I’m on a discount-to-NAV shopping spree.

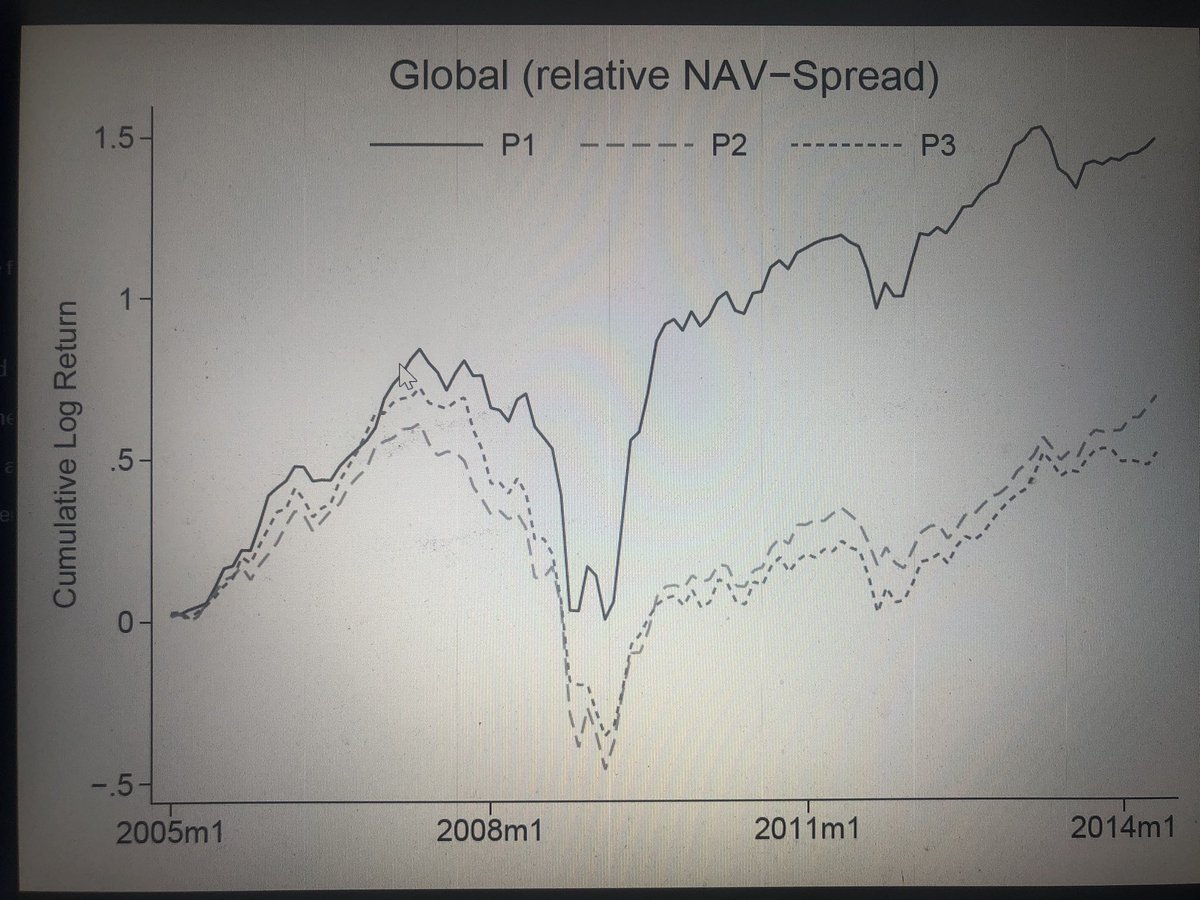

During crises, some listed investments fall way more than their underlying net asset values (NAVs). Value stocks, defined as those with the highest discounts to NAV tend to outperform over the cycle (the P1 portfolio in the picture below)

During crises, some listed investments fall way more than their underlying net asset values (NAVs). Value stocks, defined as those with the highest discounts to NAV tend to outperform over the cycle (the P1 portfolio in the picture below)

1) Simon Property Group

NAV: $168

Share price: $62.57

Discount to NAV: 62.8%

NAV is the average analyst estimate from the last 3 months (which is likely to come down significantly). https://twitter.com/value_invest12/status/1246119944695230464">https://twitter.com/value_inv...

NAV: $168

Share price: $62.57

Discount to NAV: 62.8%

NAV is the average analyst estimate from the last 3 months (which is likely to come down significantly). https://twitter.com/value_invest12/status/1246119944695230464">https://twitter.com/value_inv...

2) Macerich

NAV: $36

Share Price: $8.13

Discount to NAV: 77.5%

NAV is the average analyst estimate from the last 3 months.

NAV: $36

Share Price: $8.13

Discount to NAV: 77.5%

NAV is the average analyst estimate from the last 3 months.

3) Macerich owns high quality retail real estate across the US. Many trophy assets. They are much more risky than Simon, as LTV is 55%. At this point, I believe they will survive.

4) Vornado Realty Trust

NAV: $95

Share price: 37.79

Discount to Nav: 60.2%

NAV is based on Vornado’s own NAV estimate. Analysts had it at $82 during the last 3 months.

LTV is 49% based on Vornado’s calculations.

NAV: $95

Share price: 37.79

Discount to Nav: 60.2%

NAV is based on Vornado’s own NAV estimate. Analysts had it at $82 during the last 3 months.

LTV is 49% based on Vornado’s calculations.

5) Vornado primarily owns premier office assets in NYC. 80% of the portfolio is in office, and 80% is in NYC. 20% is Manhattan high street retail. Management is very seasoned and has an outstanding track record.

IMO prime real estate in top locations will always be in high demand

IMO prime real estate in top locations will always be in high demand

6) Real estate, especially malls and office will be under pressure. However, real estate is about the highest and best use, which can be changed. Vornado, Simon and Macerich own some of the finest real estate locations in the US.

PS: cap rates are likely to come down midterm.

PS: cap rates are likely to come down midterm.

7) Fairfax India Holdings

Book value per share: $16.89

Current share price: $6.8

Discount to BVPS: 60%

BVPS is based on fair values at 31 Dec 2019.

Book value per share: $16.89

Current share price: $6.8

Discount to BVPS: 60%

BVPS is based on fair values at 31 Dec 2019.

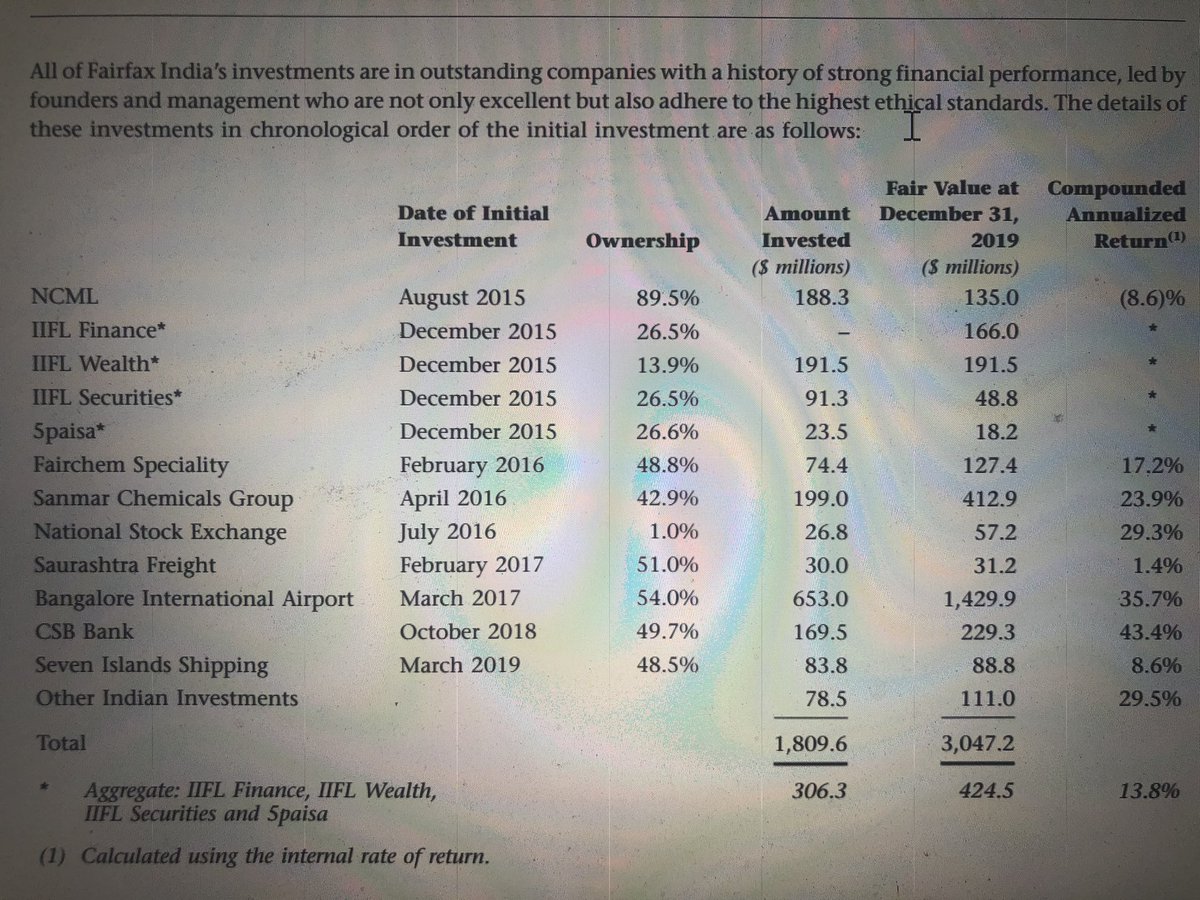

8) Fairfax India is the Indian Investment vehicle of Fairfax Financial. Prem Watsa, their CEO, has an outstanding track record and is Indian himself. He’s the chairman of Fairfax India. Their investments and criteria are listed below:

9) Their most important investment is Bangalore International Airport (~50%). Bangalore is the Silicon Valley of India. They plan to expand the airport through additional terminals and extensions. Fairfax India also owns 460 acres of land around the airport for development.

10) I’ve always thought of Fairfax India as an interesting play on India. Management is strong, but comes at a price: fees of 20% of BVPS growth above 5% per year. I found this too expensive combined with the fact that Fairfax India traded at a premium to book value historically.

11) Throughout its 5y-history, Fairfax India has grown BVPS 12.1% annually (after fees and in USD). Given the current discount, I have pulled the trigger. I expect BVPS to come down short term and Fairfax India to trade around book mid term.

12) Last but not least, and still my top position, Softbank:

Shareholder Value: JPY 10,936

Share Price: JPY 4,129

Discount to SOTP: 62.8%

80% of assets is calculated based on current stock prices. Remaining 20% is arm and vision fund.

Shareholder Value: JPY 10,936

Share Price: JPY 4,129

Discount to SOTP: 62.8%

80% of assets is calculated based on current stock prices. Remaining 20% is arm and vision fund.

Read on Twitter

Read on Twitter