/benefits, then trouble paying bills. Debt problems - which have a lead time - would follow naturally.

3/n. There& #39;s good news too. UK govt has been fairly bold on hhld debt. Mortgage holidays, 3 month credit card holidays, £500 free overdrafts, and less use of bailiffs. We see that in our data - while most issues are up, bailiff issues are *down* from 2,500 to 1,000 a week.

4/n. Still, remember that lead time. The risk is that debt problems accumulate now, behind the dam of protections, and then are unleashed leading to bankruptcies/evictions/ disconnections. So the way out is vital to get right.

5/n. One area that needs attention is high cost credit. It& #39;s not all covered by the govt& #39;s repayment holidays, and debts can mount up quickly, leading to crisis.

6/n. Likewise council tax need a *very* close eye. It’s a very harmful form of debt - see here: https://www.citizensadvice.org.uk/Global/CitizensAdvice/Consumer%20publications/Wrong%20side%20of%20the%20tax.pdf">https://www.citizensadvice.org.uk/Global/Ci... Good that local councils are acting but central govt must stand ready to help too: https://www.bbc.com/news/uk-england-52186175">https://www.bbc.com/news/uk-e...

7/n. Insolvency regimes are also relevant - changes might be needed, at least temporarily, to help the recovery. e.g. Parameters for DROs. Likewise worth considering the role of breathing space and the Statutory Debt Repayment Plan.

8/8. Exit plans will also be needed for accumulated arrears: rent, energy bills, telecoms bills. The big point is this: the exit from emergency policy measures will be as important to get right as their initial implementation.

Read on Twitter

Read on Twitter