1/ Time for a quick thread about what happened in March from the market structure and macro perspective in crypto. Spot traded volumes are up, derivatives volume/open interest is down. Let& #39;s dive in https://www.theblockcrypto.com/genesis/61095/march-by-the-numbers-a-look-at-crypto-exchange-volumes-open-interest-and-miner-revenue">https://www.theblockcrypto.com/genesis/6...

2/ Bitcoin& #39;s 60-day rolling volatility hit a 6-year high in March, surpassing the volatility level last seen in January 2018. Ethereum& #39;s volatility, on the other hand, hit a 4-year high.

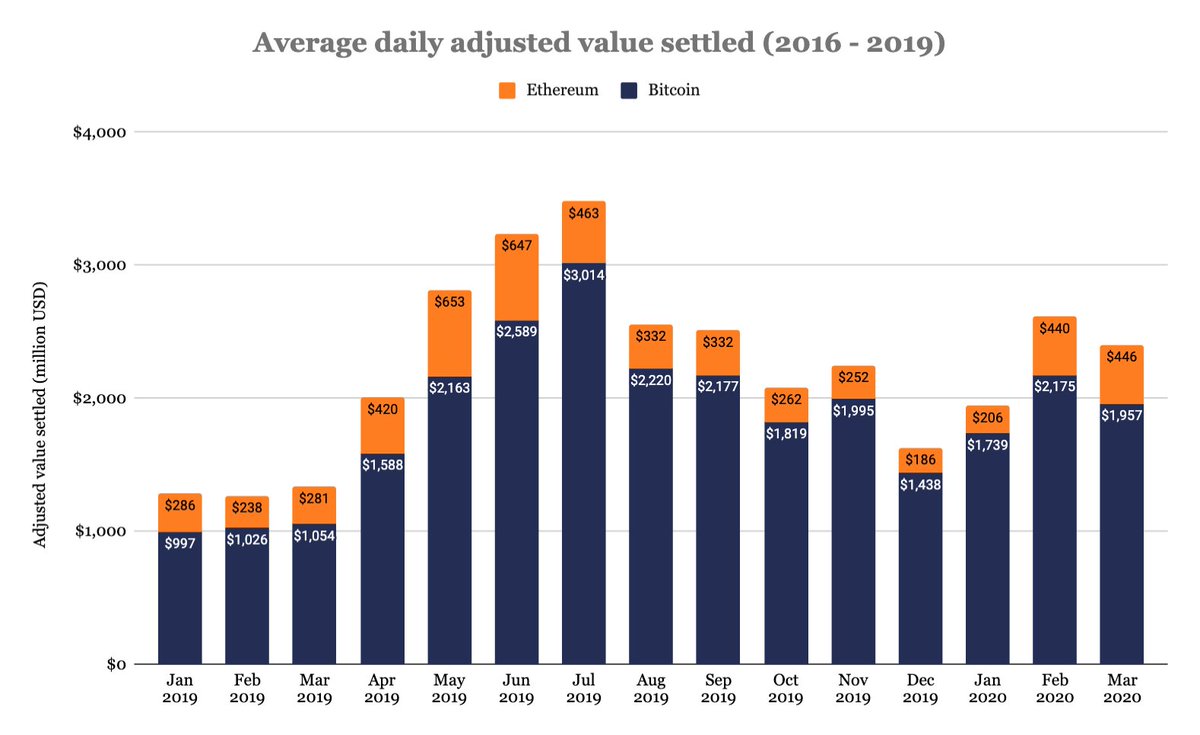

3/ Adjusted value settled saw a decrease of 8.1% in March. Ethereum& #39;s average daily value settled grew slightly, from $440 million to $446 million.

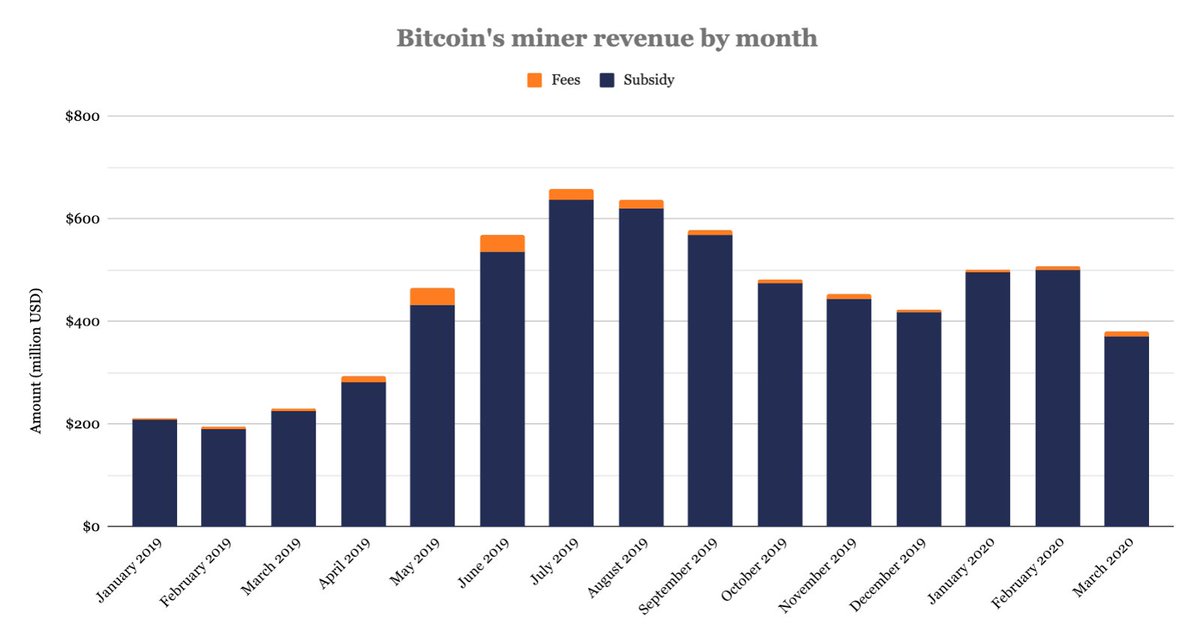

4/ Bitcoin miners have generated $380.1 million in revenue in March, which is 25% less than in February and an 11-month low. Transaction fees were about 2.12% of the total, while the rest came from subsidies.

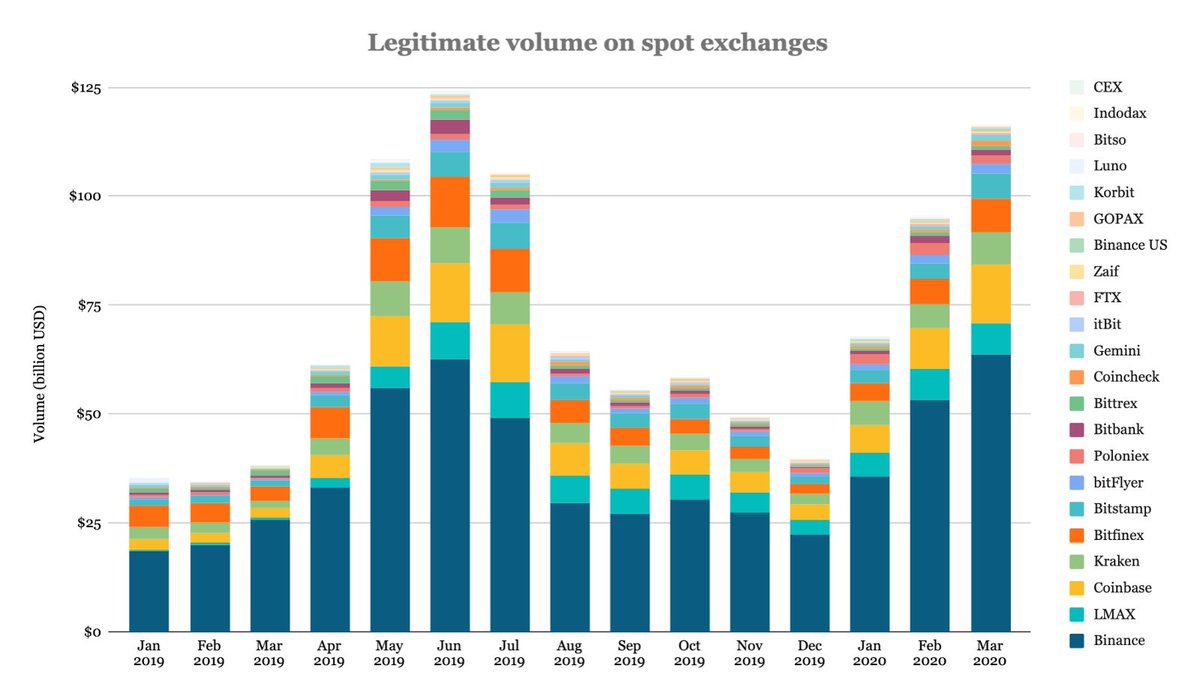

5/ Cryptocurrency traded volumes in March increased by 22.4% and reached a 9-month high. The volume on legitimate exchanges, according to The Block 22 index, was about $116.6 billion in March, which is the second-highest monthly volume since January 2019.

6/ Coinbase has seen significant growth in its market share while LMAX continues to dwindle. Poloniex also saw its market share crater after the incentive program ran its course.

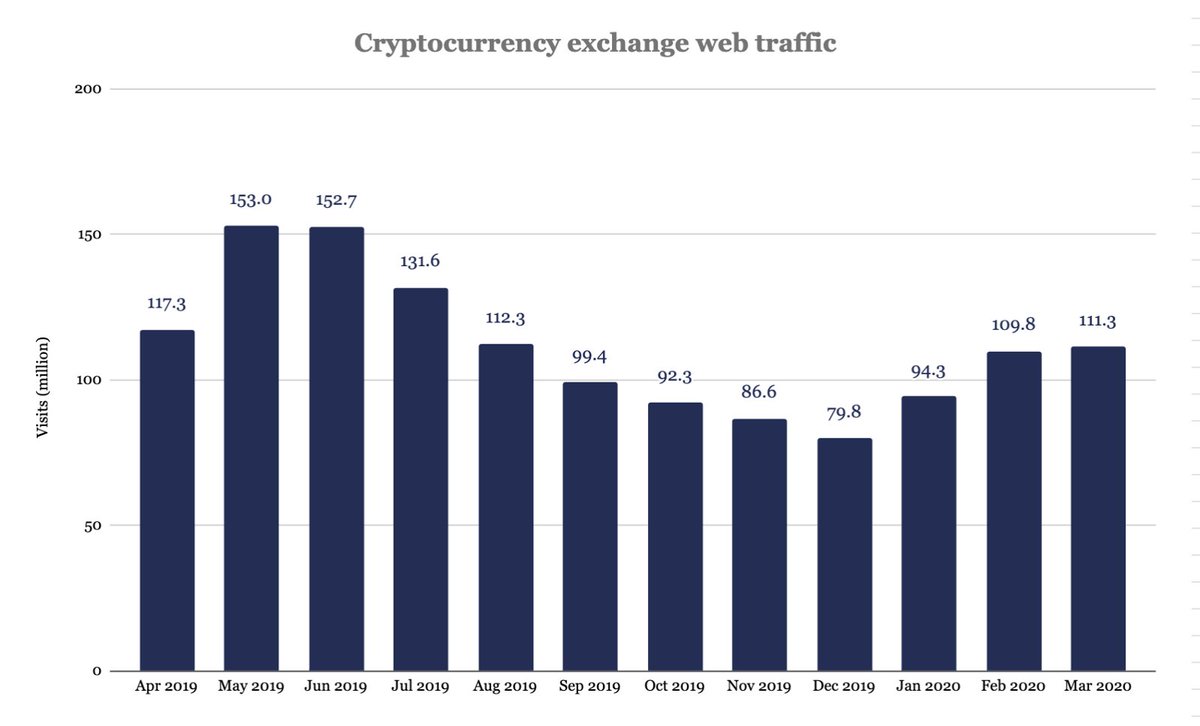

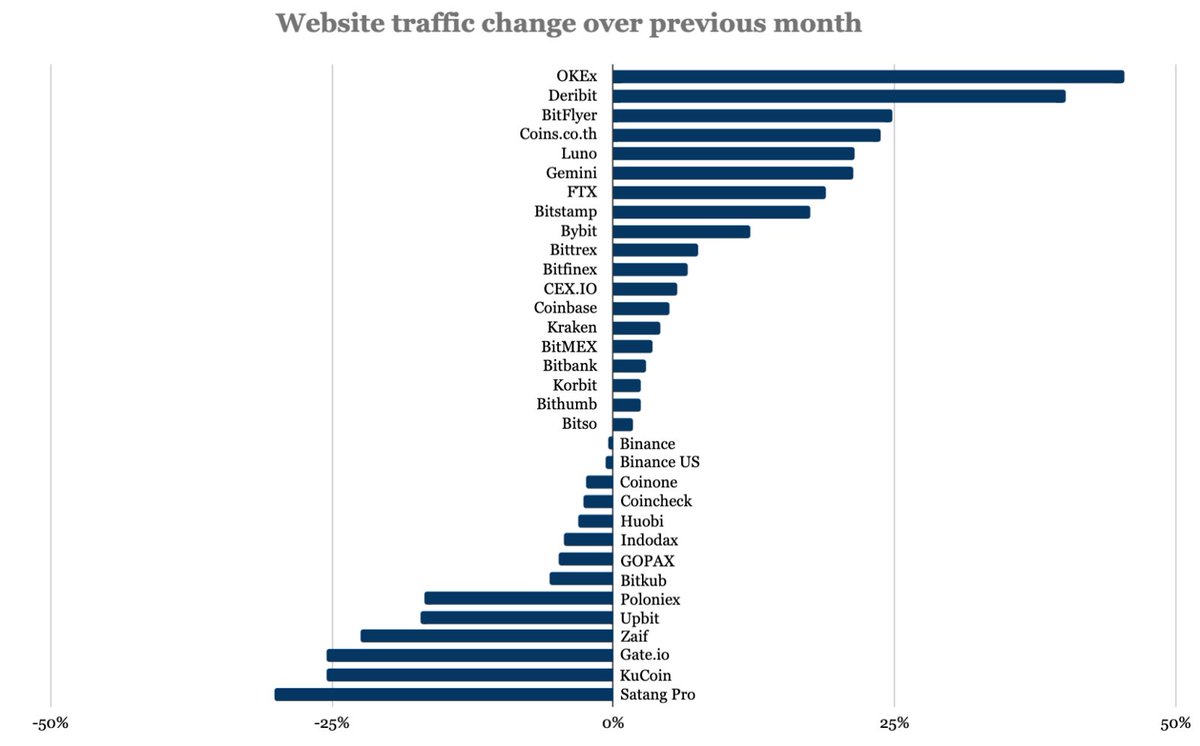

7/ Web traffic on cryptocurrency exchanges has also seen an uptick in March, although milder. According to the data from SimilarWeb, cryptocurrency exchanges (both spot and derivatives) recorded a total of 111.3M website visits in March, a month-over-month growth of 1.4%.

8/ Binance had the largest number of estimated visitors in March with about 23.7 million. They were followed by Coinbase with 23.3 million and BitMEX with 13.4 million. Binance, Coinbase, and BitMEX drew 54.3% of the total traffic.

9/ The biggest traffic gainers have been OKEx, Deribit, bitFlyer, Luno, Gemini, and FTX. The biggest losers have been Poloniex, Upbit, Zaif, Gate io, KuCoin and Satang Pro.

10/ The daily average volume of GBTC, a closed-end fund that invests exclusively in bitcoin, reached $44 million in March, which marks a month-over-month decrease of 33.5%.

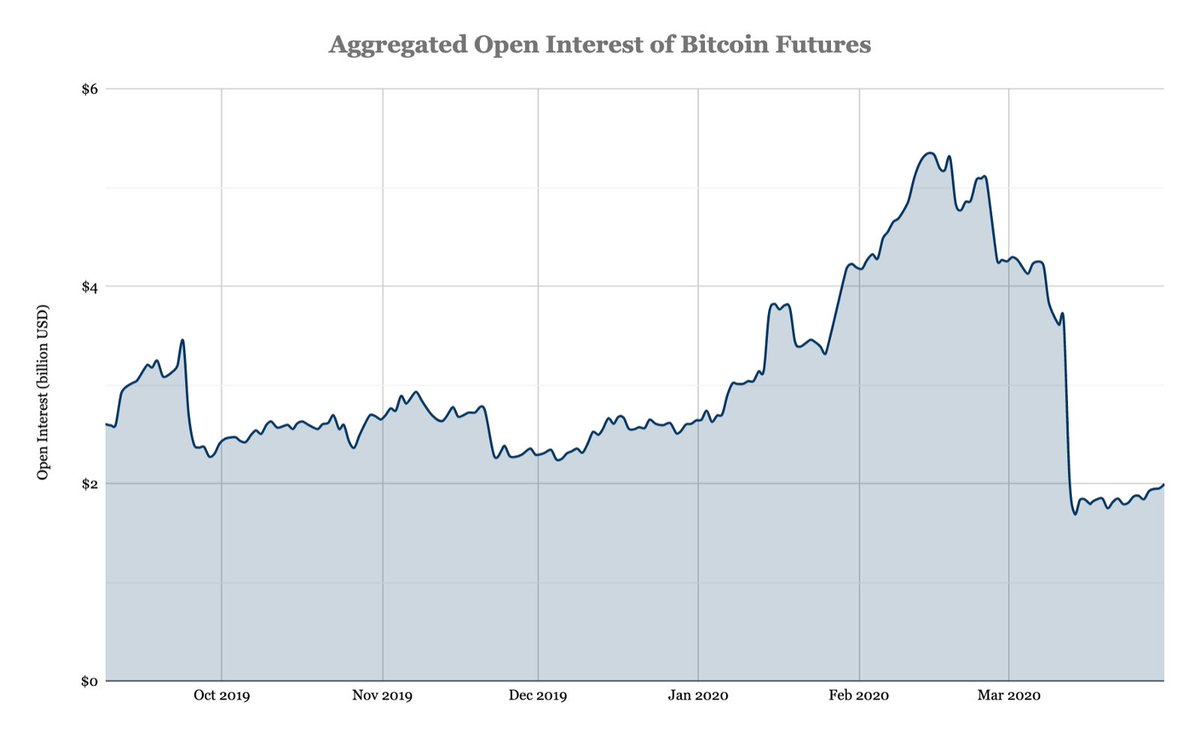

11/ Aggregated open interest for Bitcoin futures has peaked on February 14 when the sum reached $5.35 billion. Since then, it has dropped by 63% and ended March with only a little over $2 billion.

12/ By the end of the month, BitMEX has been overtaken by OKEx as the largest Futures exchange; BitMEX now has about 28.0% of the total aggregated open interest while OKEx has 29.6%. BitMEX& #39;s dominance has dwindled in recent months — falling from 44% in November 2019 to 28% now

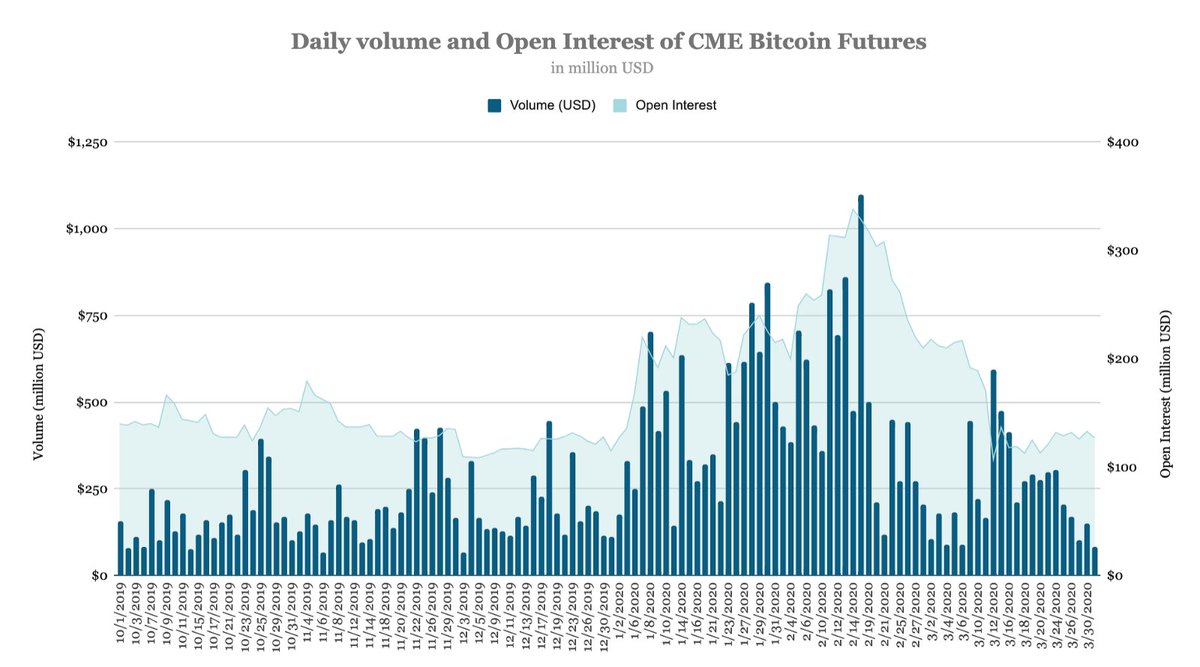

13/ On the regulated front, CME& #39;s volume has dropped by over 50% in March. The daily average volume fell from $493 million in February to $242 million in March. Open interest has fallen to $127 million since reaching an all-time high of $338 million on February 14.

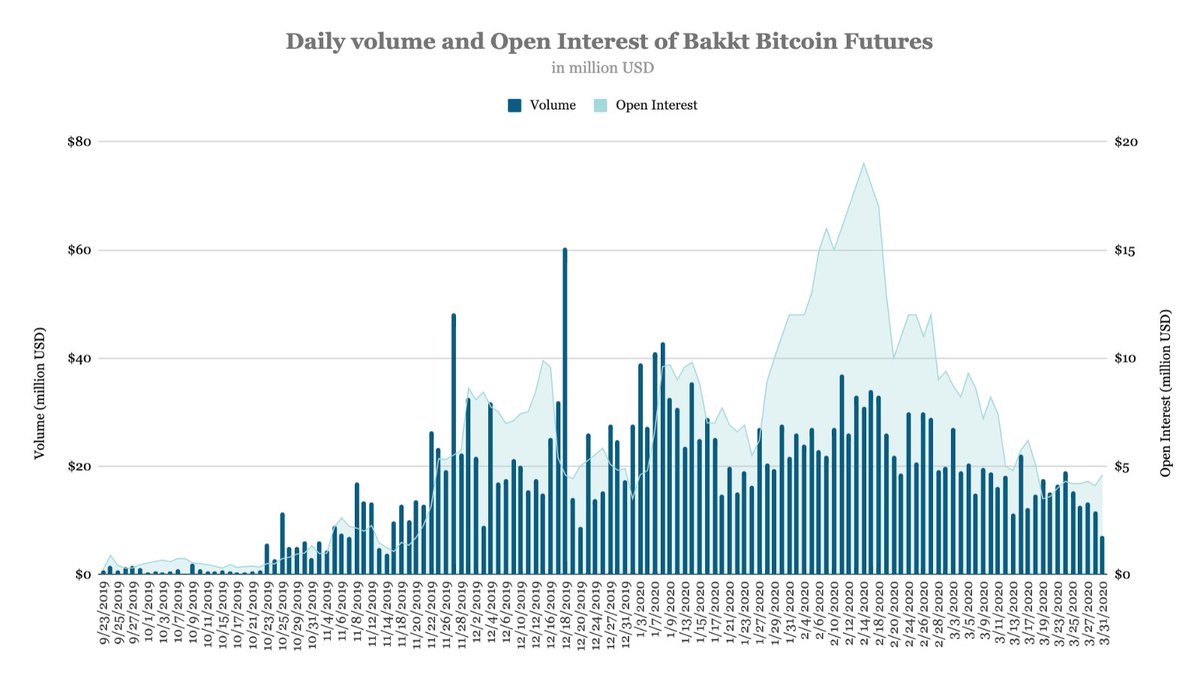

14/ Bakkt& #39;s volume has experienced the same trend as its daily average volume fell by 38.7% month-to-month — from $26.94 million to $16.51 million. Open interest has cratered to $4.6 million since reaching an all-time high of $19 million on February 14.

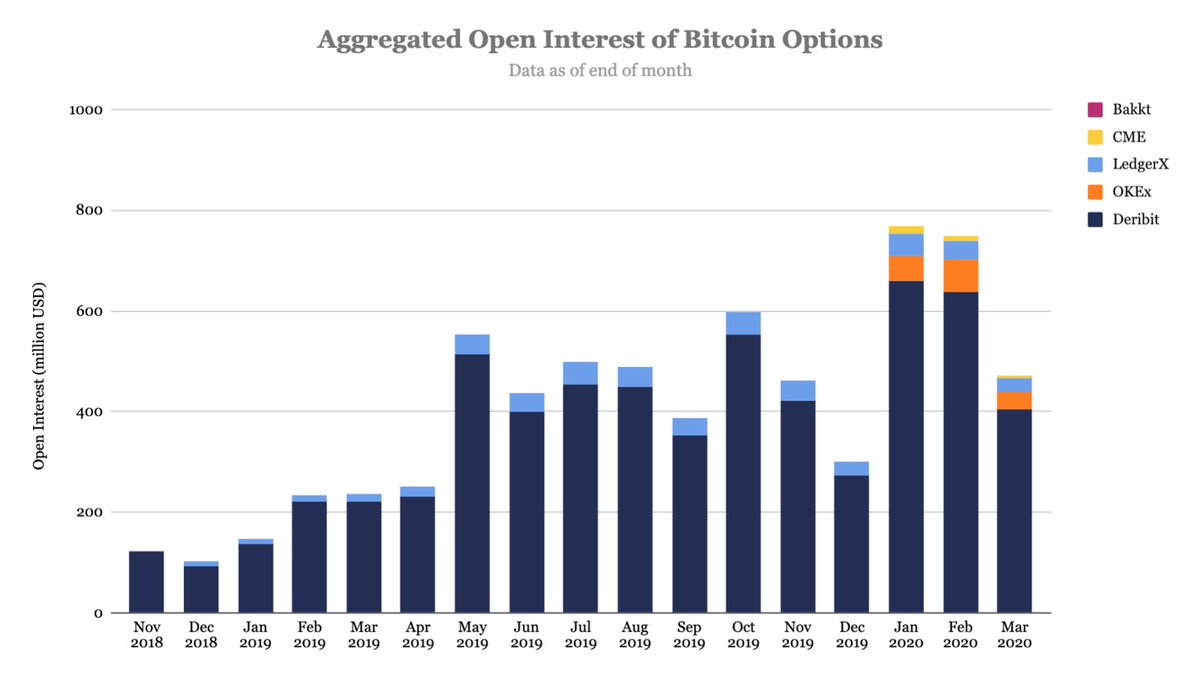

15/ Deribit continues to monopolize Bitcoin options, with 85.6% of the aggregated open interest. The exchange is followed by OKEx and LedgerX. It& #39;s worth noting that Bakkt had less than $50,000 of open interest by the end of March after launching in December.

Read on Twitter

Read on Twitter