#FinanceTwitterJa As I continue with my weekly analysis, it& #39;s time to review the exposure of our local commercial banks. For those wondering the difference between commercial banks, credit unions, merchant banks and so on, please check @CentralBankJA website for more details.

http://boj.org.jm/financial_sys/commercialbanks.php">https://boj.org.jm/financial... List of commercial banks.

As we gear up for the full effects of #COVID19, it& #39;s important to understand the exposure and grouping of debt the commercial banks have in issue. We& #39;ll be going from the largest banks to smallest in order by assets.

As we gear up for the full effects of #COVID19, it& #39;s important to understand the exposure and grouping of debt the commercial banks have in issue. We& #39;ll be going from the largest banks to smallest in order by assets.

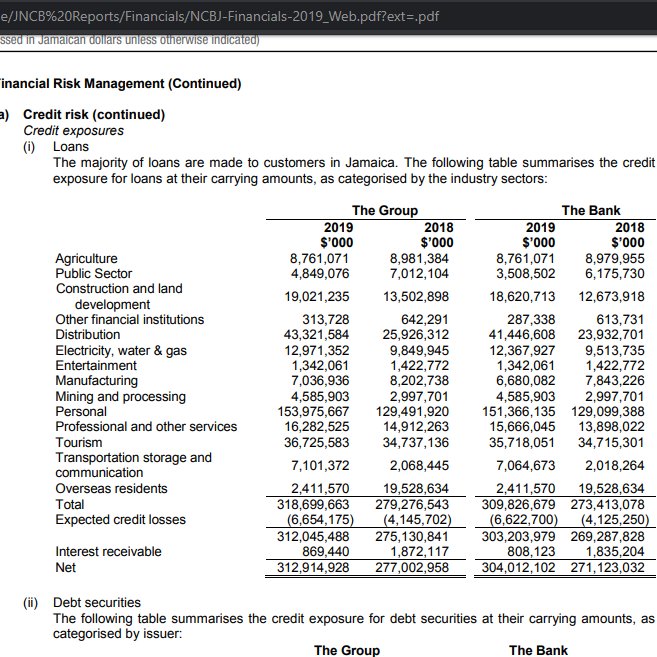

@ncbja is the biggest commercial bank in Jamaica by assets. About half (48%) of their loan portfolio are personal in nature with distribution making up 13% and tourism another 12% of their loan portfolio. This means that a significant portion of their loan portfolio has been

significantly exposed to the disruptions being faced by numerous industries as a result of shutdowns and closures. 62% of their loans and advances were assigned as low risk, 35% being medium risk, 0.5% high risk and 2.5% for default. Some of these loans may change in risk rating

in the next year. Definitely a bank to watch. https://www.jncb.com/JNCB/media/Main-Librarie/JNCB%20Reports/Financials/NCBJ-Financials-2019_Web.pdf?ext=.pdf">https://www.jncb.com/JNCB/medi... NCBJ 2019 Audited.

https://www.jamstockex.com/wp-content/uploads/2020/01/NCB-Financial-Group-NCBFG-Unaudited-Financial-Results-Three-Months-Ended-December-31-2019.pdf">https://www.jamstockex.com/wp-conten... Here is the $NCBFG.ja (parent company) results at the end of December 31, 2019.

https://www.jamstockex.com/wp-content/uploads/2020/01/NCB-Financial-Group-NCBFG-Unaudited-Financial-Results-Three-Months-Ended-December-31-2019.pdf">https://www.jamstockex.com/wp-conten... Here is the $NCBFG.ja (parent company) results at the end of December 31, 2019.

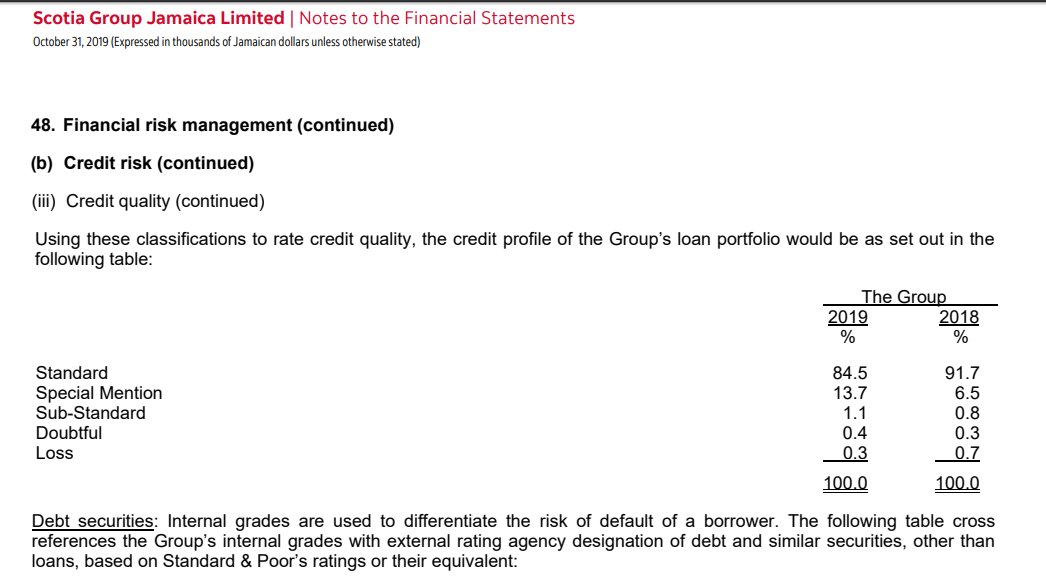

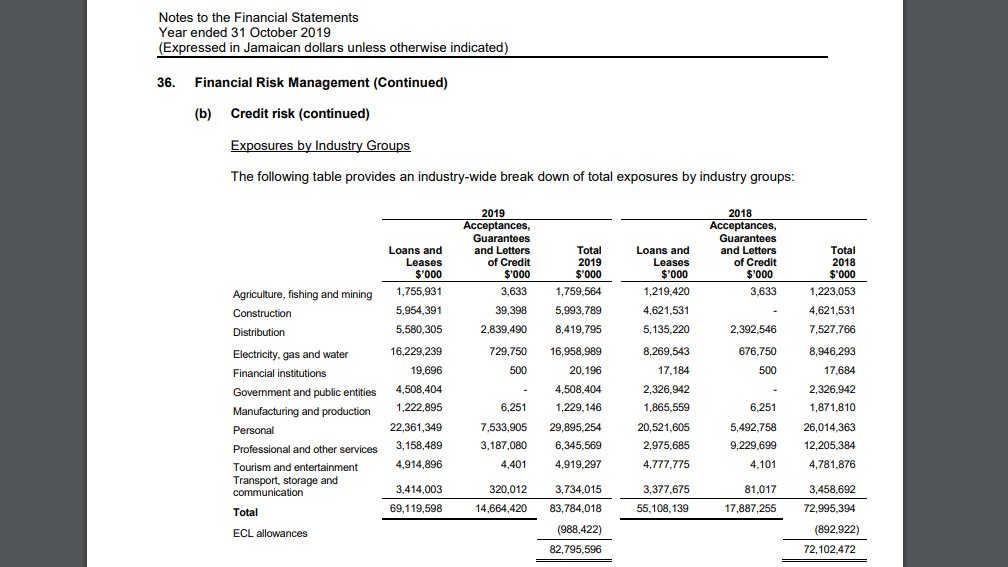

The next entity for review is @ScotiaCaribbean affiliate $SGJ.ja. Unlike @ncbja whose separate financials are published, Scotiabank Jamaica (BNSJ) isn& #39;t published separately. However, the group& #39;s audited financials does segment credit risk.

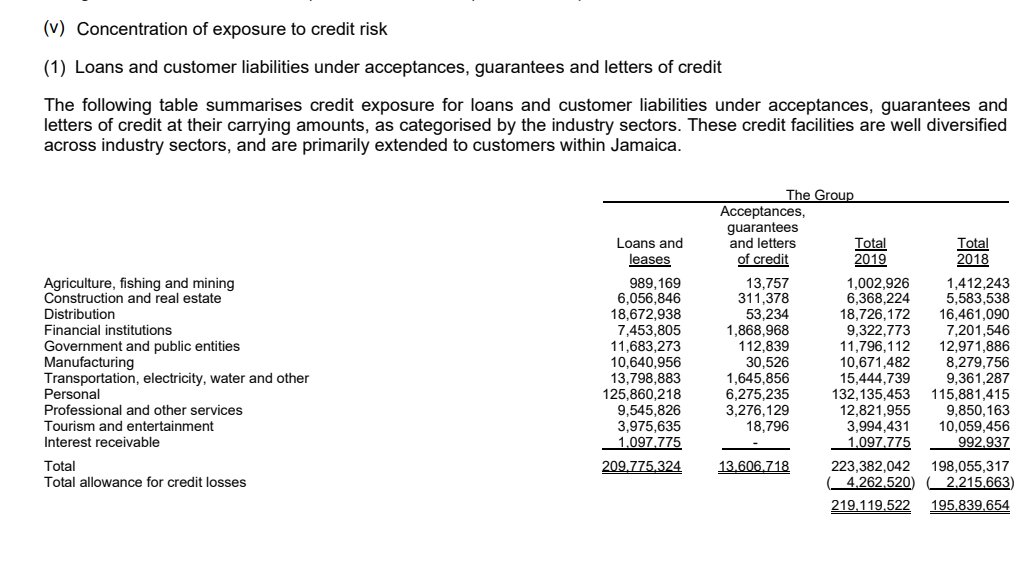

As you can see here, 59% of SGJ& #39;s loans are personal, Distribution makes up 8%, Transportation, electricity etc at 7%, Government and Manufacturing make up 5% each of the overall loans and credit.

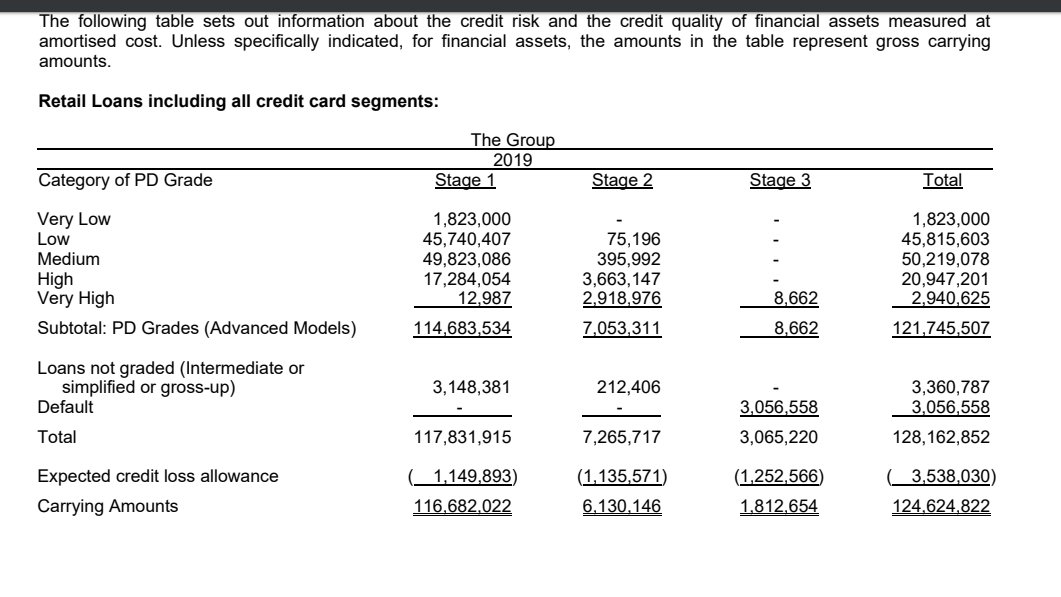

However, under the retail loan segment which includes credit cards, about 79% of the risk profiling is split between low and medium.

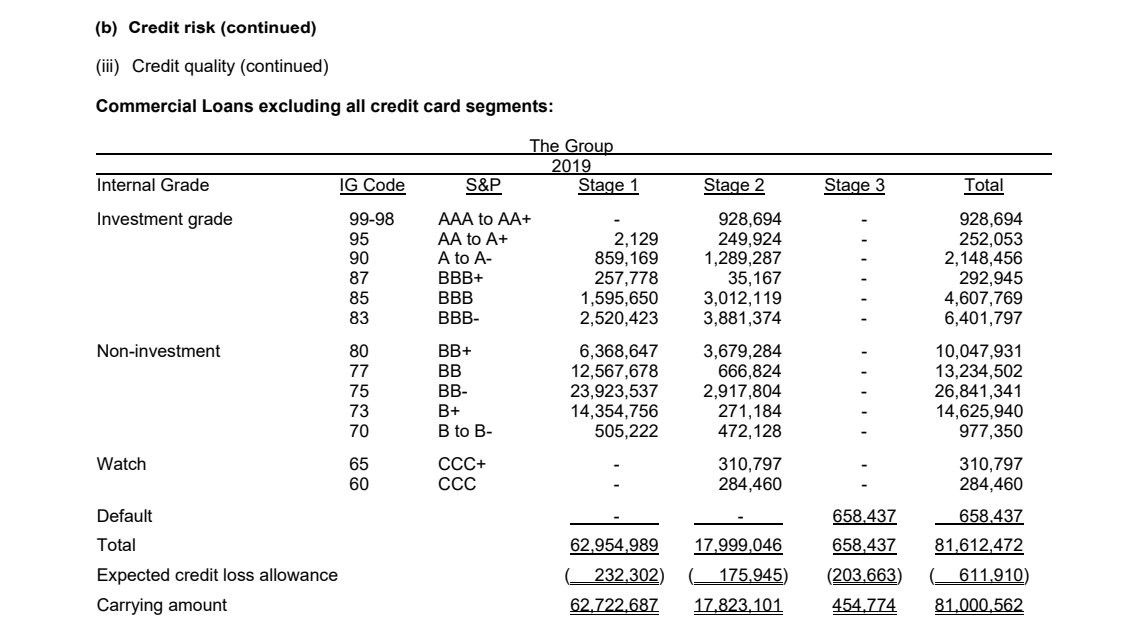

Under the commercial loan segment, 18% of loan are considered investment grade, 81% being non-investment and less than 1% being under watch and default. With this kind of structured portfolio, it will be interesting to see how they manage their exposure in the next year.

https://jm.scotiabank.com/content/dam/scotiabank/international/jamaica/documents/2019_Annual_Report_Jamaica.pdf">https://jm.scotiabank.com/content/d... $SGJ.ja 2019 annual report.

https://www.jamstockex.com/wp-content/uploads/2020/03/SGJ-Q1.2020-Media-Release.pdf">https://www.jamstockex.com/wp-conten... Results up to January 31, 2020.

https://www.jamstockex.com/wp-content/uploads/2020/03/SGJ-Q1.2020-Media-Release.pdf">https://www.jamstockex.com/wp-conten... Results up to January 31, 2020.

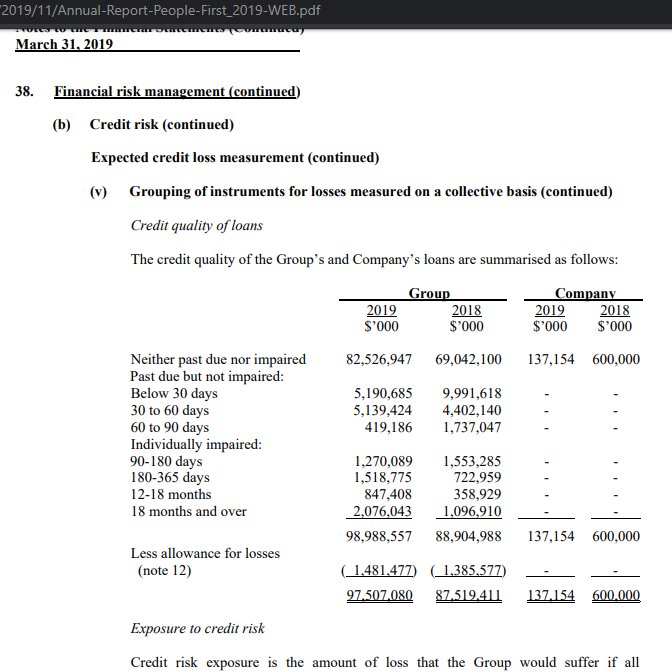

@jnbanklimited is the next commercial bank on the list. They no longer have separate published financials, but their parent& #39;s financials are available.

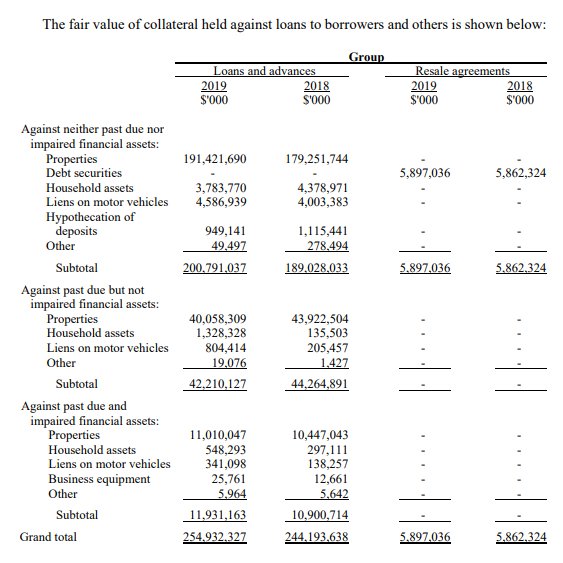

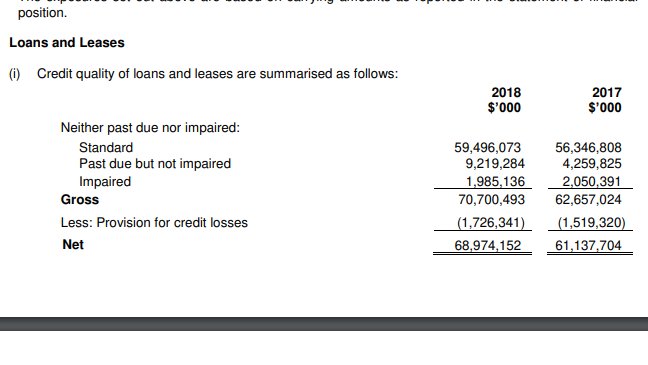

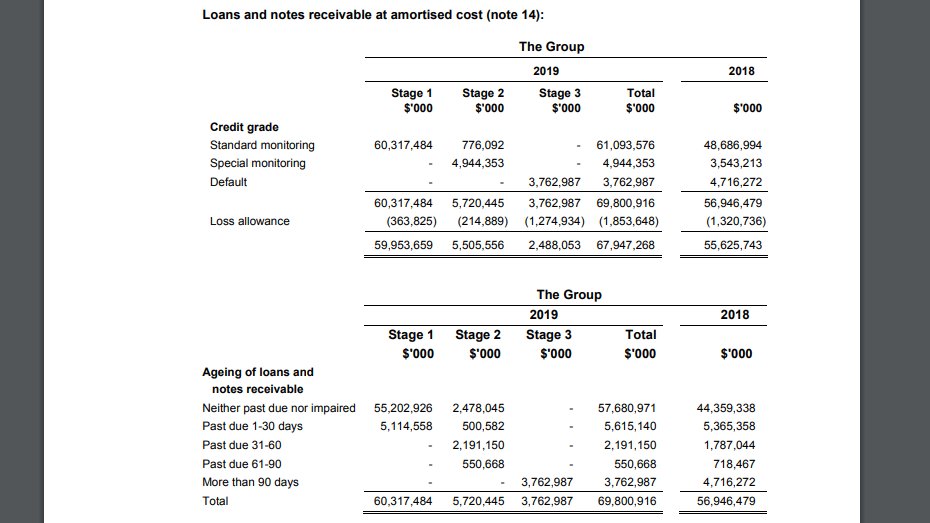

Unlike the other financials which grouped by category of loans, JN Group doesn& #39;t. As you can see below, 83% of their loans were neither past due nor impaired with less than 6% being classified as impaired.

The majority of the group& #39;s collateral against their loans and advances is in properties since JN is the largest mortgage provider in Jamaica. With JN announcing 12 month moratoriums and a significant portion of loans being mortgages, JN Bank might fare better in the next year.

https://www.jngroup.com/wp-content/uploads/2019/11/Annual-Report-People-First_2019-WEB.pdf">https://www.jngroup.com/wp-conten... JN Group 2019 Annual Report. The Group is currently having their 2020 financials audited at the moment.

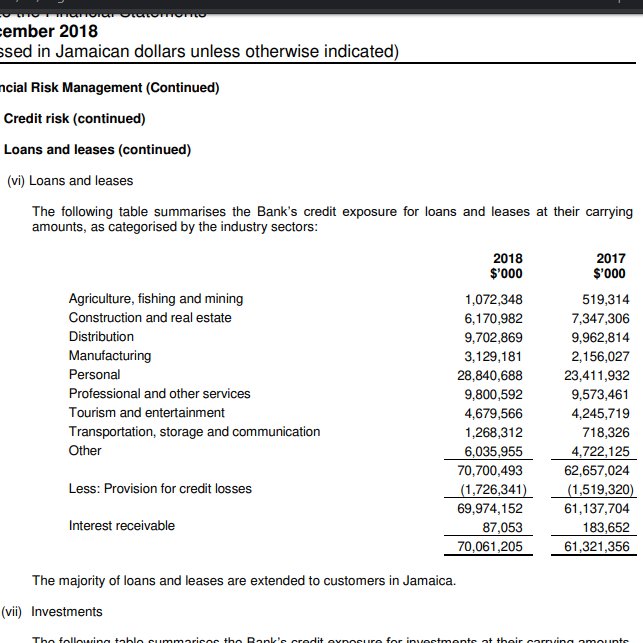

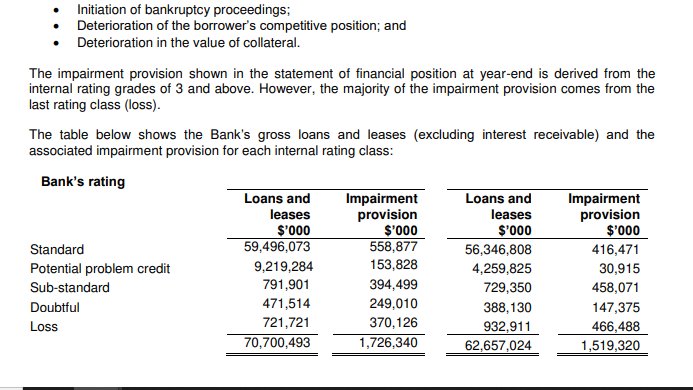

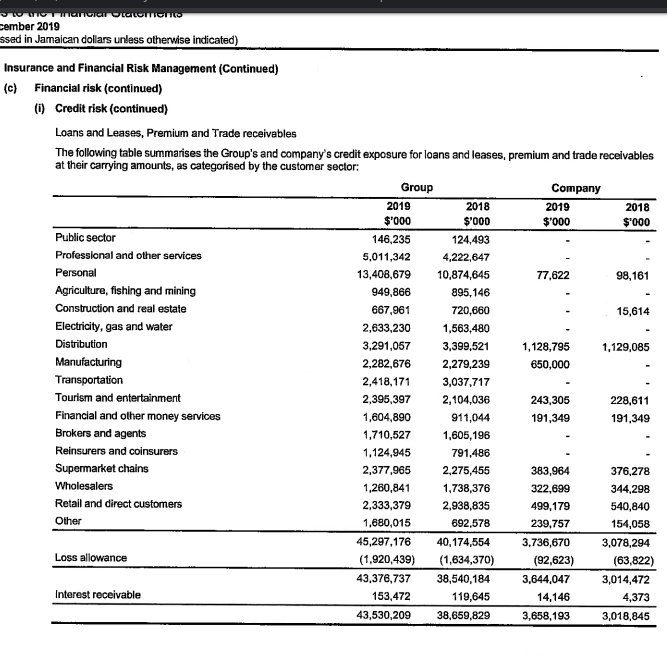

The next commercial bank is Sagicor Bank. Note that Sagicor Bank no longer publishes their audited financials on the JSE since they redeemed their preference shares. Thus, the 2018 audited results for the bank and 2019 audited results for the parent will be analyzed.

In 2018, 41% of Sagicor Bank& #39;s loans were personal while Professional and Distribution made up 14% each as their own segments. This means that 70% of their loan base then was mainly in those segments.

In relation to the credit quality, 84% of the loans and leases are recognizes as standard. Less than 3% of loans were declared to be impaired.

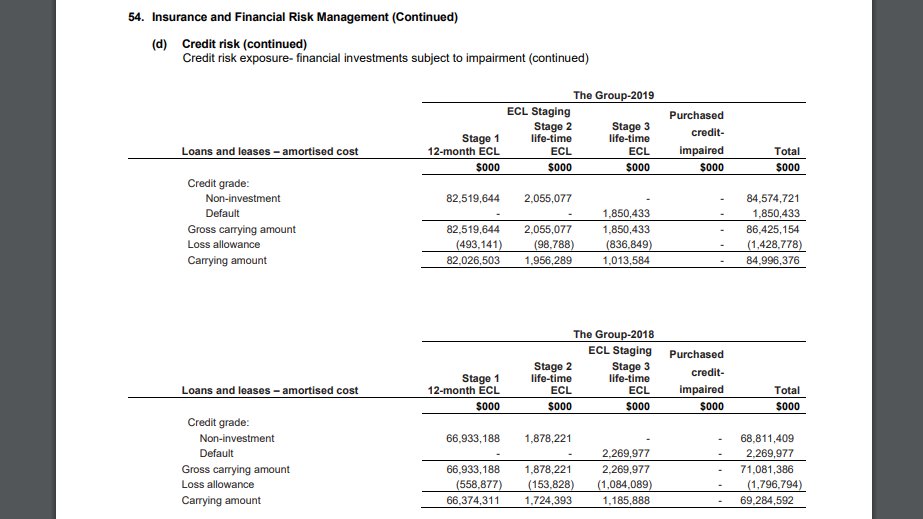

Under @SagicorJa Group financials for 2019, Sagicor Bank& #39;s financials would be mixed with other subsidiaries. However, the majority of these loans and leases would fall under the bank. As you can see for 2019, less than 2% of loans and leases were considered to be under default.

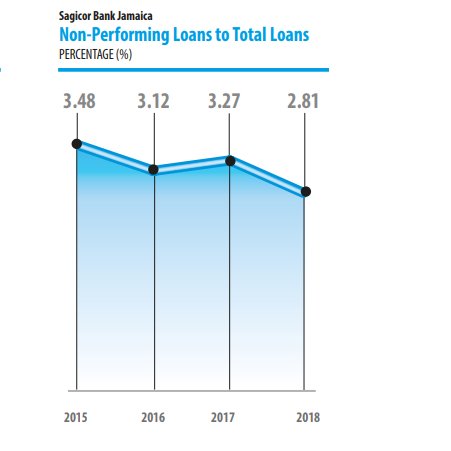

This is in line with the reports from the group about SBJ having less than 3% in non-performing loans. It will be interesting to see what happens next for the bank with such a low non-performing loan statistic.

https://www.jamstockex.com/wp-content/uploads/2020/03/Sagicor-Group-Jamaica-Limited-Audited-Financial-Statements-for-Year-Ended-DEC-31-2019.pdf">https://www.jamstockex.com/wp-conten... Sagicor Group 2019 Audited Financials.

https://www.jamstockex.com/wp-content/uploads/2019/06/Sagicor-Group-Jamaica-Annual-Report-2018.pdf">https://www.jamstockex.com/wp-conten... Sagicor Group 2018 Annual Report.

https://www.jamstockex.com/wp-content/uploads/2019/04/Sagicor-Bank-Jamaica-Limited-2018-Audited-Financial-Statements-as-at-December-31-2018.pdf">https://www.jamstockex.com/wp-conten... Sagicor Bank 2018 Audited Financials.

https://www.jamstockex.com/wp-content/uploads/2019/06/Sagicor-Group-Jamaica-Annual-Report-2018.pdf">https://www.jamstockex.com/wp-conten... Sagicor Group 2018 Annual Report.

https://www.jamstockex.com/wp-content/uploads/2019/04/Sagicor-Bank-Jamaica-Limited-2018-Audited-Financial-Statements-as-at-December-31-2018.pdf">https://www.jamstockex.com/wp-conten... Sagicor Bank 2018 Audited Financials.

The next bank on the list is @firstglobalbank. The 2018 audited financials for the bank are available, but the 2019 results haven& #39;t been published separately as yet.

For 2018, 40% of FGB& #39;s loans were for individuals. 15% were for professional and other services, 11% to transportation and distribution segments each. This means 77% of these loans are in these segments. There is no available breakdown of quality for the loans.

Under the 2019 @GraceKennedyGrp financials, there is a breakdown of credit risk, but this is for the entire group and includes receivables.

https://www.firstglobal-bank.com/Content/_assets/docs/pdf/financial_statments/2018_Financial_Statement.pdf">https://www.firstglobal-bank.com/Content/_... FGB 2018 audited Financials.

https://www.firstglobal-bank.com/About/FinancialStatements">https://www.firstglobal-bank.com/About/Fin... FGB Audited Financials.

https://www.jamstockex.com/wp-content/uploads/2020/02/GraceKennedy-Limited-2019-Financial-Statements-.pdf">https://www.jamstockex.com/wp-conten... Grackennedy Group 2019 Audited Financials.

https://www.firstglobal-bank.com/About/FinancialStatements">https://www.firstglobal-bank.com/About/Fin... FGB Audited Financials.

https://www.jamstockex.com/wp-content/uploads/2020/02/GraceKennedy-Limited-2019-Financial-Statements-.pdf">https://www.jamstockex.com/wp-conten... Grackennedy Group 2019 Audited Financials.

The next bank is @JMMBGROUP subsidiary JMMB Bank. Note that JMMB doesn& #39;t have a separate set of financials detailing the group& #39;s financials and financial risk.

As you can see, 98% of the Group& #39;s bank loans are split between Corporate and Retail with 58% of the overall loans being in Jamaica.

The majority (83%) of the Group& #39;s loans are neither past due nor impaired which implies some level of safety before COVID19. 88% of the loans are under standard monitoring which is good. However, with 95% of the loans split between Jamaica and Trinidad, there is still a risk

for their exposure to become a liability in the next year. A segment breakdown would make this analysis easier.

https://www.jmmb.com/sites/default/files/Jamaica/Annual%20Reports/JMMB%202019%20Annual%20Rerport.pdf">https://www.jmmb.com/sites/def... JMMBGL 2019 Annual Report.

https://www.jmmb.com/sites/default/files/Jamaica/Annual%20Reports/JMMB%202019%20Annual%20Rerport.pdf">https://www.jmmb.com/sites/def... JMMBGL 2019 Annual Report.

@CIBC_FCIB is the final commercial bank to be analyzed. The financials for this bank are available with a segment breakdown and quality analysis.

36% of the loans were personal while 20% were under utilities (electricities, gas and water), 10% to distribution and 8% to professional and other services.

A significant amount (97%) of their loans were considered high grade with the remainder between standard, substandard and impaired. It will be interesting to see the how this will play out over the rest of the financial year.

https://www.cibcfcib.com/binaries/content/assets/annual-reports/2019/cibc-fcib-jamaica-financial-statements-2019.pdf">https://www.cibcfcib.com/binaries/... CIBC-FCIB 2019 Audited Financials.

https://www.cibcfcib.com/about-us/investor-relations/annual-reports">https://www.cibcfcib.com/about-us/... Investor Relations.

https://www.cibcfcib.com/about-us/investor-relations/annual-reports">https://www.cibcfcib.com/about-us/... Investor Relations.

The aim for tomorrow is to analyze Lasco Financial Services and publish that analysis as well. Until then, walk good.

Read on Twitter

Read on Twitter