1/ With all the discussion on the potential for future inflation in Canada, people would do well to remember that an increase in reserve balances isn& #39;t inflationary. If there& #39;s one thing we& #39;ve learned from the GFC, its that reserves don& #39;t increase consumer prices

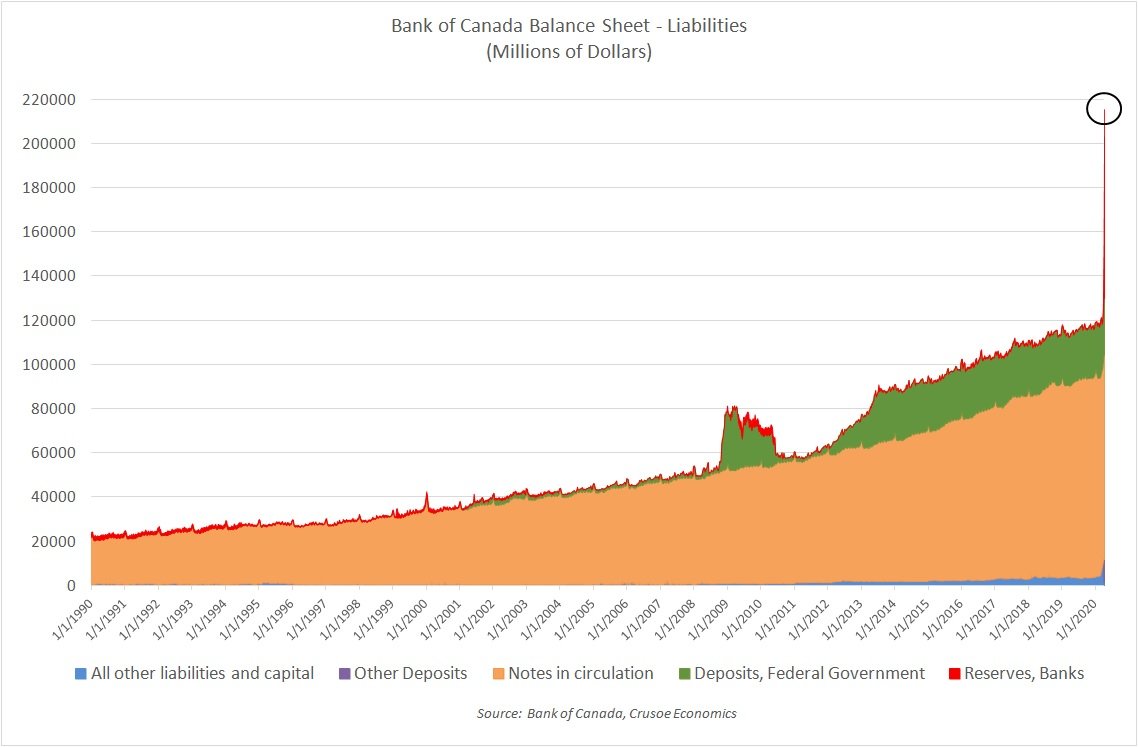

2/ Reserves are trapped within the banking system and imposed on the banks by the BoC. Furthermore, they aren& #39;t included in the money supply that& #39;s use to bid on goods/services in the real economy. As the BoC begins to expand their QE program, reserves will grow significantly.

3/ But this won& #39;t lead to CPI inflation, it will lead to asset inflation. There are no reserve requirements in Canada, and all reserves are considered "excess". Banks are currently paid a mere 25bps on reserves and will likely attempt to get rid of them by buying other assets.

4/ But all reserves must be held by *someone* at all times, so reserve become a hot potato that will keep bidding up prices as banks try to get rid of reserve balances until yields on other assets start to approach the interest rate on reserves. In other words, asset prices rise.

5/ The BoC has currently pledged to buy *at least* $5B a week in bonds. If continued for a year, this amounts to $260B annualized, which is larger than the entire BoC balance sheet at present (at $215B). For perspective, the entire GoC bond market outstanding is about $580B

6/ There would appear to be the setup for a massive asset reflation on our horizon. So is this "inflation" that people talk about? No, because the money from QE is trapped in the financial system. The inflation in the real economy will be stoked by future MMT or helicopter money.

Read on Twitter

Read on Twitter