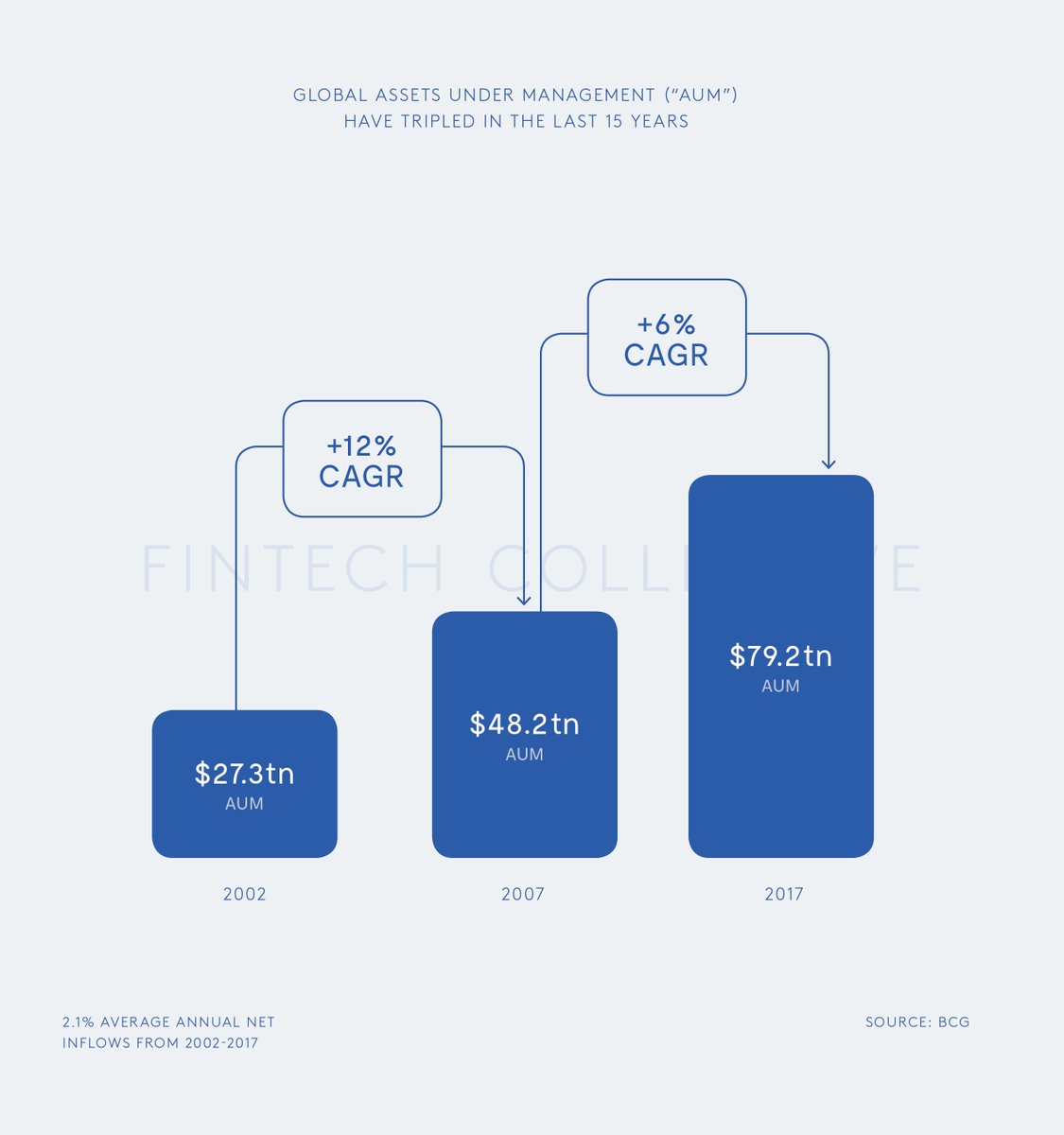

There& #39;s a massive $80 trillion market that is largely ignored in the #fintech world - asset management.

Over the past year, I& #39;ve been diving deep on the industry alongside the team @fintech_io (1/10)

Over the past year, I& #39;ve been diving deep on the industry alongside the team @fintech_io (1/10)

Our work culminated in a sharpened thesis, successful co-hosted conference with @GoldmanSachs, and three new investments.

You can find key insights from the event, plus a lens into our thesis development here: https://www.fintech.io/articles/the-80-trillion-fintech-conundrum">https://www.fintech.io/articles/... (2/10)

You can find key insights from the event, plus a lens into our thesis development here: https://www.fintech.io/articles/the-80-trillion-fintech-conundrum">https://www.fintech.io/articles/... (2/10)

Over the past 20 years, we’ve seen technology transform

nearly every sector of the financial world. But, asset management broadly, and the buy-side more specifically, has been slower to change. (3/10)

nearly every sector of the financial world. But, asset management broadly, and the buy-side more specifically, has been slower to change. (3/10)

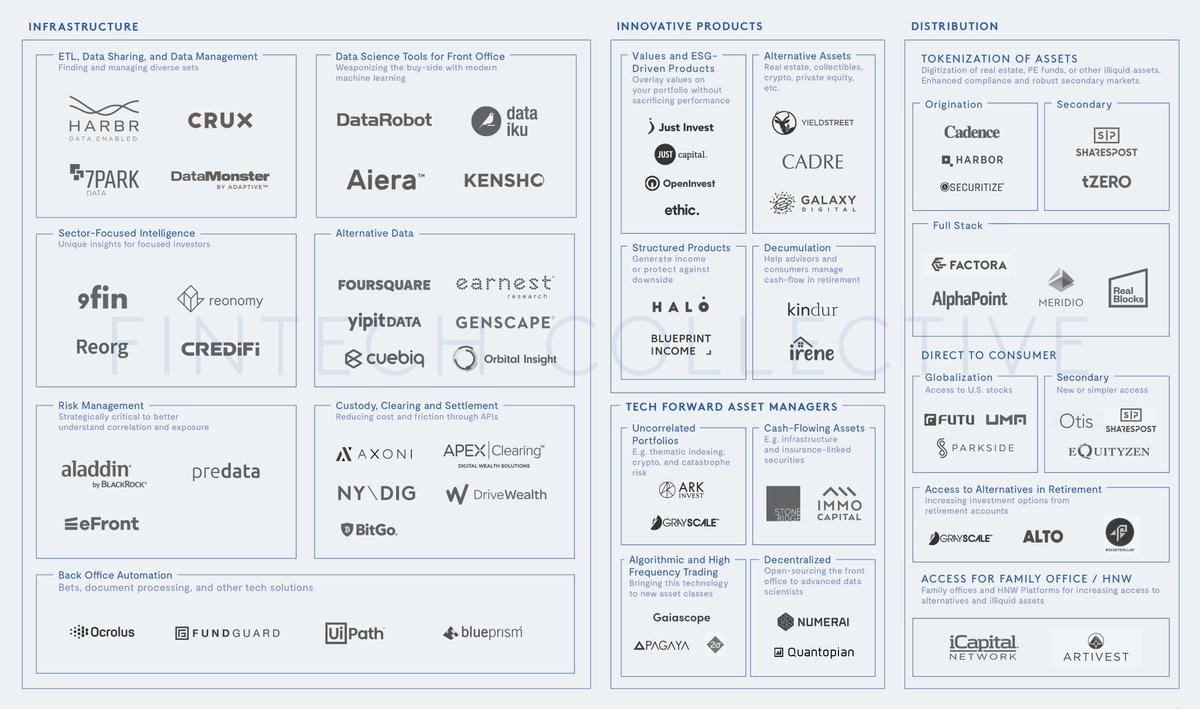

However, startups are beginning to innovate across the value chain - and the prize is big. We expect startups to become important providers of core infrastructure, innovative asset management products, and alternative distribution channels - as shown in our market map. (4/10)

The coronavirus downturn may accelerate change. AUM fee pressure necessitates automation and streamlined infrastructure. With social distancing, digital distribution and client interaction gains importance. With low rates, capital searches for novel ways to generate yield (5/10)

This “hunt for yield” creates an incredible opportunity for innovative startups to open new asset classes to scalable investment - a theme that underpins three of our most recent investments:

(6/10)

(6/10)

1) Immo is building the real estate asset manager of the future. The platform functions as an iBuyer for sellers, while also enabling institutions to scalably invest in residential real estate. http://www.immo.co.uk"> http://www.immo.co.uk

(7/10)

(7/10)

2) Underline finances intelligent community infrastructure, starting with open-access fiber optic internet. Internet connectivity should not bottleneck smaller cities and towns. http://www.underline.com"> http://www.underline.com

(8/10)

(8/10)

3) Antler is a global technology startup builder, and index fund for early-stage innovation. http://www.antler.co"> http://www.antler.co @AntlerGlobal

(9/10)

(9/10)

The next decade of #fintech will be bigger and better than the last! @fintech_io @dbgibbins @GarethFintech @seanlippel @faisalkawar

(10/10)

(10/10)

Read on Twitter

Read on Twitter