In the lead up to the release of our 2019 Annual Report, I would like to share with you a brief history on PNB, its structure, the different types of funds under management and our governance structure.

In 1971 after NEP was formed, Tun Ismail Mohamed Ali was tasked to design an effective means for the Bumiputera community to participate in corporate ownership.

He was specifically asked to create a unit trust scheme that would generate higher returns than fixed deposits (FD) in commercial banks.

Tun Ismail Ali, along with several others formed a Working Group (WG), that published a report on 28 May 1977 to propose the creation of National Bumiputera Investment Fund – which had six essential features.

The WG agreed on a structure that combined 3 key criteria:

1) open-ended nature of a unit trust; 2) ability to borrow and flexibility to invest of an investment holding company; and 3) trusteeship nature of a foundation and its ability to conserve resources.

1) open-ended nature of a unit trust; 2) ability to borrow and flexibility to invest of an investment holding company; and 3) trusteeship nature of a foundation and its ability to conserve resources.

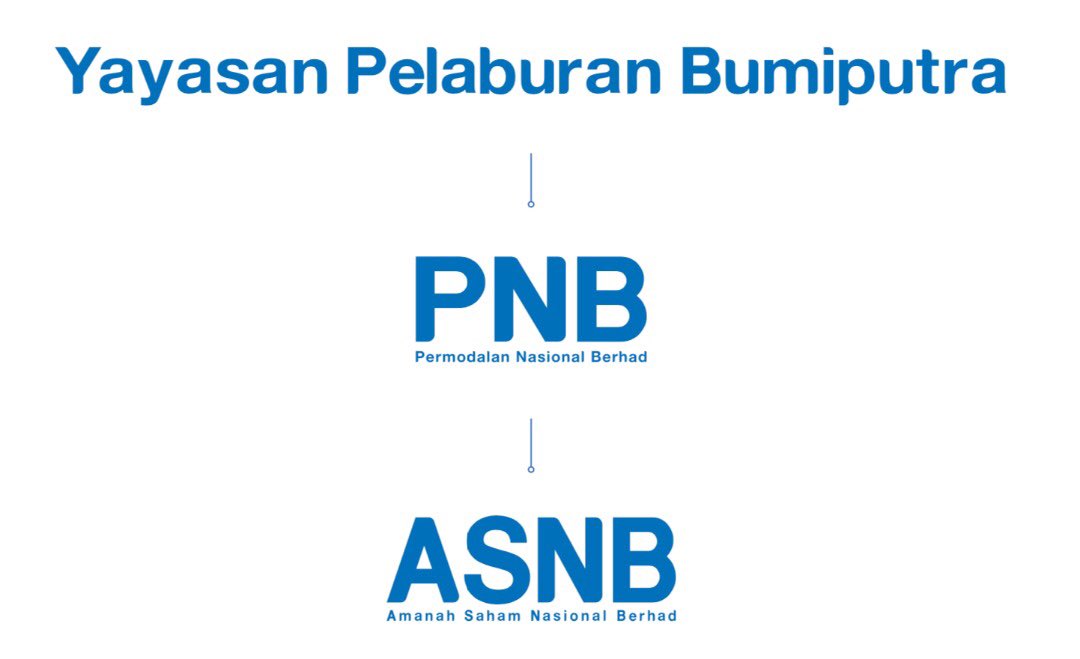

WG recommended for the creation of a foundation (YPB), and for it to wholly own an investment holding company (PNB). In turn, such company would then establish a management company that would directly manage the unit trusts of ASNB.

This was to clearly separate the roles and function to ensure separation of duties and sufficient oversight.

Using this structure, YPB is the trustee, PNB the fund manager & ASNB the unit trust company. All the funds’ sales and marketing are done by ASNB, using the Amanah Saham brand, but the funds are managed by PNB.

That concludes the history lesson. Now that you understand the structure. Next thread tomorrow I’ll talk about YPB and its role and function, followed by PNB & ASNB.

Read on Twitter

Read on Twitter