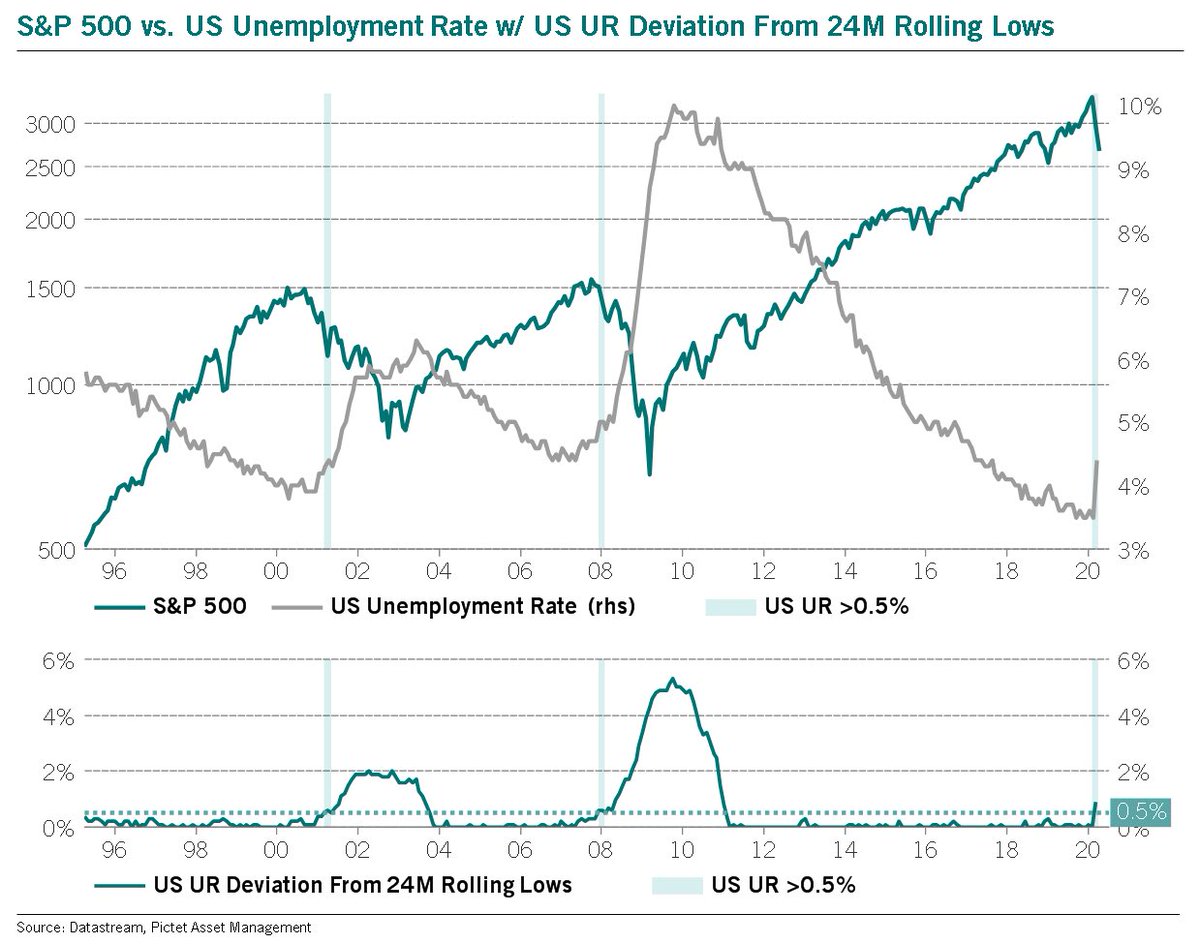

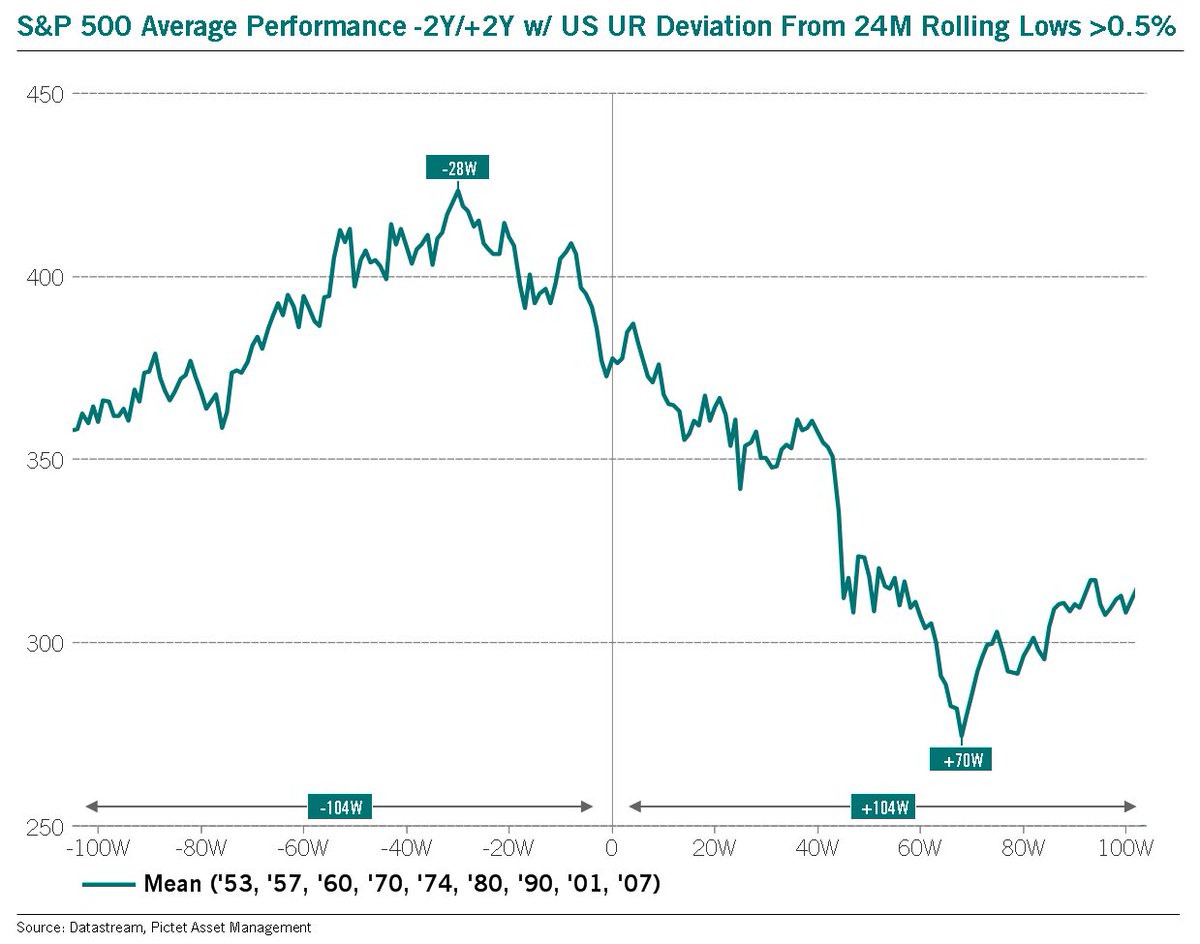

A rise in the US UR of >0.5% off 24M rolling lows has been the 100% threshold for recession. This has historically corresponded w/ deep equity bear mkts. In ‘01/‘08, equities went on to fall another 35%/50% after the signal. Strategic buying opportunity for equities? Not yet imo.

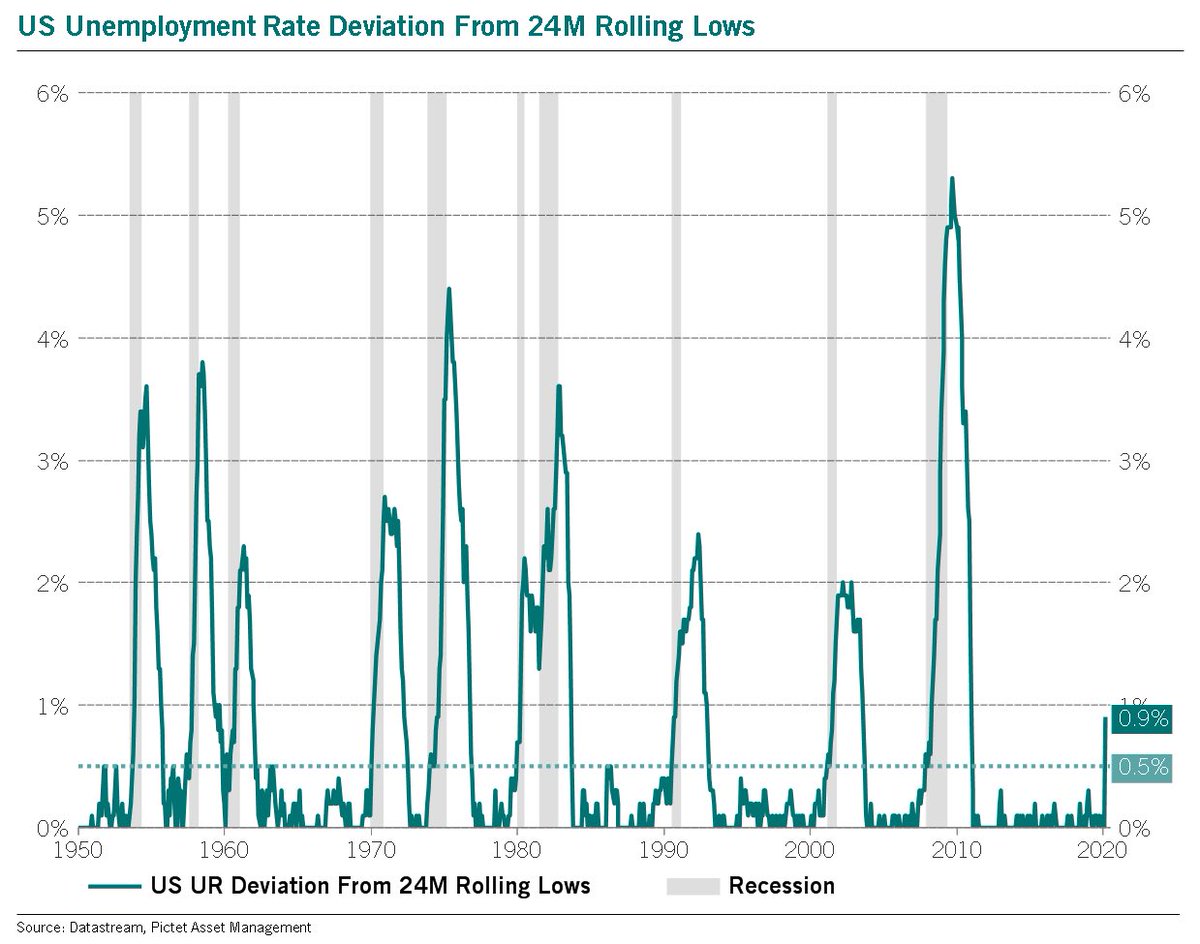

Here is the long-term chart of the US unemployment rate deviation from 24M rolling lows. A monthly close above 0.5% has a 100% track record over 70Y at signalling a recession.

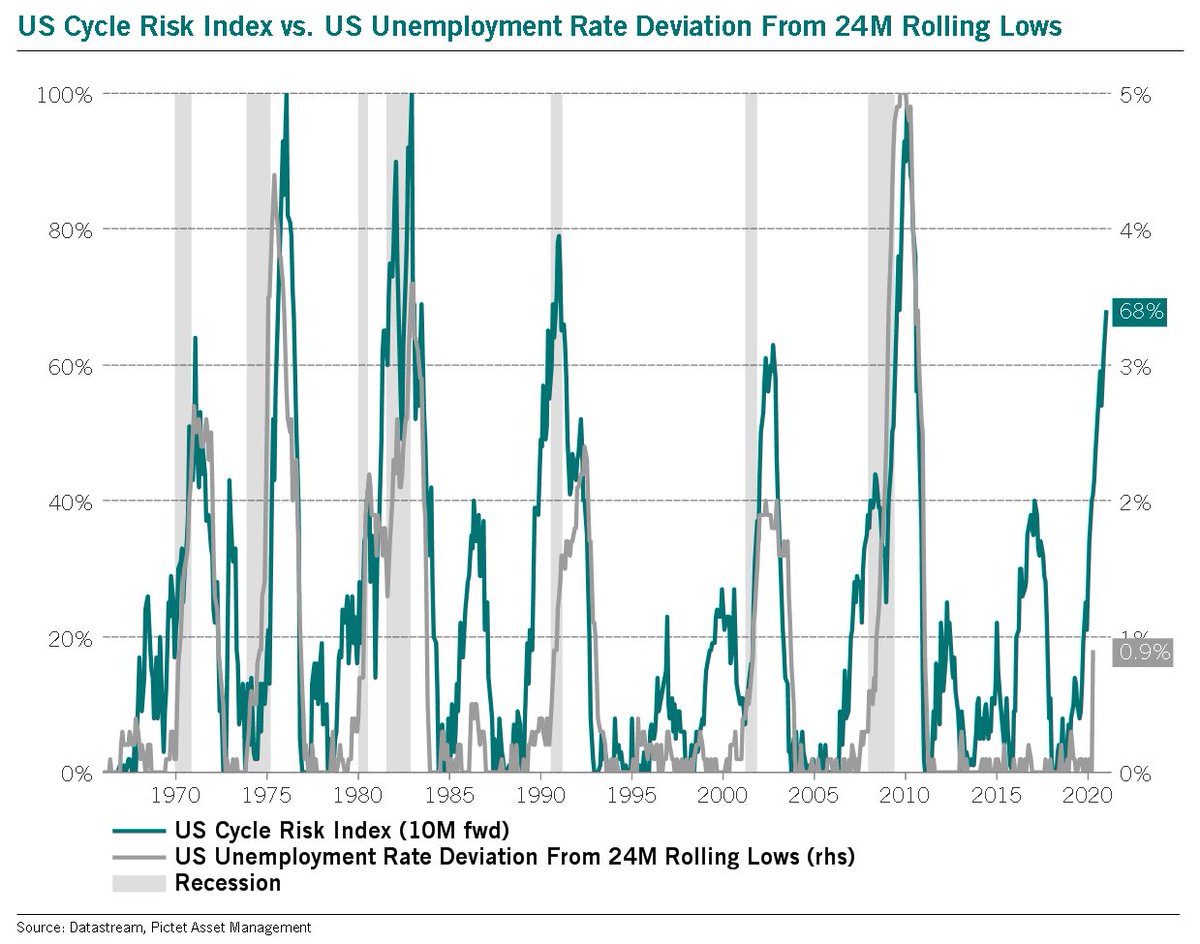

Meanwhile, my US cycle risk index is currently at 68% & suggests that the US unemployment rate will rise ~3.5% above 24M rolling lows. My guess is this lead index will soon be nearer 100%.

Read on Twitter

Read on Twitter