very good morning to @FT who& #39;s joined the fight for coordination between central bank & government, and now recognises what some of us have said for a long time: & #39;there is no clear distinction between quantitative easing and monetary financing& #39;. https://www.ft.com/content/fd1d35c4-7804-11ea-9840-1b8019d9a987">https://www.ft.com/content/f...

4 years ago, monetary financing https://twitter.com/DanielaGabor/status/700337628466561024?s=20">https://twitter.com/DanielaGa...

two years ago, joking w @Louih73 about the only flaw in Benoit Coeure (then ECB& #39;s repo man) top 3 speeches https://twitter.com/DanielaGabor/status/1038025165370785793?s=20">https://twitter.com/DanielaGa...

McCauley and Pozsar (2013): fiscal “irresponsibility” (running large deficits despite large deficits as far as the eye can see) may in fact be far more important at the zero bound than monetary irresponsibility, as a strategy of aiming for negative real rates may not work

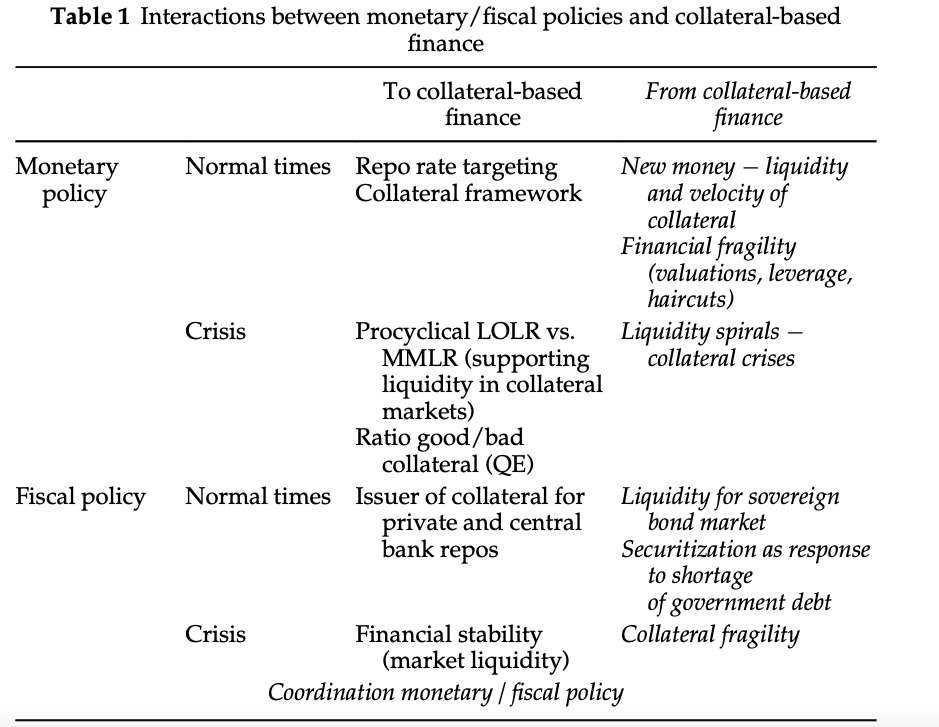

my 2016 paper on political economy of repo markets: collateral-based financial structures entangle monetary&fiscal policy, and require their coordination

https://www.tandfonline.com/doi/full/10.1080/09692290.2016.1207699">https://www.tandfonline.com/doi/full/...

https://www.tandfonline.com/doi/full/10.1080/09692290.2016.1207699">https://www.tandfonline.com/doi/full/...

in human language: central banks & governments always travel companions in capitalism.

For past 30 years, w central bank independence, clandestine encounters in finance land.

Central banks looking for financial stability in sovereign bonds, governments looking for liquidity.

For past 30 years, w central bank independence, clandestine encounters in finance land.

Central banks looking for financial stability in sovereign bonds, governments looking for liquidity.

Read on Twitter

Read on Twitter