The Parliament today passed the JobKeeper program, a $1,500 per-worker subsidy with a $1,500 wage floor for firms experiencing at least a 30% revenue decline. Some (e.g., @RabeeTourky and @PitchfordRohan) have said it’s corporate welfare. Here’s how I think of the economics. 1/12

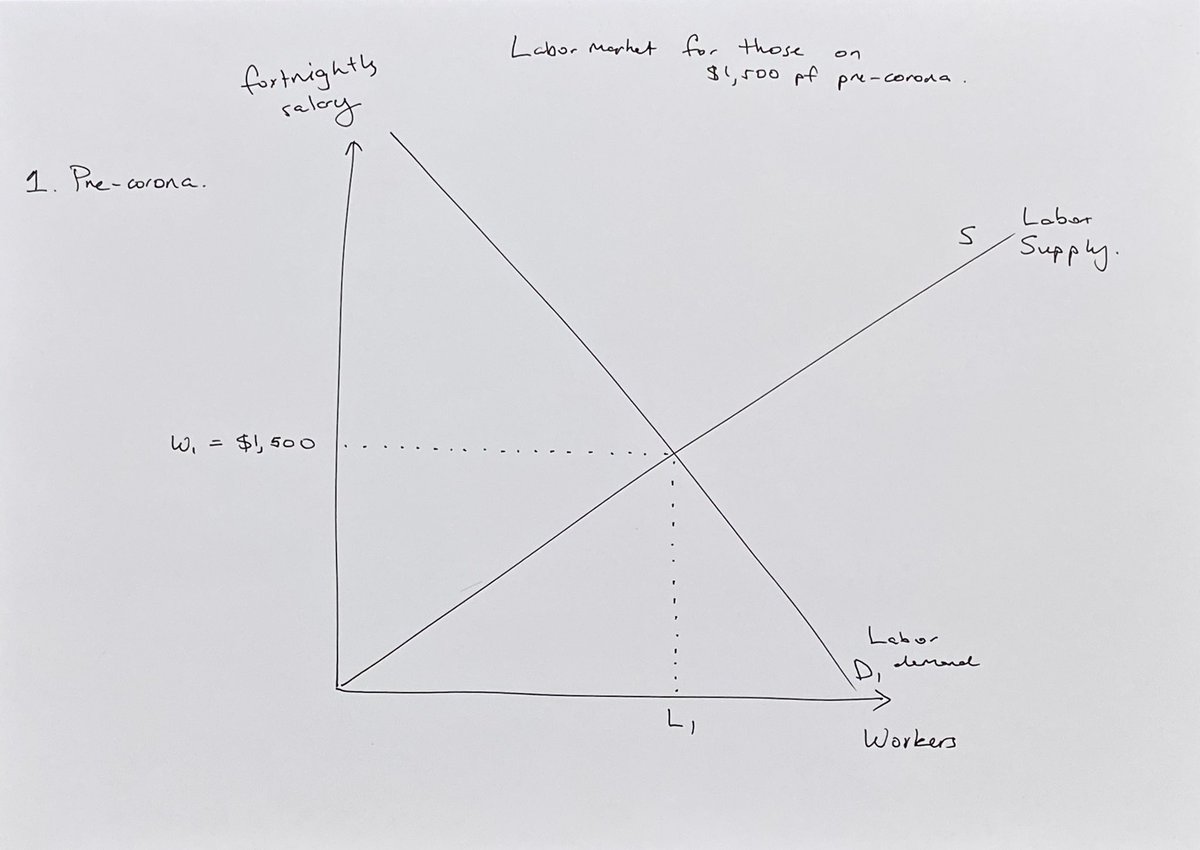

Inside firms are many different workers engaged in many different labour markets. So a full examination would consider those markets with wages equal to or less than $1,500 and greater than $1,500. I’ll consider the former. Output is in “workers” and the wage is fortnightly. 2/12

This is the pre-coronavirus competitive labor market. I don’t consider imperfect competition but you could. We have no idea what the elasticities were before. But the slope of these lines are irrelevant irrelevant anyway. All that matters is their slopes during the pandemic. 3/12

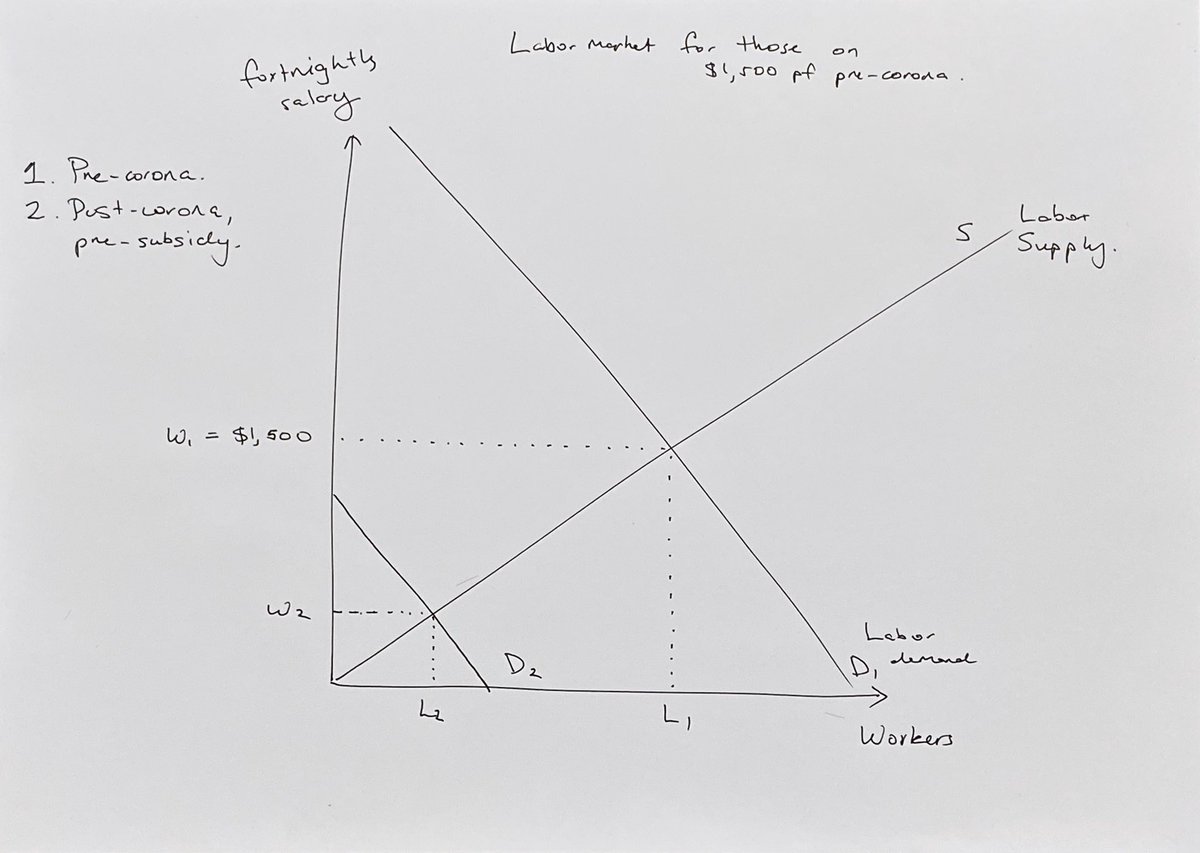

The pandemic hits. There is a large contraction in labor demand. Either due to shut downs, fear, or knock-on effects. So much so that some businesses will close entirely. For them labor demand goes to zero. Some will stay open but lay off workers. 4/12

The elasticities of supply and demand are empirical objects. None of us know what they are. I believe assuming perfectly elastic labor supply is inappropriate. This implies workers could switch to alternative firms costlessly. That is clearly not the case during a pandemic. 5/12

Perfectly elastic labor supply also implies a bunch of weird, implausible things. It would imply for example that the pandemic would cause no reduction in the equilibrium wage absent government intervention. I think that is highly unrealistic. 6/12

I have assumed there’s no reduction in labor supply. But remember the pre-pandemic curves are irrelevant to the coming analysis of the subsidy. All that matter are the post-pandemic curves. Also, I think a labor supply contraction is the wrong way to think about things. 7/12

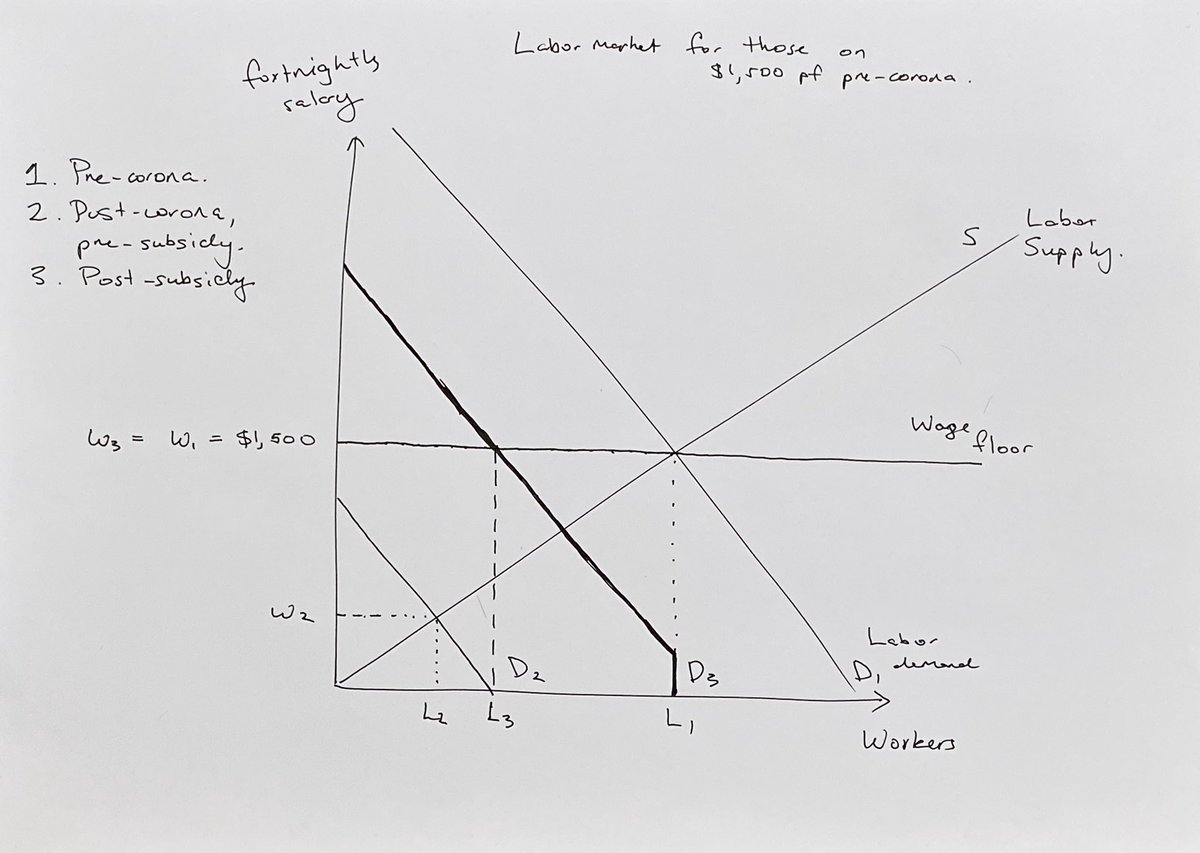

JobKeeper is 2 things. 1) A $1,500 per-worker subsidy for those employed pre-corona. 2) A $1,500 wage floor. The subsidy shifts labor demand up (statutory incidence on the firm) by $1,500 but only to the left of the original equilibrium. The wage floor is also shown. 8/12

The effects are pretty clear. The new equilibrium wage is $1,500 as per the wage floor. The subsidy pushes up equilibrium employment. Equilibrium employment would be even higher if wages were allowed to fall a bit relative to pre-corona. But there’s a wage floor. 9/12

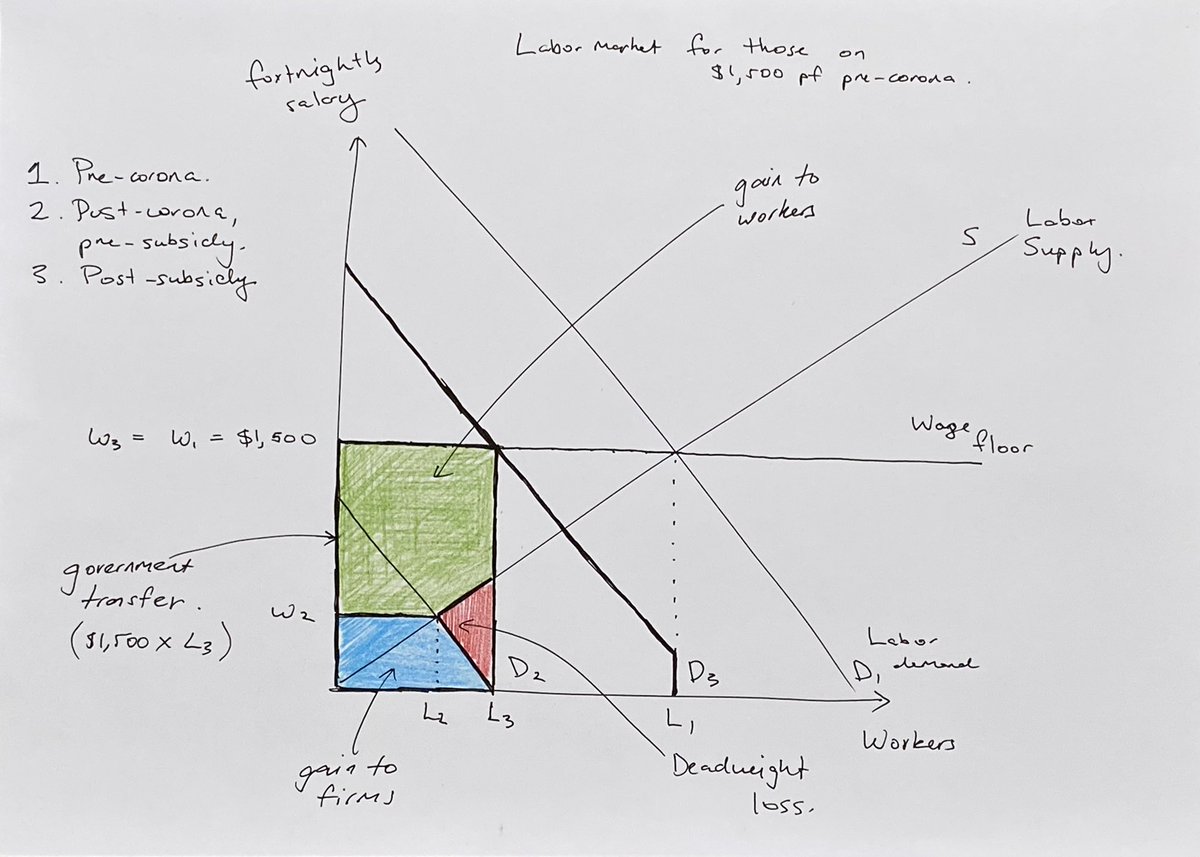

Now welfare analysis. Pretty straightforward subsidy analysis. The whole colored box is the total subsidy ($1,500 x L3). Workers gain the green, firms gain the blue. Red is deadweight loss. So you can see clearly the distributional and efficiency consequences of JobKeeper. 10/12

Welfare analysis is as follows. The subsidy distorts the labor market, generating red DWL. The subsidy will be financed through distortive taxation also generating a DWL. But the subsidy will preserve firm-specific capital by preventing firm destruction. It’s a trade-off. 11/12

This is the simplest analysis I could construct. We could argue about assumptions. Particularly perfect competition. But I think perfectly elastic supply is implausible, generating a “firm takes everything” result by assumption. This is how I would teach it to my students. 12/N

Read on Twitter

Read on Twitter