BIS Bulletin 5 deals with the recent turbulence experienced by emerging market economies

https://www.bis.org/publ/bisbull05.htm

https://www.bis.org/publ/bisb... href="https://twitter.com/BIS_org">@BIS_org

https://www.bis.org/publ/bisbull05.htm

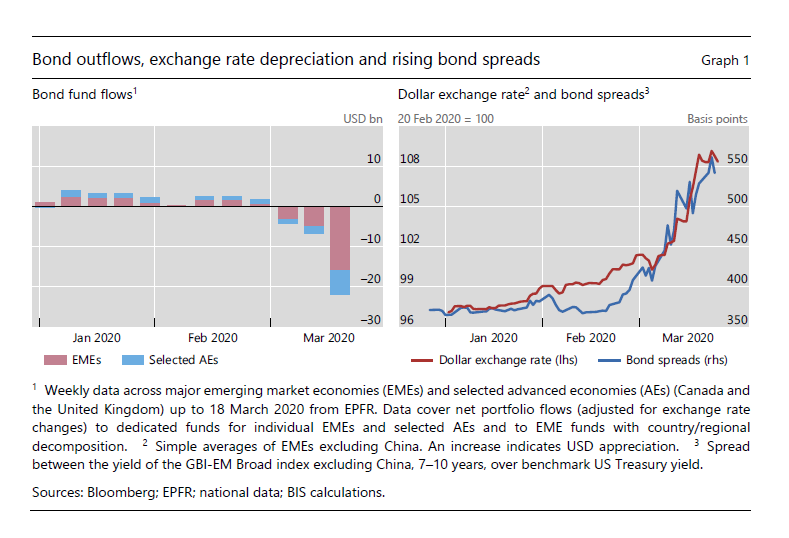

Borrowing in domestic currency has not insulated emerging markets from the global shock unleashed by Covid-19; local currency bond spreads spiked and currencies fell as EMEs experienced large portfolio outflows

Recent experience conforms to the general rule that emerging market sovereign spreads and weaker EME currencies go hand-in-hand; except that this time, it was on display with a vengeance (see the spikes in the left-hand panel)

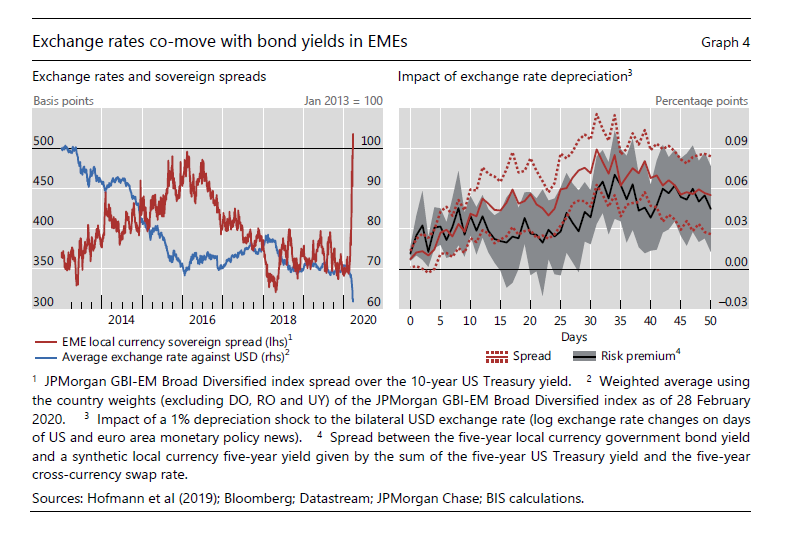

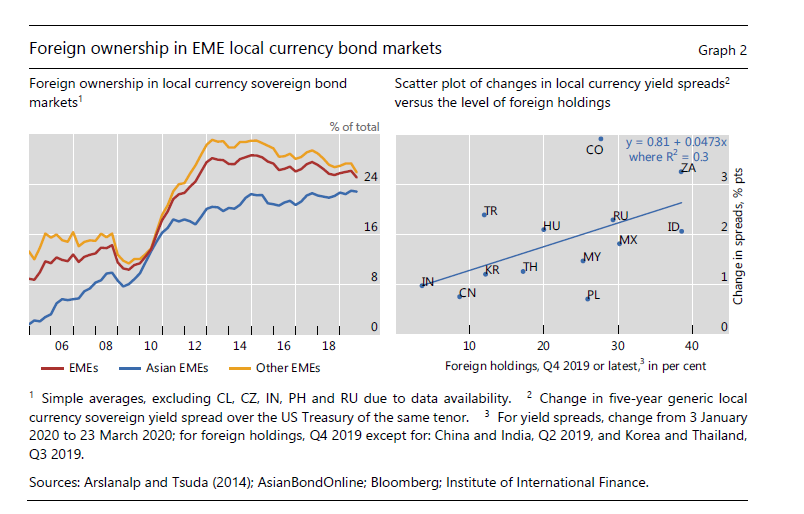

Borrowing in local currency from global investors mitigates currency mismatch for the borrower but shifts the currency mismatch to the lenders’ balance sheets - a phenomenon dubbed “original sin redux”

https://www.bis.org/speeches/sp190322a.htm">https://www.bis.org/speeches/...

https://www.bis.org/speeches/sp190322a.htm">https://www.bis.org/speeches/...

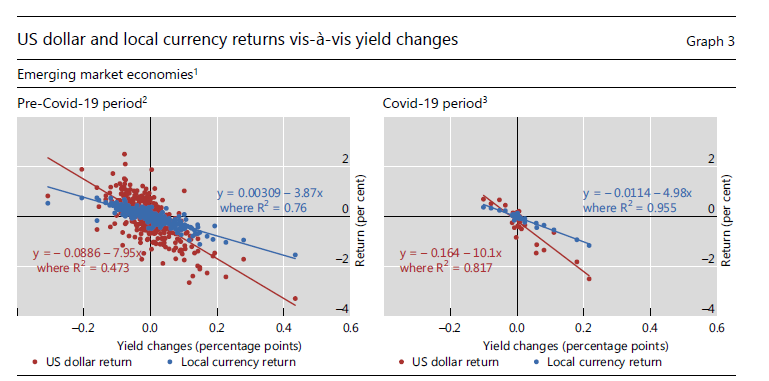

Portfolio investors face amplified losses as local currency spreads and exchange rates move together. Investors& #39; revised portfolio allocations (cutting exposures) sets up a feedback loop; duration in dollar terms ends up being higher than duration in local currency terms

EMEs with monetary policy frameworks that are equipped to address the feedback loop between exchange rate depreciation and capital outflows stand a better chance of weathering the financial fallout from the Covid-19 pandemic

https://www.bis.org/publ/arpdf/ar2019e2.pdf">https://www.bis.org/publ/arpd...

https://www.bis.org/publ/arpdf/ar2019e2.pdf">https://www.bis.org/publ/arpd...

With spreads and exchange rates spiralling in tandem, dollar lines will also help to quell domestic financial stringency, even though domestic currency bonds take up the lion& #39;s share of EME bond markets

In the longer term, the development of a deep domestic institutional investor base will be key to overcome "original sin redux"

Read on Twitter

Read on Twitter @BIS_org" title="BIS Bulletin 5 deals with the recent turbulence experienced by emerging market economies https://www.bis.org/publ/bisb... href="https://twitter.com/BIS_org">@BIS_org" class="img-responsive" style="max-width:100%;"/>

@BIS_org" title="BIS Bulletin 5 deals with the recent turbulence experienced by emerging market economies https://www.bis.org/publ/bisb... href="https://twitter.com/BIS_org">@BIS_org" class="img-responsive" style="max-width:100%;"/>