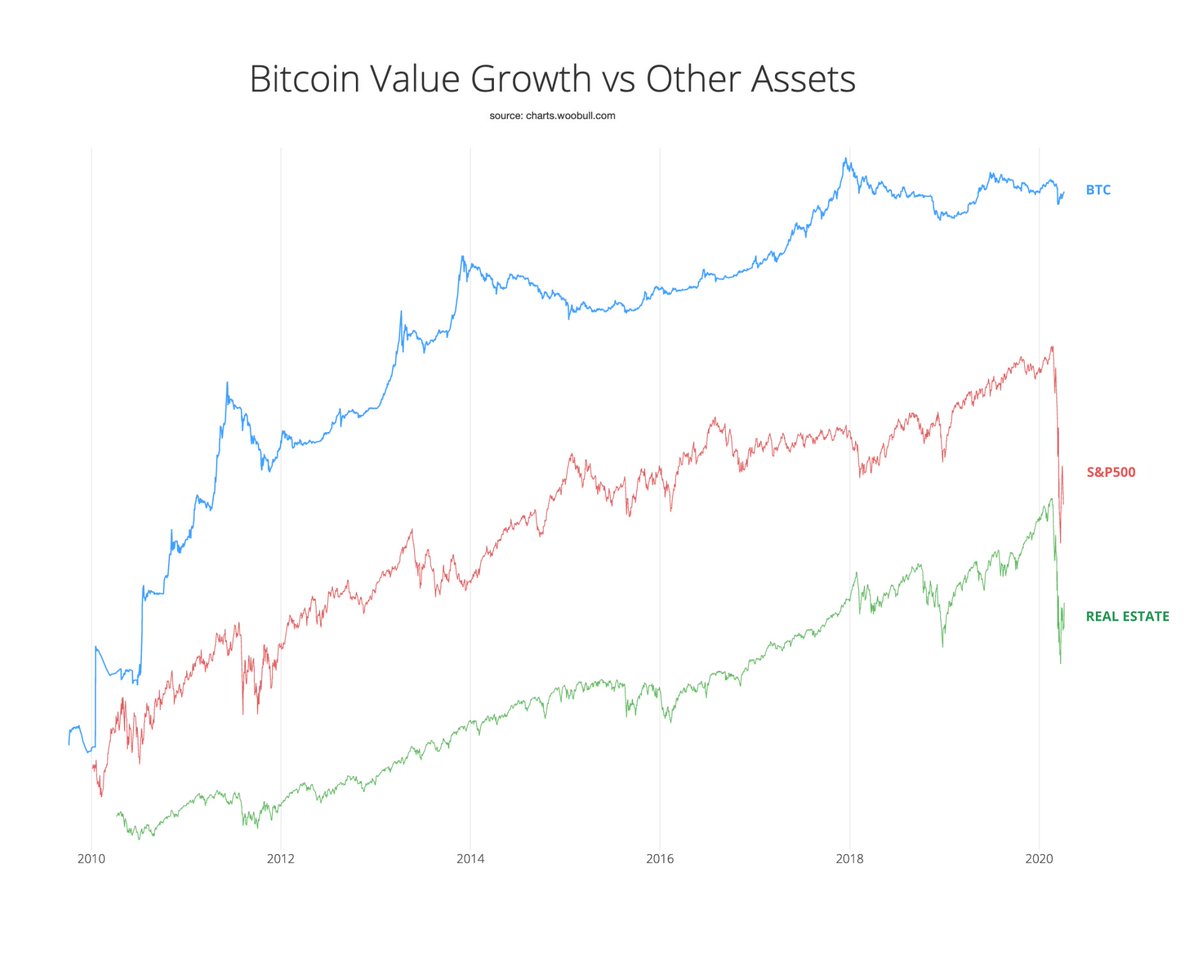

And they told me Bitcoin was a risky volatile asset...

(Plotted in log charts so % gains/losses are proportional within each respective sparkline)

(Plotted in log charts so % gains/losses are proportional within each respective sparkline)

Do I think BTC is exhibiting safe haven properties?

Yes.

I think this is in part due to the nuances of Bitcoin production costs creating a floor in price, and partly due to it getting an uplift in price due to it& #39;s adoption s-curve (other assets are at adoption saturation).

Yes.

I think this is in part due to the nuances of Bitcoin production costs creating a floor in price, and partly due to it getting an uplift in price due to it& #39;s adoption s-curve (other assets are at adoption saturation).

Some are misunderstanding the chart. Imagine riding each sparkline as a roller coaster ride. Think about the G forces you& #39;re exposed to. In our portfolios we get to amplify the G forces we can tolerate per asset as part of our allocation to that asset. BTC is a better ride.

The concept to understand is proportionality.

Say I buy an asset that goes from $1 to $10,000. Then it drops by 50% to $5000. (BTC)

Compare to an asset in the same time frame that goes from $1100 to $3300 and this drops by 31% to $2277. (SP500)

$1 -> $5000

$1100 -> $2277

Say I buy an asset that goes from $1 to $10,000. Then it drops by 50% to $5000. (BTC)

Compare to an asset in the same time frame that goes from $1100 to $3300 and this drops by 31% to $2277. (SP500)

$1 -> $5000

$1100 -> $2277

Read on Twitter

Read on Twitter